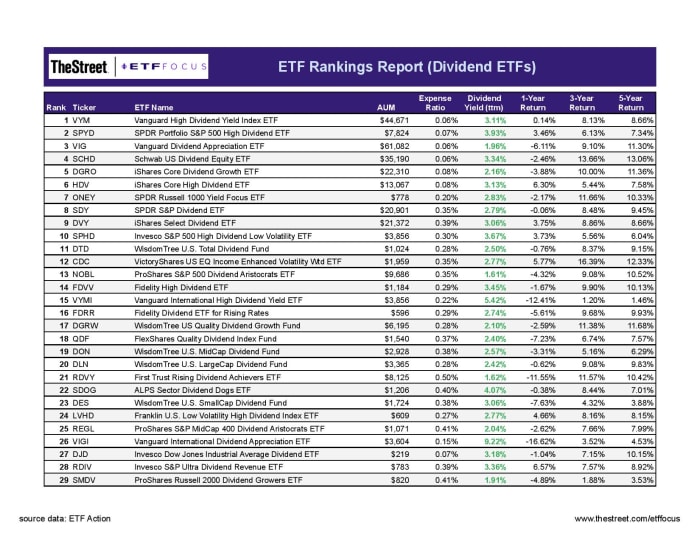

Best Dividend ETFs (Updated July 2022)

The equity markets have turned sharply south in 2022. Previous leaders, including tech and growth, have turned into laggards as valuations come back down to earth and investors shy away from more speculative investments. That's been great for more defensive themes, such as dividend payers and low volatility stocks. They haven't (for the most part) been able to generate gains in 2022, but they have outperformed the S&P 500 by a wide margin and provided investors a measure of safety.

Investors have poured more than $45 billion into dividend ETFs year-to-date through mid-July. A lot of that money has been directed towards the biggest and cheapest funds available. The top dividend ETFs in this updated ranking list have achieved their spots via investor-friendly expense ratios, popular themes and solid long-term performance.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

I often talk about the three pillars of dividend investing - dividend growth, dividend quality and high yield. All three performed comparatively well this year, but high yielders have maintained a slight performance advantage. I'm believer that investors should incorporate all of these pillars into their investment portfolios. While they all tend to be highly correlated, they do perform differently in different scenarios. High yielders tend to do better when investors are a little less risk-averse. Long-term dividend growers often outperform when defensive investing is leading. I'm a fan of ETFs that incorporate multiple pillars in their strategies, but there are winners across all categories.

There are any number of thematic or smart beta twists on dividend investing within the ETF space, as we're about to see, and I think that'll only help investors pivot their portfolios to take advantage of the market environment.

Ranking The Dividend ETFs

The variety of ETF choices makes distinguishing the best from the rest a little challenging. You've probably heard most financial pundits talk about focusing on funds with low expense ratios. That can certainly be a big factor in deciding which ETF to go with (it's probably the most important factor, in my view), but there are a lot of things that could go into making the right choice.

That's where I'm going to try to make things easier for you. Using a methodology that I've developed, which takes into account many of the factors that should be considered and weighting them according to their perceived level of importance, we can rank the universe of available ETFs in order to help identify the best of the best for your portfolio.

Now, this certainly won't be a perfect ranking. The data, of course, will be objective, but judging what's more important is very subjective. I'm simply going off of my years of experience in the ETF space in helping investors craft smart, cost-efficient portfolios.

Methodology & Factors For Ranking ETFs

Before we dive in, let's establish a few ground rules.

First, all of the data is used is coming from ETF Action. They have gone through the ETF universe to identify and categorize those ETFs used here. There are many that qualify and we'll be using their categorization as a starting point. Many thanks to them for opening up their vast database for my use.

Second, let's run down the factors I used in the ranking methodology.

- Expense Ratio - This is perhaps the most important factor since it's the one thing investors can control. If you choose a fund that charges 0.1% per year over a fund that charges 1%, you're automatically coming out ahead by 0.9% annually. You can't control what a fund returns, but you can control what you pay for the portfolio. Lower expense ratios equal more money in your pocket.

- Spreads - This relates to how cheaply you can buy and sell shares. Generally speaking, the larger the fund, the lower the spreads. Bigger funds usually have many buyers and sellers. Therefore, it's easier to find shares to transact and that makes them cheaper to trade. On the other hand, small funds tend to trade fewer shares and investors often need to pay a premium to buy and sell. Considering expense ratios and spreads together usually give you a better idea of the total cost of ownership.

- Diversification - Generally speaking, the broader a portfolio is, the better chance it has at reducing overall risk. A fund, such as the Energy Select Sector SPDR ETF (XLE), provides a good example. 45% of the fund's total assets go to just two stocks - ExxonMobil and Chevron. By buying XLE, you're putting a lot of faith in just those two companies. An equal-weighted fund, such as the Invesco S&P 500 Equal Weight Energy ETF (RYE), would score higher on diversification than XLE.

- FactSet ETF Scores - FactSet calculates its own proprietary ETF ranking for efficiency, tradeability and fit. They basically are designed to tell us if an ETF is doing what it sets out to do. I'm not going to copy and paste that work that they're doing, but there is some influence there to make sure my rankings are on the right path.

There are a few other minor factors thrown into the mix, but these are the main factors considered.

One thing that is not considered is historical returns. Most ETFs are passively-managed and are simply trying to track an index, not outperform. ETFs shouldn't be penalized for low returns simply because the index they're tracking is out of favor at the moment.

I'm ranking ETFs based on more basic structural factors. Are they cheap to own? Are they liquid? Do they minimize trading costs? Do they maintain risk-reducing diversification benefits?

