Apple’s Fiscal Q4 Earnings Preview: iPhone Under The Microscope

Apple is set to report fiscal Q4 results on Thursday, October 27. In anticipation, I have written a preview article on the Mac segment so far. Today, I turn my attention to what is likely to be (once again) the star of the show: the iPhone.

If, on the one hand, I believe that Mac results by themselves will be insufficient to move Apple (AAPL) - Get Free Report stock in either direction, the opposite is probably true of the iPhone. Below, I discuss how well the segment may have performed in the summer period, and what to expect going forward.

Read more from Apple Maven: Apple Q4 Earnings: Countdown Begins, Here Are The Key Numbers

Apple’s iPhone: likely strong numbers

As a quick recap, analysts expect Apple to deliver total company revenue growth of 7% in fiscal Q4, along with EPS of $1.27 that would be roughly flat YOY.

The iPhone accounted for 52% of Apple’s sales in fiscal 2021. With the last quarter of the year coming in next week, I expect this ratio to increase to nearly 54% in fiscal 2022 – despite the predictions of a few years back that smartphones would enter their decline life cycle soon.

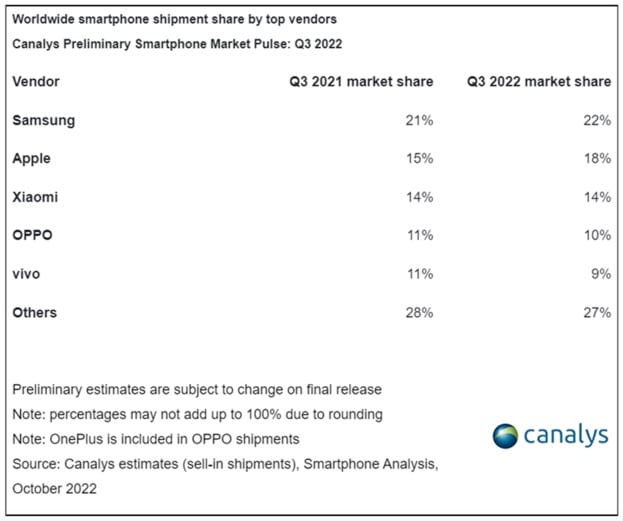

Research company Canalys has already given us a sneak peek into smartphone shipments in calendar Q3. The bottom line: the industry at large is struggling to grow amidst a period of high inflation and rising interest rates, except for Apple. See the table below.

In the summer period, smartphone unit sales dropped 9% YOY, the worst calendar Q3 since 2014, as consumers cut back on discretionary spending. But notice that Apple increased its market share from 15% to 18%.

Quick back-of-the-napkin math suggests that Apple managed to grow iPhone shipments by nearly 10% YOY in the September quarter. This is an outstanding number, and yet another indication that the company’s device has been a huge hit among tech consumers.

As the old infomercials would say, “but wait, there’s more!”

There have been many reports lately suggesting that the Pro version of Apple’s new iPhone 14 (and likely the older iPhone 13 as well) has sold much better than the less expensive trims. This probably means that iPhone ASP, or average selling price, will also improve this time due to a more favorable mix towards the pricey Pro models.

Put together the pieces of the “price x volume = revenues” equation, and it becomes clear that the iPhone will likely impress in fiscal Q4. How much is a tougher question to ask, but I am betting on 12% to 15% revenue growth on top of the 47% reported this time last year.

Read more from Apple Maven: Apple’s Fiscal Q4 Earnings Preview: How Will Mac Perform?

iPhone: will it be all about Q4 sales?

Having said the above, I think that the earnings day discussions about the iPhone will transcend the results of the most recent quarter.

Lately, analysts have been reporting on a mixed bag of bad and good news regarding iPhone 14 production. On the one hand, Apple seems to be ramping up on Pro inventory to meet demand, as mentioned above. However, the new Plus already seems to be a dud.

It is almost certain that CEO Tim Cook and CFO Luca Maestri will need to address questions about the first few weeks of iPhone 14 sales during the earnings call. As usual, I expect both to sound upbeat about demand and execution, but investors will be reading between the lines.

Expect that conversation to be as much of an AAPL stock mover as the fiscal Q4 numbers printed on the earnings report.

Land a Top Equity Research Job with Peak Frameworks

Equity research is a great career path that combines deep industry analysis and financial modeling, while exposing you to the strategic frameworks of many different types of investors in the stock market.

Many students have used the Peak Frameworks Equity Research course to break into the industry out of school, or to transition into the field from a non-finance career path. The lead instructor has experience working at Goldman Sachs and J.P. Morgan and was involved in the recruiting process at both banks, so you’ll get a comprehensive view of the skills you need to get and prepare for an interview.

To learn more, click on this link and use the code APPLEMAVEN10 for 10% off the course.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Apple Maven)