Interest Rates Increases and Opportunities (Part 1)

Inflation is good for the economy up to a point. A few percentage points of inflation are often a sign of a healthy economy. Most people work, they want or need goods, demand grows strong, and there is a small race to acquire those goods. When there is a shortage of goods and an increase of demand at the same time, you get high inflation. This is where we are currently.

While most companies are working on global shortage issues, this doesn’t stop people from wanting goods. Therefore, increasing the offer isn’t enough (and most importantly not fast enough) to slowdown the inflation. What’s the best way to kill inflation? Kill the economy. Of course, Central banks will tell you they prefer a smooth landing or an economic pause. But when you increase interest rates rapidly it’s like putting both your feet on the brakes while driving at highway speed.

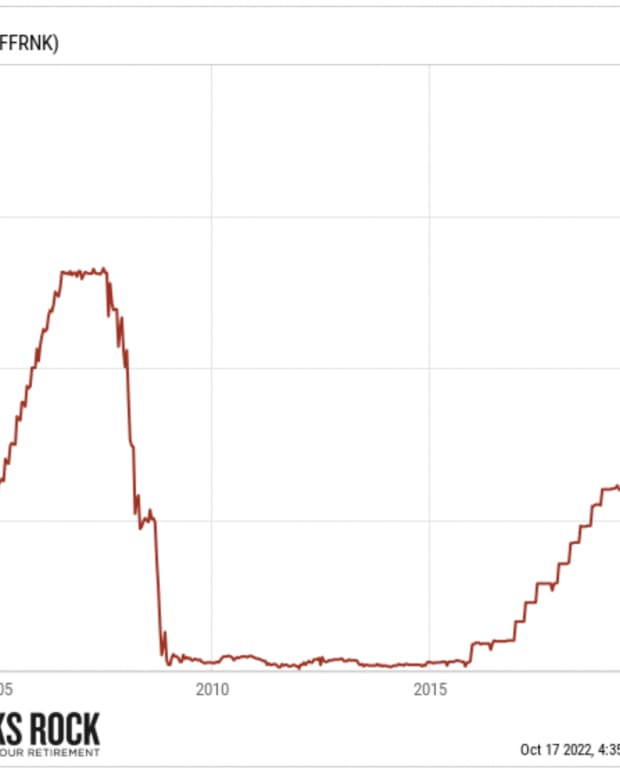

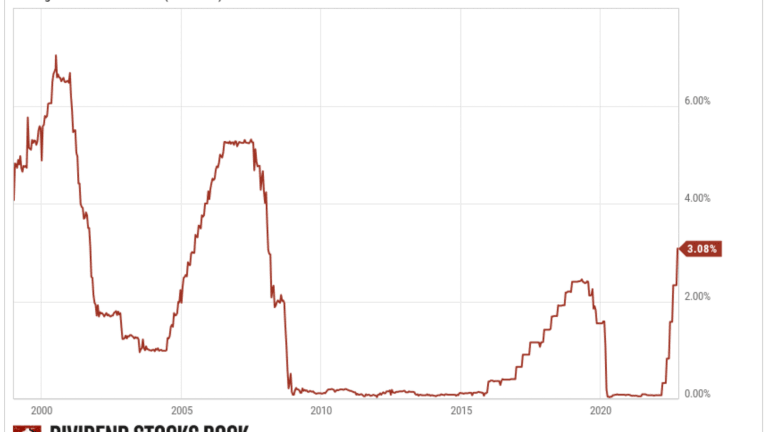

While the FED are increasing rates at a fast pace, we are still very far from the rates that were prevalent in the 80’s. In fact, we are only getting close to the rates in effect after the tech bubble in the early 2000’s. But more rate increases are expected, and investors are getting nervous. Today, we’ll review some of my favorite picks considering these higher interest rates for each sectors.

Communication Services

This sector doesn’t offer companies with strong dividend triangles, and I will continue to ignore AT&T and Verizon. However, Activision Blizzard (ATVI) shows great upside considering Microsoft agreed to buy it at $95/share. It may not happen, but ATVI is still offering a great potential going forward.

The deal is expected to be concluded in fiscal 2023, after all regulators went through it. Shares are trading at $72, so there is some upside there that accounts for the risk of the deal falling through. ATVI’s management team has recently been dealing with sexual harassment allegations and working through the MSFT deal. I believe that the deal should close and think it unlikely that MSFT would away.

Consumer Discretionary

Genuine Parts (GPC) is probably the most boring and the safest play (but be ready to pay the price). GPC is a Dividend King (click here to get the full list of all companies that increased their dividend for more than 50 years.) with 50,000 employees across 10,400 sites.

Over the years, GPC has built a solid reputation through high-level service and high-quality parts. 75% of its auto parts sales come from the commercial segment (garages). This segment lends itself to highly consistent order patterns. Genuine Parts is also known for its never-ending appetite when it comes to buying out its competitors. A winning strategy for any portfolio building method is to pick strong companies with established business models that have become leaders in their industry. GPC is the parent company of NAPA Auto Parts, which is a great performer during recessionary environments. We expect growth to be driven by an increasing U.S. vehicle age, which rose to a record high of 12.1 years in 2021. In 2022, the stock experienced a drop, but has since recovered. Take advantage of the occasional market drops to purchase some shares!

Among stocks that have iconic brands and took a serious beating, you can find Home Depot (HD), Nike (NKE), VF Corporation (VFC), and Starbucks (SBUX).

Consumer Staples

There is a long list of stable dividend growers in this sector. One that deserve your attention is definitely Clorox (CLX). The company may have enjoyed benefits over the pandemic, but they weren’t there to stay. While the revenue growth numbers are steady, revenue increases prior to the pandemic were mediocre. The company’s cash flow is fueled by its strong brand portfolio as it enjoys strong brand recognition and pricing power. Nearly 85% of Clorox’s sales come from its home turf in the USA. More than 80% of Clorox’s portfolio of products stands at places #1 and #2 in brand rankings. Consumers are still willing to pay for quality and known brands. CLX uses its cash to invest in R&D and acquisitions as the company has set very specific metrics to complete future acquisitions.

Energy

Classic plays like Chevron (CVX) and Exxon Mobil (XOM) should be considered for their resilience during difficult times. Since CVX invested massively in the past, many projects are now in production. Its timing was perfect, as it is now enjoying higher oil prices. Production capacity is growing fast which enables CVX to surf oil booms. The lack of exploration in 2020 and international tensions have led to a supply-demand imbalance. CVX will enjoy much greater cash flows as it invested at the right time. The company is now leaner and more efficient. Longer-term, we think CVX will expand its offerings in low-carbon solutions, renewables and hydrogen. Unfortunately, the stock price has been stagnant for many years now. An investor can buy CVX for its yield (3.5%) and modest dividend growth.

Financials

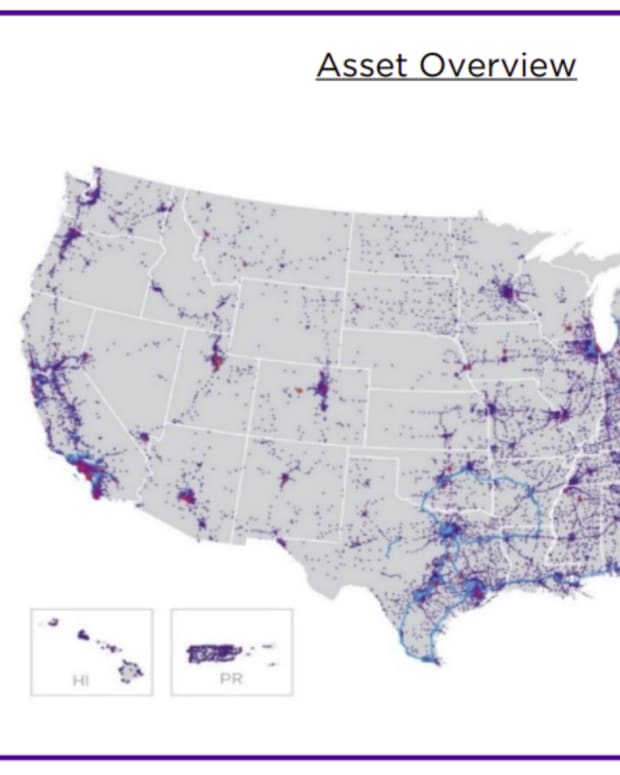

BlackRock (BLK) is on top of my list at this point. The company will show weaker revenue (and EPS) as fees on assets under management (AUM) will be lower because of this down market. However, relationships with institutional investors won’t be impacted and they remain the largest player in many investing areas.

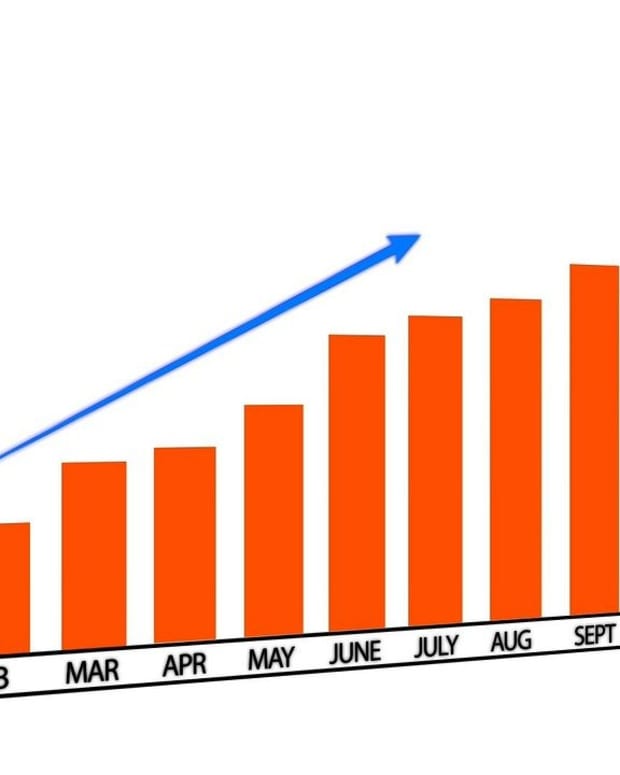

BLK is a winner and will be a keeper for decades to come. BLK’s net inflow of assets under management continues to increase quarter after quarter. BLK enjoys size and scale like no other asset manager. The company sees steady organic growth even for its higher fee earnings equity products. In other words, there is always new money coming in. The company is a leader in the growing investment field of ETFs and has a strong relationship with several institutional customers. Institutional investors are more inclined to stay with their providers for several years. We believe BLK’s strong position in passive investments and strong fund performance will attract assets at above industry-average rates over the next few years.

Stay Tuned for more ideas next week!

I think that’s enough for this week! Next week, I’ll conclude with part 2, including my favorite stocks in the healthcare, industrial, materials, real estate and the utility sector. You don’t want to miss this one!

The pandemic accelerated the inevitable: global shortage and high inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

I recently hosted a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Watch the replay now (it’s free, no strings attached!)

See you there!

Mike