Crown Castle: Choosing A Stock For My November Dividend Reinvestment

In my public Dividend Growth Portfolio, I reinvest dividends monthly.

Unlike many dividend investors, I don’t drip them, which means that I do not automatically reinvest them back into the stocks that sent them to me. Rather, I collect them and then hand-pick a stock to buy with them.

When selecting a stock, I generally favor building up a position that I already own. After all, those companies have been vetted for quality, attractive dividend characteristics, financial soundness, and the like.

One stock under consideration for my November reinvestment is Crown Castle (CCI). I purchased CCI once, in February, when I started a position in it. It sits at 1.3% of my portfolio.

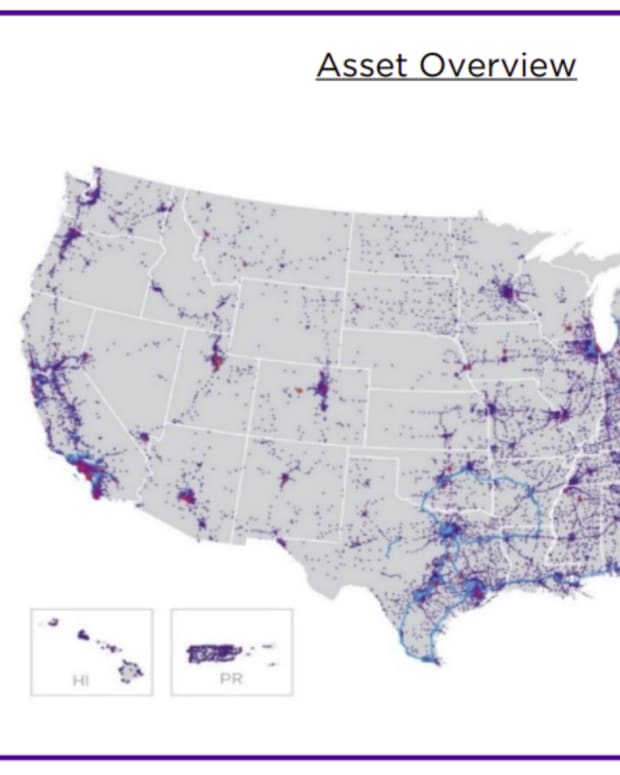

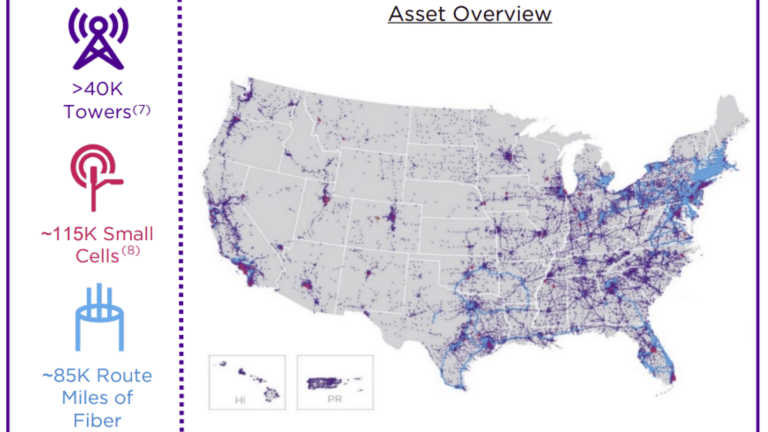

Crown Castle is a REIT (real estate investment trust) that bills itself as the nation’s largest provider of shared communications infrastructure. It owns cell towers, short-range small cell nodes, and thousands of miles of fiber. It focuses on the United States, and it has a presence in every major domestic market.

As you are probably aware, the amount of data being generated nowadays is huge and growing exponentially. New terms have been coined to measure it, such as “datasphere” (referring to all data everywhere) and “zettabyte.”

Moving all that data around and connecting entities is an exploding business, with emerging markets in 5G, the internet of things, and smart city technologies, not to mention markets that are more established but still growing.

CCI is right in the middle of all this, committed to providing the nation’s wireless carriers with prime real estate assets they need to run their networks.

One step in selecting companies is to rate their quality, using rankings from sources that I have come to trust over the years. Here is CCI’s Quality Snapshot.

Crown Castle clocks in as a solidly investable stock, scoring 18 out of 25 possible points. If you’d like more detail on how I derive Quality Snapshots, see this video.

I create other snapshots, and I’d like to share one more with you: CCI’s Dividend Snapshot:

If you would like to see how I create Dividend Snapshots, see this video. CCI’s score of 27 out of 35 possible points is above average, and it includes a 6.5% dividend increase just announced. The company has stated that its target is to grow the dividend 7-8% per year over the long term.

CCI’s dividend situation has improved since I first bought it.

- Its yield is higher, now at 4.9%.

- It has added another year of dividend increases with the one just announced.

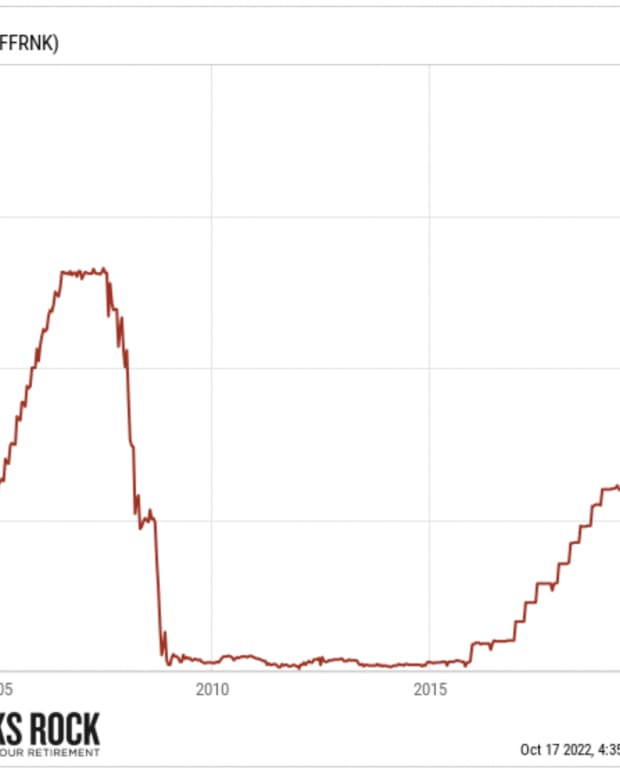

CCI’s higher yield brings us to my final consideration: Valuation. The reason that CCI’s yield is so high now is that its price has been dropping like a rock.

In fact, as I write this, it’s down over 3% just today (October 20). That’s a little puzzling, as CCI just issued its quarterly report, and it was pretty positive. Jay Brown, CCI’s CEO, said this:

The dividend increase is supported by the expected growth in cash flows in 2023 and reflects our confidence in the strength of our business model despite the challenging global macroeconomic environment. I believe we remain in the early stages of 5G development in the U.S., providing a long runway of growth in demand for our comprehensive communications infrastructure offering across towers, small cells and fiber. Our customers continue to upgrade their macro tower networks, and we expect another year of strong growth in 2023.

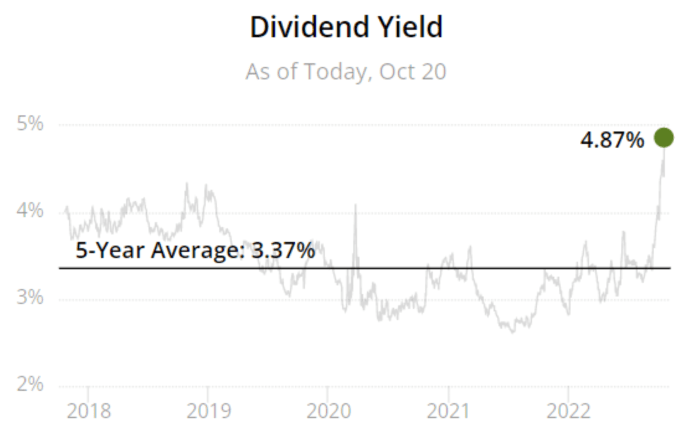

Yield and price move in opposite directions, so CCI’s price dive has caused its yield to shoot up, as shown here:

(Source: Simply Safe Dividends)

The ratio between a company’s current yield and its 5-year average yield is one of four metrics that I most often use in valuing a stock. I won’t get into all those details here, but here’s my assessment of CCI’s valuation:

CCI has a better valuation now than when I first bought it in February. One last thing: CCI is registering as a “Buy” or “Strong Buy” among most of the analysts that follow it.

I won’t make my final decision for a couple of weeks, but currently I find Crown Castle to be a high-quality candidate with a very attractive dividend resume. And it’s undervalued.

Not only that, but the ex-dividend date for CCI’s new increase is not until December 14, so if I do buy CCI in November, I’ll get more shares eligible for the newly increased dividend.

That, DGI friends, is my favorite scenario for investing: High quality + good dividend story + discounted price.

Thanks for reading.

--Dave Van Knapp