Apple’s Fiscal Q4 Earnings Live Blog: Our Coverage In Real Time

The day has come! Thursday, October 27, is Apple’s (AAPL) - Get Free Report fiscal Q4 earnings day.

The Apple Maven follows the developments of the day via live blog below, starting at 4 p.m. EST – the exact time of the closing bell at the corner of Broad and Wall Streets, in New York City. We start with a brief wrap-up of what investors should expect to see. To skip straight to live coverage, scroll down to the section Live Coverage Starts Here.

As a reminder, refresh your browser every so often to see the most recent update, in case the browser does not do so automatically.

Apple’s Fiscal Q4: What to Expect

For the September quarter, analysts expect revenues to increase just short of 7% to $88.8 billion. The growth rate may seem small, but it is off of tough comps in 2021. Compounded over two years, the annual sales growth number is a much more impressive 17%.

EPS is projected to land at $1.27, only 2% above last year’s comparable figure. The story is similar, however: over a two-year period, annualized earnings growth looks much better, at 32% compounded.

As usual, the iPhone will be a very important story to follow. I expect to see strong numbers, as Apple has likely gained quite a bit of market share from its global smartphone competitors in calendar Q3. My estimate is for segment revenue growth of 12% to 15%, in FX-neutral terms.

The Mac accounts for only 10% of total revenues, but it could be one of the bullish stories this quarter. Supported by a robust new MacBook Air equipped with M2 chip, I think that segment revenues could climb as much as 38% – less so when currency headwinds are factored in.

The segment that I expect to lag relative to its own historical record is services. Pressured by lower discretionary spending that is likely to have hit the App Store and other offerings, I would not be surprised to see segment revenue growth dip to or below 10%.

Apple stock is currently about 17% off the early January 2022 peak. Keep an eye on how the share price will react to the earnings print. I asked Twitter for an opinion on what to expect, and here is what they had to say:

Live Coverage Starts Here

3:00 a.m. PST: Today is the big day! But it is still early in New York City, even earlier at Apple’s HQ, in Cupertino-California. Live coverage begins at 4 p.m. EST, see you then!

12:55 p.m. PST: Hello, everyone! The day has come, and the time is (almost) now!

12:56 p.m. PST: In about half an hour, Apple will release its fiscal Q4 results.

12:57 p.m. PST: Quick reminder, my name is Daniel Martins, and I will be following the events of the day starting now. The earnings release should come out at 1:30 p.m. Cupertino time, and the conference call starts 30 minutes after that.

12:58 p.m. PST: The trading session has NOT been friendly to Apple stock... it is down a sizable 3% as I type this sentence.

1:00 p.m. PST: ...and the closing bell has rung! It's been a rough day for stocks in general, but especially for the tech sector.

1:02 p.m. PST: If anyone has an interest, Amazon's (AMZN) - Get Free Report Q3 results are out, and the stock is taking a big hit! Down about -10%.

1:03 p.m. PST: Within the FAAMG or Big Tech peer group, only Apple can save the day... what a terrible earnings season for tech!

1:04 p.m. PST: Oh, never mind... AMZN is down 20% in afterhours! AAPL is now also dipping 1.5% in addition to what it lost during the regular session, certainly in sympathy.

1:06 p.m. PST: From a sentiment perspective, everything that we have seen from the likes of Amazon and Meta Platforms (META) - Get Free Report this quarter is not good news for AAPL. But from a glass-half-full perspective, maybe AAPL goes into the print today a bit more de-risked and with lower expectations.

1:08 p.m. PST: AAPL stock is down nearly 2% in afterhours... reminder: this has nothing to do with the company's results yet. They're coming in about 25 minutes.

1:10 p.m. PST: Apple stock has been down 22% for the year so far, including today's afterhours action. Shares have been shifting in and out of bear market territory since May -- although all-time highs were nearly hit in August.

1:12 p.m. PST: Let's talk Apple's fiscal Q4 results for a moment. The numbers to keep in mind are revenue expectations of $88.9 billion for nearly 7% growth YOY. EPS is forecasted to hit $1.27, barely an improvement YOY.

1:14 p.m. PST: As I mentioned in my previews, one theme that I expect to see is that the global economies have been putting pressure on tech companies and their ability to keep demand afloat... but that Apple is likely performing way better than its competition.

1:15 p.m. PST: We'll see if I am right...

1:17 p.m. PST: While we are talking projections, I think that the iPhone will do well, with ex-FX growth north of 10%. I think that the Mac will be a shining star, and I see a big sales number within that segment. Of course, because of its size, the iPhone will likely be the most important piece of the puzzle. My main concern is services, where I would not be surprised to see segment revenue growth dip below 10%.

1:19 p.m. PST: And then, of course... guidance. It will be huge. Pay attention not so much to the numbers themselves -- in fact, Apple no longer offers a total revenue guidance range anymore. Instead, keep an eye on the demand narrative heading into the holiday quarter, including an early read on the success of the iPhone 14.

1:20 p.m. PST: Right now, AAPL stock down 2% in afterhours, for a total loss of about $120 billion in market value between today's opening bell and now.

1:22 p.m. PST: We are only about 10 minutes away from Apple's earnings release! I'm a bit nervous, not going to lie... well, time for a quick break to regroup. Stay tuned, I will be back soon!

1:28 p.m. PST: Ok, I'm back! And I'm glued to this chair, there's no getting up now... Apple fiscal Q4 numbers will be out in 3 minutes!!

1:29 p.m. PST: AAPL still down 2% in afterhours... will it be the ONLY of the Big Tech stocks not to take a massive hit on earnings day??

1:30 p.m. PST: Eyes on the screen for stock price reaction any moment now...

1:31 p.m. PST: And AAPL stock is on the move! Shares down a bit more, -4%!

1:31 p.m. PST: Quick numbers, revenues of $90.15 billion is a slight beat, and so is EPS of $1.29.

1:33 p.m. PST: iPhone revenue of $42.63 billion is below my own projection of $43.1 billion... we are still talking YOY growth of about 10%, not terrible.

1:34 p.m. PST: Services were not good at all, even worse than I expected! Revenues of $19.2 billion for growth of 5%. This is the lowest segment growth that I have ever seen.

1:35 p.m. PST: Wedbush's Dan Ives calls Apple's print a "positive data point in a dark market".

1:36 p.m. PST: Let me plug in some numbers for a couple of minutes... AAPL stock recovered a bit, down -1% now.

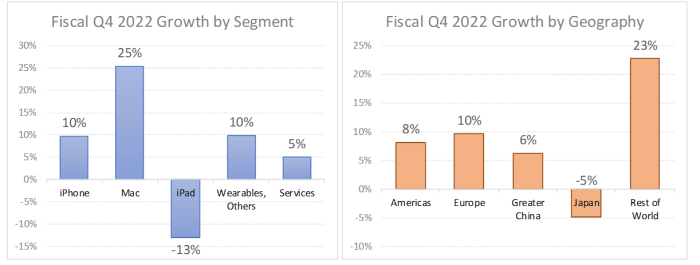

1:40 p.m. PST: Ok, here are a couple of graphs for you:

1:42 p.m. PST: What I see here is some of the themes that we all expected, including (1) a resilient iPhone, (2) a very strong Mac, (3) a soft services segment, (4) some headwinds in China and Japan, with "the West" holding up better.

1:43 p.m. PST: The problem, not a huge one, is that what was good may not have been as good as some expected. I suspect that FX has a lot to do with this gap to expectations, we'll hear more about it during the earnings call.

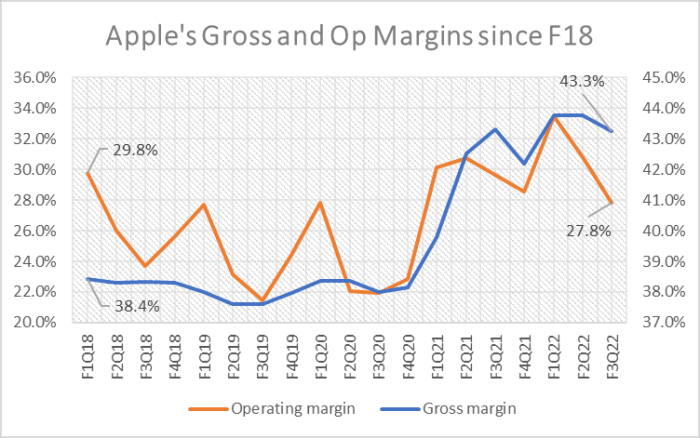

1:46 p.m. PST: Going down the P&L, gross margin of 42.3% was solid, near the end of the guidance range. What could have played a role here is a heavier mix of pricy iPhone Pro models, maybe offset by the higher-margin services segment spinning it wheels.

1:49 p.m. PST: Opex of $13.2 billion was actually above the guidance range. This is interesting, considering that companies usually have some control over this line (think about headcount management, etc.). Is this bad, or a good sign that Apple is not too worried about investing in R&D and its sales infrastructure? Tough one, but I am not too concerned here.

1:51 p.m. PST: Other expenses landed at $237 million, which is worse than guidance of $100 million. That alone accounts for 2 cents in EPS.

1:52 p.m. PST: Well, from that perspective... FX was a huge headwind, opex came in rich, so did other expenses (which has nothing to do with the core of Apple's business) ... I'm starting to think that, operationally, the quarter was not a thing of beauty, but it wasn't bad either. It may have been the best FAAMG earnings print of the past week.

1:53 p.m. PST: It will come down to the earnings call narrative and the guidance to be delivered in about 30 minutes. So definitely stay tuned for that!

1:54 p.m. PST: By the way, here is the link for the earnings call, if you want to listen in. I will be live blogging through it as well. It starts in 5 minutes.

1:55 p.m. PST: Let me prepare for the call, I will be back with you in 5! AAPL stock now down only -0.5%.

1:59 p.m. PST: Earnings call start any moment now. Here's a fun graph (I know, I'm a dork for having fun with graphs) that shows how Apple's margins have improved drastically during this COVID-19 period -- but they seem to have plateaued.

2:01 p.m. PST: The call has started!

2:03 p.m. PST: Reminder that the 2022 holiday quarter will have one extra week... watch out for how this could impact YOY comparisons.

2:04 p.m. PST: CEO Tim Cook has the floor. "Record revenue", "better than anticipated despite heavier than expected FX".

2:05 p.m. PST: The CEO sounds upbeat, not a surprise. He talks about strong double-digit growth in certain emerging markets. Also, he mentions that supply chain issues were not significant in the quarter. That's good.

2:06 p.m. PST: "Customers are loving our iPhone 14 lineup", says Cook. Looking for indication that the Pro has done much better than the rest of the portfolio.

2:07 p.m. PST: The CEO talks about each product segment, including the iPad. iPad revenues were down 13% YOY, likely due to timing of product launches (I suspect, not confirmed by Tim Cook).

2:10 p.m. PST: "Enthusiasm and strong engagement" in services, says Cook. He is talking product/service performance, not necessarily financial results yet.

2:12 p.m. PST: So far, the call is going as expected. Tim Cook is excited, no yellow flags at this point. Tim and Microsoft's (MSFT) - Get Free Report Satya Nadella are always very optimistic. AAPL down 1% still.

2:13 p.m. PST: If any yellow flag comes up, it will likely be introduced by CFO Luca Maestri. He is up next. Keep an eye on guidance.

2:15 p.m. PST: Tim Cook is talking about ESG matters at this point, which he usually addresses on every earnings call.

2:15 p.m. PST: Here is Luca. He is "very pleased" with performance, despite volatile macro environment.

2:16 p.m. PST: 600 bps headwind from FX. Strong double-digit growth outside the US on an FX-adjusted basis.

2:17 p.m. PST: Over 600 bps headwind in services. So, outside currency, service revenues would have increased 12% YOY.

2:18 p.m. PST: "Favorable mix" helped to push gross margin higher 10 bps. Considering that high-margin services lagged, a heavier mix of pricy iPhone models played a role, I suspect.

2:20 p.m. PST: Luca talks about the iPhone, strong performance from upgraders and switchers. He also talks Mac, citing the launch of new models as a plus. Filling the channel and fulfilling pent-up demand helped as well.

2:20 p.m. PST: iPad struggled due to FX and tough comps against product launches last year.

2:22 p.m. PST: In services, large FX headwinds. Some services hurt more than others from the macroeconomic challenges, namely digital advertising and gaming. Strong growth in paid subscriptions -- double the subs vs. three years ago.

2:23 p.m. PST: Oh, hello! Apple stock turns positive in afterhours! Up +1%.

2:24 p.m. PST: I would say that the narrative is more encouraging than concerning. Nothing about softening demand, it's more about FX and some hiccups in corners of the product and service portfolio (e.g., ad and gaming).

2:25 p.m. PST: Even AMZN stock has recovered nicely, from a loss of 20% to a loss of "only" 13% in afterhours. Market is volatile.

2:26 p.m. PST: CFO now talks cash flow. Apple is an impressive cash machine!

2:27 p.m. PST: Guidance is now!

2:29 p.m. PST: No specific revenue guidance, as expected. Overall, sales performance will decelerate vs. September with 10 percentage points of FX headwinds. Tough Mac comps. Services will grow, but with lots of challenges. Gross margin should fall within 42.5% and 43.5%. Opex will be within $14.7 billion and $14.9 billion. Other expense should be $300 million, and tax rate 16.5%.

2:30 p.m. PST: Q&A has started! AAPL stock back down! Now -3%.

2:30 p.m. PST: Tim Cook is asked about the iPhone demand, which is really the big question. CEO was pleased with the performance, 3 of the top 4 smartphones in US and UK. Apple is still constrained on 14 Pro and Pro Max, so they are trying to catch up with demand.

2:32 p.m. PST: Question on gross margin puts and takes. Luca says that 42.3% was a September quarter record, despite FX. Strong dollar makes pricing a challenge, but Luca sees commodities behaving favorably.

2:36 p.m. PST: Question on iPad and Mac performance, what were the important factors that explain the divergent performance? Tim Cook says that Mac was helped by product launches and some supply issues in June quarter that were resolved. This topic was addressed during the prepared remarks. On the iPad side, the opposite happened on launches, as the 2021 comps were tough.

2:37 p.m. PST: Question on the 14-week quarter ahead. Luca says that calendar shift will have an impact on both revenues and costs but did not see anything worth elaborating further on.

2:37 p.m. PST: Apple stock inches up, now -1%.

2:39 p.m. PST: Question on services and price strategy. Tim talks about price hikes in Apple Music, TV+ and Apple One. Cost of music licensing increased, which explains the price hike. On TV+, Tim mentions the increase in content volume, which justifies the price hike.

2:41 p.m. PST: Question on capex for 2023 and the moving pieces. Luca says that Apple has "good capital intensity". Company is monitoring the 3 big capex buckets (manufacturing, data center and offices) and Luca sees nothing unusual for the next 12 months. He seemed to hesitate a bit on the answer, but I won't read much into it.

2:43 p.m. PST: Question on wearables. As a reminder, this segment represented 11% of total revenues in fiscal Q4 and grew 10% YOY. Tim Cook seems satisfied, two-thirds of Watch were sold to first time users. Supply constraint, FX headwinds and Russia were soft spots.

2:44 p.m. PST: Question on Mac again. Tim answers it the same way that he had previously.

2:47 p.m. PST: Question on services and FX impact, could the headwinds be front-loaded for the segment? Luca agrees that services and products behave differently to FX effects. He restates some of the same talking points of earlier in the call, then reemphasizes that the customer is very engaged. It feels like the answer was to a different question, but we move on...

2:50 p.m. PST: We are heading to the last 10 minutes of the call. Questions tend to become more "obscure" at this point of the call, as the important topics have already been addressed. I may start to shift the focus of this live blog to my key takeaways. AAPL stock pretty much flat in afterhours.

2:53 p.m. PST: Good question on FX, inflation and labor costs, what can Apple do? Tim says that Apple is taking care of its teams, "empowering them to do the best work of their lives". Regarding inflation, Tim sees pressures in labor and silicon components. The management team has taken all of this in consideration in the gross margin guidance. Luca adds that Apple hedges its FX exposure, including in China.

2:53 p.m. PST: Apple stock turns slightly positive again, +0.2%.

2:56 p.m. PST: Question on revenue guidance, is growth going below 8%? Luca says that the rate will be lower as guided, but too much uncertainty to be more specific. "Keep in mind the 10-percentage point of FX headwinds".

2:57 p.m. PST: Question on acquisitions. Tim says that company is constantly looking around, especially for IP and talent. He reminds that Apple acquires a company per month, on average. Luca jumps in on Apple's buyback program. It has been successful, and Apple is still positive on net cash. Cash flow remains strong.

2:58 p.m. PST: Ok, the call is over! Time for some quick takeaways.

3:00 p.m. PST: Apple stock ends the call up +1%, after being down as much as -4%. The reasons for the recovery, in my view, are two: (1) plain volatility in the tech space during this earnings season, and (2) a business that, under the surface (think FX challenges and some lingering supply constraints), continues to do quite well. On this last point, I think it took the earnings call to make it clear that the management team remains upbeat about what they see and the holiday quarter ahead.

3:01 p.m. PST: Apple's quarter was not the best I have seen, but it may have been the best in the Big Tech universe this quarter.

3:02 p.m. PST: And that's all for today! Thanks for your company, I'll see you later on thestreet.com/apple !

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Apple Maven)