Best Blockchain ETFs (Updated November 2022)

There's little doubt that blockchain has the potential to be a revolutionary technology. As an investment, blockchain stocks have followed the familiar boom/bust cycle that's common to many nascent products and technologies. After stagnating for a couple years, blockchain stocks really took off following the COVID recession bottom. In the 11 months following the March 2020 low, the Amplify Transformational Data Sharing ETF (BLOK) gained more than 360%.

Of course, the bear market of 2022 has had its way with more speculative technology companies and the blockchain space was not spared. BLOK currently sits about 65% below its all-time high and may head even lower before all is said and done. Some ETFs have done even worse. Blockchain will continue to develop as a disruptive innovation in the defi space, but 2022 is a good reminder that as an investment it will remain very volatile until the industry matures more and price discovery is made.

The blockchain ETF space has grown about as rapidly as blockchain itself. The first four blockchain ETFs debuted within days of each other in early 2018 (fun fact: none of them have "blockchain" in the name because the SEC was concerned it was too hot of a buzzword at the time and would attract speculators that didn't understand what they were buying). BLOK was the first one to launch and to this day remains easily the largest ETF in the sector with assets of more than $500 million.

Today, there are more than 20 ETFs that fall under the blockchain umbrella in some way. The original funds focused on blockchain stocks, but now you've got some that sprinkle in crypto or crypto futures exposure as well. It's become one of those groups where you really need to dig into the fund to discover how it works and what it's invested in. As much as almost any other market segment, blockchain ETFs can look VERY different despite having similar names. They're far from interchangeable and some homework is required!

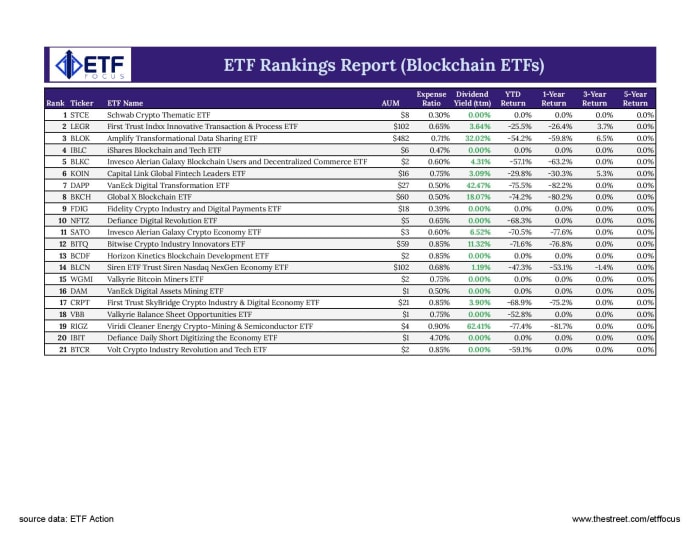

Ranking The Blockchain ETFs

The variety of ETF choices makes distinguishing the best from the rest a little challenging. You've probably heard most financial pundits talk about focusing on funds with low expense ratios. That can certainly be a big factor in deciding which ETF to go with (it's probably the most important factor, in my view), but there are a lot of things that could go into making the right choice.

That's where I'm going to try to make things easier for you. Using a methodology that I've developed, which takes into account many of the factors that should be considered and weighting them according to their perceived level of importance, we can rank the universe of available ETFs in order to help identify the best of the best for your portfolio.

Now, this certainly won't be a perfect ranking. The data, of course, will be objective, but judging what's more important is very subjective. I'm simply going off of my years of experience in the ETF space in helping investors craft smart, cost-efficient portfolios.

Methodology & Factors For Ranking ETFs

Before we dive in, let's establish a few ground rules.

First, all of the data is used is coming from ETF Action. They have gone through the ETF universe to identify and categorize those ETFs used here. There are many that qualify and we'll be using their categorization as a starting point. Many thanks to them for opening up their vast database for my use.

Second, let's run down the factors I used in the ranking methodology.

- Expense Ratio - This is perhaps the most important factor since it's the one thing investors can control. If you choose a fund that charges 0.1% per year over a fund that charges 1%, you're automatically coming out ahead by 0.9% annually. You can't control what a fund returns, but you can control what you pay for the portfolio. Lower expense ratios equal more money in your pocket.

- Spreads - This relates to how cheaply you can buy and sell shares. Generally speaking, the larger the fund, the lower the spreads. Bigger funds usually have many buyers and sellers. Therefore, it's easier to find shares to transact and that makes them cheaper to trade. On the other hand, small funds tend to trade fewer shares and investors often need to pay a premium to buy and sell. Considering expense ratios and spreads together usually give you a better idea of the total cost of ownership.

- Diversification - Generally speaking, the broader a portfolio is, the better chance it has at reducing overall risk. A fund, such as the Energy Select Sector SPDR ETF (XLE), provides a good example. 45% of the fund's total assets go to just two stocks - ExxonMobil and Chevron. By buying XLE, you're putting a lot of faith in just those two companies. An equal-weighted fund, such as the Invesco S&P 500 Equal Weight Energy ETF (RYE), would score higher on diversification than XLE.

- FactSet ETF Scores - FactSet calculates its own proprietary ETF ranking for efficiency, tradeability and fit. They basically are designed to tell us if an ETF is doing what it sets out to do. I'm not going to copy and paste that work that they're doing, but there is some influence there to make sure my rankings are on the right path.

There are a few other minor factors thrown into the mix, but these are the main factors considered.

One thing that is not considered is historical returns. Most ETFs are passively-managed and are simply trying to track an index, not outperform. ETFs shouldn't be penalized for low returns simply because the index they're tracking is out of favor at the moment.

I'm ranking ETFs based on more basic structural factors. Are they cheap to own? Are they liquid? Do they minimize trading costs? Do they maintain risk-reducing diversification benefits?

Being in the bottom half of the list doesn't automatically make a fund "bad". It simply means that due to a low asset base, a high expense ratio, a concentrated portfolio or some other factor, it poses additional costs or downside risks.

Best Blockchain ETF Rankings

The blockchain ETF space consists of just a couple major players and a number of other issuers trying to gain traction. Three of the four original blockchain ETFs are the only ones with more than $100 million in assets, but they land at very different spots on the list.

BLOK, despite landing at #3 on this list, remains my favorite for investing in blockchain. I've maintained this stance for quite a while and the logic for doing so is simple - it's an actively-managed fund at the price of a passively-managed one in a very dynamic industry. Active management sometimes gets a bad rap. People complain that it's too costly and has a long history of failing to keep up with the benchmarks. That's mostly fair, but there are times when it makes sense. Blockchain investing is one of them. The industry is changing so rapidly that you want your investments to be able to respond accordingly. Some index funds only rebalance or reconstitute every 3 or 6 months. If there's some type of major legislation passed or some development, do you want to be stuck with the existing portfolio for another few months unable to make changes? I want an active fund that can respond right away. BLOK does and it's become the face of the blockchain ETF group.

The #1 spot, however, goes to the Schwab Crypto Thematic ETF (STCE). It's not often that a fund that's only two months old immediately moves into the top spot of the rankings, but that's the case here. Cost is a major factor. Its expense ratio of just 0.30% is at least 20 basis points cheaper than almost every other fund on this list. The tiny $8 million asset base would usually result in wider spreads and higher trading costs, but that's actually not so much the case here. STCE has one of the narrower spreads in this group and that combination of comparatively low expenses and low trading fees is a win for shareholders. The fund's investments include companies engaged in mining, trading, banking, or implementing applications of blockchain technology.

The Siren Nasdaq NextGen Economy ETF (BLCN) was the 2nd blockchain ETF to launch, but it's fallen well off the pace of the best funds out there. It obviously lost out on the first mover advantage that BLOK benefited from and even though there's a larger asset base here compared with its peers, its cost structure doesn't really separate itself from the pack.

The Capital Link Global Fintech Leaders ETF (KOIN) is a good example of how a fund's objective and strategy doesn't produce the right end result. Its methodology is reasonable enough - it uses AI to determine involvement in the industry and weights components according to their ranking and perceived exposure - but the final portfolio doesn't provide, in my opinion, enough exposure to pure blockchain. The top holdings include IBM, Mercedes, Visa, Samsung, Oracle and Salesforce. These are companies developing blockchain solutions, but it's such a small part of the overall business model. This ends up looking more like a generic tech fund than a blockchain one. KOIN switched indexes at the end of last year, which resulted in a somewhat lesser focus on blockchain specifically, but I think there are better options out there.

The Bitwise Crypto Industry Innovators ETF (BITQ) deserves a mention. Bitwise is the world's largest crypto index fund manager, which means you may not find a company better suited to run a blockchain ETF than this one. It weights more heavily towards pure play innovators, which is a definite advantage, but much of the portfolio is market cap weighted and tied to an index. There are plusses and minuses, but having Bitwise managing BITQ should probably bump it up a few notches from where it is.

Read More…

Best Ultra Short-Term Bond ETFs

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs