ETF Flows Show Investors Remain Defensive Despite Last Week's Rally

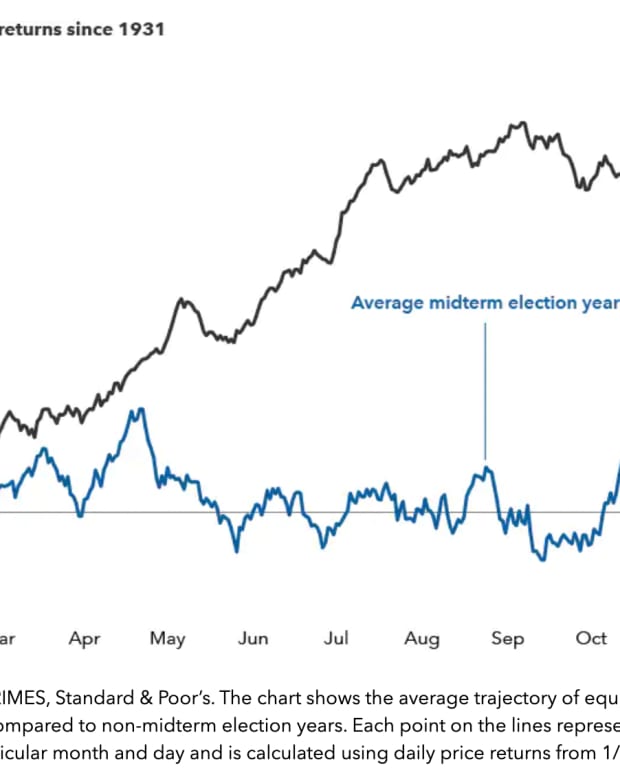

Last week, I talked about a roadmap for equities to stage a powerful rally. The catalyst, a government rescue of the bond market, never came to be, but stocks still delivered solid returns (albeit with a fair amount of volatility). Stocks were certainly due for a decent week after September resulted in a 9% loss for the S&P 500.

Is bullish sentiment back? ETF flows suggest that the answer is no.

Investors have been in a defensive mood for a little while now. Money has been flowing into all asset classes in 2022, which isn’t a surprise given how the ETF industry has grown over the past several years. Over the past three months, however, investors have shown a definite preference for fixed income ETFs and that trend has accelerated over the past month.

Last week, the S&P 500 gained 1.6%, small-caps outperformed and long-term Treasuries lost more than 1%. Despite that, investors still pushed hard into defensive assets.

Equities drew in $5.7 billion in new money, but fixed income attracted $8 billion. Fixed income assets overall are less than 1/3 that of equities. That’s a huge gap that continues to grow even though bonds have performed just as poorly as stocks throughout this year. If you break that fixed income bucket down another level, however, it’s easier to see why investors don’t seem terribly risk-seeking at the moment.

The ultra-short term category is where the action is happening. Bonds fall in this group based on their duration, so think T-bills and floating rate notes. These are your traditional defensive risk-off assets and they’re the best indication that investors are playing it safe at the moment.

To provide some perspective on the net flows moving into ultra-short term bond ETFs, September saw $13.7 billion go into these funds, the largest single-month inflow ever into this group. What’s more is the next closest month isn’t even close. The 2nd largest inflow was $8.7 billion, which occurred during March 2020, a time when conditions were pretty bearish in their own right.

This doesn’t necessarily mean that stocks are going to continue moving lower. During the COVID recession, investors piled into T-bills only to have equities stage a major comeback following the multi-trillion dollar government stimulus package. It does, however, suggest the lack of at least a certain degree of buying interest in stocks.

Another deeper dive down into the individual ETFs seeing the biggest inflows confirms where the money is going.

Seeing the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) at the top of this list is pretty unusual. That spot is usually occupied by one of the major stocks ETFs, such as the SPDR S&P 500 ETF (SPY) or the Invesco QQQ ETF (QQQ). But it’s not alone here. In fact, far from it.

The iShares Short Treasury Bond ETF (SHV), the iShares 1-3 Year Treasury Bond ETF (SHY), the WisdomTree Floating Rate Treasury ETF (USFR), the iShares 0-3 Month Treasury Bond ETF (SGOV), the Vanguard Short-Term Treasury ETF (VGSH) and the iShares Treasury Floating Rate Bond ETF (TFLO) all focus on the same area. These are all cash alternative ETFs that eliminate almost all duration risk. The JPMorgan Ultra-Short Income ETF (JPST) essentially does the same thing, but invests in corporate notes.

Takeaway For The Week

ETF flows can be a bit of a lagging indicator, so these numbers could very well pivot back towards equities again soon. If risk asset prices, including stocks, junk bonds and international equities, continue drifting higher over the next 2-3 weeks, but ETF flows continue to show fixed income and ultra-short bonds doing well, it could be a sign that the rally doesn’t have legs.

Another category worth watching is long-term Treasuries. Not surprisingly, they’ve seen very little in the way of inflows in 2022 given that they’re down nearly 30% on the year. There has been a little more interest lately. I think if the Fed ever gives the signal that it’s ready to conclude its rate hiking program, Treasuries could be positioned for a strong rally. We’re not there yet, but it may happen around the end of the year.

Conclusion: Flows don’t show investors are bullish yet. Watch Treasuries for a rally in early 2023.

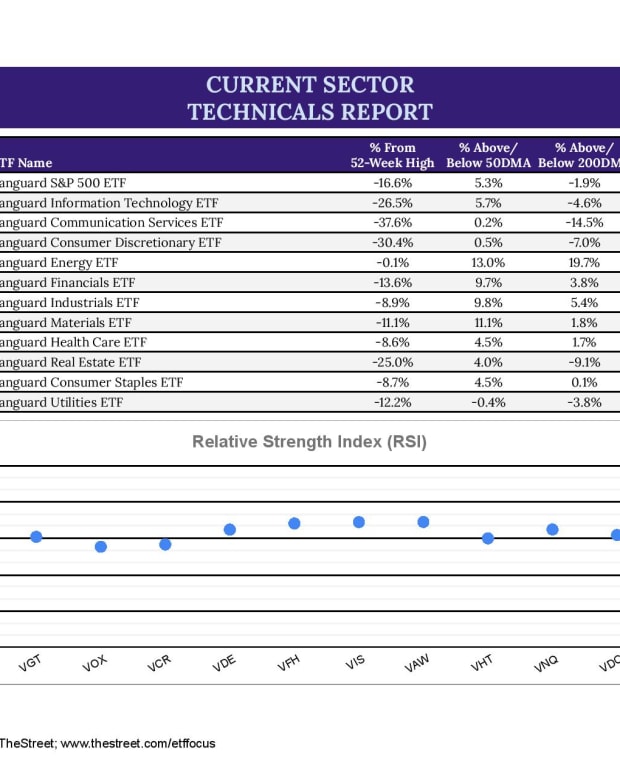

On the equity side, there’s not much strength to be found anywhere. Energy stocks enjoyed a strong rally last week thanks to a steeper than expected production cut from OPEC. I’m not sure it’s sustainable, but it could accelerate a slowdown in global demand if prices at the pump begin moving higher again.

Defensive stocks are firmly out of favor, but that’s a trend that was developing even before this past week. Utilities have been historically bad over the past two weeks and REITs are finally reflecting the cratering real estate market.

The lack of any real progress from tech stocks could be a concern. This sector has usually been a market leader in broader risk-on moves, but it’s struggled to match the S&P 500 for more than a year. The Q3 earnings season is about to start and I think tech could be one of the hardest hit from potential earnings downgrades. The market may be sniffing some of that out here.

Best of luck this week!

Dave

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs