Election Day Could Be Ready To Rally Stocks

The U.S. midterm elections take place on Tuesday. No, I don’t want to have a political discussion, but I do want to talk about how the outcome could impact your portfolios. If the election results end up looking like it seems they will, investors could have reason to feel optimistic about the remainder of the year.

People will try to decipher all sorts of trends in historical stock price movements. The January effect. The Santa Claus rally. Sell in May and go away. They’ve got this sort of “feel good indicator” aspect to them, but they’re not really based on any macro level data or fundamentals.

The election year indicator could be different. Or in this case, the midterm election year indicator, which basically says that stocks tend to perform better than average in this midpoint year in between presidential election years. On top of that, November also tends to be an historically strong month for equities as well.

The logic behind it has some merit. Over the course of history, it’s been demonstrated repeatedly that the party in the White House tends to lose seats in Congress during the midterms. This tends to bring more of a balance between the executive and legislative branches of government and helps limit some of the more aggressive policy tactics of one party or the other. While the government ship is usually slow to turn, a split government is often considered more market-friendly.

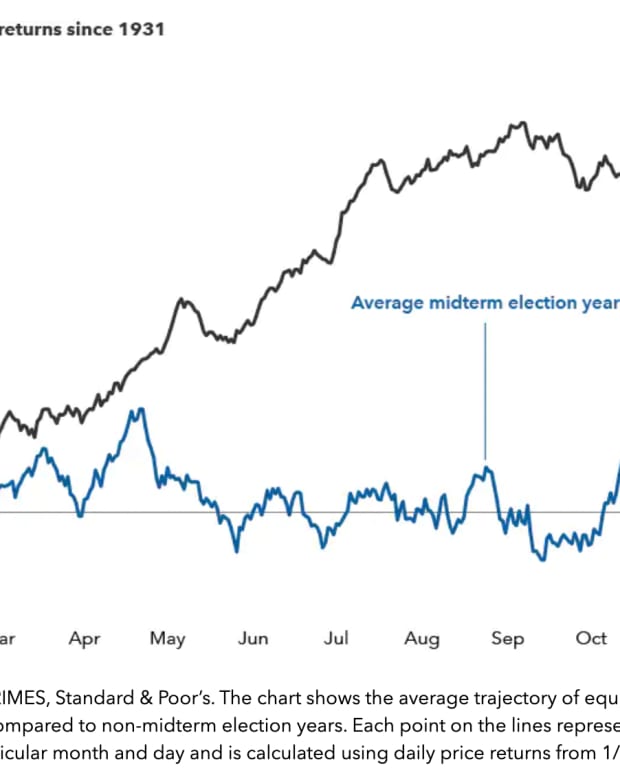

Historically, midterm election years tend to start slow but pick up speed in the lead up to and after the election itself.

The path of returns makes sense. During the first half of the year, the outcome of the elections is still uncertain and investors aren’t sure yet about the market impact of the pending political environment. As we get closer to election day, we get much more certainty around how the election is going to play out and investors begin positioning themselves accordingly.

This year, it’s very likely that we’re going to end up with a split government. Joe Biden, of course, will remain president until 2024. The House of Representatives seems almost certain to flip from Democratic to Republican control. The Senate could still go either way. From a market perspective, this is the most advantageous spot for investors.

Over the past 90 years, we’ve seen the strongest market returns come during the 4th quarter of midterm years. On average, the S&P 500 gains around 6% during this three-month period. 2022’s path of returns make the math a little more complicated. The S&P 500 is already up 5% since the beginning of the quarter. While that could be interpreted as the gains have already been had, I suspect this year is an outlier. The S&P 500 is still down 20% on the year and there’s a little more upside potential than in past years. Plus, returns tend to be steady throughout the quarter, especially in the immediate post-election period.

In other words, history is telling us that the remainder of 2022 is setting up to be quite a positive one for risk assets, at least in terms of the current election cycle.

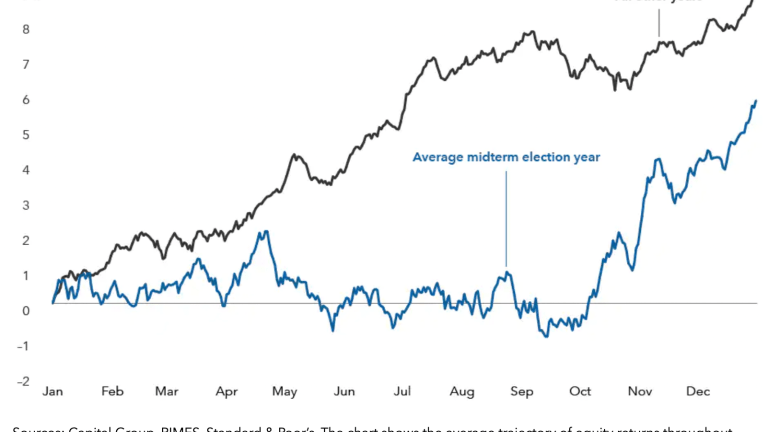

The gains aren’t just limited to the immediate post-election period either. Stocks have historically performed very well in the 12-month period following a midterm election.

The S&P 500 is a perfect 18-for-18 in posting positive returns in the year following a midterm. Not just positive returns, significantly positive returns. On average, the S&P 500 has gained 15% in the following 12 months, more than double what the index typically returns.

Does this mean that there are double digit returns ahead? History would suggest that the odds are good, but we’ll see if it plays out again this time. It looks like we’re heading into a recessionary period with a housing market that’s crumbling, a war in Ukraine and double digit inflation all over the world. That’s not exactly the types of conditions that occurred during prior midterm years. That could make 2022 a true outlier.

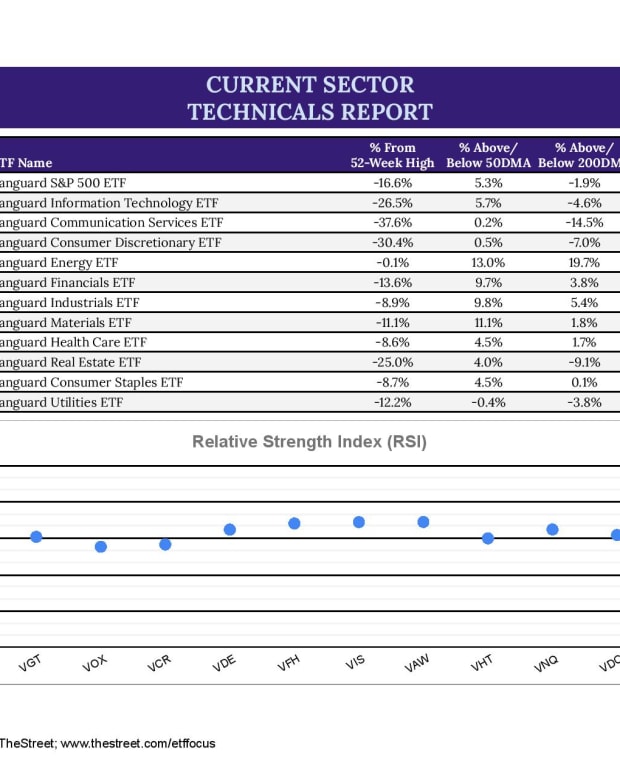

ETF Sector Analysis

Last week marked a real shift in sentiment. Investors had been bidding up more speculative and riskier assets in anticipation of a potential Fed pivot that never came. Post-Fed, the shift was made over to defensive and cyclical sectors and away from the growth sectors that had been in favor. That much is clear looking at short-term relative strength.

Energy remains the clear winner in this market, but financials, industrials and, to a lesser extent, materials are moving into leadership. Defensive sectors made a sharp turnaround, but not to the point where I’d consider them looking strong. Utilities are still in questionable shape and have turned much more volatile than they’ve been at any point since the start of the COVID pandemic.

Tech and growth are looking pretty ugly here. Earnings were poor, layoffs are coming and outlooks are being downgraded. Even though tech stocks took a beating around earnings, I think there’s still plenty more downside risk ahead.