Utilities Stocks Are On An Historically Bad Run; Haven't Done This In 20 Years

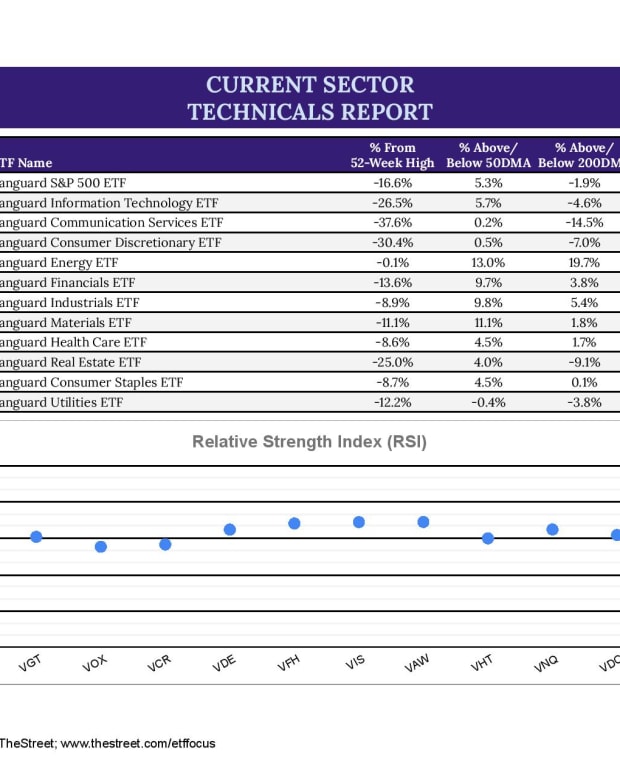

We've seen stock prices declining pretty steadily throughout 2022, but conservative equities have held up pretty well. Dividend growth, low volatility and consumer staples have limited losses and eased some of the pain of this unprecedented year.

One of the markets best performing sectors had been utilities. I say "had been" because that trend has made a remarkable reversal.

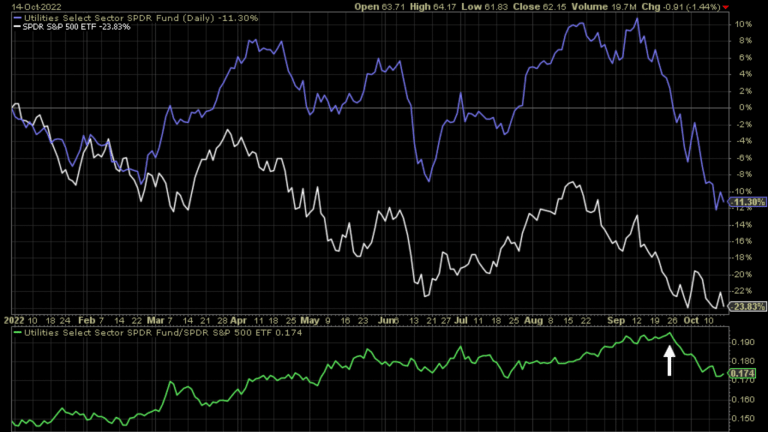

The sector was up more than 10% on the year as recently as early September and was outperforming the S&P 500 by more than 25%. However, sentiment over the past three weeks within utilities has deteriorated mightily.

It's a bit curious. The typical environment where we see utilities do particularly well is during down markets. If stocks are falling, investors tend to move into the aforementioned conservative equity sectors as well as Treasuries. We know that Treasuries aren't working this year and that's helped explain why defensive equities have done so well.

But the past month has been an anomaly. Utilities are underperforming even as stock prices continue to fall. And not just by a little bit. By a lot! Over the past 15 trading days, utilities (XLU) has underperformed the S&P 500 (SPY) by more than 10%.

If you look back over the 24 years that XLU has been around, you can see that this has been a rare occurrence indeed.

You probably wouldn't be surprised at the other times this has happened.

- 2001-2002: Tech bubble

- 2008-2009: Financial crisis

- 2015: Junk bond crisis

- 2018

- 2019

- 2022

But, again, utilities usually underperform the S&P 500 when conditions are bullish. After all, when stocks are running higher, investors don't want to be conservative. They want to be aggressive. In 2022, utilities are underperforming significantly even as the broader market is falling.

Since XLU debuted in 1998, this has only happened one other time. In 2002, during the tech bubble, utilities underperformed the S&P 500 by more than 10%, while the S&P 500 was down. That's it.

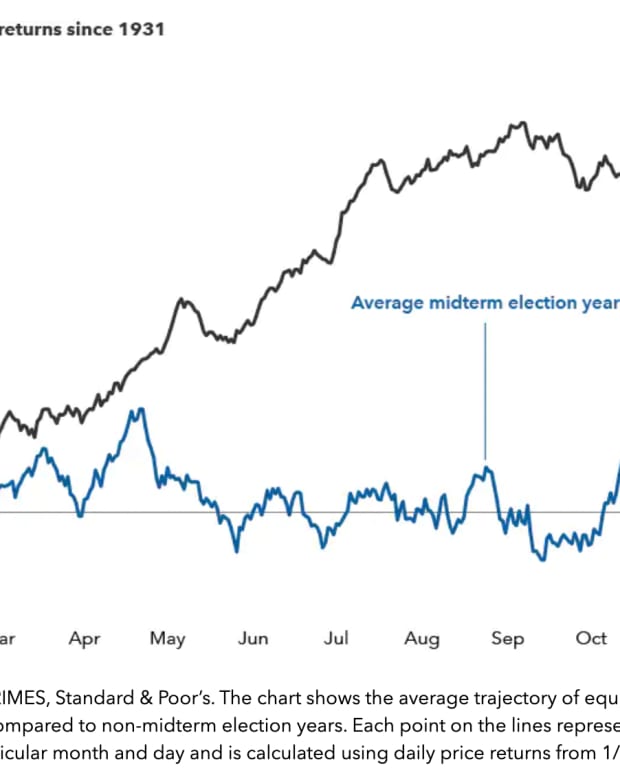

2022 has been one of the weirdest markets in history. Little anecdotes like this just make the year look weirder.

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs