Apple (AAPL) Fiscal Q4 Earnings: Highlights and Takeaways

On October 27, Apple stock (AAPL) - Get Free Report traded sideways in after hours action as the Cupertino company delivered a mixed-bag fiscal Q4. Below, we present the highlights of Apple’s earnings day, organized by main topics.

(Read more from Apple Maven: Apple’s Fiscal Q4 Earnings Live Blog: Our Coverage In Real Time)

Apple’s earnings in a nutshell

Apple's quarter was not the best I have seen, but it may have been the best in the Big Tech universe this quarter.

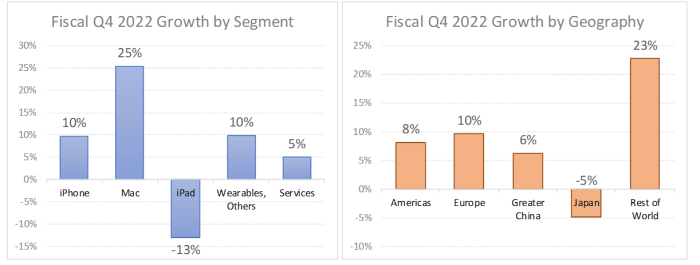

What I saw were some of the themes that we all expected, including (1) a resilient iPhone, (2) a very strong Mac, (3) a soft services segment, (4) some headwinds in China and Japan, with "the West" holding up better.

Apple stock ended the earnings call up +1%, after being down as much as -4%. The reasons for the recovery, in my view, are two: (1) plain volatility in the tech space during this earnings season, and (2) a business that, under the surface (think FX challenges and some lingering supply constraints), continues to do quite well.

On this last point, I think it took the earnings call to make it clear that the management team remains upbeat about what they see and the holiday quarter ahead.

iPhone held up well

iPhone revenue of $42.63 billion was below my own projection of $43.1 billion. But we are still talking YOY growth of about 10%, not terrible. CFO Luca Maestri attributed the strong performance to the iPhone from upgraders and switchers.

When asked about the iPhone demand, which was really the big question, CEO Tim Cook was pleased with the performance, 3 of the top 4 smartphones in US and UK. Apple is still constrained on 14 Pro and Pro Max, so they are trying to catch up with demand.

Mac was a shining star, iPad fought all headwinds

When questioned on iPad and Mac about what were the important factors that explain the divergent performance, CEO Tim Cook said that Mac was helped by product launches and some supply issues in June quarter that were resolved.

On the iPad side, the opposite happened on launches, as the 2021 comps were tough. iPad struggled due to FX and tough comps against product launches last year. iPad revenues were down 13% YOY.

Services could be a concern

Services were not good at all, even worse than I expected. Revenues of $19.2 billion for growth of 5%. This is the lowest segment growth that I have ever seen. This is largerly due to FX headwinds.

Some services hurt more than others from the macroeconomic challenges, namely digital advertising and gaming. Strong growth in paid subscriptions -- double the subs vs. three years ago.

About services and price strategy, CEO Tim Cook talked about price hikes in Apple Music, TV+ and Apple One. Cost of music licensing increased, which explains the price hike. On TV+, Tim mentions the increase in content volume, which justifies the price hike.

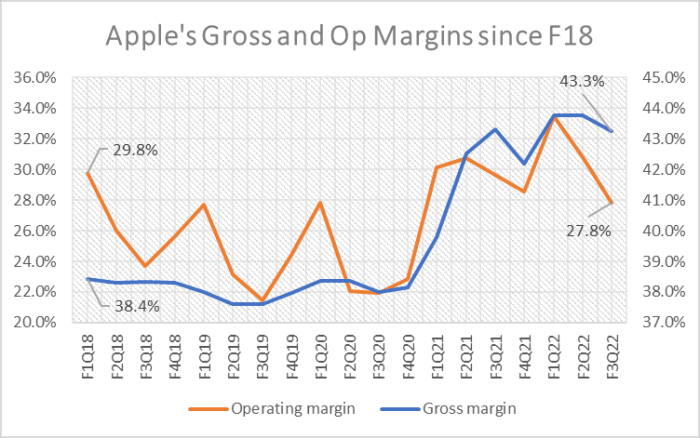

Impressive margins

Going down the P&L, gross margin of 42.3% was solid, near the end of the guidance range. What could have played a role here is a heavier mix of pricy iPhone Pro models, maybe offset by the higher-margin services segment spinning it wheels.

CFO Luca Maestri when asked about gross margin puts and takes, said that 42.3% was a September quarter record, despite FX. Strong dollar makes pricing a challenge, but Luca sees commodities behaving favorably.

Here's a fun graph that shows how Apple's margins have improved drastically during this COVID-19 period -- but they seem to have plateaued.

Land a Top Equity Research Job with Peak Frameworks

Equity research is a great career path that combines deep industry analysis and financial modeling, while exposing you to the strategic frameworks of many different types of investors in the stock market.

Many students have used the Peak Frameworks Equity Research course to break into the industry out of school, or to transition into the field from a non-finance career path. The lead instructor has experience working at Goldman Sachs and J.P. Morgan and was involved in the recruiting process at both banks, so you’ll get a comprehensive view of the skills you need to get and prepare for an interview.

To learn more, click on this link and use the code APPLEMAVEN10 for 10% off the course.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Apple Maven)