Here's The Roadmap For A Big Rally In Equities This Week

Last week, investor concerns shifted from their focus on economic deterioration and inflation to a potential full-blown systemic failure.

A little over a week ago, new U.K. Liz Truss unveiled the government’s plans to enact sweeping tax cuts and fund spending with new borrowing. The plan was ill-conceived from the start and the result was soaring gilt yields and a cratering pound. Many of the nation’s pension plans are loaded up on long-dated government bonds, some of which use leverage to add to their exposure. High gilt yields triggered margin calls that some of these funds wouldn’t be able to meet. Enter the Bank of England, which suspended previous plans to wind down its balance sheet and began adding liquidity to the market through new bond purchases. It ended up driving yields back and helping the pound, but it unveiled some of the tail risks that are becoming very real in this system.

But that wasn’t it. Next up was the news that a “large European investment bank” was on the brink of collapse (most likely Credit Suisse, Deutsche Bank or both!). Anybody who follows the Euro banks knows that some of them have been over-leveraged and at risk of a Lehman moment for years now, but soaring rates could be the catalyst that finally sets it off.

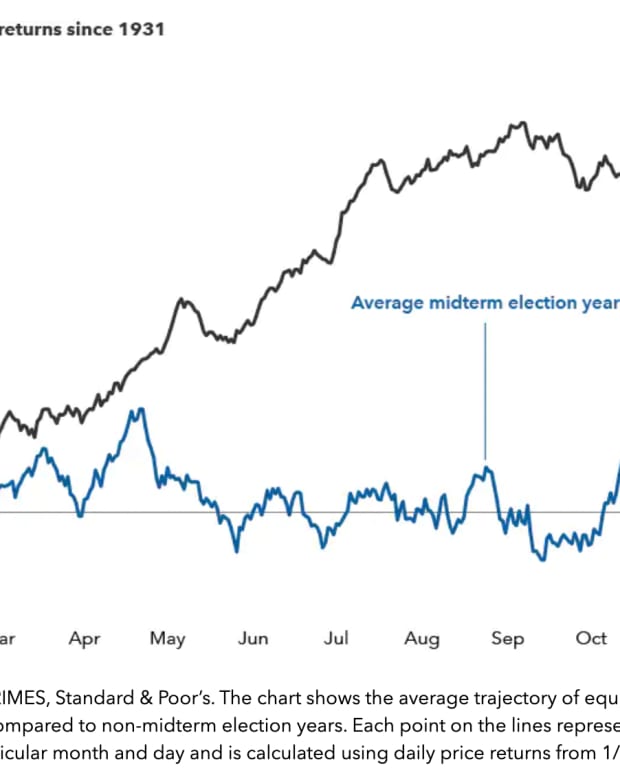

The S&P 500 is down 24% on the year. Long-term Treasuries are down 30%. Investor sentiment is at historic lows. The market is almost universally oversold at this point.

Those conditions alone support the idea of a recovery rally coming this week, but there’s one other thing that could set things in motion.

The Fed Board of Governors is going to meet on Monday. Not to decide on interest rates, but to discuss lending rates.

Given events over the past week, I have a hard time believing they’re not going to at least discuss ways of supporting the bond market and financial institutions. The Bank of Japan has been instituting yield curve control for a while. The Bank of England has effectively done the same. I think the Fed will consider taking a similar path. That probably won’t mean the Fed will halt its plans to raise interest rates to combat inflation, but I think they could decide to suspend QT and instead stand ready to buy long-dated bonds. That would add liquidity to a market that’s seeing it dry up pretty quickly and help stabilize the bond market.

And that’s the recipe for a big time rally in both stocks and Treasuries. A lack of liquidity is perhaps the biggest risk facing the markets today. When you remove a significant risk (or at least mitigate it to some degree), that usually leads to buying in equities.

The Fed has been talking a tough game for a while. It wasn’t that long ago when Jerome Powell said that the central bank was going to allow some economic pain in order to bring inflation back down to earth. Now we’re starting to see that “economic pain” could mean something far worse than just a garden variety recession. Rising interest rates are creating a serious liquidity and credit crunch that could very well get even worse before it gets better. If the Fed is willing to raise interest rates another 100-150 basis points before it ends this rate hiking cycle, something breaking within the financial system is not at all outside the realm of possibility.

I suspect some U.S. financial institutions are at risk as we speak. If the government can intervene to save the the bond market, while the Fed continues to address inflation risk, I think they might do it.

If they do, it could be rally time for stocks.

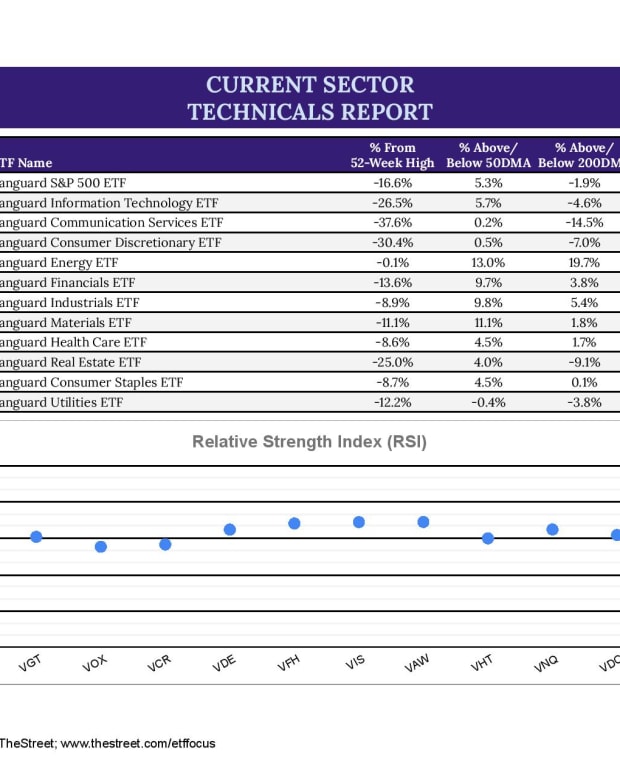

Note: There won’t be an ETF market view this week. The ETF Action database I use for my analytics is undergoing an upgrade, which means I’ll be upgrading some of my reporting as well. The sector level reports will be returning very soon!

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs