New Bull Market or Another Bear Market Fakeout?

Last week’s market rally was an across the board move higher in asset prices. Not only did the S&P 500 post a nearly 6% gain on the week, small-caps, Treasuries and even gold (yes, gold!) delivered huge gains!

The global catalyst, of course, was an unexpectedly lower reading on October inflation. The headline rate fell to 7.7%, its lowest since January, while core inflation dipped slightly to 6.3%. Both numbers are still nowhere near where the Fed wants to see them, but it is an improvement. Goods inflation is coming down significantly (think cars, electronics, home goods), but services inflation remains stubbornly high. It’s the latter piece that tends to take longer to come down, so we’re not out of the woods by any stretch. I still expect to see elevated inflation readings into the end of 2023, albeit at far lower than the levels we’re at now.

Let’s break down the rallies in each of the major asset classes.

Small-caps & Large-caps

Equity investors were waiting for this. Sentiment was still quite negative heading into last week, although it had been improving slightly. We’ve seen throughout 2022 that the only thing the markets have really responded favorably to is a positive inflation development or a dovish development from the Fed. Even though inflation is still way above the Fed’s target level and will continue to stay high for at least another couple quarters, investors were looking for any reason to get bullish again and the October report gave it to them.

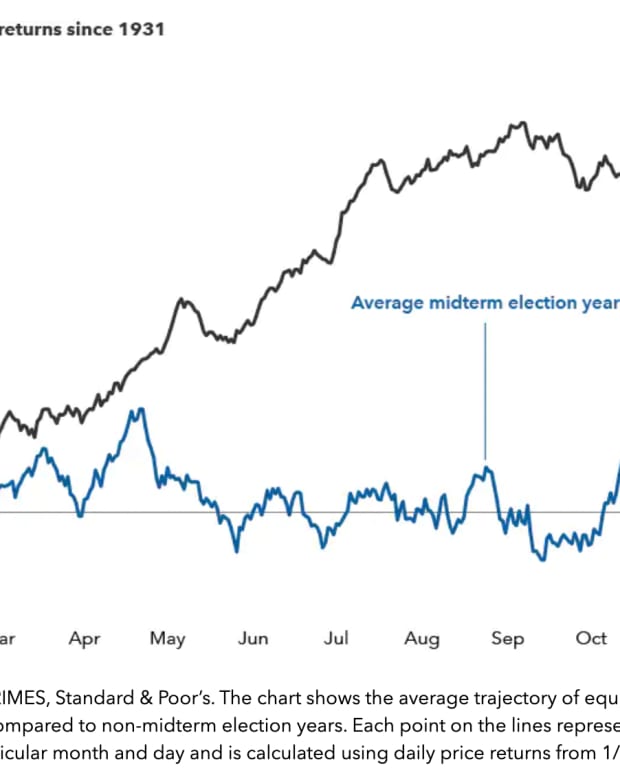

My expectation is that this helps carry stocks through the end of the year, but not far beyond that. The end of the year tends to be positive for risk assets and this could very well be the push that gets things going. We shouldn’t get too many surprises before the end of the year. We kind of know what we’re getting out of the Fed. The Q3 earnings season is mostly done. We’re getting some clarity out of the midterm elections. The only thing that might derail this newly found positive sentiment is the November inflation reading coming in a few weeks. If that shows more easing, we could be positioned for a nice rally heading into the new year.

That being said, I don’t believe it lasts. As inflation eases and the Fed nears an end to its rate hiking program, we’re probably looking at favorable conditions for stocks. After that, the recession narrative takes over. The data suggests there probably isn’t an imminent threat of recession any longer, but it will instead get likely pushed into the second half of 2023. There are already signs of revenue and earnings trouble from several names, including Apple, Walmart and Alphabet. Consumer spending is holding up for now, but savings is running out and the high cost of basic needs is still altering spending habits. All sorts of companies are announcing layoffs and hiring freeezes, so an increase in the unemployment rate is probably inevitable at this point. These are catalysts that might be slow moving on a short-term basis, but eventually tend to result in recession.

Treasuries

The bond market has consistently reacted to Fed expectations throughout the past 12 months more than anything else, so it’s no surprise they rallied from the perception that lower inflation will lead to a lower terminal Fed Funds rate.

The degree of the rally, however, was a bit surprising to me. From peak to valley last week, the 10-year yield dropped more than 40 basis points. That’s an incredibly strong move that could bode very well for the longer-term prospects for fixed income.

I’ve been overweight Treasuries in my personal portfolio for a while now. So far, that hasn’t really paid off, but I do like how 2023 is setting up. Treasury yields should continue to moderate as the pace of Fed hiking eases and eventually concludes. As investors switch their focus to recession risk, Treasuries should have another tailwind of buying support.

I wouldn’t be surprised if long-term Treasury yields started sliding back towards 2% at some point in 2023 and investors are able to capture double digit gains.

Gold & U.S. Dollar

Here’s perhaps the biggest winner of last week. We all know well that gold has failed to provide the inflation hedge that many were expecting heading into 2022 (again, gold isn’t really correlated to stocks or bonds, so there was always roughly a 50/50 chance that it would or wouldn’t work). The one thing that gold has been reasonably correlated to in the past is the dollar. Specifically, if the dollar goes up, gold tends to go down and vice versa.

Since April, gold and the dollar have maintained a stronger than average negative correlation. With the greenback soaring, that resulted in gold falling more than 20% from its 2022 high.

That has now reversed. The dollar is in the process of tanking over the past two weeks and gold has been taking off. As I noted on Twitter this week, gold just had its 15th best week since the gold ETF launched back in 2004.

I don’t think the dollar will decline at quite the rate it has over the past couple weeks, but I do think it will progressively move back towards its long-term equilibrium level of 100. If that occurs, expect further above average returns in gold and…

International Equities

Yes, international equities have been an investor albatross for a while, but a falling dollar is a tailwind for international stocks. That alone doesn’t make foreign investments a roaring buy, but it does create a scenario where they outperform the S&P 500.

We saw that in developed markets stocks last week as sentiment slowly starts improving in Europe, but emerging markets have still struggled. I think the COVID reopening trade in China is overblown and there’s growing political risk in Brazil, even after the recent election. Risks are still elevated, but I do believe in the longer-term story of international stocks over the S&P 500.

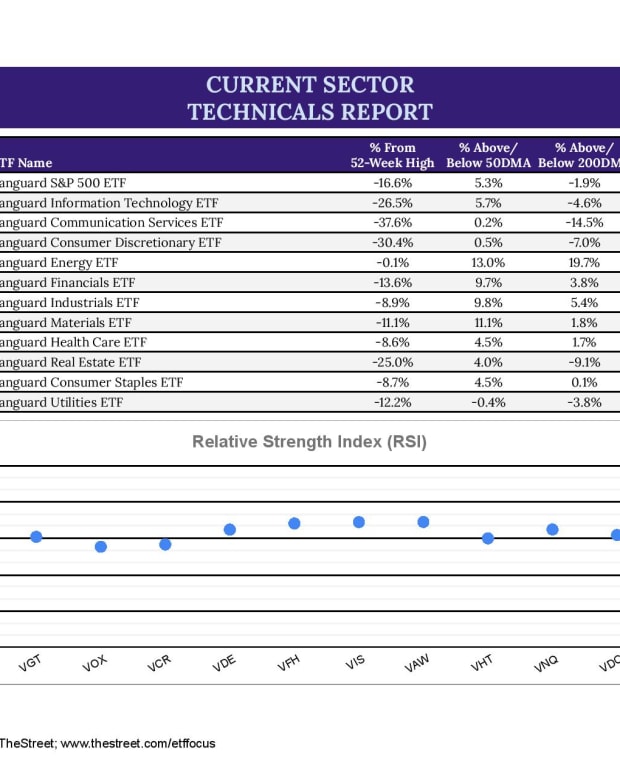

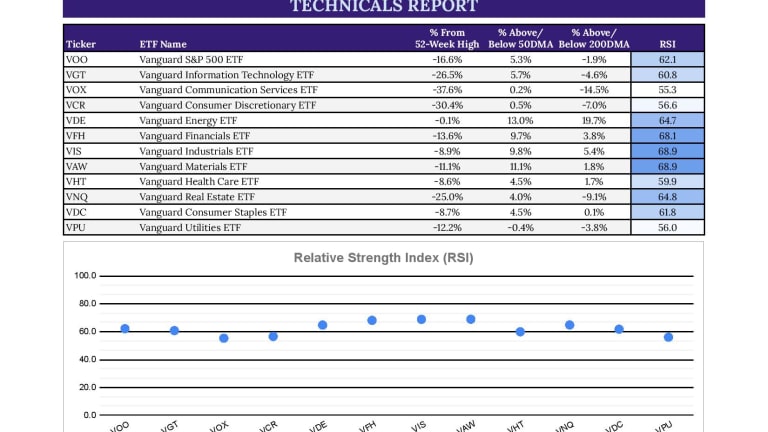

ETF Sector Analysis

Last week’s rally pushed short-term relative strength in every major sector, but the composition has changed dramatically. Defensive sectors had been in the lead with selective strength in cyclicals. Cyclicals are still looking fairly strong here, but growth, tech and high beta clearly had the best week. These are the areas that had been the most beaten down over the past several months, so it’s reasonable that they would be the best performers in a reversal. Several tech subsectors, including semiconductors, software and cybersecurity, posted double digit gains.

Consumer discretionary was the notable laggard among growth sectors as it actually underperformed the S&P 500. As I mentioned above, the retail environment is trending worse and consumer spending habits will continue to adjust as long as inflation remains persistent. Short-term conditions through the end of 2022 probably still favor growth and cyclicals as long as the narrative doesn’t do a sudden about face. Longer-term, I’m still in the camp of defensives, low volatility and dividend stocks.