Being in the bottom half of the list doesn't automatically make a fund "bad". It simply means that due to a low asset base, a high expense ratio, a concentrated portfolio or some other factor, it poses additional costs or downside risks.

Best Dividend ETF Rankings

As is usually the case in these rankings, the ultra-cheap ETFs tend to have the advantage and that's no clearer than looking at the dividend ETFs. The chasm between the ultra-cheap and the next tier is so large, in fact, that it's no surprise that the six ETFs that charge less than 10 basis points annually take the top 6 spots on this list.

The Vanguard High Dividend Yield ETF (VYM) has consistently been at the top of these rankings and takes the #1 spot again in the latest update. It's huge. It's liquid. It's ultra-cheap. It checks all the boxes for what you'd want in an ETF.

VYM along with the SPDR Portfolio S&P High Dividend ETF (SPYD) and the iShares Core High Dividend ETF (HDV), obviously, focus on the high yield end of the space. The Vanguard Dividend Appreciation ETF (VIG) and the iShares Core Dividend Growth ETF (DGRO) use slightly different criteria to target dividend growers. The Schwab U.S. Dividend Equity ETF (SCHD) goes after long-term dividend payers with quality characteristics and above average yields, so it would be your multi-themed option. If you're looking strictly for a high quality, low cost, long-term buy-and-hold dividend ETF, this group is a great place to start. If I can choose only one fund out of this group to invest in, it'd probably be SCHD due to its inclusion of growth, quality and yield characteristics.

A little further down the list, the iShares Select Dividend ETF (DVY) is another great fund with a solid track record, but gets dinged because of its 0.39% expense ratio. Same story for the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which only includes the stocks meeting the strict definition of dividend aristocrats by raising their dividend for at least the past 25 consecutive years.

The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) has long been one of my personal favorite dividend ETFs and it's finally made a big performance comeback in 2022. Its low volatility approach hasn't done well in years past as mega-cap growth and tech names have dominated, but it's made a strong comeback this year.

Other funds I particularly like include the WisdomTree U.S. Quality Dividend Growth ETF (DGRW) at #17, the FlexShares Quality Dividend Index ETF (QDF) at #18 and the First Trust Rising Dividend Achievers ETF (RDVY) at #21.

The Vanguard International High Dividend Yield ETF (VYMI) and the Vanguard International Dividend Appreciation ETF (VIGI) are the highest rankings foreign equity ETFs on the list. Whenever overseas stocks come back into favor (I suspect international will outperform U.S. during the 2020s decade as a whole), these two would be clear candidates for inclusion in a dividend portfolio. As is the case with most Vanguard ETFs, they lead on cost and liquidity and follow similar strategies to their U.S. counterparts.

The next batch of 30 names in the rankings include a few funds I thought would rank higher, a number of interesting mid-size ETFs and some newbies.

The two ETFs that stand out here are the First Trust Value Line Dividend Index ETF (FVD) and the Invesco High Yield Equity Dividend Achievers ETF (PEY). FVD has stood out recently on the performance front, but that 0.67% expense ratio is way above the category average. PEY has long been a favorite of mine due to its focus on dividend growth and yield, but also gets pushed down the list based on cost. If either of them had an expense ratio of even 0.20%, they'd land in the top 15.

The JPMorgan U.S. Dividend ETF (JDIV) at #46 is the opposite case. It has a great expense ratio, but just hasn't caught on with investors. At just $72 million in assets, it's easily the smallest ETF to land in the top 50. Due to that and the lack of trading volume, spreads are quite high making the total cost of ownership not quite so advantageous.

There are lots of 7%+ yield options out there nowadays, but most come from the riskiest areas of the market. Funds, such as the iShares International Select Dividend ETF (IDV) and the WisdomTree Emerging Markets High Dividend ETF (DEM) are in that range, but the returns over the past year demonstrate why investors shouldn't choose based on yield alone.

Special shout out to the Pacer Global Cash Cows Dividend ETF (GCOW). It has been one of the best dividend ETFs of 2022 and highlights what's been a fantastic year for Pacer, in general. The Pacer Cash Cows 100 ETF (COWZ) continues to rake in the cash and is a top performer in its own right. Pacer is still only the 20th largest ETF issuer by assets, but watch for it to continue climbing the list!

Other ETFs I like from this group: the First Trust Nasdaq Technology Dividend Index ETF (TDIV), the VictoryShares U.S. Large Cap High Dividend Volatility Weighted ETF (CDL) and the VictoryShares Dividend Accelerator ETF (VSDA).

Now we're starting to get to the area of these rankings where there might be some investability issues. These ETFs may be getting dinged on expense ratios, concentration or liquidity. They may also just be too small to have really gained any scale at this point.

There are also a lot of international ETFs in this range, which tend to rank a little lower on size and expense ratio compared to U.S. dividend ETFs. The WisdomTree International Hedged Quality Dividend Growth ETF (IHDG) is the only fund in this group with at least $1 billion in assets.

I've always found the AAM S&P 500 High Dividend Value ETF (SPDV) kind of interesting. There aren't a whole lot of dividend ETFs that focus on value and SPDV could be interesting if that theme continues to do well. It's also been a top performer this year.

It's a little unusual to find 11 WisdomTree ETFs all bunched up here. WisdomTree is a terrific ETF issuer and their funds generally follow a very well thought out and logical strategy. It may never compete with the lowest fee dividend ETFs, but its lineup has a lot of reasonably priced funds that fit almost any strategy.

A couple of other funds I think are set up fairly well are the Siren DIVCON Leaders Dividend ETF (LEAD) and the VanEck Morningstar Durable Dividend ETF (DURA).

And the rest of the dividend ETF rankings:

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs