Carl Icahn Is Shorting GameStop Stock. Should Investors Worry?

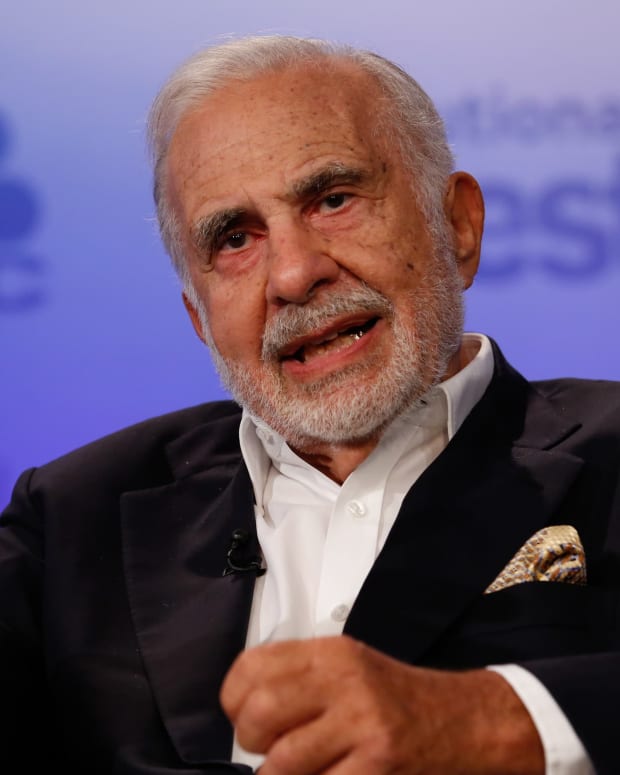

- According to Bloomberg, legendary investor Carl Icahn has held a short position in GME since early 2021.

- Although he's not a fan of short sellers, GME Chair Ryan Cohen has remarked that he admires Icahn's investing career, and it's likely that the two activist investors recently discussed GameStop.

- Icahn's short position on GME shouldn't have any practical effect for the stock's investors.

Read more: Why Ryan Cohen Invested In GameStop Stock

Is Carl Icahn Shorting GME?

According to a new Bloomberg report, legendary activist investor Carl Icahn is a GameStop (GME) - Get Free Report bear.

In fact, he has been betting against the video game retailer since the short-squeeze event of January 2021, which kicked off the meme stock trend.

It's not public knowledge how large Icahn's short GME position is, but apparently, he started shorting GameStop when its stock was near its all-time high of $483 per share — before the 4-for-1 stock split.

Reportedly, Icahn has added to his short position over time. He has said he believes that GameStop shares are not trading according to the company's business fundamentals and are doomed to fall.

Although reports indicate that Icahn has other short positions on assets such as shopping centers, dealing in so-called "meme stocks" is not customary for the investor.

But as the HBO documentary Icahn: The Restless Billionaire revealed, he has been slowly handing over the reins of his investing empire to his son, Brett. And it's likely Brett could be behind some of Icahn's most recent investments.

What Is Ryan Cohen's Relationship With Carl Icahn?

Not so long ago, GameStop Chairman Ryan Cohen posted a photo taken of himself with Carl Icahn to his Twitter account.

This led retail investors who support GameStop's stock to speculate about what connection Icahn could have with the retailer's chair.

And Ryan Cohen himself made a joke along this theme in August: "Ryan Cohen by day, Warren Icahn by night."

Cohen's admiration for Carl Icahn's philosophy should come as no surprise. However, in his "Warren Icahn" tweet, perhaps Cohen was indicating that he also sees himself as a value investor who buys "cigar butt" companies with the potential for long-term gains.

In a recent interview with GMEdd.com, when asked about the picture with Carl Icahn, Cohen said that he did not want to expose publicly the content of his conversation with the investing legend. Cohen also said in the interview that he is not a fan of short sellers.

However, now that Icahn's short position in GameStop has been revealed, this may have been one of the topics of conversation between the two activist investors.

How Many GameStop Shorts Are There?

The truth is that GameStop has been heavily shorted for years. So the news about Icahn's GME short position should come as no surprise.

It's difficult to pinpoint exactly how many hedge funds and institutional investors hold short positions in GameStop. This is because, unlike investors who are "going long," shorts do not need to close out their positions.

The latest data provided by S3 Partners points out that $1.23 billion worth of GameStop shares are being shorted, which is about 20% of the company's total stock float.

According to S3 Partners Managing Partner Bob Sloan, short interest above $1 billion could fuel a new short squeeze. Short squeezes occur when a shorted stock's underlying share price suddenly ticks sharply higher, causing short sellers to scramble to cover their positions.

So even though it may sound a bit disappointing to GameStop shareholders Carl Ichan is shorting the company, the practical effect of his short position should have been already absorbed.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Wall Street Memes)