Great Buy or Value Trap? 3 Stocks That Fell More Than 40% in 2022

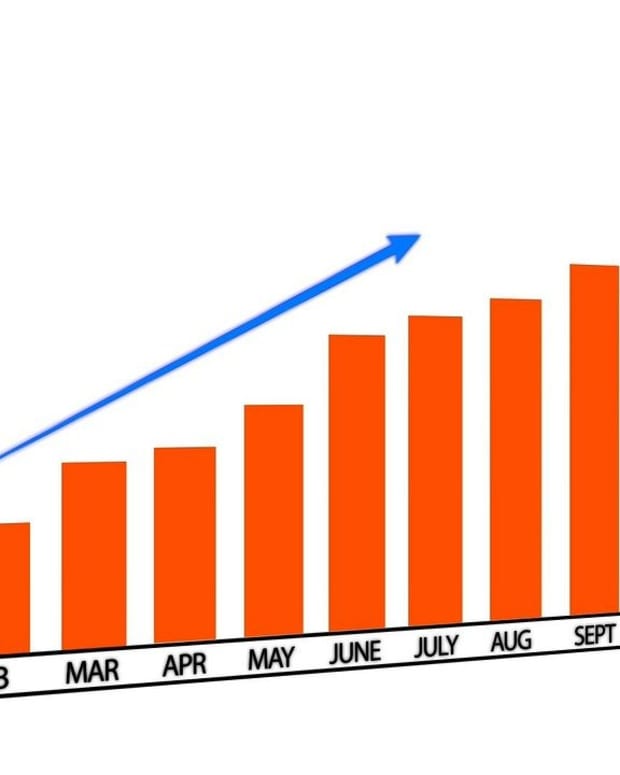

I like to compare the stock market to a wave. When the tide rises (bull market), all stocks go up. When the wave hit the shore and crash (bear market), all stocks go down. However, while some will go to the bottom of the ocean and never recover, others will rise back and thrive.

Bear markets have this advantage: it's a rare opportunity where the market isn't efficient. You can catch a falling knife and boost your return when the stock recovers. Unfortunately, not all falling knives are an opportunity. Some are just a value trap.

Today, we look at three stocks that have lost more than 40% since the beginning of the year and determine if it's a great buy or a value trap.

FedEx (FDX)

FDX's 1Q'23 results were adversely affected by softness in global volumes mostly towards the quarter-end, and especially weakness in Asia and service challenges in Europe. The stock crash on earnings day and FDX is now 45% year-to-date.

Investment Thesis

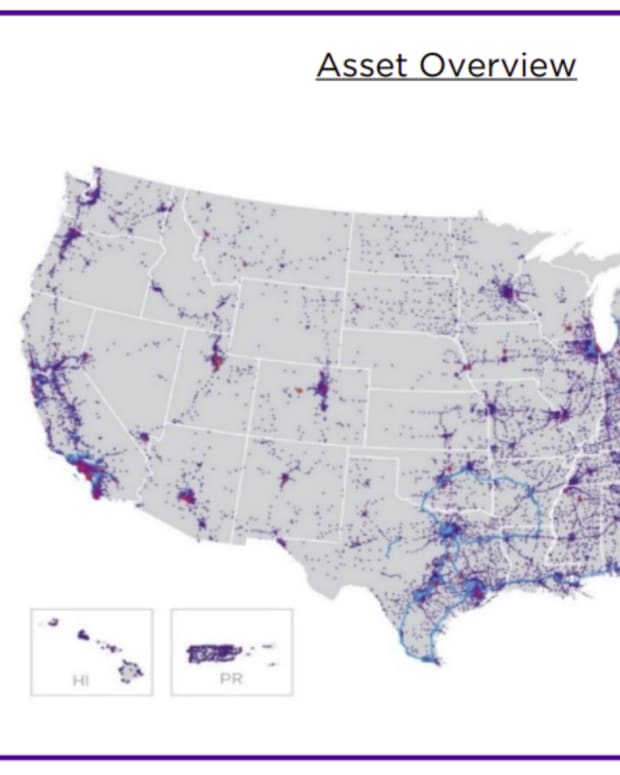

The business model is fairly simple: FedEx, along with competitor UPS are the reference brand names for shipping parcels, both locally and internationally. FDX has proven its ability to work through oil price crises, recessions, and even cyber-pirate attacks, all while still rewarding its shareholders. With an impressive air fleet and 50,000 drop boxes, FDX has the size and scale to remain competitive in this oligopoly. At DSR, we prefer UPS to FDX mostly due to the difference in dividend growth policies. FDX disappointed when the company stopped increasing its dividend in 2019 due to its stagnant growth in 2017-2020. The company came back strong in 2021 and offered a substantial dividend increase (from $0.75/share to $1.15/share). Nonetheless, FDX was able to ride the e-commerce pandemic wave, which we expect it to gain further momentum from in years to come.

Potential Risks

FDX is highly exposed to a possible international economic slowdown. With Europe slowing down and the remaining commercial tension with China, it’s hard to believe that the global economy will surge over the coming quarters. Utilizing a large air fleet at full capacity is very costly, and FDX will have to maintain these costs, even during a recession. Finally, labor and equipment shortages could damage FDX by putting pressure on margins in the short to mid-term.

Dividend Growth Perspective

FedEx posted 9 consecutive years of dividend increases but put a hold on their dividend growth policy in 2019, only resuming it in 2021. Yet, the uncertain economic outlook, could affect FDX’s cash flow. As previously mentioned, FDX already resumed increases with a generate raise of 53%. Will it continue its dividend growth policy now that we face a recession?

Verdict: Probably a Great Buy

With a forward P/E ratio of 8 and a 3% yield, FedEx looks like a great buy if you are willing to through the recession. You get paid to wait, but expect fluctuations.

Intel (INTC)

Horror! Intel reported a very bad quarter with a quarterly loss (-$0.11 EPS) and revenue down 17%. Do I need to tell you INTC missed all analysts' expectations? On top of that, Intel lowered its full-year outlook, citing a weak economy and execution problems. Data Center revenue fell 16% year-over-year, while the company's largest segment, Client Computing, accounted for $7.7B in sales, down 25% year-over-year.

Investment Thesis

INTC is the King of microprocessors. As it enjoys strong cash flows from its PC line, the company has expanded into new business segments. INTC developed a completely new business model in cloud computing with its data-centric services. With this fast-growing segment, INTC has garnered some love from the market. Unfortunately, new chip development debacles (delays) have raised concerns among investors. INTC generates strong cash flows from its core business while its data centric business (about 50% of revenue) is exhibiting double-digit growth. The foundry opportunity is a lucrative one, with an estimated $100 billion market by 2025. We believe INTC will benefit from the desire for a non-Asia footprint by U.S./European governments and corporations. Although the foundry is a huge opportunity, a project of this size could have its setbacks.

Potential Risks

INTC’s most significant risk is that technology evolves very quickly. INTC isn’t the only one interested in server processors, IoT and AI technology. The company faces strong competition from other “old techno’s” such as NVIDA and AMD. In 2020, INTC failed to develop its next generation processors on time. Competitors such as AMD jumped on the occasion. We also saw Apple and Microsoft developing their own microprocessors for their Mac and Microsoft Surface. INTC isn’t alone in its market any longer. The company is doing well with data centers, but it has failed miserably to enter one of the most lucrative markets in tech over the past decade: smartphones. For a chipmaker of its size, we would have expected dominance in that field. This demonstrates that Intel isn’t flawless. Finally, we see a market share loss to AMD on the CPU server market through to 2023.

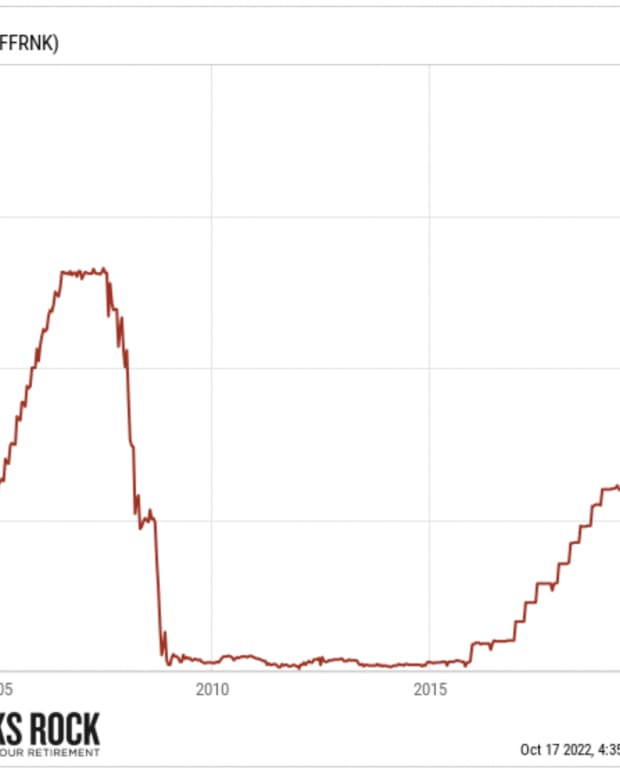

Dividend Growth Perspective

Intel has had consecutive dividend increases since 2015. Bolstered by its new growth drivers, INTC has a low payout ratio. With both payout ratios under 50%, expect mid to high single-digit dividend growth for the coming years. The PC business will continue to generate strong cash flow that is not only used to finance the company’s growth, but also to buy back shares and increase its dividend payouts. INTC increased its dividend in 2022 by 5%, from $0.3475 to $0.365.

Verdict: Value Trap

This company looks like another IBM (IBM). Intel is an iconic tech company that had glorious days during the PC era. Like IBM, Intel lacks growth, and its old business model is slowing down. Both revenues and earnings are on a downtrend.

Stanley Black & Decker Inc (SWK)

It wasn’t a good quarter for SWK. The company sharply cut its guidance for 2022 with adjusted EPS to $5.00-$6.00 (from $9.50-$10.50). This forced the stock price even lower. While the market is unsure, I see a very good opportunity to buy shares of a stellar business. SWK manages iconic brands and is #1 in many construction, DIY, auto repair, and industrial segments. Through its dominant position in various tool sectors, SWK generates steady cash flows, and this cash is used to buy back shares, increase its dividend systematically, and acquire other businesses.

Investment Thesis

SWK exhibits several strong pillars of a successful business. The company has been around for more than a century and has built strong brand recognition. Through its dominant position in various tool sectors, SWK generates steady cash flows, and this cash is used to buy back shares, increase its dividend systematically, and acquire other businesses. SWK has successfully integrated other brands such as Newell Brands and Craftsman in the past. Management intends to keep using its extra cash for additional acquisitions in the future. SWK has struck a great balance between organic and M&A growth. After the stock has been on a downtrend for the last year, we believe the stock price is attaining more attractive levels.

Potential Risks

The issue with such a company is that it’s very hard to buy its stock at a discount; the dividend discount model is not likely going to work as SWK exhibits a low yield with a steady, but not astronomical, dividend growth rate. Between 2016 and 2018, SWK’s price went from $100 to $180 before dropping to $110 amid the coronavirus crisis in early 2020. Fast forwarding to 2022, and we might be making sight of a purchase opportunity. The company reported decent earnings in Q1 2022. We believe that supply chain constraints might hurt SWK’s volume. In the long term, we see some upside as demand will drive higher prices.

Dividend Growth Perspective

SWK yield is not usually very attractive, but today it is yielding a decent ~2.7%. SWK has successfully increased its dividend yearly since 1967, qualifying the company to be a part of the elite group of Dividend Kings. The latest dividend increase was a strong one ($0.09/share or +12% in 2021), but we would not expect such increases in the future. Both payout ratios are well under control (under 40%), which means there is room to grow. If management maintains its policy, stockholders should expect mid to high single-digit increases moving forward.

Verdict: Great Buy!

Stanley Black & Decker has been suffering greatly in 2022 after seeing its stock price surge above $210 in 2021. Can you pass on buying a Dividend King after a 50%+ price drop? Not to mention that the company now trades at a forward P/E of 16.7 and has never offered such a generous yield in the past 10 years (excluding the quick 2020 pandemic market crash).

The Pandemic Accelerated the Inevitable: Global Shortage & High Inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

I recently hosted a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Watch the replay now (it’s free, no strings attached!)

See you there!

Mike