Walgreens: The Dividend Aristocrat With A 5% Yield That's Come Roaring Back To Life

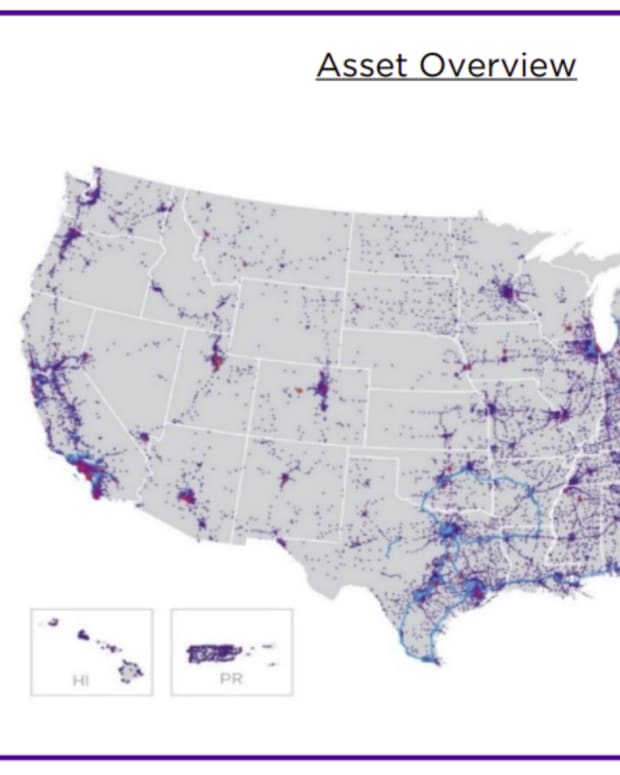

Walgreens Boots Alliance, Inc. is an integrated healthcare, pharmacy, and retailer with operations in the United States (U.S.), the U.K., Germany, and other countries. Three divisions comprise its business: U.S. Retail Pharmacy, Overseas, and U.S. Healthcare. Additionally, it offers services for health and well-being, specialty pharmacies, and home delivery.

With 47 years of consistent dividend increases, WBA has been paying dividends to shareholders for a very, very long time. It is a dividend aristocrat and is nearly a dividend king. The corporation has a long streak of paying dividends, yet its distributions have been highly consistent despite that.

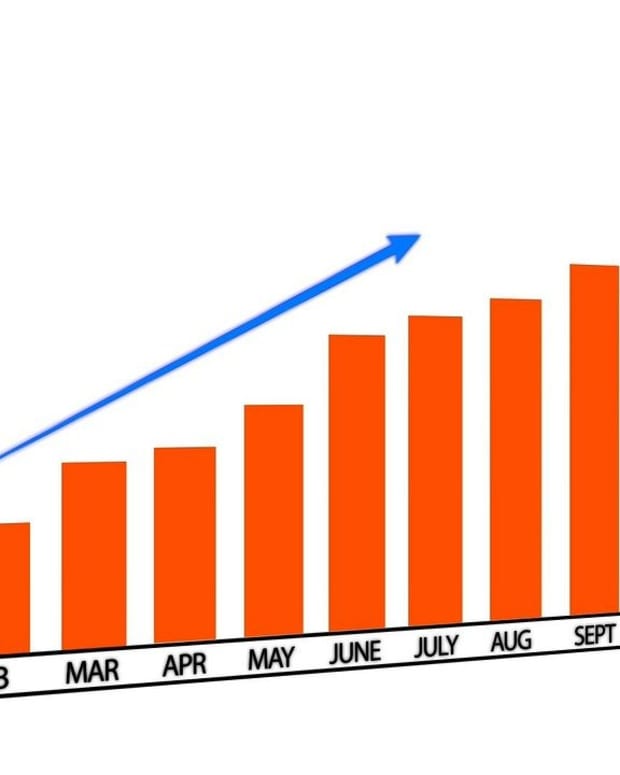

Since 2012, the payout has increased from $0.90 per year to $1.92 per year. This translates to a compound annual growth rate (CAGR) of almost 7.9% annually over that period. We believe this can give investors a decent extra source of income for their portfolios because the dividend growth has been relatively consistent.

Dividend Analysis of Walgreens Boots Alliance

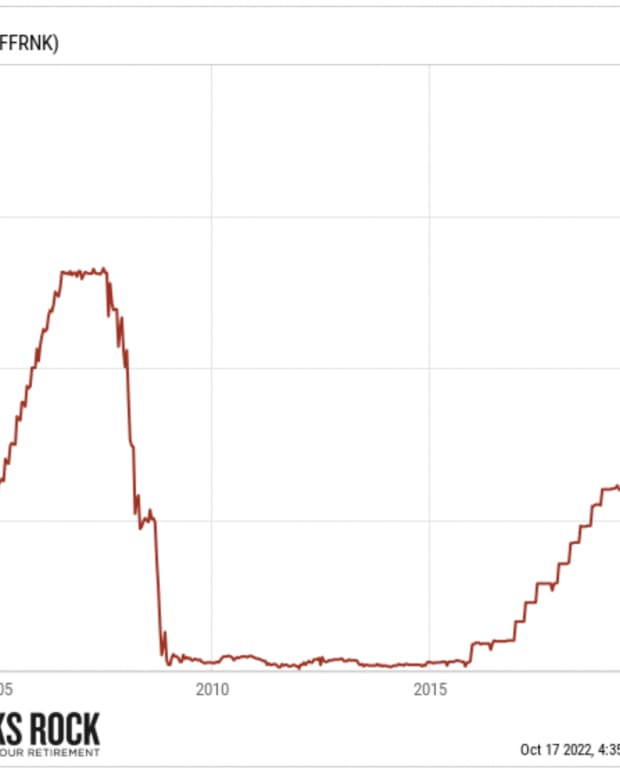

Walgreens Boots Alliance Inc. has given dividends to its stockholders every quarter since March 12, 1973. When contrasted to the retail-drug industry median, Walgreens Boots Alliance Inc.'s relative dividend yield as of November 5, 2022, was 5.3%, which is an excellent rate. The dividend yield for Walgreens Boots Alliance Inc. was 4.2% in 2016.

Walgreens Boots Alliance Inc. has distributed quarterly dividends of between $0.03 and $0.50 per share since March 12, 1973. The dividend yield for Walgreens Boots Alliance Inc. has been 3.1% annually on average for the previous five years.

Dividend Yield

The stock's current dividend yield is hovering around 5.2%, with Walgreen's most recent dividend increase being a modest 2.1%. Walgreens is now one of the Dividend Aristocrats Index's constituents with the highest yields as a result. It's a unique opportunity to find a good company that offers a high dividend yield.

The share payout ratio should be close to 35%, even if we predict more or less consistent EPS this year. Consequently, the generous dividend yield is relatively well covered. So, it's not unlikely that Walgreens' dividend growth rate will speed up at some point in the future.

As a result of the stock's continued slide, Walgreens is selling at close to 10x its anticipated earnings, which is close to the low end of the scale of its historical normal. From a different angle, the stock is trading at a P/B multiple of about 1.4, the lowest P/B multiple in Walgreens' history. We think that this multiple is very attractive, and when combined with the 5.2% yield, it should give investors a large amount of safety.

Dividend History

A $0.48 dividend will be paid on December 12 by Walgreens Boots Alliance, Inc. Accordingly, the annual dividend represents 5.2% of the stock price at the time of payment, which is more than the industry standard. In 46 years, Walgreens has consistently increased its dividend. The company's impressive record of dividend increases makes Walgreens a Dividend Aristocrat.

The business has a long history of paying dividends consistently with slight variation. In 2012, $0.90 per year had been paid out over the previous ten years, and $1.92 was paid out over the latest financial year. This translates to a growth in distributions of 7.9% annually over that time.

We believe this is an appealing combination since it gives shareholder returns a healthy boost. At the same time, dividends have increased at a fair rate over this time without experiencing any significant reductions in payment over time.

Dividend Sustainability

A high yield for a short period of time won't matter all that much if the dividends aren't stable. However, before this disclosure, Walgreens Boots Alliance was distributing more than 75% of its free cash flows to shareholders and could comfortably sustain its dividend with earnings. But growth in the future could be limited if more than 75% of free cash flow is given to shareholders.

Over the coming year, EPS is predicted to decline by 14.9%. We project that the payout ratio for the dividend could reach 47% if it keeps going in the current direction; this level is sustainable for the company to maintain going forward.

The company's stock has decreased by more than 17% this year. Investors are worried that inflation would reduce the company's sales volumes and that fewer customers would visit its storefronts for COVID-19 vaccinations, which would result in a reduction in sales, which makes sense. We think Walgreens' value would stay the same during a recession because healthcare spending is usually pretty stable, the company's operations go beyond its retail stores, and the company's finances look good.

Cash Flow Analysis of Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance reported a free cash flow of over $2.7 billion in the recently completed twelve months, compared to over $4.4 billion in the previous year. The company appears to be in excellent shape, which won't change soon.

WBA just increased its dividend by 1/4 of $0.01, but the company bought back $4 billion worth of shares over the previous two quarters. The total amount of dividends paid has increased by 50% of free cash flow. This number is often closer to 33–38% for organizations in the normal stages of growth.

As was previously mentioned, Walgreens Boots Alliance pays out more than 75% of its free cash flow to investors and can comfortably cover its dividend with earnings. The company is not using its cash to expand the business since it returns a sizable portion to shareholders.

Debts Analysis for Walgreens Boots Alliance (WBA)

With creative yet responsible use of debt, Walgreens Boots Alliance has a debt-to-EBITDA ratio of 1.9. In keeping with that tendency, its trailing twelve-month EBIT was 7.5 times its interest expenses. Sadly, Walgreens Boots Alliance's EBIT declined by 19% over the past four quarters.

If that kind of decline is not stopped, controlling its debt will be more complex than charging a premium for ice cream with a broccoli flavor. The balance sheet undoubtedly provides the most helpful information about debt. But more than anything else, future earnings will determine Walgreens Boots Alliance's capacity to preserve a sound balance sheet moving forward.

The ratio of WBA's net debt to equity (30.2%) is seen as fair. Over the last five years, WBA has decreased its debt-to-equity ratio from 45.8% to 38.4%. Operating cash flow (33.4%) adequately covers WBA's debt. EBIT more than covers WBA's interest payment on its debt (7.7x coverage).

Should You Invest in Walgreens Boots Alliance Considering Its Outstanding Dividend Payouts?

The stock price of Walgreens has substantially underperformed in recent years, probably for a good reason. But we think there is a substantial investment case because the company is making record profits, growth projections are in the single-digit range, the dividend yield is high, and the price multiple is attractive.

As income-focused investors take advantage of Walgreens' high dividend yield and steady history of dividend growth, the company should make up some of the ground it lost.

Walgreens' price decrease has resulted in a stock with a price-to-earnings (P/E) ratio of less than six, which is more than 28% lower than the average P/E of an S&P 500 business. One of the earliest companies to recover from the present market crisis is probably a strong one with a pretty high dividend yield. People need security, and Walgreens gives them both while rewarding long-term investors with a respectable income.