7 Dividend Growth Stocks For June 2022

Welcome to another edition of my monthly 7 Dividend Growth Stocks series!

Every month, I select seven dividend growth stocks from my Dividend Radar watch list for further analysis and possible investment. I use different monthly screens to highlight various aspects of dividend growth [DG] investing.

In case you missed previous articles in this series, here are links to them:

- 7 Dividend Growth Stocks For May 2022

- 7 Dividend Growth Stocks For April 2022

- 7 Dividend Growth Stocks For March 2022

- 7 Dividend Growth Stocks For February 2022

- 7 Dividend Growth Stocks For January 2022

- 7 Dividend Growth Stocks For December 2021

- 7 Dividend Growth Stocks For November 2021

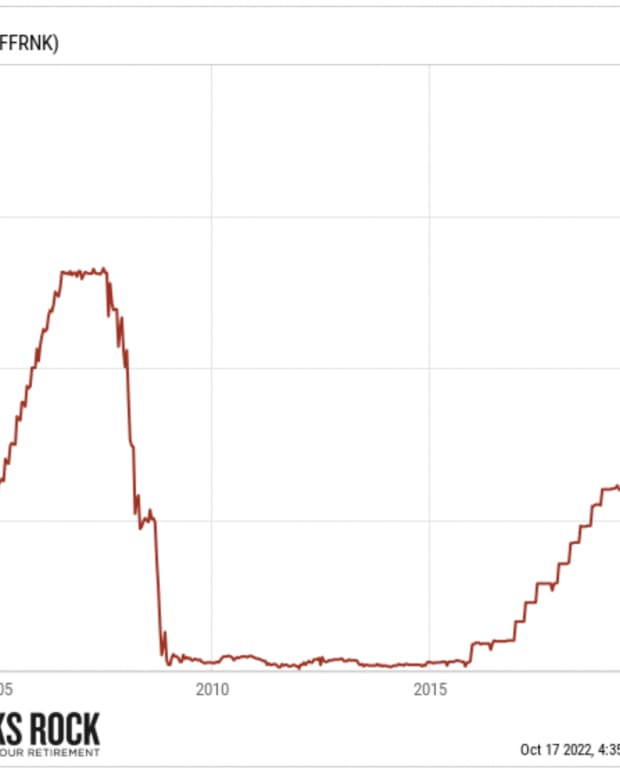

To compile this month's candidates, I used Portfolio Insight's screening tool to find stocks with dividend increase streaks of at least 14 years and 10-year trailing total returns of at least 20%.

The first screen eliminates stocks of companies that cut, suspended, or froze their dividends during the Great Recession. The second screen looks for stocks that have performed exceptionally well over the past decade. Total return accounts for price appreciation and dividend income and is annualized over the trailing period in question, in this case, ten years.

I ranked candidates that passed my screens using DVK Quality Snapshots and my ranking system.

Screening and Ranking

For this month’s article, I used the following screens:

- Stocks in Dividend Radar

- Stocks with dividend increase streaks of at least 14 years

- Stocks with 10-year trailing total returns [TTRs] of at least 20%

The latest Dividend Radar (dated June 10, 2022) contains 738 stocks. Of these:

- 250 stocks have dividend increase streaks of at least 14 years

- 101 stocks have 10-year TTRs of 20% or higher

Only 31 stocks passed both these screens.

I ranked the 31 candidates by sorting their DVK Quality Scores in descending order and breaking ties using the following metrics, in turn:

- Simply Safe Dividends' Dividend Safety Scores

- S&P Credit Ratings

- Forward Dividend Yield.

7 Top-Ranked Dividend Growth Stocks for June

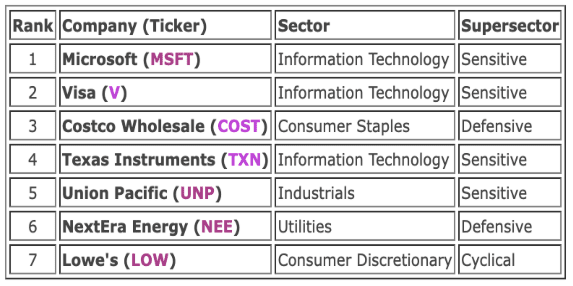

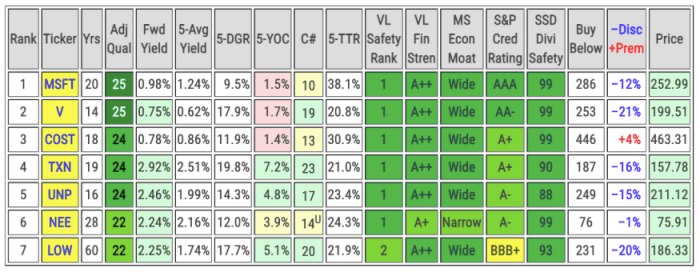

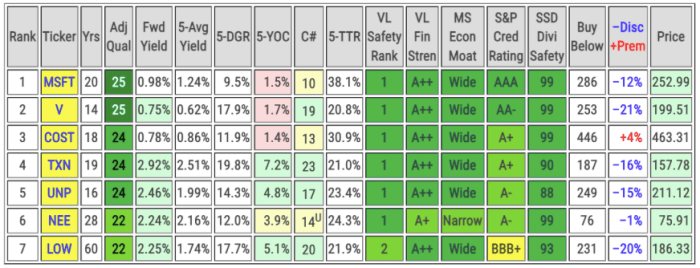

Here are the top-ranked DG stocks that passed this month’s screens:

I own all of these stocks in my DivGro portfolio.

Below, I provide a table with key metrics of interest to DG investors:

- Yrs: years of consecutive dividend increases

- Adj Qual: DVK Quality Snapshots adjusted quality score

- Fwd Yield: forward dividend yield for a recent share Price

- 5-Avg Yield: 5-year average dividend yield

- 5-DGR: 5-year compound annual growth rate of the dividend

- 5-YOC: the projected yield on cost after five years of investment

- C#: Chowder Number, a popular metric for screening dividend growth stocks

- 5-TTR: 5-year compound trailing total returns (as of the latest quarter)

- VL Safety Rank: Value Line's Safety Rank

- VL Fin Stren: Value Line's Financial Strength ratings

- MS Econ Moat: Morningstar's Economic Moat

- S&P Cred Rating: S&P Global's Credit Ratings

- SSD Divi Safety: Simply Safe Dividends' Dividend Safety Scores

- Buy Below: my risk-adjusted buy below price (see below)

- –Disc +Prem: discount or premium of the recent share Price to my Buy Below price

- Price: recent share price

The Fwd Yield column is colored green if Fwd Yield ≥ 5-Avg Yield.

Key metrics of the 7 Top-Ranked Dividend Growth Stocks this month (includes data sourced from Dividend Radar).

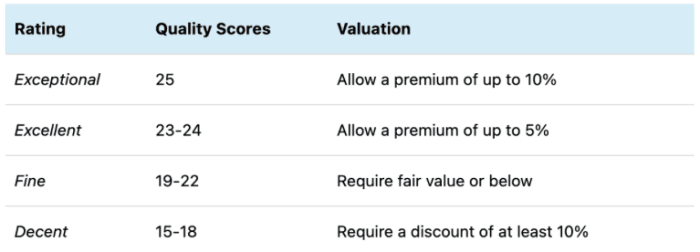

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

To estimate fair value [FV], I survey fair value estimates and price targets from sources such as Portfolio Insight, Finbox, and Morningstar. I also estimate fair value using a stock’s five-year average dividend yield. With up to eleven estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

Next, let's look at each stock in turn. All data and charts are courtesy of Portfolio-Insight.com.

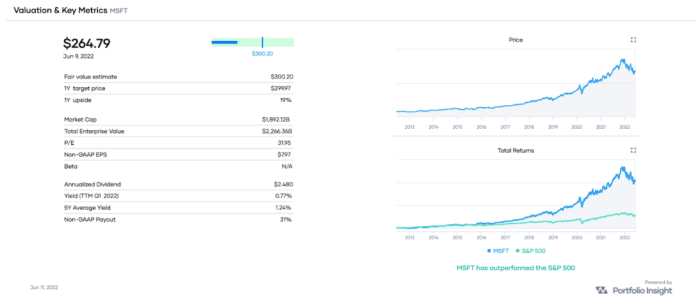

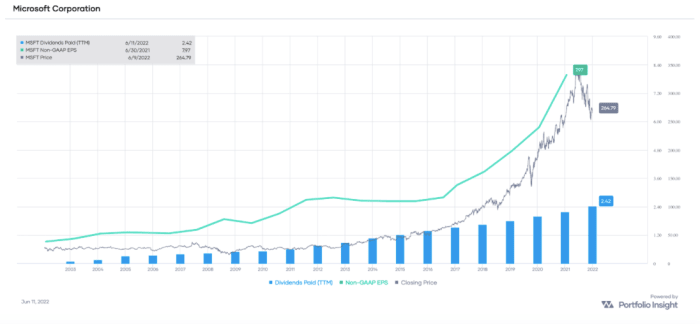

Microsoft (MSFT)

Founded in 1975 and based in Redmond, Washington, MSFT is a technology company with worldwide operations. The company’s products include operating systems, cross-device productivity applications, server applications, productivity and business solutions applications, software development tools, video games, and online advertising. MSFT also designs, manufactures, and sells several hardware devices.

MSFT is rated Exceptional (quality score: 25) and has the highest 5-year TTR of this month’s candidates (38.1%). Portfolio Insight classifies MSFT as a hypergrowth stock with a 1-year upside of 19% and a 1-year target price of $300.

The company has ample room to continue paying and raising its dividend, given its non-GAAP payout ratio of only 31%.

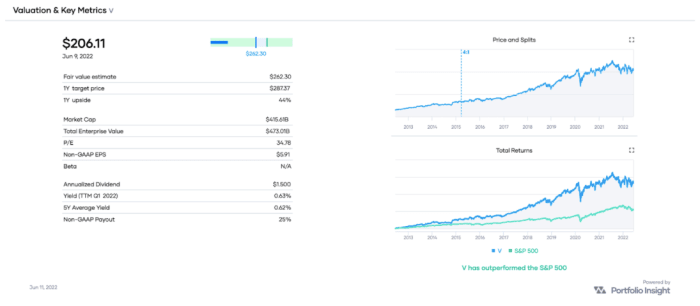

Visa (V)

Headquartered in San Francisco, California, Visa operates as a payments technology company worldwide. The company facilitates commerce through the transfer of value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. Visa provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

V is rated Exceptional (quality score: 25) and is discounted most of this month’s candidates (-21%). Portfolio Insight classifies V as a hypergrowth stock with a 1-year upside of 44% and a 1-year target price of $287.

The company has ample room to continue paying and raising its dividend, given its non-GAAP payout ratio of only 25%.

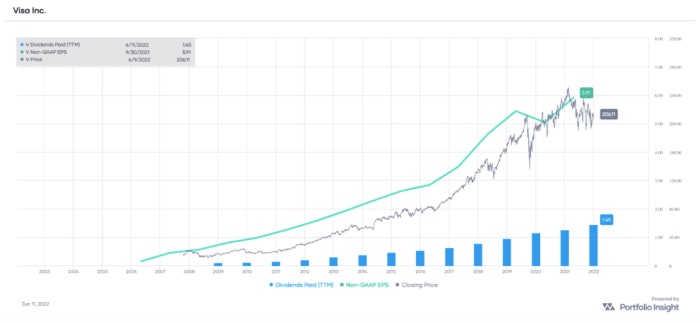

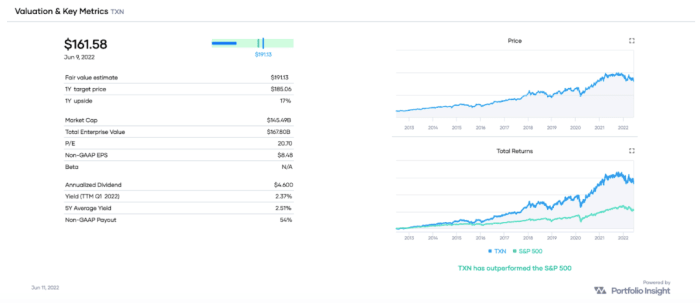

Costco Wholesale (COST)

Founded in 1976 and based in Issaquah, Washington, COST operates more than 700 membership warehouses in the United States and internationally. The company offers branded and private-label products in a range of merchandise categories. COST also operates gas stations, pharmacies, food courts, optical dispensing centers, photo processing centers, and hearing-aid centers; and engages in the travel business.

COST is rated Excellent (quality score: 24) and is the only stock of this month’s candidates that are not discounted to my Buy Below price. Portfolio Insight classifies COST as a hypergrowth stock with a 1-year upside of 12% and a 1-year target price of $518.

The company has ample room to continue paying and raising its dividend, given its non-GAAP payout ratio of only 32%.

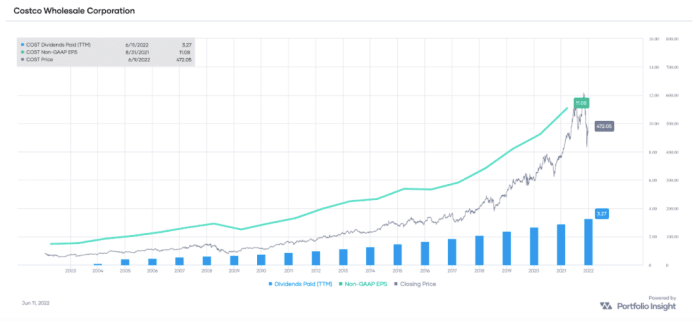

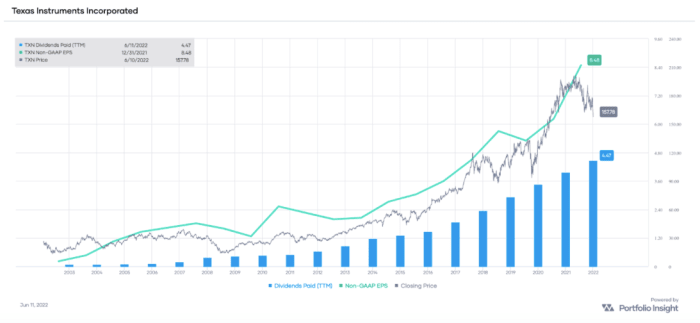

Texas Instruments (TXN)

TXN designs, manufactures, and sells semiconductors to electronics designers and manufacturers globally. The company operates in two segments, Analog and Embedded Processing. It markets and sells semiconductor products through a direct sales force and through distributors, as well as through its website. TXN was founded in 1930 and is headquartered in Dallas, Texas.

TXN is rated Excellent (quality score: 24) and has the highest yield and 5-year dividend growth rate of this month’s candidates (2.92% and 19.8%). Portfolio Insight classifies TXN as a slow-growth stock with a 1-year upside of 17% and a 1-year target price of $185.

The company’s non-GAAP payout ratio of 54% is a little high and I expect dividend increases will be more modest in the future, unless the company manages to grow earnings faster.

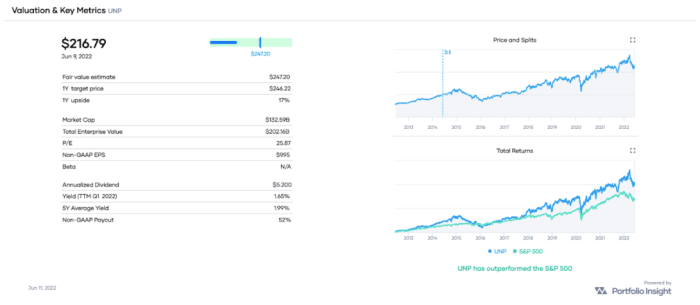

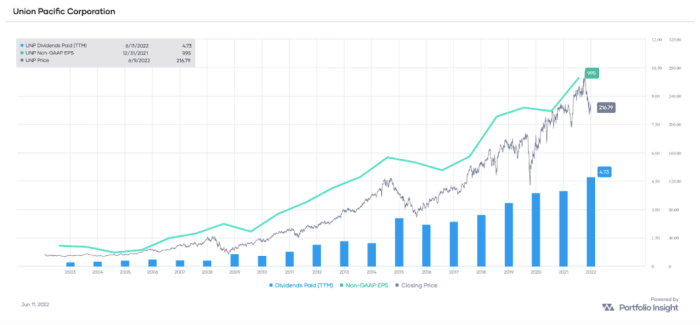

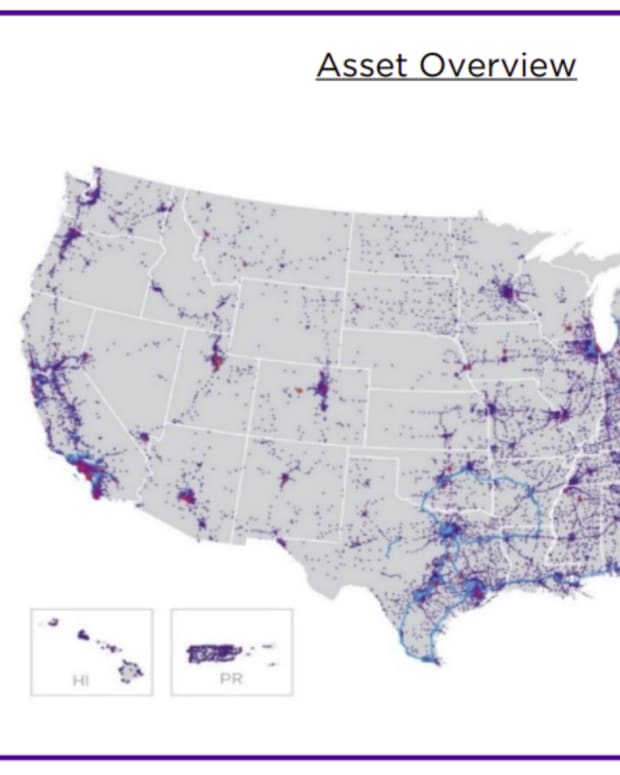

Union Pacific (UNP)

Omaha, Nebraska-based UNP operates the largest public railroad in North America, with 32,000 miles of track linking 23 states in the western two-thirds of the United States. UNP hauls coal, industrial products, intermodal containers, agricultural goods, chemicals, and automotive products. UNP owns a quarter of the Mexican railroad Ferromex. The company was founded in 1862.

UNP is rated Excellent (quality score: 24) and has the second highest yield of this month’s candidates (2.46%). Portfolio Insight classifies UNP as a slow-growth stock with a 1-year upside of 17% and a 1-year target price of $246.

The company’s non-GAAP payout ratio of 52% is a little high and I expect dividend increases will be more modest in the future, unless the company manages to grow earnings faster.

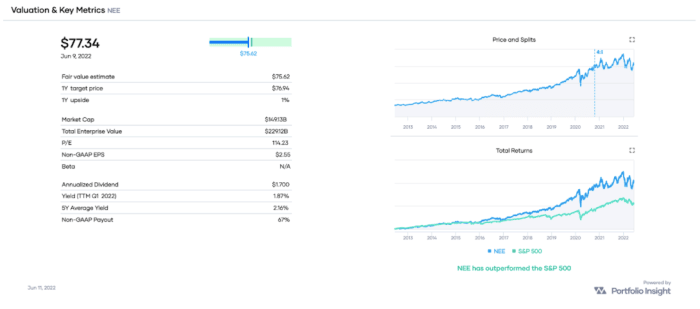

NextEra Energy (NEE)

NEE generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, and fossil fuel. It also develops, constructs, and operates assets focused on renewable energy generation. NEE was founded in 1984 and is based in Juno Beach, Florida.

NEE is rated Fine (quality score: 22) and is the only Utilities sector stock of this month’s candidates. Portfolio Insight classifies NEE as a slow-growth stock with a 1-year upside of 1% and a 1-year target price of $77.

The company’s non-GAAP payout ratio of 67% is low for Utilities, so NEE has ample room to continue paying and increasing its dividend.

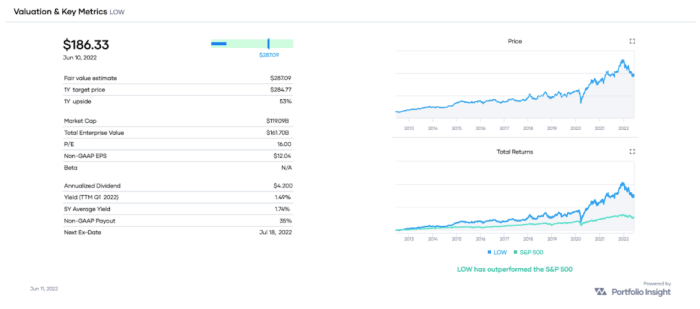

Lowe's (LOW)

LOW is a home improvement retailer. The company offers a complete line of products for maintenance, repair, remodeling, and home decorating. It also offers installation services through independent contractors, as well as extended protection plans and repair services. LOW was founded in 1946 and is based in Mooresville, North Carolina.

LOW is rated Fine (quality score: 22) and is discounted second most of this month’s candidates (-20%). Portfolio Portfolio Insight classifies LOW as a hypergrowth stock with a 1-year upside of 53% and a 1-year target price of $285.

The company has ample room to continue paying and raising its dividend, given its non-GAAP payout ratio of only 35%.

Concluding Remarks

In this article, I ranked stocks with dividend increase streaks of at least 14 years and 10-year trailing total returns of at least 20%. Of the seven top-ranked stocks, five trade well below my risk-adjusted Buy Below prices. The exceptions, COST and NEE, trade near my Buy Below prices. If COST and NEE drop by 5-10%, they will offer great buy opportunities, too.

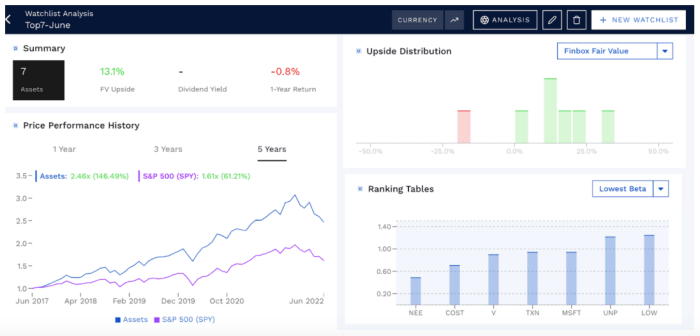

Here's a comparative analysis of an equal-weighted portfolio of this month's seven DG stocks:

From a price-performance perspective, the portfolio would have outperformed the S&P 500 over the last five years by a margin of 2.39-to-1. Finbox considers all but one of the stocks to be undervalued. Although not indicated, the exception is NEE. Note that only LOW and UNP have Betas above 1.00.

As always, I advise readers to do their due diligence before investing.

Thanks for reading, and take care, everybody!

Please follow me here:

- Twitter: @div_gro

- Facebook: @FerdiS.DivGro

I’d be happy to answer any questions you may have!