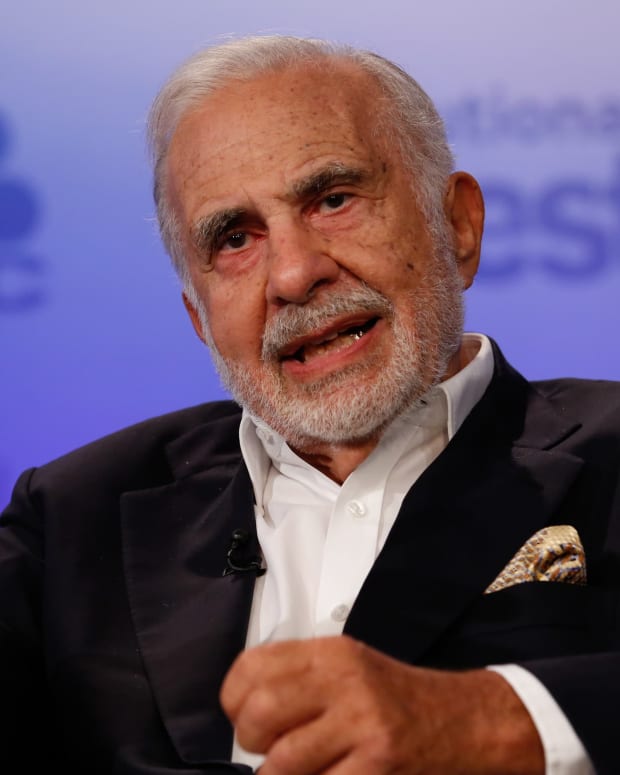

Cliff Asness on AMC Stock "Ape" Investors: "Paranoid Investing Death Cult"

- Hedge fund manager Cliff Asness is one of the best-known AMC bears.

- Asness has an antagonistic relationship with AMC investors, recently calling them a "paranoid investing death cult."

- In 2022, AMC short sellers have been winning — but shorting the stock involves high borrow fees.

Figure 1: Cliff Asness on AMC Stock "Ape" Investors: "Paranoid Investing Death Cult"

Misha Friedman/Bloomberg

Read also: GME Stock’s Borrow Availability Is Too Low For Large Short Trades, Says This Expert

Who Is Cliff Asness?

Clifford Asness is the manager of hedge fund AQR Capital Management. This year, he revealed that he is shorting AMC Entertainment (AMC) - Get Free Report.

Asness said that his bearish bet was due to AMC's valuation issues, as well as the movie theater chain's business fundamentals.

"[AMC stock is] super expensive, super unprofitable, super high beta, and volatile," Asness said in June.

However, Asness has made statements about the risks of betting against a stock like AMC, which has broad support from retail investors. The hedge fund manager fired back at AMC shareholders (or Apes):

"I dare all the meme-stock maniacs to try to hurt us."

Why Does Asness Keep Trolling the Apes?

Despite broad market turmoil, Cliff Asness' hedge fund has had a good year.

According to a Bloomberg report, the AQR Absolute Return strategy, which consists of a mix of quant trades, was up 38% through early November. That makes 2022 the best year for the fund since its launch more than 20 years ago.

In addition, AQR's equity fund is up 23%.

However, during a recent interview, Asness mentioned the antagonistic relationship he has with AMC Apes, calling them a "paranoid investing death cult."

"I leaned in too much, partly out of ignorance of how crazy that part of the world is," he said of his interactions with AMC's retail investors.

And in a tweet, Asness wrote that he bothers to argue with meme-stock investors because he is sure that one day they will thank him for it:

Also, the quantitative investor laid out his investment philosophy of seeking out cheap, steadily profitable stocks with upward momentum. Asness said that his factor-investing returns may be just beginning, because even after this year's positive returns, value stocks remain cheap.He expects this trend to continue for the next two-and-a-half years.

Based on his strategy that has been successful (at least for this year), the AQR hedge fund manager sent a message to the meme-stock investors: "There are a lot of investment strategies you should hold onto for dear life — if they're good long-term strategies.

"To my meme-stock friends, there's an acronym they use: HODL, Hold On For Dear Life. It's a great and important idea, but they use it wrong,"

Are AMC Shorts Winning in 2022?

Cliff Asness' hedge fund is one of many that are betting against (or have bet against) AMC. It's no news that the movie theater chain's stock has been popular among short sellers in recent years. In 2022 alone, the stock has dropped roughly 70%.

According to the latest data provided by S3 Partners Research, there is about $771 million in short interest in AMC. And through November 23, shorts have earned $1.73 billion in mark-to-market profits.

If history is any guide, it's risky to draw conclusions about the stamina of retail investors — especially meme-stock investors. Their resilience has been shocking the markets since early 2021.

Even if short sellers are winning the battle against AMC shareholders — so far — their gains may be short-lived, especially considering current stock borrow fee rates of nearly 45%.

Generally, when borrow fees are high — above 3% — short sellers are forced to close their positions. As a result, their remaining mark-to-market profits are burned.

Furthermore, by confirming that there is a lot of demand from short sellers, AMC's high borrowing fees put more pressure on short sellers to close out their positions and take as much profit as they can.

However, Cliff Asness himself doesn't seem to be too concerned about the cost of shorting AMC. He supports the thesis that stocks that are expensive to short have high valuations and little subsequent return.

Finally, there may still be significant catalysts for AMC stock to come. The most recent was after the third-quarter earnings results, when AMC stock surged over 50% in a few days.

Short-selling hedge funds may seem confident in their current positions, but a surprise rally in AMC's share price may indeed test their contrarian bets.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Wall Street Memes)