The Most Popular Stocks at Dividend Stocks Rock

What if you could follow the most popular stocks held by savvy investors? In this article, we will look at the most popular stocks held by members at Dividend Stocks Rock. We used our DSR PRO database to identify which company is held by the most members (roughly 1,900 DSR PRO members).

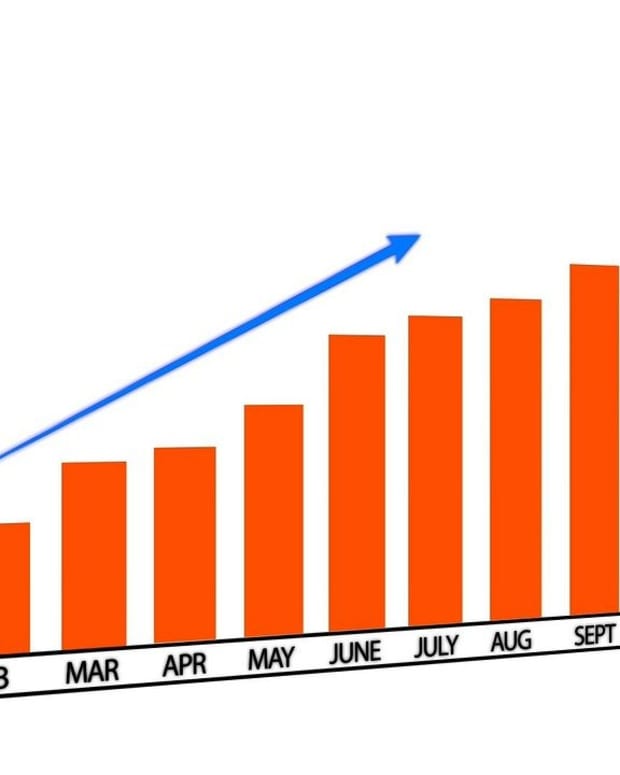

Can they be reliable? On average, our members are aged between 55 and 70 and manage over $500,000. Their top 10 favorites stocks greatly outperformed the S&P 500 over the past ten years.

Here’s our review of the top 3:

Microsoft (MSFT)

Microsoft doesn't need any presentation. This giant tech company has deep roots with Corporate America. MSFT’s strength is in the many businesses using their services (Windows, software, servers, services, etc.). The company can count on its cloud services and gaming products to support long-term growth.

Investment Thesis

Microsoft is one of the oldest and newest tech companies, all at the same time. While it benefits from a strong core business model that generates cash flow through subscriptions, management has proven its ability to develop other growth vectors. Its most recent success is with Azure, which is No. 2 in public cloud services. Azure is on the path to strong growth over the coming years. Cloud services will also be integral to the future of many businesses, and this segment is already exhibiting tremendous growth. MSFT recently acquired a player in artificial intelligence (Nuance) for $19.7B. This will mesh well with MSFT’s business portfolio and open the door to healthcare solutions. We would also like to mention MSFT’s acquisition of Activision, which may bring with it some tailwinds. Finally, if you have been waiting for an entry point with MSFT, the downtrend in the tech sector could be bringing us to that potential entry point.

Microsoft is part of our Dividend Rock Stars list.

Potential Risks

Microsoft has several dark clouds hovering over it: the first is evidently the Windows desktop OS. Desktops are often replaced by smartphones, tablets, or 2-in-1 solutions, where Windows isn’t a major player. Desktops won’t disappear soon, but there won’t be much growth from them either. Microsoft is also seeing a slowdown in growth from its subscription business. Most of its product suites (Windows, Office) are mature products, which are good for cash flow generation, but won’t keep the market excited (as it is right now!). While Microsoft can count on Azure and Dynamics to ensure growth, both products are not leaders in their respective markets. The tech giant must wrestle with other companies just as large. The pandemic has helped grow sales in some of their business verticals such as cloud services and LinkedIn.

Dividend Growth Perspective

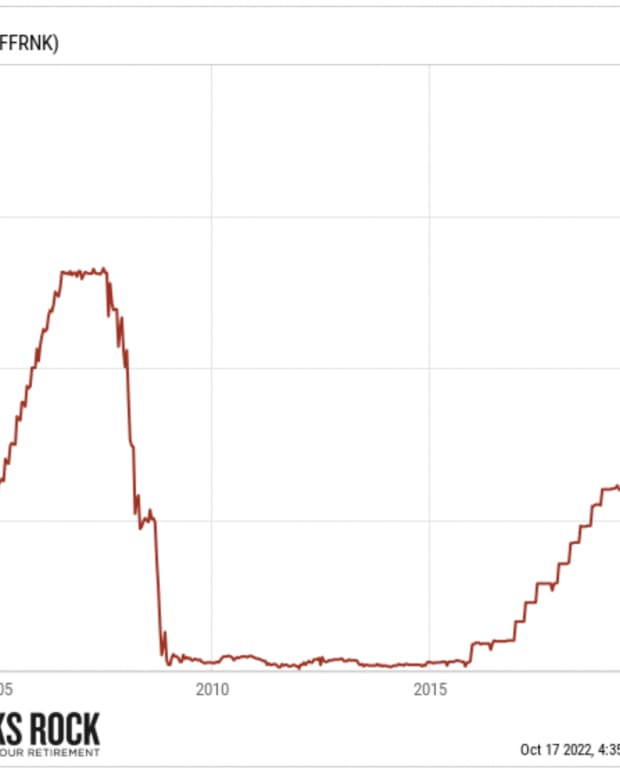

Microsoft has successfully increased its dividend yearly since 2004. Its yield used to be more attractive at approximately 3%, but the hype surrounding the stock has made it a low-yielding (~1%) stock. Even a double-digit dividend growth rate wasn’t enough to compensate for the stock price surge since 2015. Microsoft has a strong dividend triangle, and an investor can expect high-single-digit dividend increases for a while. Even after the 10% dividend increase in Q4 2021, the stock is yielding ~1%.

Apple (AAPL)

Apple is one rare company showing a perfect dividend triangle. Apple is not only the most profitable smartphone makers, it can build multiple businesses around its iconic product. From AirPods to Apple watch, Apple has developed a great range of "mini" businesses generating billions in cash flow.

Investment Thesis

There is continued interest among consumers for premium products. AAPL’s first growth vector remains its iPhone. It is also seeing double-digit growth in its services division, which generates higher margins; services such as Apple Pay, Apple Music and Apple TV represent just the tip of the iceberg. We think that Services will benefit from rising paid subscribers (825M; up 165M from a year ago). As more iPhones are purchased, their users are inclined to purchase the services related to them. Apple’s iPhones and IOS are beloved by customers and are a symbol of stability and security in terms of technology. Management has become increasingly shareholder-friendly, as evidenced by strong dividend growth and massive share buybacks. AAPL is among the rare companies that don’t need to be first movers in order to impress as the company surprised the market once again, beating estimates by $0.09 and revenue by $3.28B in Q1 2022!

Potential Risks

There aren’t many headwinds that we can identify for Apple. We feared the recession would impact Apple’s results, but the company still saw many loyal customers upgrade their phones, and it seems like this happened again with the iPhone 13. It is well-known that tech companies need to continually innovate their product offerings to remain on even playing field with their competition. Apple protects its core products with a strong product ecosystem and additional services, however the introduction of a competitor’s new phone that could potentially erode iPhone sales remains a possibility. Finally, the competition in artificial intelligence has many contenders, such as Amazon and Google, just to name a few.

Dividend Growth Perspective

An investor shouldn’t be fooled by the low yield as AAPL will double its payment every 8 years going forward. Both payout and cash payout ratios are very low. With strong sales growth and consistent earnings increases, the company should maintain a double-digit dividend growth rate for years to come. Unfortunately, the latest dividend increase was only 4.5% (from $0.22/share to $0.23/share), but the company is in good shape to keep increasing its payment. Finally, take advantage of the recent pullback if you want to add AAPL to your portfolio!

AbbVie (ABBV)

Finally, AbbVie is the most generous yield in this top three (you can guess DSR members aim for total return more than high yielding stocks). AbbVie is a spin-off of a well-known Dividend King, Abbott Laboratories (ABT). ABT kept the medical devices segment and created AbbVie for its pharmaceutical activities. ABBV has made acquisitions to bolster its drug pipeline to a whole new level.

Investment Thesis

ABBV’s dependence on Humira, a tumor necrosis factor blocker that reduces the effects of inflammation, has been reduced over the past few years. Humira represented about 58% of profits in 2019, down to 36% in 2021. ABBV will lose Humira’s exclusivity in 2023. New drugs in the company’s immunology portfolio such as Skyrizi and Rinvoq are accelerating more aggressive growth. ABBV expects Rinvoq and Skyrizi to contribute over $15B in sales by 2025. ABBV’s growth is also fueled by its hematologic oncology portfolio, with growth of 8%. In addition, we see promising growth from its psoriasis and rheumatoid arthritis drugs. The company’s primary reason for acquiring Allergan was to diversify its revenue sources and find more diverse ways of extending its patents.

Potential Risks

As Humira’s patent expiration (2023 for the U.S.) is on the horizon, we are reminded of the pivotal role of patents and competition in the industry. Patents allows players to reap the benefits of billions invested in R&D, and while ABBV may be one discovery away from making billions, the same goes for many of their competitors. For instance, competitor Pfizer could impact ABBV’s sales expectations. Now, ABBV must convince the market that its pipeline is worthy of their investment despite Humira’s patent expiration, and a few more quarters may be necessary for this. ABBV also increased its leverage through the acquisition of Allergan. Failures in the pipeline, litigation, or even integration complications with Allergan, are risks that ABBV could face in the future.

Dividend Growth Perspective

ABBV has been generous with its shareholders as of late. The company has successfully increased its dividend since 1973 (including Abbott’s history). Management has more than doubled its payout in the past 5 years, in addition to buying back shares. With a yield of 4.5%, it is a great candidate for any retirement portfolio. The most recent dividend increase announcement in Q4 2021 (+8.5%) demonstrates high confidence from management.

The Pandemic Accelerated The Inevitable: Global Shortage and High Inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

On Thursday, September 22nd, I’ll host a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Save your spot now (limited to 500 live attendees)

See you there!

Mike