What Is Monetary Policy? Definition & Tools for Implementation

What Is Monetary Policy?

Monetary policy is a strategy undertaken by a government or central bank to influence a country’s economy or financial system. In the U.S., the central bank, the Federal Reserve, is in charge of setting monetary policy.

The Fed’s so-called dual mandate is to maintain stable prices and to achieve maximum employment, while at the same time having moderate long-term interest rates. It has a set of tools at its disposal to carry out monetary policy.

Modern financial systems and economies are complex, and keeping prices in check while getting more people employed can be challenging. There’s no easy way of achieving both. Sometimes one objective has to give way to the other. Does the Fed risk raising interest rates and thereby the possibility of creating jobs so that it can keep inflation under control?

To help it understand when and how it should implement monetary policy, the Fed relies on a plethora of information on the economy. Inflation, nonfarm payrolls, auto sales, retail sales, and real wages are among the economic indicators the Fed monitors.

It also needs to keep an eye on signs of inflationary pressures, which can come from prices of goods and services such as homes and automobiles, or the pay rates of salaried and part-time workers. It can capture an overall picture of the job market via the employment situation report.

In order to understand how monetary policy affects the economy, it’s important to understand policy stance. A hawkish stance means taking aggressive moves, while a dovish stance is more of a relaxed position.

A tightening in monetary policy means raising interest rates as a means of leading the economy into contraction and thus preventing the sort of rapid growth that could lead to inflationary pressures. Conversely, a loosening in monetary policy means lowering interest rates to help the economy grow.

Brief Guide to Monetary Policy Stance

Tightening of monetary policy could lead to a contraction in the economy, while a loose policy could lead to expansion.

Tight Monetary Policy → Economic Contraction

Loose Monetary Policy → Economic Expansion

What Influences Monetary Policy?

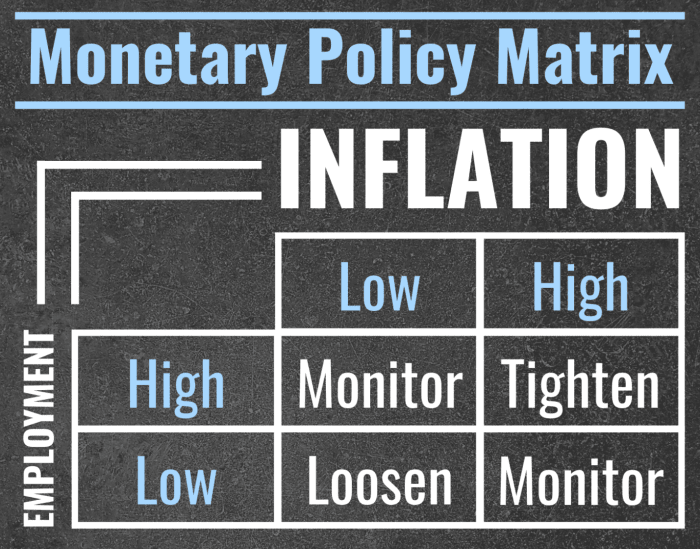

Signs of inflationary pressures or changes in the number of people employed are key influences on monetary policy as the Fed tries to keep up with its dual mandate. Below is a matrix on inflation and employment with regard to monetary policy stance.

When both inflation and employment are high, inflationary pressures can mount, and the Fed often tends toward a tightening of monetary policy. Conversely, low inflation and low employment could push the central bank toward a loosening of monetary policy. In other cases—in which inflation is low and employment high, or inflation high and employment low—the Fed might simply monitor prices and jobs.

When inflation and employment levels are high, the Federal Reserve skews toward tightening monetary policy. If inflation and employment levels are low, the Fed tends toward loosening monetary policy.

How Is Monetary Policy Implemented?

The Federal Open Market Committee (FOMC) sets regular meetings to decide on monetary policy, and the central bank has various tools at its disposal. One of its goals for price stability is to achieve an annual inflation rate of around 2 percent for the long term.

As of August 2022, annual inflation was running at around 8 percent, and the Fed funds rate was 2.5 percent. That suggests the Fed is hesitant to tighten monetary supply and may be waiting for the inflation rate to drop. It tends to take a long-term, conservative approach on monetary policy, hoping to avoid raising rates too quickly and having to scale back those increases soon after.

Interest Rates

The Fed can influence interest rates of all sorts by changing its key interest rate—the Federal funds rate. This is a short-term interest rate that is set by the Fed and that banks use to loan money to each other. It’s a benchmark used by practically every bank in setting their own lending rates. Any change in the Fed funds rate likely means that banks have to adjust their rates on mortgages, other types of consumer loans, and commercial loans.

Depositary institutions have accounts with any of the 12 regional reserve banks, and they actively trade balances in these accounts. The Fed exerts considerable control over the Fed funds rate, and that affects the supply and demand for balances at the reserve banks.

Reserve Requirement

The Fed sets the amount of money that banks must set aside from their deposits to cover potential liabilities. Increasing the reserve requirement would lead banks to reduce the amount of money that they use for loans. Conversely, lowering the reserve ratio expands the amount of money banks have available for lending. Moving balances from one institution to another can help facilitate creating money via payment of interest based on the Fed funds rate.

Open-Market Operations

The Fed can also influence monetary policy via money supply by purchasing government securities through what it calls open-market operations. After the financial crisis of 2007–2008, the central bank went on a long-term buying spree of U.S. bonds known as quantitative easing. These purchases effectively increased America’s money supply by releasing more liquidity into the economy.

How Does Monetary Policy Affect the Economy and the Financial System?

With various tools at the Fed’s disposal, U.S. monetary policy can have a tremendous impact at home as well as abroad. In the broadest terms, according to the Fed, “monetary policy works by spurring or restraining growth of overall demand for goods and services in the economy.”

Impact on the Dollar

High interest rates can make the dollar a more attractive investment relative to currencies in other financial markets. Higher interest rates also push yields on bonds higher, thereby making them a better investment opportunity, particularly for foreign investors. Dollar-based assets in general stand to benefit from rising interest rates. Conversely, lower rates make dollar-based investments less attractive.

Impact on Financial Markets

Tightening monetary policy is usually bad news for the stock market. Higher interest rates make it more expensive for companies to conduct operations—in other words, they increase the cost of capital. Higher interest rates mean corporations have to pay more to take out loans from the bank. Additionally, any corporate bonds they issue would have to pay more interest to creditors.

What Are the Limitations of Monetary Policy?

Policymakers can be wrong, too. In the mid-2000s, the Fed was slow to act in raising interest rates. Keeping interest rates low was a contributing factor to the financial crisis of 2007–2008, as a lengthy period of easy monetary policy allowed many Americans to take out loans that they had difficulty repaying.

Central banks can also be quick to act in loosening monetary policy, and that can help a president in their administration. But when an incumbent is up for reelection, there can be undue influence on policymakers to resist raising interest rates.

That slowness to act on monetary policy could be detrimental to the economy. Setting interest rates too low for long periods can lead to a sudden acceleration in inflation, which could force the Fed to act quickly to catch up with a series of steep rate increases that might cause the economy to stop growing or to slip into recession.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about monetary policy.

How Does Monetary Policy Differ From Fiscal Policy?

Monetary policy refers to a central bank’s moves to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth. Fiscal policy refers to a government’s tax and spending policies. The U.S. Department of the Treasury oversees fiscal policy.

How Does Monetary Policy Affect Money Supply?

Open-market operations have the effect of creating money when the Fed buys government securities, which are typically U.S. Treasuries in the form of notes, bills, and bonds. Money can also be created when banks move balances between their accounts via the Fed funds rate.

How Does the Federal Reserve Communicate Monetary Policy?

The Fed relies partly on forward-looking statements, such as the FOMC policy statement, in communicating monetary policy. Officials may point to a series of interest rate increases or decreases over a period to contain or spur economic growth. In doing so, it helps to avoid any shocks to the financial system.