The Fed Pivot Is A Myth, But The Markets Might Rally Anyway

Stocks staged a big comeback last week following a first half of October that was largely forgettable. Some better than expected earnings results from the big banks kicked off the week, but Friday’s rally was inspired by something entirely different.

On Friday, the Wall Street Journal published an article that said the Fed was planning on raising by 75 basis points at its November meeting, but would discuss the “pace of tightening” starting with the December meeting. Two months of bearishness left investors searching for any reason to be optimistic again and this article provided it.

Now, we’re back to dealing with a very familiar narrative: The Fed pivot rally.

Why Is It Important?

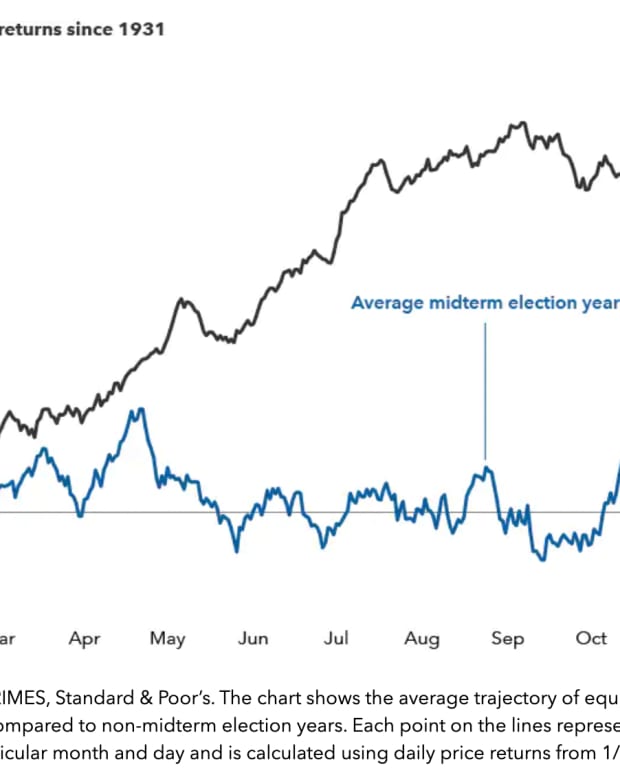

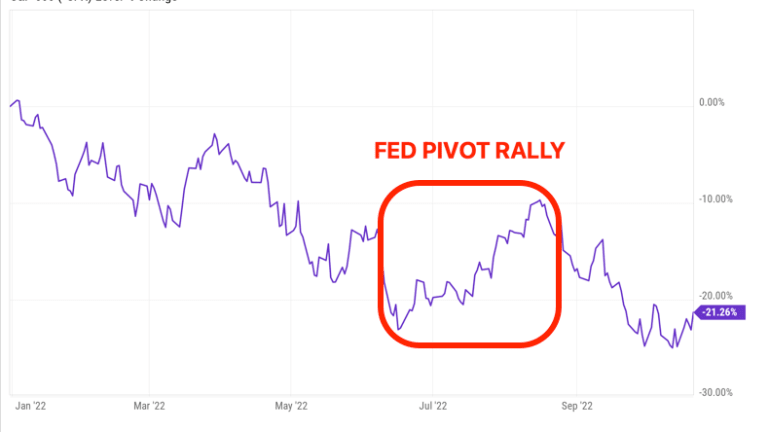

This is the same phenomenon that happened this past summer. Investors believed that the economy was slowing significantly enough that the Fed was going to be forced to abandon (or at least slow) its rate hiking cycle to try to avoid recession. The thing is that this was never backed by anything concrete. The Fed never gave any indication that it was preparing to pivot, but investors talked themselves into the idea that it could happen.

It was enough to push the S&P 500 higher by 17% from June to August. Not surprisingly, it didn’t last because Powell decided to make it abundantly clear that the Fed was going to continue raising until inflation got under control. Within two months, the bear market rally was dead and the equity markets pushed to new lows.

Now, the same scenario is playing out again. This time, it’s based on an article centered around a supposed leak from inside the central bank. There may be a hint of truth to it this time around, but I think there’s one thing to be very clear about.

Going From 75 Basis Point Hikes To 50 Basis Point Hikes Isn’t A Pivot

I can understand that investors are looking for any reason to be positive after a year that has delivered huge losses in both stocks and Treasuries. An easing of the rate hiking cycle would be one such reason because it could signal that we’re getting closer to the end of this misery, but Friday’s rally seems like a bit of an overreaction.

First, the market has been pricing in a 75 basis point hike in November and a 50 basis point move in December for much of the past quarter. It was only recently following a hot September inflation report that expectations shifted to the possibility of 75 in December as well. After the WSJ article, we’re effectively back to the point where we were a month ago. Only this time, investors are viewing it differently.

I think the real pivot comes when the Fed indicates an end to the rate hiking cycle. Not even a rate cut, but a pause. It can’t just be an unsourced quote that uses phrases like “reevaluate”. It needs to be something more concrete, something that the Fed has consistently failed to give up until this point. I think the real pivot still may not come for another couple months, but it almost certainly did not come last week.

Still, Stocks Could Rally Here

Here’s the good news for investors. Just because this likely isn’t “the” pivot doesn’t mean stocks can’t move higher on the BELIEF that it’s “the” pivot.

Like we saw this past summer, investors simply bought into the idea that because the economic data was getting worse, the Fed wouldn’t risk tightening so far that it resulted in a recession. That belief turned out to be false, but it lingered long enough that stocks were able to rally on it.

The same thing could happen here in October, although I think Powell might be quicker to swat down the idea than he was last time. If the central bank’s goal is to squash inflation by any means necessary, he probably doesn’t want to risk a repeat that adds volatility to the equity markets. Maybe I’m giving the Fed too much credit for giving this scenario that much thought, but Powell has taken a much more firmly hawkish stance over the past few months. He could do so again.

The Fed’s next rate decision gets announced on Wednesday, November 2nd, so there may not be much of a window of opportunity. If Powell does, however, reiterate the “pace of tightening” comments hinted at in the WSJ article, it could give stocks a reason to extend the rally further as we head into the end of the year.

I don’t think the idea of a Fed pivot right now is a smart reason to buy stocks, but I have to acknowledge that a rally could very well happen anyway if enough investors believe it.

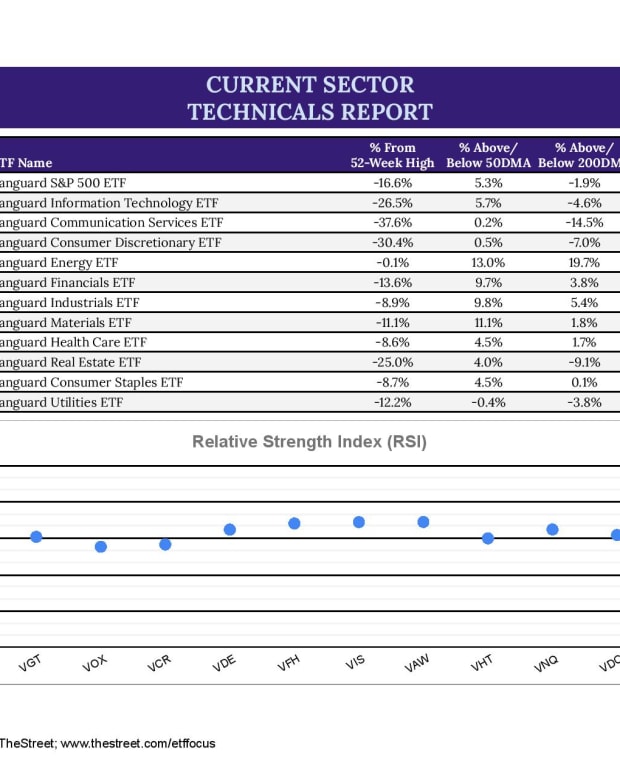

ETF Sector Review

Stocks were able to take advantage of a string of better than expected earnings along with the WSJ article to stage one of the best weekly rallies in recent memory. One of the things it did was ignite the tech sector again, one area of the market that has been consistently lagging for months. If the Fed pivot narrative does have legs, expect tech stocks to be one of the biggest beneficiaries. Just last week, semiconductors, software, cybersecurity and autonomous vehicle stocks all added around 7%. Growth has ceded leadership to value for sometime now and this could be the catalyst that brings growth back into the lead.

On the flip side, defensive sectors, which have been market stalwarts throughout 2022, have turned into the biggest short-term underperformers. Utilities continue to get hit really hard as some of its excessive valuations get unwound. After setting new highs not that long ago, the sector is almost in bear market territory today. Consumer staples, healthcare, dividend and low volatility stocks have all experienced similar struggles, but I think the longer-term case for market outperformance remains intact.

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs