Best Performing Dividend ETFs for October 2022

Throughout 2022, we've seen dividend stocks and dividend ETFs hold up much better than the S&P 500. As the bear market has deepened, investors have pivoted back to defensive sectors and themes, including utilities, low volatility and value. Much of the trend from the 1st half of the year was losing less than the market, but October turned out to be the opposite. Dividend ETFs had a terrific month with all major dividend strategies posting gains of 10% or more.

The reasons for this, of course, can be very subjective. Some investors are scooping up stocks on the belief that the Fed is going to make a slightly dovish pivot this week and indicate that the pace of rate hikes is going to slow. There was the Q3 GDP report that definitionally would end the technical recession the U.S. economy has been in this year. Others believe that inflation is peaking and that will be the impetus that causes the Fed to take its foot off the pedal.

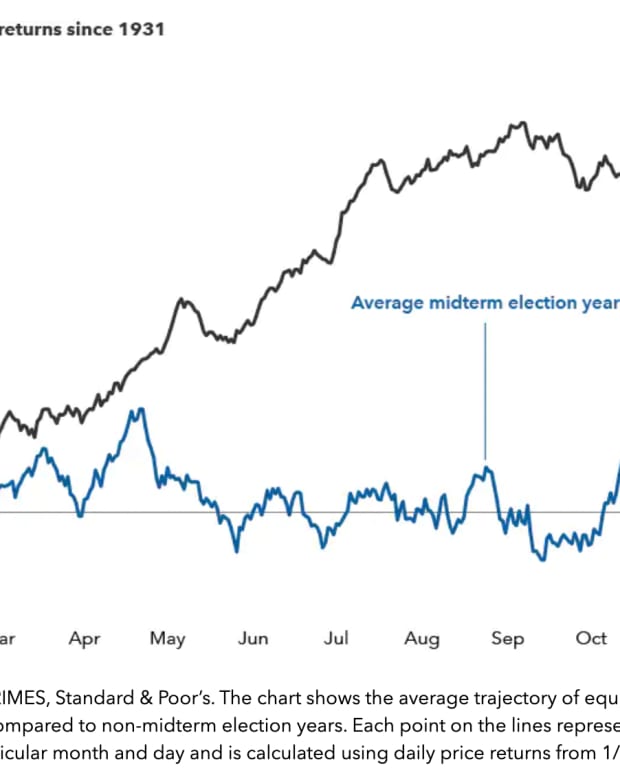

One reason could simply be that market sentiment in September was about as bad as it could get. There was so much gloom & doom and so much selling in risk assets that investors couldn't see a silver lining in any of it. Many would view that as a contrarian indicator. As Warren Buffett would say, "be greedy when others are fearful", and I think that had a hand in the October rally.

It wasn't necessarily a big shift towards risk taking. The fact that dividend payers outperformed the S&P 500 is a sign that there's still a bit of caution in the markets. Given how rough Q3 earnings looked within the FAAMG names, there's probably some reluctance to push heavy back into growth stocks again, but it could all come down to what the Fed does this week. Investors are probably going to be very forgiving of earnings and things like that if the Fed signals that it's about to loosen conditions again.

In the meantime, it was a good time to be a dividend investor and that's merely an extension of the behavior we've been seeing all year.

Here's the list of the best performing dividend ETFs for October 2022.

It's not often you see such a simple strategy near the peak of the top performer list, but that's what we get this month in the Invesco Dow Jones Industrial Average Dividend ETF (DJD). This fund effectively takes the Dow 30 and weights it by trailing 12-month dividend yield. That's it! A simple strategy that was surprisingly effective as its high yield/value/low volatility tilt checked all the boxes and returned nearly 14% last month. Its 3.6% yield isn't the highest you'll find in this segment of the market, but it is nearly twice that of the cap-weighted Dow 30.

The next batch of top performers all focus on small-caps. WisdomTree lands a pair in the top 5 with the WisdomTree U.S. SmallCap Quality Dividend Growth ETF (DGRS) and the WisdomTree U.S. SmallCap Dividend ETF (DES). DES is the $2 billion fund that covers the broader small-cap dividend stock universe, while DGRS layers on both growth & quality screens. The quality factor hasn't necessarily been a source of outperformance this year, but small-caps have pretty consistently led large-caps in 2022 as they did especially in October. The WisdomTree U.S. High Dividend ETF (DHS), which falls a little further down the list, is an all-cap high yield fund.

The VictoryShares U.S. Small Cap High Dividend Volatility Weighted ETF (CSB) is the sibling to the VictoryShares U.S. Large Cap High Dividend Volatility Weighted ETF (CDL), a fund that I have touted on this site more than once. These funds both take the 100 highest-yielding stocks from within their index subsets and weight them by the inverse of their daily standard deviation of returns. CSB's small-cap value tilt hit the sweet spot of where the market saw some of its greatest gains last month.

The TrueShares Low Volatility Equity Income ETF (DIVZ) is one of the few dividend ETFs that has actually posted a positive return on the year. It's an actively managed, concentrated portfolio comprised of 25 to 35 favorably-valued companies with attractive dividends that the portfolio managers expect to grow over time.

The 2nd 15 features a number of the biggest and most familiar dividend ETF names. The Vanguard High Dividend Yield ETF (VYM) and the Schwab U.S. Dividend Equity ETF (SCHD) are consistently in the top 5 of my dividend ETF rankings. The Invesco High Yield Equity Dividend Achievers ETF (PEY) remains one of my favorite funds. It bridges the gap between long-term dividend growers, a traditionally lower-yielding group, and high dividend yields.

The Invesco KBW High Dividend Yield Financial ETF (KBWD) is a highly aggressive ETF that expands its definition of "financial" to include things, such as mortgage REITs and BDCs. When conditions are right for these securities, like they were in October, the fund can deliver big returns and the 12% yield looks enticing, but things can get ugly if this group falls out of favor.

A quick shout out to a couple of the newer funds on this list. The Emerge EMPWR Sustainable Dividend Equity ETF (EMCA), the USCF Dividend Income ETF (UDI) and the Touchstone Dividend Select ETF (DVND) have all debuted within just the past few months, but have gotten off to healthy starts. ECMA targets dividend payers that meet specific ESG criteria. UDI also uses an ESG approach but also layers on several quality screens to its portfolio's components. DVND focuses on large-cap dividend growers with sustainable competitive advantages.

Read More…

Best Ultra Short-Term Bond ETFs

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs