Why I Am a Dividend Growth Investor

Hi. My name is Dave Van Knapp, and this is my first article for TheStreet. I am happy to become a contributor to Dividend Strategists.

I have been a dividend-growth (DG) investor for about 15 years, and I completely converted all of my wife’s and my stock investments to the DG strategy about 10 years ago. I did that as I came to realize that DG investing provides a clear path to the financial objectives that I was trying to achieve.

There are millions of strategies for stock investing. There is no single “correct” way to invest.

While many define investment success as “beating the market,” it is a better approach to consider your own goals: What do you want to accomplish? When? How are you going to get there? How much risk can you stomach?

I have different goals from beating the market, as do many other investors who employ the DG strategy. My goals include:

- Create a sufficient, reliable income stream that grows faster than inflation.

- Be pretty confident about how much cash I will get from dividends and when I will get it

- Feel that I am very likely to get that cash when I need it.

Ultimately, my goal is to use that cash in retirement.

The Top Reasons I Like DG Investing

With those goals in mind, here are the most important reasons that I use the DG strategy.

Reason #1. The process is smooth and less emotional

Like most investors, and as advised by most advisers, I used to invest for maximum total return. You know, “What’s your number?”

When I was a total-return (TR) investor, trying to beat the market, I felt great when my stocks were doing well. But I also realized that their total value fluctuated every minute that the stock market was open. Sometimes they fluctuated a lot.

It can be hard to keep your eyes off of that. I was happy when the market went up and tense when it went down.

Many stock investors follow the market and react emotionally to what it is doing. CNBC's programming is built around that prevailing interest in stock prices. They use colorful flashing displays to play to their audience’s price fixation. Rising prices are shown in a soothing green, but price declines appear in alarming red. Even a meaningless price drop of 0.01% is shown in red.

But after I switched from price focus to income focus in 2007-2008, my interest in the market dwindled to a fraction of what it used to be. CNBC hardly reports on dividends, so I hardly watch the channel any more. The charts on CNBC are almost 100% price charts, which is not what I am interested in any more.

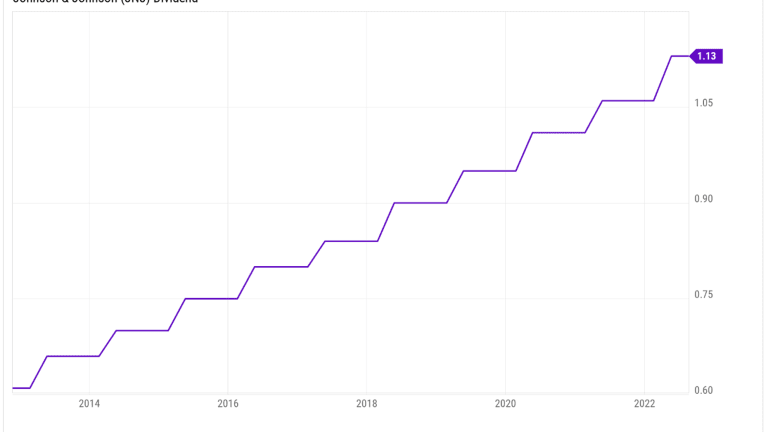

Let’s look at the volatility difference between prices and dividends, looking back 10 years through the lens of a typical DG stock, Johnson & Johnson (JNJ):

I used to focus on the orange price line. You can see that the price jumps around all the time on a short-term basis. That volatility can make investors uncomfortable, even fearful, when it goes down. On CNBC or any financial channel or site, all those down periods would be red, day after day, week after week.

Volatility often makes people trade too much, because they try to be in for the upside, get out for the downside, then back in for the next upside.

It is possible to make money that way, but it is very hard. Studies show that most investors underperform the very stocks they invest in, because they jump in and out at bad times.

The truth of that is shown in the following chart. Note the orange “Average Investor” bar near the right side, and compare it to the various equity categories that I circled. The average investor underperforms almost every kind of stock!

Now think back to the first chart that showed JNJ’s price and dividends. As a dividend-growth investor, I don’t pay much attention to the orange price line. What I care about is the purple dividend line, shown here with the price line removed.

The dividend line tells a different story from the price line. Instead of all the volatility, the dividend line is a smooth stair-step, moving constantly up and to the right. Each step up is a dividend raise, one each year. Unlike price, the dividend line doesn’t fall.

