This Dividend Aristocrat With A 7% Yield Is A Real Buy Low Opportunity

VF Corporation (VFC) is down 60% year-to-date thanks to a confluence of factors - global growth challenges, a tough retail environment and consumer discretionary stocks, in general, being out of favor.

That's created a potential bargain, however, for dividend income investors. The yield is all the way up to 7% and the company has raised its dividend annually for nearly a half century, putting it in some truly rarified air among dividend growth stocks.

Is the dividend sustainable though? Is the company positioned for a turnaround?

VF Corporation (VFC) Overview

Together with its subsidiaries, V.F. Corporation creates, acquires, markets, and distributes branded lifestyle clothing, footwear, and related goods for men, women, and kids throughout the Americas, Europe, and the Asia-Pacific. Outdoors, Active, and Work are its three functional segments.

V.F. has a remarkable 49-year streak of dividend increases, nearly twice as long as what is necessary to become a Dividend Aristocrat. The company has a long history of raising dividends but has also been an outstanding dividend growth stock. It has increased by an average of slightly over 10% over the last ten years, giving investors nearly 50 years of continuous growth and double-digit yearly gains.

Dividend Analysis of VF Corporation (VFC)

V.F. Corporation (VFC) is a Dividend Aristocrat, significantly increasing its dividend for 49 consecutive years. V.F. Corp. boosts its dividend every year, including in 2020, a challenging year for the corporation and the economy owing to the coronavirus outbreak.

However, V.F. Corp. has a firm that can continue to be highly profitable even when the economy is experiencing a slump. This lets it keep raising its dividends yearly even if business conditions worsen.

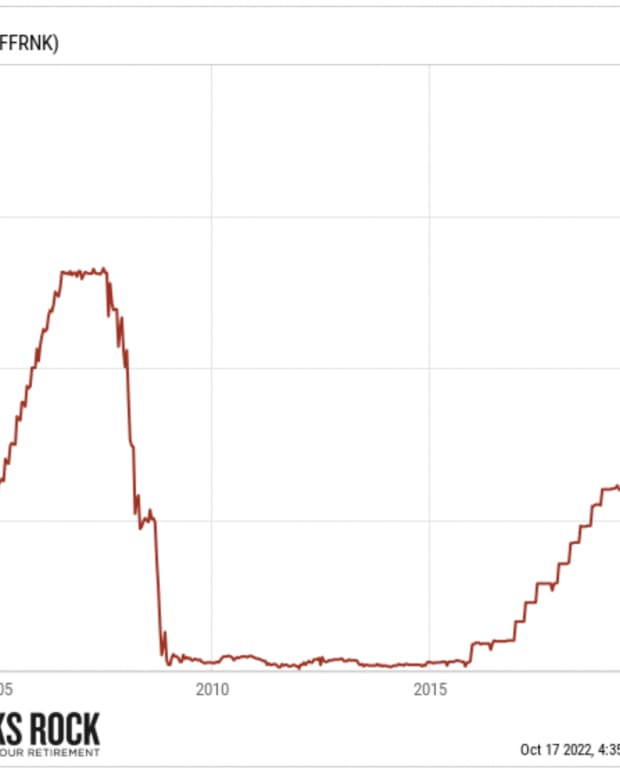

The current dividend yield on V.F. Corp. shares is 7.2%. The payout ratio is 63% based on the new yearly dividend of $2.00. The year 2021 was considerably better for V.F. Corp., which continued to be a leader in the sector with well-known brands. In 2022 and 2023, as the global economy keeps improving, V.F. Corp. should resume growing.

Dividend Yield

With a $2.04 yearly dividend that brings the dividend yield to about 7.2%, the corporation is currently halfway to achieving its aim of a 50% dividend distribution goal. Due to stock buybacks in the past, the net payout yield has gone up to 8.2%. This gives shareholders more than just the dividend yield.

With its recent dividend rise, VF Corp has boosted its dividend for the 50th time in a row, crowning it America's latest Dividend King. VF has raised its dividend at a healthy annualized pace of 11% over the past ten years. Even though dividend increases are happening much more slowly right now because of how bad the economy is, they are still happening.

V.F. Corp has demonstrated that it is remarkably resilient to weathering economic swings without harming its bottom line, as seen by its Dividend Aristocrat status. The corporation has a significant edge in this situation thanks to its diverse portfolio of brands since it can adapt to shifting consumer preferences with various styles, patterns, and price points.

Also worth mentioning is the dividend's strong foundation. There is a massive gap between earnings and the present payout rate, with the yearly dividend at $2.04 per share.

Given its current operational conditions and scale, VFC offers one of the best dividends currently on the market. The management does not have any plans to lower the current dividend yield further unless stock prices skyrocket, which have hit rock bottom in the past two years.

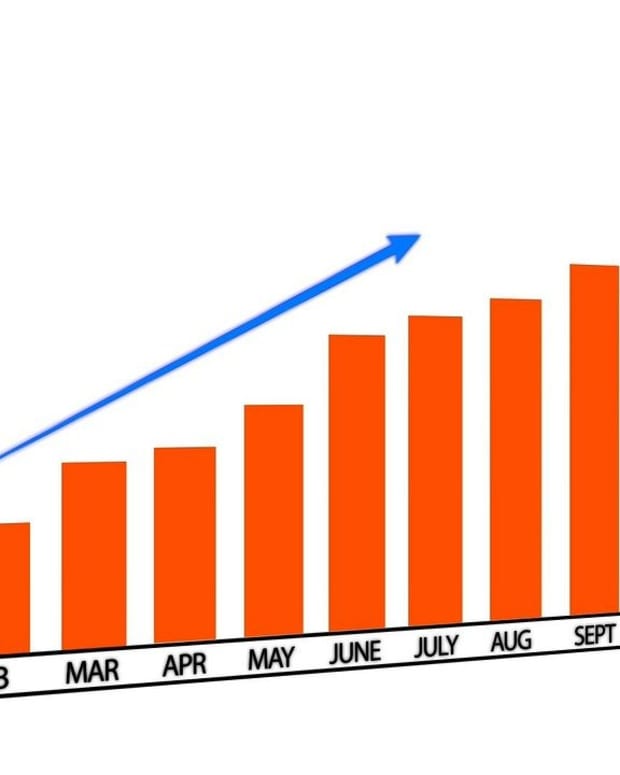

Dividend History

In order to provide the most exactly relevant comparison of VFC's historical dividends, the above-described dividend history graphic for VFC has been given after accounting for any recorded stock split occurrences. When historical dividends are plotted on a graph, they can show long-term fluctuations and growth in the VFC dividend history.

Examining VF Corp's dividend history is a solid starting point for determining dividends' sustainability. But studying dividends involves more than just examining a company's dividend yield and growth. For investment decisions, other financial variables are also crucial.

V.F. Corp. has grown its dividend every year since 1974 for a total of 49 years. The December dividend will be increased if history holds. The company is also in the S&P 500 index, which solidifies its place as one of the well-known Dividend Aristocrats.

It's unlikely that clothing or fashion, in general, will go out of style anytime soon. Due to the push for leading healthy lifestyles, the market for outdoor apparel and footwear has expanded. V.F. Corporation appears well-suited to weather the present economic environment, despite the fact that the clothing and footwear industry can be unpredictable.

Here's a graph showing the comparison between dividend growth, dividend yield, and the earnings per share of VFC over the years.

Dividend Sustainability

Even if the dividend yield is crucial for income investors, it's also essential to take any significant changes in share price into account because they typically surpass any dividend income gains. The stock price of V.F. has dropped 37% in the past three months, which is unsuitable for investors and can account for the high rise in dividend yield. But it's estimated to bounce back soon, which probably gives investors a good chance to buy the stock.

A high dividend yield for a short period of time is meaningless if it cannot be maintained. Prior to this disclosure, V.F. was losing money and paying out 183% of its earnings, with no free cash flow being produced. It would be impossible to keep paying out dividends that are so high compared to earnings and still have no free cash flow.

EPS should increase significantly next year, according to analysts. Suppose the dividend continues on its current path. In that case, analysts estimate the payout ratio would be 57%, which would put us at ease about the dividend's long-term viability, despite the current high levels.

The company has a track record of consistently paying dividends with minimal variation. The dividend has increased from a 2012 total yearly payment of $0.72 to the latest total annual payment of $2.00. This translates to a growth in distributions of 11% annually over that time. A trait that an income stock should have is steadily increasing dividends over time.

Cash Flow Analysis of VF Corporation (VFC)

VF Corp.'s financial stability is of the utmost importance for both external investors and internal stakeholders. The cornerstones of VF Corp's success are creating enough cash flow to pay bills, pay off debt, and maintain a steady profit year after year, together with efficiency and cost control.

Understanding how VF Corp makes and spends money over a specific time period requires understanding its cash flow. It can also assist you in determining how much money you have on hand and where your money is going at any given time.

Given the company's present industry classification, its debt-to-equity (D/E) ratio of 1.88 and the debt of 6.3 B are acceptable. The current ratio for VF Corp. is 1.3, which indicates that it might not be able to meet its financial obligations when the payments are due. Debt can help VF Corp until it is unable to repay it, either with additional funds or with free cash flows.

In this instance, debt can be a terrific and far more effective tool for VF Corp to engage in development at high return rates. Debt should always be taken into account alongside cash and equity when analyzing VF Corp's usage of debt.

Debt Analysis for VF Corporation (VFC)

It's crucial to comprehend the foundational ideas behind developing strong financial models for VF Corp. The appropriate projection of a stock's fair market value is made possible by taking into account its historical fundamentals, such as total debt. Because the critical accounts VF Corp uses in its financial reporting are linked and depend on each other, it is important to look for any possible connections between related accounts.

The net debt-to-equity ratio of VFC (178.2%) is considered excessive. Over the last five years, VFC's debt-to-equity ratio has risen from 110.9% to 196.1%. Operating cash flow only covers 2% of VFC's debt. The debt interest payments for VFC are adequately covered by EBIT (11.3x coverage), which seems reasonable compared to other stocks similar to VF Corp.

Most VF Corp stock investors today examine various VF Corp growth ratios in addition to static indicators when looking for future investment possibilities. When fundamental ratios consistently go up or down, it's often a sign that there might be a profitable pattern.

Should You Invest in VF Corporation Considering Its Outstanding Dividend Payouts?

Through dispositions and additions, VF has developed a portfolio of powerful brands across several garment categories. We think VF will expand faster than most rivals in the long run and preserve its competitive edge despite short-term disruption from the COVID-19 situation and the economic slowdown in China.

VFC, with a stock price of 28.25 USD as of November 3, 2022, has a market value of $12.3 billion and trades at a P/E ratio of 10.43, less than its rivals. It is reasonable to state that the stock is most likely undervalued compared to its 52-week high of $78.91.

VFC indicates how to profit from the market turbulence that drives some investors to flee. Today, VFC isn't just one of the finest high-yield aristocrats you can trust to invest in for the long run; it's one of the best stocks you can purchase, period. A company that can assist you in making your long-term fortune on Wall Street and possibly retiring in safety and splendor.