Retirement Strategy: If The 60/40 Portfolio Is Broken, What Is The Replacement For Bonds?

You've been working for decades. You've been saving diligently all that time. You're either in retirement or nearing it and you're finally ready to leverage that nest egg to enjoy your golden years!

And then 2022 happens.

It's one of the worst possible outcomes - a major market decline right when you need to begin accessing the money. The equity portion of your portfolio, if it's invested in the S&P 500 (SPY), has fallen by a bit over 20%. Those returns are bad enough, but you've taken a risk-managed approach and utilized the old-fashioned 60/40 portfolio.

This is exactly why you have bonds in your portfolio - to mitigate overall portfolio risk and own an asset that historically rises in value when stocks decline. You should still be in fairly decent shape, right?

Not in 2022.

Thanks to high inflation and an aggressive Fed, bonds have done even worse! Long-term Treasuries (TLT) are down 30%! The one segment of your portfolio that was supposed to help save it when conditions got rough has made it even worse.

Death of the 60/40 Portfolio

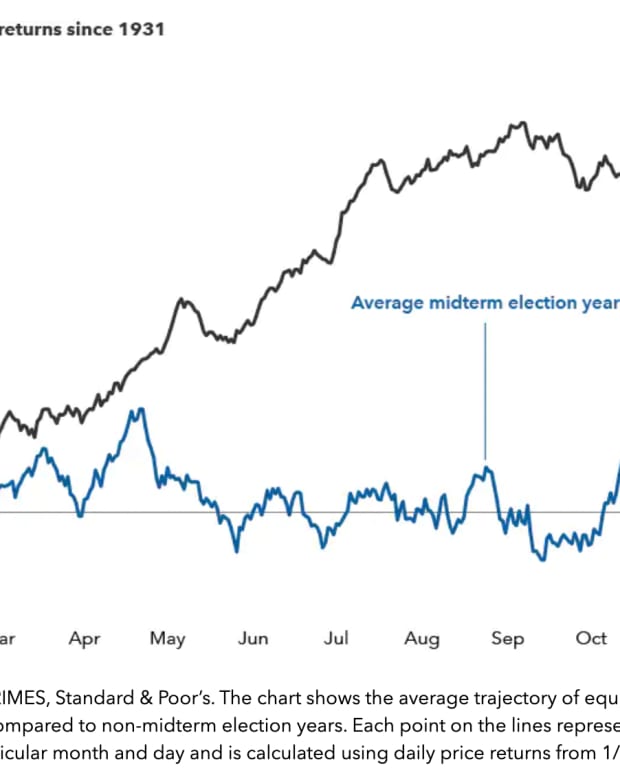

This is the dilemma that income investors face today. Nobody complained about the "40" part of the 60/40 portfolio when 30-year Treasury rates were falling from around 15% in the early 1980s to sub-2% roughly 40 years later. That was the time when investors were able to earn solid returns from both sleeves of their portfolio - stocks and bonds.

Those days, however, have gone. When the 30-year Treasury bond bottomed out at 1% in March 2020, it did two things. First, it eliminated the ability of income seekers to obtain anything resembling a reasonable yield from bonds. Second, it virtually exhausted any opportunity for investors to see share price gains from falling interest rates.

Effectively, every drop was squeezed out of the fixed income turnip and returns had almost no choice but to turn negative. Interest rates had nowhere to go but up! It only took the highest inflation rate in 50 years and a Federal Reserve that was way too slow to respond to combine to create one of the worst environments for bonds in history.

If you're a retiree and you were relying on bonds to provide at least some income, you've no doubt already been dealing with razor thin yields for years. Now you've got crashing bond prices to add to your misery.

It raises a very important question - is the 60/40 portfolio truly dead?

You'll hear a lot of people answer this question with yes, but I'm going to say no. It's probably more accurate to say that the opportunity for the 60/40 portfolio to experience success is much more narrow today than at maybe any point over the past 40 years. However, I believe the core principle behind the 60/40 portfolio still works. Creating a portfolio that balances the growth potential of equities with the defensiveness and income of bonds still makes sense.

But it is worth asking if bonds are still the appropriate thing to be using for the "40" in the 60/40 portfolio.

Replacement Options For Bonds In A Retirement Portfolio

As you've probably already guessed, I'm an ETF investor. With 3,000 different ETFs to choose from here in the United States, there's an investment option for almost every factor, theme, region, style or corner of the market you can think to put your money in.

That's a great thing for you if you're looking for alternatives to replace traditional fixed income within your portfolio. Be aware, though, that some of the ETFs I'm about to mention won't look anything like traditional bonds or bond funds. They're probably better categorized as income alternatives. They'll generate yield (or, in some cases, high yield), but you'll want to closely examine their risk/reward profile before diving in. Reaching for an 8% yield is fine, but if it's more volatile than you're prepared for and has more downside potential than you're comfortable with, have you really come out ahead in the end?

I've come up with five alternative ideas to consider for the "40" in a 60/40 portfolio. To be fair, I keep mentioning the 60/40 portfolio as a proxy since it's been the benchmark for portfolio construction for so long, but these options I'm about to discuss could be used regardless of how big the income component of your nest egg is.

Buy Treasuries

OK, I realize how silly it must sound to suggest the very asset class that has plummeted in 2022 and is the source of your income angst in the first place, but hear me out.

Treasuries were a rotten deal at 1%. With a 4% yield, it's a different story. Here's the case for re-considering Treasuries in your portfolio. Let's start with short-term bonds.

One year ago at this time, a 2-year Treasury note yielded just 0.3%. Today, that number is 4.3%. If we ignore for a moment at what's happened over the past year and look at short-term Treasuries from this point forward, getting a 4% yield on an ETF that's 100% AAA-rated and has a duration of less than two years is a pretty good deal. This is the highest yield on this type of bond in the last 15 years and investors would be wise not to simplify dismiss it out of hand.

The ETF to consider here is the iShares 1-3 Year Treasury Bond ETF (SHY).

For those unfamiliar with the term "duration", it's essentially a measure of interest rate sensitivity. In theory, an ETF with a duration of two years could be expected to decline in value by 2% for every 1% increase in interest rates. A lower duration means it's more conservative. A higher duration means it's more volatile. Treasury bills might have a duration of nearly 0. Long-term Treasury bonds could come with durations of around 20 years.

I like to look at a fund's yield-to-duration ratio, especially in rising rate environments. It's only one measure of risk (it doesn't consider the credit risk of corporate or junk bonds), but it does give a sense of how adverse conditions could get before investors start looking at losses.

With a current yield of around 4% and a duration of 1.8 years, that means (in theory) interest rates could rise by another 200 basis points before investor returns dropped to 0% over the next 12 months (e.g. 4% yield earned minus 4% share price loss due to higher interest rates). Are yields in this group about to rise to 6% by the end of 2023? It's possible I suppose, but nobody I know is projecting it. In fact, I think it's more likely that yields go down over the next 12 months.

A 4% yield plus the opportunity for modest share price gains from a low-risk Treasury bond ETF? Sounds like a pretty good deal to me for income seekers!

Now, how about the home run swing? I'd be looking at the iShares 20+ Year Treasury Bond ETF (TLT).

It's the same concept as above except the duration here is 18 years. That means if interest rates rise another 1%, TLT could be expected to fall by about 18%. Just take a look at a chart over the past 12 months to see what that's like.

It's also yielding around 4% right now, so the income component is nice, but it's more of a pure bet on falling interest rates. Again, I think that interest rates will fall over the next 12 months. Within six months or so, the Fed will probably be finished with its rate hiking cycle and then its attention will turn towards recession risk. With inflation (in theory) coming under control, the Fed can start cutting rates again to kick start the recovery. Even if it doesn't, investors will likely flee towards the safety of Treasuries again feeling as if the Fed will no longer get in their way.

This is a much riskier bet, although one that could pay off bigger. If you're looking for more of a pure income option, SHY is the better choice. Rates may not have yet peaked since the Fed is still hiking, but a low-risk return in the neighborhood of 3-4% seems reasonable.

Buy Interest Rate Risk Hedges

This is a bit of a cheat since it's not really an income-producing alternative. It's simply a portfolio hedge in case rates keep rising.

This is something that's really only a short-term fix for the current market. Since stocks and bonds tend to usually move in opposite directions, securities that move higher when bond prices are falling would, therefore, have a positive correlation with stocks. Under more normal market conditions, that means 100% of your portfolio would, in theory, be moving in the same direction. That's pretty much the opposite of what a diversified 60/40 portfolio is supposed to do.

But, these are unusual times. And when stocks and bonds are falling together to a degree that we really haven't seen in the past 100 years, it might call for unusual measures.

One of the better interest rate hedge vehicles out there right now is the Simplify Interest Rate Hedge ETF (PFIX).

PFIX started the year with about $116 million in assets, pretty good for an ETF that has a very niche appeal. Today, that number is over $360 million. Investors are clearly seeking out bond market hedges right now, although a 90% year-to-date is not doubt appealing to performance chasers as well.

PFIX invests holds a portfolio of interest rate options contracts and is intended to provide direct exposure to large moves in interest rates. Simplify notes that owning PFIX is "functionally similar to owning a position in long-dated put options on 20-year US Treasury bonds".

Again, this should be considered only for a short-term holding period. As long as stocks and bonds continue to move in the same direction, PFIX should be an ideal risk hedge and a good way to at least temporarily return to the sanity of a traditional stock/bond mix, at least from an asset correlation standpoint. Once bonds begin to behave normally again i.e. as a safe haven asset for volatile markets, it's probably wise to exit the position and return to something like Treasuries.

Buy Synthetic Equity Income ETFs

Among the high yield seeking investor universe, the JPMorgan Equity Premium Income ETF (JEPI) and the Nationwide Nasdaq 100 Risk-Managed Income ETF (NUSI) are well-known. They're not traditional income-producing ETFs, however. By combining an underlying equity portfolio with an options contract strategy, they are able to deliver broader equity exposure and a (really) high yield.

These setups are important to understand before you jump in. Investing in either of these isn't as simple as getting a full investment in an index or equity portfolio with a double-digit yield to boot. The options overlay strategies impact the risk/return profiles of these ETFs. There's always a tradeoff involved and those high yields can come with a price.

First, JEPI is a fund that has only been around for a little over two years, but has proven incredibly popular with investors. It has just over $13 billion in assets and, yes, a current 12.5% yield.

JEPI starts by investing in a broad portfolio of around 100 low volatility stocks designed to have less overall volatility than the S&P 500. In addition to that, it can invest up to 20% of assets in what are known as equity-linked notes. The ELNs that JEPI invests in combine the characteristics of an S&P 500 investment with a written call option all in a single security. At a very high level, JEPI is a covered call ETF.

Covered call ETFs, however, come with a downside. In exchange for that high yield, the portfolio itself gives up a lot or, in some cases, all upside potential. This happens because if the underlying security price rises above the written option strike price, the holder will "call" the stock away. That means selling a stock at below market prices. There is a bit of downside protection though, usually be the performance of the underlying portfolio minus the extra yield earned. Think of it as narrowing the possible range of returns in exchange for a plus-sized yield.

Up until this year, with Treasuries yielding next to nothing and the S&P 500 not doing much better, JEPI became a popular alternative income option, but 2022 went to another level. Assets in the fund more than doubled even though stocks and bonds have tanked this year. JEPI is only down 11% year-to-date compared to a 24% loss for the S&P 500. The low volatility portfolio itself has outperformed the broader market and the high income was an added bonus.

It's important to note, however, that this is an equity fund, not a bond fund. Adding this as an income alternative turns a 60/40 portfolio into a 100/0 portfolio. On the plus side, JEPI is typically about 30-40% less volatile than the S&P 500, so there is a risk reduction advantage to be had, but it still has a correlation factor of more than 0.9 with the S&P 500. Essentially, the two move in lock step with each other.

NUSI uses a somewhat similar strategy, but adds options exposure on both ends of the investment.

In the case of NUSI, the fund starts with a full replication of the Nasdaq 100. On top of that, it layers on a collar strategy - writing a call option to generate income and then using part of the income received to buy a protective put. Like JEPI, the strategy puts a cap on upside, but adds downside protection as well. The leftover net income from the trade goes to shareholders. The current yield on NUSI is approximately 8%.

Just like the warning I gave with JEPI, NUSI is an equity position and an aggressive one at that. The Nasdaq 100 as an income alternative is less than ideal as the replacement for the "40" in the 60/40 portfolio. In reality, it's probably better as an addition to an equity portfolio as opposed to a bond replacement, but it is an option for generating a high yield. NUSI also has sister ETFs using this strategy, but are based on the S&P 500, Russell 2000 and Dow 30.

In the case of both ETFs, they've managed to significantly outperform their underlying benchmark indices. JEPI has outperformed the S&P 500 by 11% year-to-date, while NUSI has beaten the Nasdaq 100 (QQQ) by 5%.

Another advantage is that both JEPI and NUSI pay monthly distributions.

Buy Covered Call Bond ETFs

This is a relatively new creation that I'm a little surprised hasn't launched before now. Covered call ETFs have existed for years, but those have been based on stocks. These new iShares ETFs write call options instead on bonds.

There are three in total, one for investment-grade corporate bonds and one for high yield corporate bonds, but the one I want to focus on is the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW). Its underlying holding is TLT, the same ETF mentioned earlier, but adds on a series of one-month written call options to generate income.

The options strategy has a couple of advantages.

First, the written options are approximately 2% out-of-the-money. Although it comes at the expense of less income earned, the further out of the money the option is, the less likely it is to be called away, increasing the chances the fund can simply capture the income with no impact to the underlying position.

Second, the written calls are European-style options. What does that mean? In most cases, options are American-style, meaning they can be exercised at any point up through the expiration date. European-style options can only be exercised at expiration. That's particularly attractive for this type of strategy because it takes a lot of volatility out of the equation. Volatility is the enemy of written options because it means more opportunity for it to fall in-the-money and be exercised by the buyer. With the European option, it only matters what it looks like at the finish line.

TLTW is only about two months old, so we don't have much data to work with. The two distributions that have been made thus far have been $0.64 and $0.56 per share. If we take those numbers and annualize them, that works out to a yield of around 20%!

I don't think I want to assume that this will be the annualized distribution rate going forward, but anything near it would be especially enticing. The Treasury market is experiencing one of its most volatile periods ever and high volatility does equate to high options premiums. It's entirely possible that this distribution rate continues, but I'd still be cautious at this point.

Perhaps the best part about TLTW, especially in relation to some of the other options on this list, is that it's a bond fund and thus an ideal fit into the 60/40 portfolio. When conditions normalize, this fund could resume being the safe haven asset that balances out the risks on the equity side of the portfolio. Even if conditions remain as they have throughout 2022, the high yield should help offset most, if not all, price declines that may occur.

Conclusion

There are, of course, lots of other income alternatives out there. Some will suggest REITs, but I'm not sure I want to be holding those heading into what surely looks like a housing market bust.

Perhaps long/short strategies, such as the AGFiQ U.S. Market Neutral Anti-Beta ETF (BTAL), could work? It's not really an income generator, but its long low vol/short high beta strategy has proven to deliver superior risk-adjusted returns and lower overall portfolio risk? That seems more like a complement to an equity portfolio as opposed to an income replacement.

There's no real good options if prices continue to decline, especially on the fixed income side, but I don't think we're going to be in that environment much longer. Bond prices are reacting to the Fed, not economic conditions like they usually do. Once the terminal Fed Funds rate is hit (or the Fed says we're nearing it), Treasuries should have permission to act like a risk-off asset again. That's why I'm actually getting bullish on government bonds even though we may not yet have reached the end of the rate hiking cycle. Long-term Treasuries at 4% sure look a lot better than long-term Treasuries at 1%.

I tend to favor TLT and TLTW on this list. TLT is kind of the home run swing based on the Fed pivot. SHY is the much more conservative option if you just want to focus on the income component (the 4% yields there look pretty attractive). TLTW is the (so far) really high income play, but still comes with the volatility of TLT.

People say the 60/40 portfolio is dead. I don't think it is, but expectations should be adjusted. A 40-year bond bull probably isn't coming again anytime soon, but the attractiveness of 4% yields on short duration Treasuries shouldn't be ignored. We will eventually exit this cycle and that's where I think the "40" can start to yield results again.

In the meantime, there are some worthwhile alternatives to consider.

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs