Decoded: GameStop Chair Ryan Cohen's Cryptic Tweets

Ryan Cohen has become one of the major characters in the GameStop (GME) - Get Free Report story. The activist investor bought a large chunk of the company's shares in 2020 and watched them rise in value during the January 2021 "meme mania."

However, Cohen went further. His investment in the company has turned out to be a long-term commitment that got him to the position of chairman of GameStop's board. And Cohen has been leading a comprehensive turnaround plan for the company's business.

Figure 1: Decoded: GameStop Chair Ryan Cohen's Cryptic Tweets

MARK ABRAMSON FOR THE WALL STREET JOURNAL

Read more: Citadel's Ken Griffin: Could the FTX Collapse Hurt the Financial Markets as a Whole?

Cohen's Cryptic Tweets

GameStop Chairman Ryan Cohen is the kind of executive who rarely makes public appearances. Instead, he often communicates with the company's shareholders through his Twitter account.

However, Cohen's tweets are often cryptic, leaving GameStop shareholders struggling to figure out their meanings and what they mean for the company. When asked, Cohen simply says, "My tweets are just me being me."

In a recent interview with GMEdd.com, Cohen revealed the meanings of some tweets that have puzzled GameStop's retail shareholders.

The McDonald's soft-serve cone

This is connected to Chewy’s (CHWY) - Get Free Report — Cohen’s former company — first board meeting, which included a trip to McDonald’s (MCD) - Get Free Report for soft serve.

“That was before the super-high inflation," Cohen said. "[It was] $1.42 for 150-200 calories [of] ice cream. It [was] a good deal for a great treat.”

Ryan Cohen’s tombstone

“I have a very dark sense of humor, and I can be very self-deprecating at times.”

Sears being torn down

“That could be GameStop.” Cohen said, laughing. “I think that it has a lot of potential similarities.”

Toilet with a fax machine and a phone

“A very efficient setup by the way. And I do my best work at the toilet.”

David vs. Goliath

“That’s the kind of sentiment it sometimes feels about GameStop.”

Learning from Wikipedia

“I can’t believe the amount of money spent on college tuition when you can basically find and learn everything online.”

Short Sellers

“I’m not a fan of short sellers.”

Ryan Cohen mystery shopping

“When I go to [GameStop’s] stores, I am always ghost shopping.”

Wall Street vs. Main Street

“I don't know what the solution is. I don't understand all these management fees and why people give their money… whether in mutual funds, private equity, or venture capital. A lot of structures are set up with "heads I win and tails you lose." They make money regardless of whether they outperform the S&P 500.”

Executives' risk-free compensation

Cohen later replied by saying that “directors should comprise owners who bought shares with their own money.”

About this reply, Cohen said, “I think this is the simple and most effective solution. We’ve got a boardroom full of owners who are risking their capital. It is very very different when something is given to you as risk-free compensation and regardless the business does… you end up making money versus you bought shares with your own money and serve on a board.”

Cracking down on short sellers

“If you are long you have to disclose those positions, but if you are short, you don’t have to. It should be the same rules that apply to short sellers as people that have long positions… and ultimately that is what probably is going to happen.”

Expensive executives leaving a company in shambles

“Most of [executives'] compensation is risk-free and they don’t work very hard. They’re basically preparing PowerPoint presentations and doing conference calls. Corporate America is littered with risk-free compensation and overpaid executives.”

He also added, “It is deeply disturbing to see what is going on and the wealth inequality in this country.”

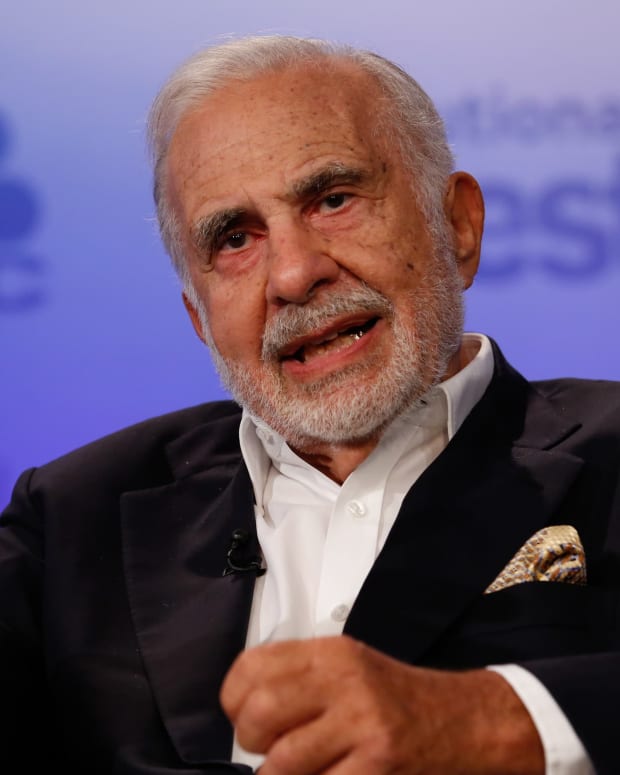

Cohen, Buffett, and Icahn

“I think that there is a lot to learn from Carl [Icahn]. He’s the [Original Gangster] activist and he’s been doing it for a long time. When it comes to investing, I learn a lot from my father and I kind of have an híbrid approach ready to go, activist, if the opportunity is right.

“But if I can sit on my hands and invest in a great business with a competent management team the way that Buffett does and let your capital compound for you. So I’m pretty agnostic in terms of what the approach is whether activism or passive investing.”

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Wall Street Memes)