JNJ has been paying dividends for more than 100 years, and it has raised them for 59 consecutive years. I own JNJ in my real-life, public Dividend Growth Portfolio. JNJ’s price swings don’t concern me at all. The ride on the purple line is smooth and positive. The only volatility is upward. It generates no fear.

It is a near certainty that JNJ will raise their dividend each year. The only real unknown is how much they will raise it. JNJ raised it 6.6% this year, and their 5-year average raise has been about 6% per year.

As a DG investor, the temptation to sell or trim a stock like JNJ comes not when its price is plunging, but when its price is high. The temptation is not based on fear, it is simply business-like opportunism. Higher price equals lower yield. Maybe I could get more income elsewhere, from a stock with a better yield. Maybe the high price has resulted in significant overvaluation or caused JNJ to take up more of my portfolio than I want it to.

The point is that the temptation to sell when JNJ's price is up rather than down is an inversion of the usual emotional response to price changes. Since the usual response causes investors to underperform, inverting it is a good thing.

What I’ve found is that dividend-growth investors seem to develop a layer of insulation from down-market panic. I don’t think that anyone enjoys seeing their total wealth go down. But if you are focused on income — rather than prices — then you can enjoy watching your income go up even while the market is going down.

An investor focused on prices gets too much feedback from the wrong place — the market. It is difficult to interpret the meaning of price changes. Are they based on mere market noise, company problems, or something else? Many investors will not hold on long enough to find out, choosing instead to sell as prices drop, because the fear engendered by price declines and paper losses triggers a flight response. Such fear can make the investor feel that they must do something, and what they often do is sell.

Dividend growth stocks help sidestep this problem by providing positive returns that arrive in cash every quarter (or every month from some companies). The positive feedback helps reduce the temptation to sell at unfortunate times. Some investors call this “getting paid to wait” for their stocks – or the whole market – to stop falling.

After I reorganized my investing around the DG strategy, I found that I was no longer stressed about stock price fluctuations or the market. It was a major paradigm shift, and once I made it, investing became much easier.

My income goes up each year no matter what prices the market assigns to my stocks. The market may crash, but dividends don’t crash.

Reason #2. Dividend-growth stocks raise their dividends

My next reason – continual dividend increases – is actually made up of several sub-reasons.

For one thing, a dividend increase can usually be interpreted as a positive sign that management has confidence in the company’s prospects. Most companies look ahead a few years when considering whether to increase the dividend. During good economic times, a company with a sound approach does not want to raise the dividend so high that it might need to cut or freeze it later if its business slows down.

Another positive point about dividend increases is that the historical dividend growth patterns at many companies result from deliberate managed dividend policies, and the payments become quite reliable. A long-standing dividend program can become woven into the culture of a company. Once that policy has been established, it takes extraordinarily bad circumstances for the company to abandon it.

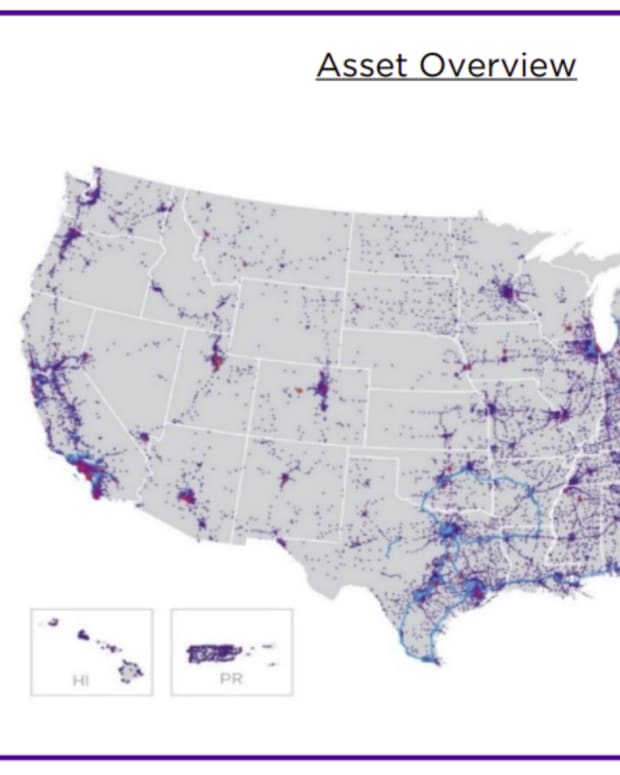

One DG favorite, Realty Income Trust (O), has even branded itself around its dividend program. It calls itself the Monthly Dividend Company, even registering that as a trademark.

Realty Income has a current streak of 29 straight years of annual dividend increases, including uninterrupted raises straight through the real-estate collapse in 2007-09. While any company can be wounded during bad economic times, the best dividend companies increase their dividends even during recessions. When hard times hit, the dividend growth rate may slow, but the company is still able to increase its dividend a little.

This may come as a surprise, but the most recent Dividend Champions document shows that 143 companies have raised their dividends for at least 25 years in a row, and another 364 have done it for at least 10 years. The DG investor has lots of great companies to choose from.

One wonderful result of reliable dividend increases across a portfolio of DG stocks is that an investor can set realistic long-term income goals, and his or her progress toward them can be tracked.

Here’s another wonderful result: When a company increases its dividend, your yield on cost—that is, the dividend payout divided by your original investment—goes up. This happens even though the current yield quoted online fluctuates.

How can this be? It’s simple math. Say you purchase XYZ Inc. when its price is $100 per share and its yield is 4%. If you buy 10 shares (cost = $1000), the stock pays you $40 in Year 1 of ownership.

No matter how the stock’s price changes after you buy it, your yield on cost will always be based on that original $1000. Unless you later add shares at different prices, your cost of ownership stays the same.

So let’s say that XYZ’s earnings increase 10%, and the company bumps up its dividend by the same percentage. That means in Year 2 the company pays out $44 to you, so the yield on your original $1000 investment increases to 4.4%: $44 / $1000.

This annual growth of the dividend cashflow is a very powerful aspect of DG stocks. It is why DG investors are content with slower-growing prices. It is why retirees — seeking income that keeps up with inflation — become attracted to these stocks. It is why many income investors consider dividend growth stocks to be more attractive than bonds, whose yields are fixed. It is why dividend investors can tolerate market pullbacks and fluctuating prices.

This is not abstract theory: It works in real life. In my public Dividend Growth Portfolio, my yield on cost just hit 13%. In other words, the portfolio is now sending me, in cash each year, an amount equal to 13% of what I spent to start the portfolio. And as dividend increases roll in like clockwork, that percentage goes up steadily each year.

It is hard to overstate the importance of reliable dividend growth as a component in the DG strategy. Dividend-growth investors are looking for rising income, not fixed income, and dividend-growth stocks deliver income streams that can rise to significant levels over time.

Reason #3. You can reinvest dividends to make them increase faster

That 13% yield on cost didn’t get there only via dividend increases. I reinvest my incoming dividends monthly. Reinvestment creates a Dividend Growth Machine for the investor:

Shareholders can do three things with dividends: Reinvest them, keep them, or spend them.

If you reinvest the dividends (either in the same stock or elsewhere), the reinvestment brings compounding into play. As you purchase more shares with the dividends, the number of shares on which you receive dividends goes up. They then generate additional dividends, which can themselves be reinvested.

This creates a virtuous cycle of dividends reinvestment more shares more dividends, etc. This is compounding in action. It’s like a snowball rolling down a hill: It builds wealth and income at an accelerating pace. Your share base grows faster and faster because of the reinvestments. The additional shares, in turn, accelerate the growth of the dividends you receive.

If the dividends themselves are increasing, as they will in a well-selected DG portfolio, that acts as a super-charger to the process just described. The reinvestment of growing dividends builds wealth at an even faster pace, beyond that of the companies themselves.

If you draw dividends off as cash to spend, of course, the compounding effect of reinvestment is not present. Your income stream will still grow, however, in line with the dividend increases themselves.

Reason #4. Dividend growth companies are usually outstanding businesses

The best dividend growth companies typically have:

- Proven, time-tested business models

- Steady annual growth, with many more up years than down years

- Sustainable competitive advantages (moats) and the resources needed to defend or expand them, which gives them pricing power

- Product lines filled with essential stuff that people need, like food, electricity, healthcare, diapers, and beverages

- Low debt loads, solid balance sheets, and good credit ratings; many DG companies have light capital requirements

- The strength needed not only to survive recessions, but even to gain market share when competitors struggle

- Reliable generation of excess cash

It requires an outstanding business to increase dividends for many years in a row. Weak businesses simply cannot do it.

Reason #5. You do not have to sell the stock to get the dividend

If a stock pays no dividends, its total return comes solely from price changes, and you can only realize them if you sell the stock. There is no other financial benefit from ownership.

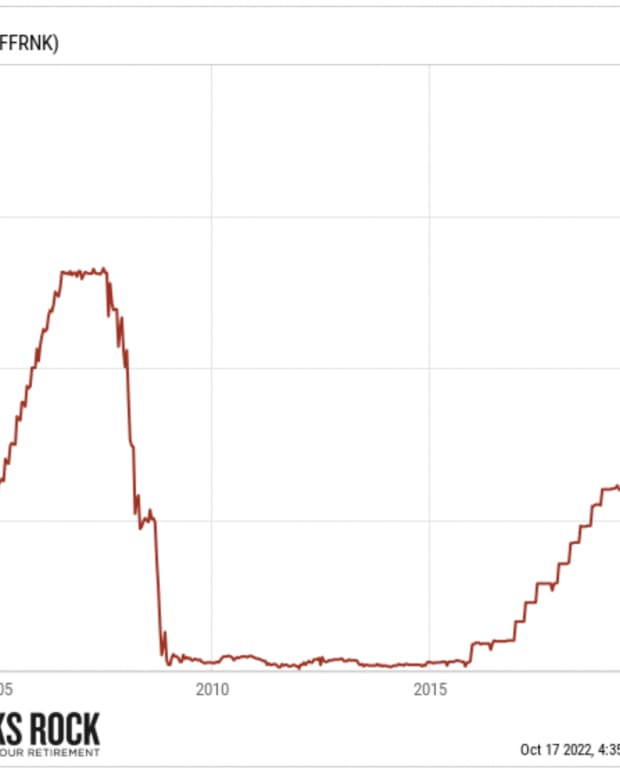

Price changes are determined by the irrational Mr. Market. Stock prices fluctuate all over the place, sometimes wildly and frighteningly. That’s shown by this chart, which simply plots the price of SPY (an ETF that tracks the S&P 500) over 2021 and 2022.

Unlike 2021, 2022 has been a very hard and confounding year for price-watchers riveted by the market.

In contrast, dividends are sent to shareholders directly by the company. The market has nothing to do with dividends.

DG investors often see stocks differently from other stock owners. Stocks become like cash machines that generate streams of income. The dividend investor does not lose all interest in the prices of those shares, but price doesn’t matter as much. During bull or bear markets, and even recessions, the dividends keep increasing.

Critics of dividend investing sometimes state that “a dollar is a dollar,” so what difference does it make if you get a dollar from dividends or a dollar from selling a few shares?

The difference should be obvious. In order to get your hands on a dollar of capital gains, you must sell shares. After selling them, you own fewer shares. The shares you sold can no longer accomplish anything for you, since you no longer own them.

Dividend returns do not deplete the number of shares that you own. The shares are still in your portfolio, and they will continue to spin out cash to you each month or each quarter.

Reason #6. Dividend stocks tend to be less volatile

Many dividend-growth stocks are less volatile than other stocks. Their prices change less, and change more slowly, than the prices of other companies.

I can illustrate that from my own public Dividend Growth Portfolio. I have loaded the portfolio into Simply Safe Dividends, and it calculates that my portfolio’s Beta is 0.57.

Beta measures price volatility relative to the S&P 500. The beta of 0.57 means that my portfolio has been only 57% as volatile as the index over the past five years.

This muted price volatility gets back to a point I made earlier: It’s simply easier, as an investor, not to get worked up about price zig-zags when you hold steadier stocks.

Not only that, the dividends help to cushion portfolio losses when equity prices are declining. The smoother overall ride generally makes dividend growth stocks easier to hold during times of market distress.

And that completes my top reasons for being a dividend-growth investor. When you invest using the DG strategy, you expect to succeed right along with the companies you own. Price aside, that shared success happens when they not only send you cash that reflects their business achievements, but also grow the amount each year along with their own growth.

Thanks for reading.

--Dave Van Knapp