Interest Rates Increases and Opportunities (Part 2)

Last week, I’ve discussed the impact of higher interest rates on the market and started to make a list of my favorite stocks for each sector. Today, I complete my sector tour with 6 more sectors.

Health Care

Abbott Laboratories (ABT) is among the most stable dividend grower in this sector. After spinning off its research-based activities into AbbVie (ABBV) several years ago, ABT now focuses on various medical devices, nutritional products, and branded generic medicine distribution. Its major acquisitions in 2014 and 2017 strengthened the company and created numerous growth vectors for years to follow. ABT has successfully integrated St. Jude Medical, which opened the door to the structural heart product industry. ABT has a long history of successful product launches and has aggressively cut its costs and improved its margins (including new facilities in China). You can expect EPS to grow more quickly in the coming years. The company has a strong profile and ignoring this stock for your portfolio or watch list would be a mistake. The rapid COVID-19 test is also a strong player in ABT’s medical product arsenal.

Industrials

During economic downturns, railroads like Union Pacific (UNP) and CSX (CSX) will drop in price and offer you a great opportunity. However, you must remain patient to see the upside as those stocks will go down if we confront a potential deep recession. UNP manages the largest railroad in North America. This network can’t be replicated and offers a unique route to transport goods to Western ports leading to Asia. UNP also manages all 6 major rail gateways between the U.S. and Mexico. With 10% of its revenue coming from Mexico, UNP is well-positioned to capture growth coming from south of the border. UNP’s coal transportation shipments are on the decrease. While coal is in a secular decline, UNP benefits from the cheap coal originating from the Powder River Basin. The pandemic doesn’t seem to have affected the railroads but more recently the winter storm has. A rebound in demand for many products (intermodal, agriculture, chemicals, etc.) is supporting the bullish thesis.

Information Technology

I will not reinvent the wheel here as you know my favorite tech stocks. Apple (AAPL), Microsoft (MSFT), Texas Instruments (TXN) and Broadcom (AVGO) have three things in common: #1 They are mature companies counting on stable revenues, #2 They generate tons of cash flow, and #3 They also count on several growth vectors for the next 10 years. If you are looking for a decent yield, Broadcom at 3.35% is probably your best bet.

Broadcom is in a growth phase; it manufactures one of the best RF filters used by all high-end smartphones to improve connectivity. We could assume that companies like Apple would not want to use subpar products and risk the quality of their connectivity. AVGO’s large size also brings economies of scale and enables it to build millions of filters. Its growth-by-acquisition strategy has rendered the company an expert in integrating companies. Expect AVGO to benefit from higher spending from cloud customers and telecom providers that are looking to upgrade their infrastructure and networks. We’re very confident in management’s execution and expect AVGO to benefit from higher spending from cloud customers looking to upgrade their infrastructure and networks.

Materials

Like the energy sector, you won’t find many long-term dividend growers in this sector. However, Air Products and Chemicals (APD) is standing on top of the crowd with its 40 years of dividend increases. The company offers a decent yield (2.60%) and the dividend increased by 70% over the past 5 years. That’s more than enough to cover inflation. APD is part of our Dividend Rockstar List!

APD has a diverse way of positioning its business in a sector where most are stuck with commodity price fluctuations. As a provider of industrial gases, APD signs long-term contracts with its customers. Industrial customers are more concerned with stability and reliability than costs, since gases make up a small part of their expenses but are vital to their business. APD strategically acquired Shell’s and GE’s gasification businesses in 2018. The company became a leader in its industry and has opened doors to expand its business in China and India. APD has an impressive backlog of projects that we think will continue to improve its top tier return on invested capital. APD’s ambitious growth plan, including $14.1B to be spent on its project backlog, has potential to continue improving return on invested capital. Demand for hydrogen should continue to increase in 2022 and 2023 as demand for jet fuel recovers.

Real Estate

Equinix (EQIX), a data center REIT, is showing a perfect dividend triangle and is trading at 2020 levels (before the pandemic). The last time it offered a yield above 2.50% was in late 2018, right at the bottom of this quick bear market. If you are concerned about dividend growth rates, EQIX should ease your mind with an annualized growth rate above 10% over the past 5 years.

The beauty behind the EQIX business model is that it is both poised for strong growth and hard to replicate. EQIX excels in matching customers in the data and cloud service arenas with each other. Its cloud-based global platform, through a distributed infrastructure, is a critical source of differentiation making EQIX the partner of choice for some of the largest technology companies. With over 10,000 customers including 1,800 networks, EQIX is a well-diversified cash cow. The acquisition of Packet for $335M should help deployment and delivery of its interconnected edge services. The only problem is that the stock price has been soaring consistently, however after a pullback in early 2022, it is looking more attractive. This might be a good entry point if you would like EQIX to be a part of your portfolio.

Utilities

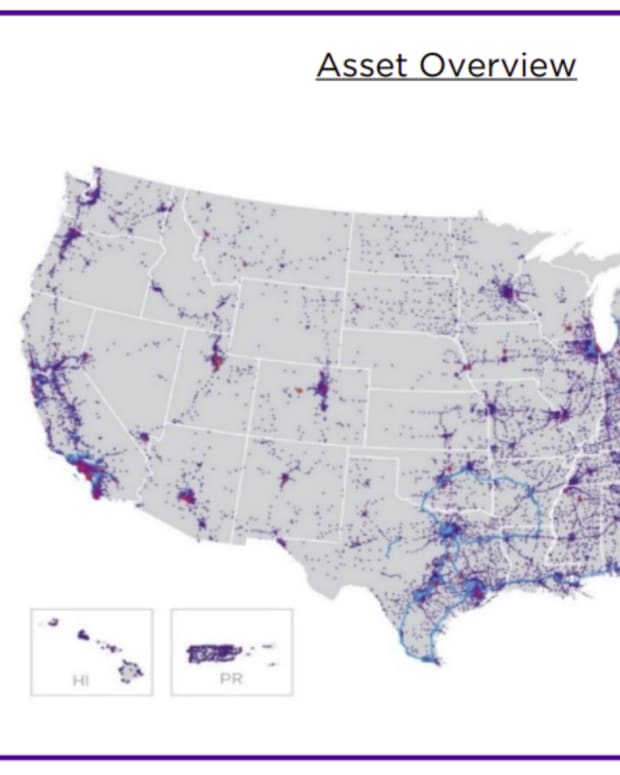

Since the purpose of this list is to give you “safe” ideas, I’d go with water utilities in the U.S. American Water Works (AWK) and American States Water (AWR) offer a modest yield (close to 2%) but show a long history of dividend increases. Water utilities offer an essential service combined with repetitive purchases. You can’t go wrong.

The investment thesis for such a company is simple: an investor is buying shares of a monopoly that is selling an essential product with repeat purchases. This reflects well on its dividend triangle! With a highly fragmented industry and the urgent need for heavy investment in water connections, a leader of its size will surely find a way to grow its business. The company surfs on three earnings growth vectors: favorable regulatory frameworks, increasing operational efficiency, and acquisitions. Water needs will continue to increase as the population grows and luckily, the company operates a near recession proof business. Over the next 5 years, AWK purports that it has opportunities to acquire up to 1.2 million customers, placing it in a position to benefit from continually increasing cash flows.

FINAL THOUGHTS

Higher interest rates will force most companies to tighten their budgets. Only the most profitable and stable businesses will do well while the others will suffer. If you anticipate a tough winter, you might want to review your portfolio with this in mind.

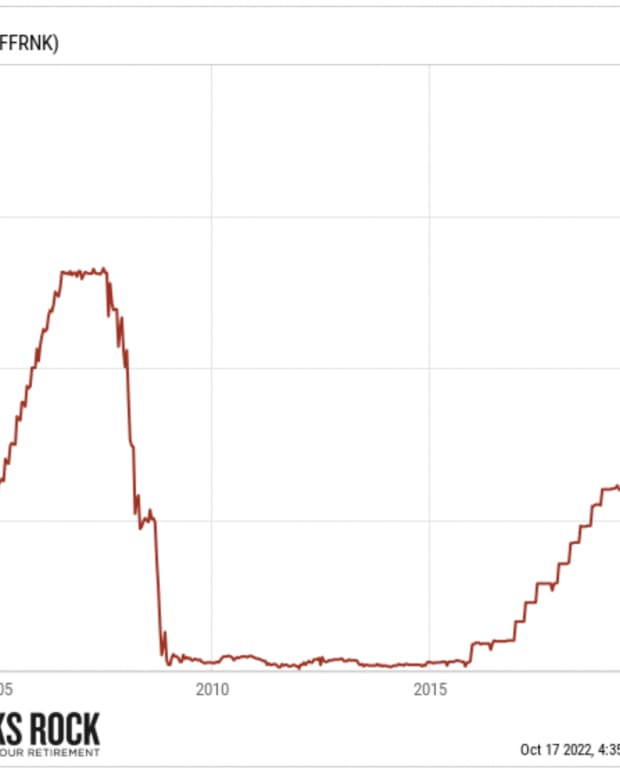

The pandemic accelerated the inevitable: global shortage and high inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

I recently hosted a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Watch the replay now (it’s free, no strings attached!)

See you there!

Mike