If You're Worried About Stocks, You Need To Look At Buffer ETFs

Last week, the S&P 500 fell more than 4%, the Russell 2000 declined by more than 6% and long-term Treasuries lost 1%. In fact, as I noted on Twitter this past Saturday, it was the 2nd consecutive week where the two equity indices fell by at least 4% and long-term Treasuries lost 1%. The only other time over the past two decades that this happened was earlier this year in June.

It’s goes without saying that these are highly unusual times. The Fed is raising rates even more aggressively into a steadily deteriorating economy and that’s resulted in some hefty losses for both stocks and bonds. Both asset classes are down between 20-30% year-to-date.

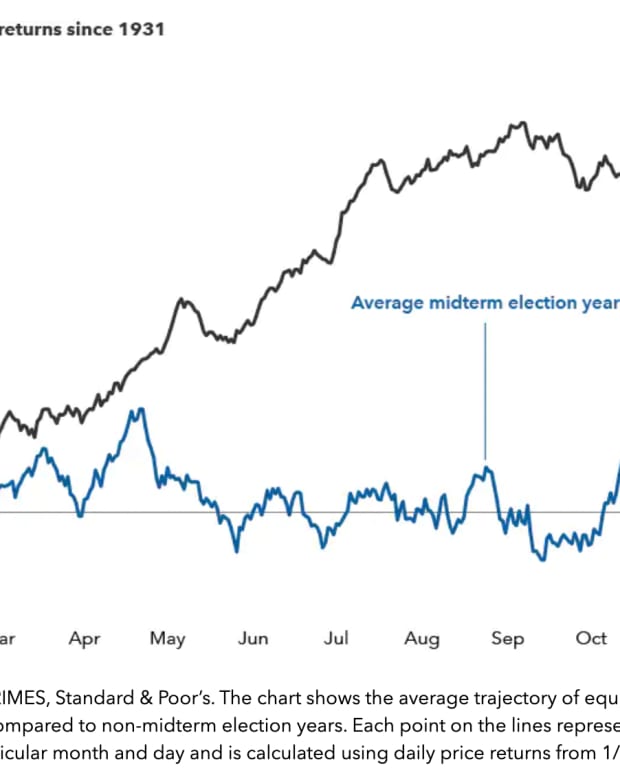

In a garden variety recession, this is the area where stock prices tend to bottom out - losses in the 20-30% range. It’s in recessions that are the result of some type of tail risk event that we see declines in the 40-50% range. Think the financial crisis or tech bubble. The big question now is will history show that this is a typical recession or an unusual recession. My money is on the latter, but nobody knows for sure.

We do know that portfolio protection is rapidly on the rise. Put option volume on the S&P 500 this year is going vertical and investor sentiment is at historically bearish levels. If you’re a believer that the bottom isn’t yet in and there’s more downside ahead, it’s time to think of portfolio protection yourself.

For a lot of investors, this means selling everything and moving into cash. This tends to be the investing equivalent of taking care of an anthill with a stick of dynamite. It requires not only the investor be correct in predicting that prices will continue falling, but also the discipline to buy back in before prices rise again and be right there as well. If investors are inclined to sell everything during times like these, they’re probably not likely at all to buy back in when things get worse. This “sell low, buy high” emotional decision making behavior is what usually shoots people in the foot and explains why the average investor doesn’t see returns anywhere near the market averages.

That doesn’t mean, however, some type of portfolio protection can’t be used. Buffer ETFs have become all the rage since the first one - the Innovator Laddered Allocation Power Buffer ETF (BUFF) debuted six years ago. Since then, more than 150 additional buffer ETFs have launched consisting of nearly $17 billion in total assets.

The premise here is simple. The buffer ETF provides a pre-determined level of downside protection in exchange for a cap on upside potential. Those two levels are usually correlated - the higher the downside protection, the lower the upside potential and vice versa. It’s a good way to protect your portfolio while still maintaining upside potential in case the protection isn’t needed.

The catch is that you need to hold the fund for the entirety of the “outcome period” in order to fully capture the upside/downside range. You can’t just buy a buffer ETF at any time and assume because you bought it that you now have 15% downside protection on your portfolio. It only applies if you buy the fund at the beginning of the outcome period and hold it through the end of the outcome period. If you buy and sell in between, your range of returns may differ.

The outcome period is generally one year on most buffer ETFs. That’s why you see funds with names, such as the Innovator U.S. Equity Buffer ETF - July (BJUL). Issuers, such as Innovator, have expanded their lineups to include ETFs with outcome periods beginning every month of the year. You’re always no more than a few weeks away from being able to invest in a buffer ETF with a new outcome period.

Here’s an illustration from Innovator that explains the outcome profile of a buffer ETF.

Notice that the buffer ETF offers protection from a pre-determined level of downside, but not all downside. Once the protection level has been reached, 15% downside for example, the ETF will capture losses beyond. In theory, if the market drops 30%, this buffer ETF, for example, would still fall 15% in value.

Most of Innovator’s ETFs offer protection at three different levels - 9%, 15% and 30%. Their buffer ETF lineup includes funds based on large-caps, small-caps, developed markets, emerging markets, the Nasdaq and Treasuries. Similar products are offered by FT Cboe Vest, Pacer, Allianz and TrueShares.

Should buffer ETFs be part of the core of your portfolio? Probably not, although I think you could make a case for it. Over the long-term, the returns on stocks usually exceed the caps on these products (especially at the higher protection levels), so it may be more beneficial to go uncapped if you have years and years to invest.

But downside protection isn’t to be underestimated. I’ve personally heard multiple people, including family members and neighbors, complain about how much they’ve lost lately. That includes the ones who said they’re just a few years from retirement. If you’re in the latter boat, buffer ETFs would be a wise move. At that point, you should be focused on principal preservation, not return maximization. Being three years from retirement and 100% invested in stocks is just asking for trouble.

Buffer ETFs may not protect against all downside risk, but they can eliminate a good chunk of it. If you’ll sleep better at night knowing that your portfolio isn’t at quite as much risk despite very uncertain circumstances, adding a buffer ETF to your mix is well worth considering.

Here are the top 20 Innovator ETFs according to my latest ETF rankings, although the ETF you should pick depends on when you’re investing, which index you want to track and what level of protection you’re looking for.

Note: There won’t be an ETF market view this week. The ETF Action database I use for my analytics is undergoing an upgrade, which means I’ll be upgrading some of my reporting as well. The sector level reports will be returning very soon!

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs