6 Stocks That Increased Their Dividend Recently

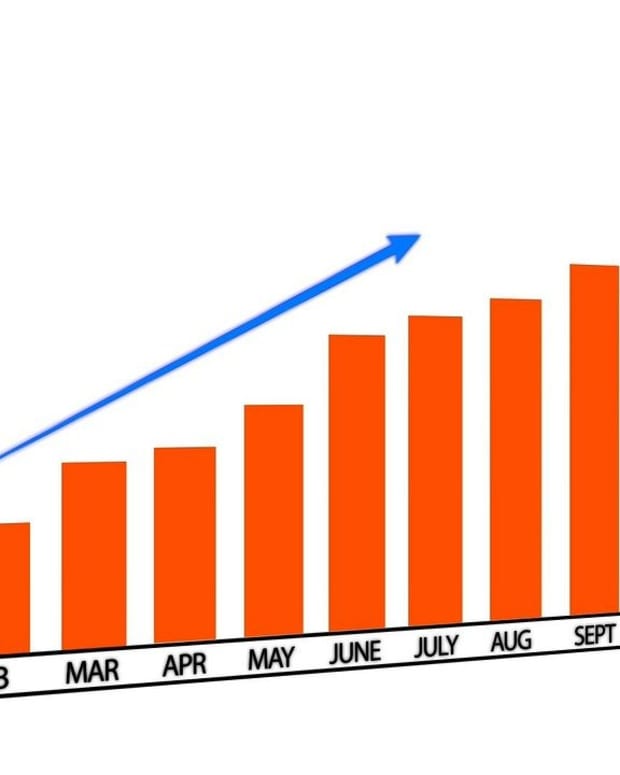

While the market keeps heading lower and lower, how about focusing on what really matters? Dividend growth! Dividend growers are usually good businesses with a robust balance sheet. They should not let you down during recessions.

Today, I highlight six companies that announced a dividend raise in the past six weeks.

Bank OZK (OZK) +3%

On October 3rd, Bank of OZK increased its dividend once again from $0.32/share to $0.33/share. This regional bank habitually rewards shareholders quarterly with a dividend increase. Its dividend growth policy has been going on for the past 49 quarters.

The small bank with a big vision has a strong reputation in the savings and loan banking industry. As a traditional bank, OZK is well-positioned to benefit from the U.S. economic tailwind. We trust the man behind the bank, George Gleason II, who has been President of OZK since 1979. He’s the mastermind behind the bank’s growth, and we think that he’ll stick around for years to come. Its Real Estate Specialities Group is a loan growth powerhouse, which, in Q2 2022, just reported its highest level of originations since 2017 (and third record breaking quarter in a row). OZK is exiting the crowded loan activity market to focus on Real Estate specialities. As the bulk of the bank’s projects are in NYC, the bank could either perform very well or poorly in the coming months, depending on the economy’s state. The recent pullback is yielding a PE multiple of ~10x which is hard to find nowadays; this might be a good entry point if OZK is on your watchlist.

Texas Instruments (TXN) +7.8%

On September 15th, Texas Instruments made a double announcement. It first increased its dividend from $$1.15/share to $1.24/share (+7.8%) and the board of directors also authorized to repurchase an additional $15B worth of stocks over time.

TXN has the size to benefit from economies of scale and stay ahead of their competition. The company has leading market share in both analog chips and digital signal processors. While there has not been much revenue growth over the past few years, the company’s future looks bright. TXN has benefitted from the fragmented market to purchase many manufacturers at low prices and consolidate its position in the analog chip business. With the rise of the IoT, its chips will have the possibility of being used in various other industries in the future. Demand for automotive and industrial will be robust in 2022. TXN has been able to secure customers and generate additional cross-selling opportunities as its sales team works to bring in additional revenues. TXN enjoys a sticky business with embedded analog chips for customers.

Starbucks (SBUX) +8.2%

On September 28th, Starbucks announced it will raise its dividend from $0.49/share to $0.53/share for an 8.2% increase. The iconic coffee maker has raised its dividend for 12 consecutive years already.

Starbucks enjoys one of the strongest brands in the world and uses that strength to expand its stores across China. With 500-600 new store openings per quarter, SBUX is growing rapidly in this country, with Chinese stores being much more profitable than U.S. stores. SBUX is successfully achieving its “transformation” plan by closing underperforming stores to open smaller, more efficient stores. This should help boost both sales and margins. The coffee maker also counts on its powerful membership program (over 24.8M members) to boost its sales. Its reward program often grows its members by double-digits (30% in 2021). SBUX has accelerated plans to open about 2,000 net new stores in FY 22 (+75% are expected internationally, including in China).

Microsoft (MSFT) +10%

On September 20th, Microsoft announced the increase of its dividend from $0.62/share to $0.68/share for a 9.7% increase. The tech giant shows double-digit annualized dividend growth rate for the past ten years. Needless to say, MSFT is part of our Dividend Rockstar List!

Microsoft is one of the oldest and newest tech companies, all at the same time. While it benefits from a strong core business model that generates cash flow through subscriptions, management has proven its ability to develop other growth vectors. Its most recent success is with Azure, which is No. 2 in public cloud services. Azure is on the path to strong growth over the coming years. Cloud services will also be integral to the future of many businesses, and this segment is already exhibiting tremendous growth. MSFT recently acquired a player in artificial intelligence (Nuance) for $19.7B. This will mesh well with MSFT’s business portfolio and open the door to healthcare solutions. We would also like to mention MSFT’s acquisition of Activision, which may bring with it some tailwinds. Finally, if you have been waiting for an entry point with MSFT, the downtrend in the tech sector could be bringing us to that potential entry point.

Lockheed Martin (LMT) +7.1%

On September 30th, The F-35 maker increased its dividend from $2.80/share to $3.00/share for a 7.1% increase. It was its 20th consecutive dividend increase. LMT is well on its way to becoming a dividend aristocrat! (25+ years with a dividend increase).

As geopolitical tensions continue to rise around the globe, Lockheed Martin is in a favorable position to offer its products to other countries. LMT counts on its F-35 fighter aircraft program and missile defense to grow in the upcoming years. After Russia’s invasion, Congress set FY22 defense funding $40B above FY21. We see another large U.S. defense spending increase of at least $40B for FY23. LMT will benefit from this ramp-up as a key provider of missile systems that Ukraine and U.S. allies are now ordering in large numbers. There are very few competitors in these markets and LMT is increasing its order backlog at a rapid pace. LMT has a new CEO, and we have yet to see his full impact on the company. LMT exhibits a strong dividend triangle, which adds confidence to future growth. Finally, it seems that a bolstered defense capability is now viewed as a more effective deterrent than diplomacy!

Honeywell (HON) +5.1%

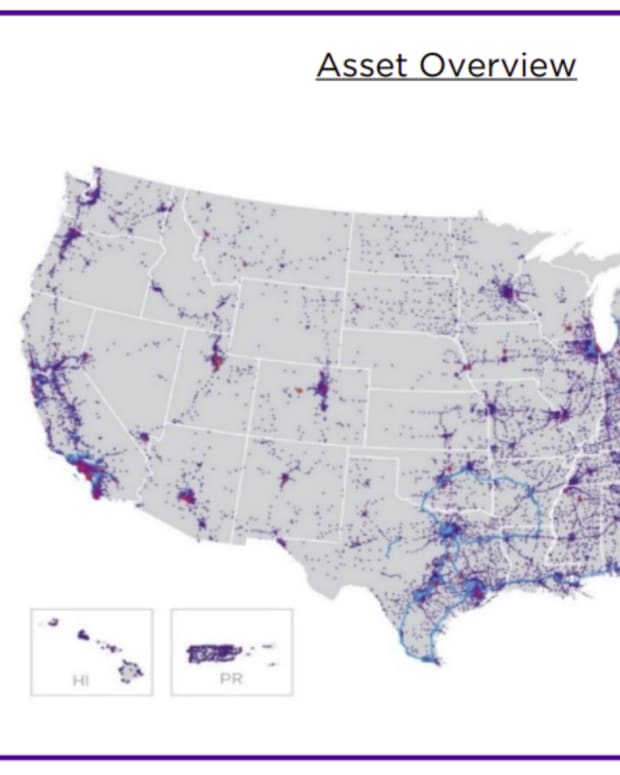

On September 30th, Honeywell increased its dividend from $0.98/share to $1.03/share for 5.1% increase. It was its 13th consecutive dividend increase.

An investment in HON is first and foremost an investment in a very strong dividend growth company. It benefits from a strong U.S. income base and can use its cash flow to seek growth in other markets, where it continues to develop its infrastructure. HON will continue to thrive by providing warehouse automation products such as their Intelligrated systems to improve their customers’ businesses. HON is using its software business across all its lines to offer high quality products. Commercial construction could be a long-term tailwind for the company, while Oil & Gas could help at least in the short-term. HON’s increasingly profitable margins will lead to additional profits and an increase in the stock price.

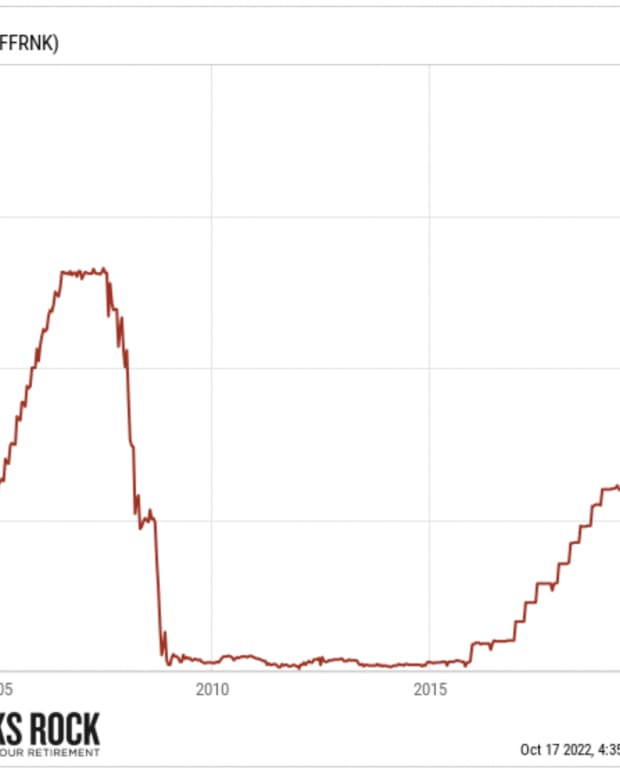

The pandemic accelerated the inevitable: global shortage and high inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

I recently hosted a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Watch the replay now (it’s free, no strings attached!)

See you there!

Mike