Best Performing ETFs for September 2022

Even though the major U.S. equity indices were down about 9% in September, there were some ETFs that did well. Quite well, in fact. You probably won't be surprised to find out that the month's biggest gainers had nothing to do with equities at all. In fact, of September's top 15 performing non-leveraged ETFs, exactly zero of them invested in stocks. It's a unique group of winners from a very unique market environment!

There are some equity ETFs to be found that posted positive returns in September, but they mostly invest in precious metals miners. If you want an equity fund that invests in something more closely resembling a traditional equity portfolio, you'd have to go all the way down to #25 and the iShares Neuroscience & Healthcare ETF (IBRN). Needless to say, there was very little in traditional stocks or bonds that worked in September.

The biggest winners were ETFs that invested in hedges, currencies and commodities. With interest rates continuing to soar as the Fed works to combat inflation, investments that are hedged against a stronger greenback performed quite well. Within international equity ETFs, those that hedged their exposure to the dollar outperformed their unhedged counterparts by about 4%. But those still weren't enough to offset the declines in stock prices. To capture larger positive returns, investors needed to invest in products that targeted one of two specific themes - rising interest rates and the rising dollar.

If you were prescient enough to see the rise in interest rates coming at the beginning of September, you could have captured 10%, 20% or even 30% returns! Even though I don't include VIX-linked futures ETPs in this list, any product that bet on rising volatility also did very well. When market conditions are favorable, investors often pursue the goal of return maximization. When things turn south, risk mitigation should take priority. September was perhaps the perfect example of why risk mitigation is important to consider in a broader portfolio strategy.

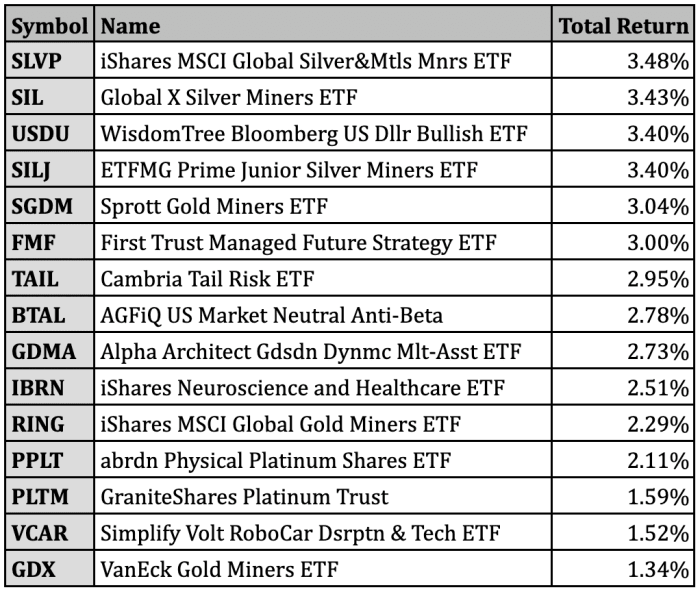

Here's the list of the best performing ETFs for September 2022.

It's no surprise that three of the five best performing ETFs for the month involved interest rate hedges. The Simplify Interest Rate Hedge ETF (PFIX) is the biggest of the bunch at $360 million in assets. It simply invests in direct interest rate option contracts designed to move in sync with changes in the yield curve. The Global X Interest Rate Hedge ETF (IRHG) pursues a similar strategy, although its expense ratio comes is 5 basis points cheaper than PFIX. The Advocate Rising Rate Hedge ETF (RRH) takes a more expansive approach. It can invest in stocks, Treasuries, option contracts and interest rate derivatives, essentially anything that could have a positive correlation to rising interest rates. A little further down the list is the FolioBeyond Rising Rates ETF (RISR), which invests in more complex interest-only mortgage-backed securities (MBS IOs) and U.S. Treasury bonds.

The Simplify Tail Risk Strategy ETF (CYA) and the Cambria Global Tail Risk ETF (FAIL) are more pure risk hedges. CYA invests in a combination of equity index put contracts, interest rate hedges and currency exposures to protect against downside. FAIL is a little more basic in that it invests in out-of-the-money put options on global equity indices that are designed to profit when stocks go down. The Cambria Tail Risk ETF (TAIL), the U.S. market equivalent, also makes the top 30 list in September.

The other winning trade for September was simply the dollar, something that we rarely see except in environments where things are starting to break. The Invesco DB U.S. Dollar Bullish ETF (UUP) and the WisdomTree Bloomberg U.S. Dollar Bullish ETF (USDU), which shows up in the next graphic, have a combined $2.5 billion in assets, but the pair has drawn in more than $1.3 billion of that just in 2022. The dollar remains one of this year's most popular trades.

Here's where all the precious metals miner ETFs show up. The VanEck Gold Miners ETF (GDX), which sneaks in right at the bottom of the list, is easily the largest with more than $9 billion in assets, but the others are large enough to remain tradeable and liquid. The iShares MSCI Global Silver & Metals Miners ETF (SLVP), the Global X Silver Miners ETF (SIL) and the ETFMG Prime Junior Silver Miners ETF (SILJ) all performed nearly identically. SILJ focuses on smaller miners, while SLVP has more large-cap and U.S. company exposure.

The AGFiQ U.S. Market Neutral Anti-Beta ETF (BTAL) and its long/short strategy has been one of this year's success stories. It goes long low beta stocks and short high beta ones, which means it will post positive returns whenever low volatility outperforms high beta. That's definitely happened this year and has led to a 14% year-to-date gain for BTAL. The fund started the year with around $100 million in assets, but has grown to more than $310 million today.

The only other non-miners equity ETF on the list is the Simplify Volt RoboCar Disruption & Tech ETF (VCAR). It's rather unique in that it takes very targeted and concentrated bets on just the handful of companies it believes will be winners in the autonomous driving space. The management team's anticipated big winner is Tesla (TSLA), so it's become the fund's top holding with a 11% target allocation split between a 6% equity position and a 5% call option position.

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs