3 Undervalued Stocks to Buy in September 2022

We have seen the stock market trading at crazy valuations for many years. This year's correction brings some great opportunities for investors looking for good deals. I've identified three undervalued stocks that could be great addition to your portfolio.

BlackRock (BLK)

Dividend yield: 2.90%

Dividend growth since: 2010

P/E ratio: 17.82

Forward P/E ratio: 20.06

Sector: Financial Services

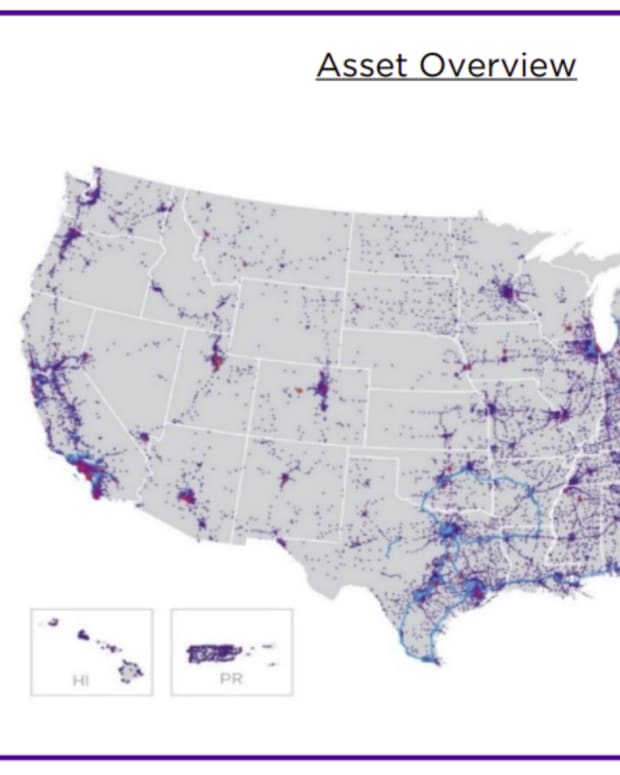

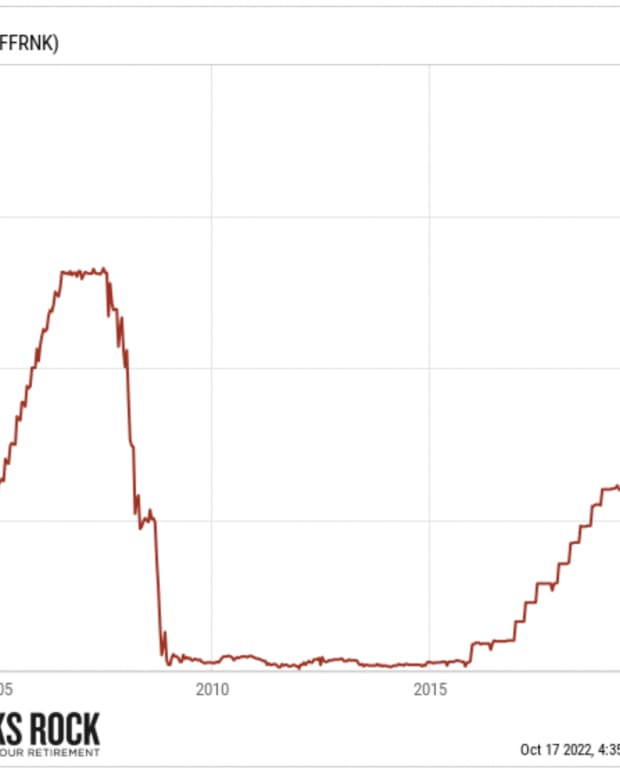

BlackRock is the largest asset manager in the world, with $8.487 trillion in AUM at the end of June 2022. The company is also the world's largest ETF manufacturer through its iShares ETF business division.

Investment Thesis

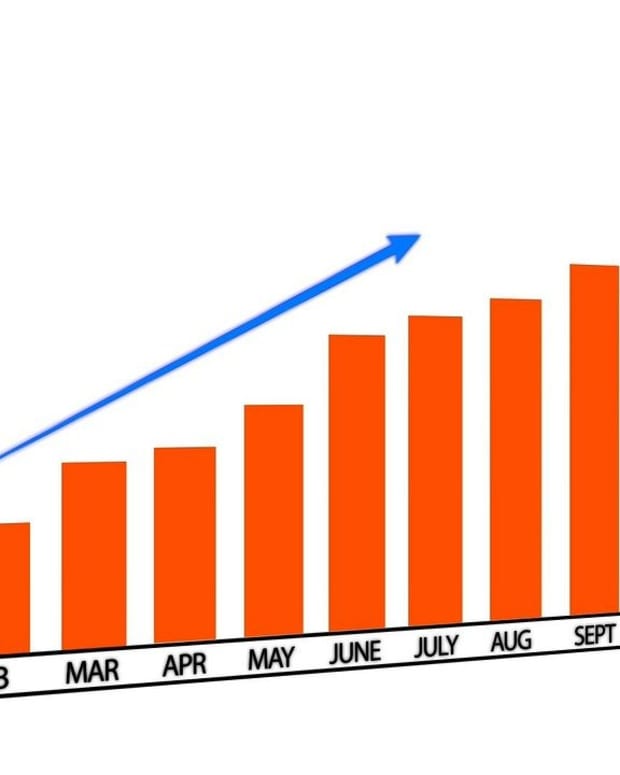

BLK is a winner and will be a keeper for decades to come. BLK's net inflow of assets under management continues to increase quarter after quarter. BLK enjoys size and scale like no other asset manager. The company sees steady organic growth even for its higher fee-earnings equity products. In other words, there is always new money coming in. The company is a leader in the growing investment field of ETFs and has a strong relationship with several institutional customers. Institutional investors are more inclined to stay with their providers for several years. We believe BLK's strong position in passive investments and strong fund performance will attract assets at above industry-average rates over the next few years.

Potential Risks

Asset managers are obviously more likely to suffer in bear markets. Although BLK exhibited positive net inflows during Q1 2022, this might be short lived as the market crumbles. To add to this, fees earned on AUM temporarily decrease during market crashes. The company must find a way to increase its actively managed assets, as these encompass its most profitable products. The company's size may become a burden as it could become less agile. Finally, regulation could also be a concern with potential policy changes.

Dividend Growth Perspective

The company has shown an impressive dividend growth rate track record since 2010. Over the past 5 years, BLK has maintained an 11%+ annualized dividend growth rate. This year was no exception as BLK rewarded shareholders with an 18% dividend increase. What's more, the current payout and cash payout ratios are well under control. We expect a high single-digit dividend growth rate going forward, even if the payout ratio permits growth rates in the low teens. The company exhibits a robust dividend triangle, and shareholders can sleep well at night while holding this security in their portfolios.

A.O. Smith (AOS)

Dividend yield: 1.90%

Dividend growth since: 2006

P/E ratio: 17.75

Forward P/E ratio: 16.55

Sector: Industrials

A. O. Smith Corporation is a provider of water heating and water treatment solutions. The company operates through two segments: North America and Rest of World.

Investment Thesis

In addition to being a leader in its market, AOS has several growth vectors. It has used its strong North American position to expand to emerging markets where the demand for water heaters & boilers is growing. AOS also sells reverse osmosis water treatment products. Even as technology continues to evolve, reverse osmosis remains the most efficient and preferred way to treat heavy metals in water. China, India, and other water treatment segments represent 36% of sales and represent the company's fastest-growing opportunities. AOS has a strong balance sheet, with only 10% of its total capital comprised of debt at the end of 2021. We believe this, combined with solid free cash flow, gives AOS the financial flexibility to pursue M&A opportunities. The housing market is strong and should provide AOS with a stable and predictable cash flow. Finally, as the economy continues to recover, AOS should see an increase in demand from the commercial market as well. A.O. Smith is part of the Dividend Rockstar list.

Potential Risks

The company may face headwinds as the rise of raw material prices, such as steel, continues to affect its profitability. Margins are thin in the revenue segment outside of North America, exhibiting a difference of roughly 10% from North American margins. This has been a recurring problem in recent years, causing AOS' earnings not to grow as quickly as they have historically. While sales are now back in growth mode in Asia, we saw that tariffs adversely affected AOS' business. Finally, while AOS has enjoyed strong momentum since the second half of 2021, the stock price has pulled back to September 2021 levels. An investment in AOS could be subject to short-term fluctuations in the current inflationary environment.

Dividend Growth Perspective

AOS has increased its dividend over the past 14 consecutive years (since 2006). It exhibits great dividend growth but a low yield (~1.9%). The company is focused on R&D and growing its markets. With a payout ratio below 40%, the funds are not currently making their way to shareholders, as management deems that it can offer stronger share value appreciation than if funds were being paid out as dividends. After reviewing its growth vectors, we tend to agree. Nonetheless, AOS has increased its dividend by 8% for Q3 2021, and this company can be leveraged as a robust investment, even in financial downturns.

V.F. Corporation (VFC)

Dividend yield: 4.50%

Dividend growth since: 1973

P.E. ratio: 16.11

Forward PE ratio: 13.55

Sector: Consumer Discretionary

V.F. Corporation is an apparel, footwear, and accessories company. It manages iconic brands such as Vans, The North Face, Timberland, and Dickies.

Investment Thesis

Active brand portfolio management is key in a world where fashion evolves at a rapid pace and brand power means pricing power; V.F. Corporation got this right. In May 2019, VFC spun off its jean brands into Kontoor (KTB). VFC is now looking to sell its workwear brands to generate cash flow for new acquisitions. VFC has built a successful brand with incredible growth potential with Vans. We like their focus on e-commerce and branded stores to avoid dependence on third-party retailers. This enables V.F. to control its brands and its message. The company may face a difficult period, but we expect them to pursue further acquisitions at bargain prices. VFC is well positioned to take advantage of consumers' shift to a healthier lifestyle through its Active and Outdoor segment. Similarly, the Work segment might be key with labor constraints and rotation. Finally, the stock price has been in a downtrend since mid-2021, and we could be at a good entry point.

Potential Risks

Even though the company demonstrated its ability to manage its brand portfolio, the fashion industry evolves quickly. Thus far, management has successfully maintained its brand power and expanded margins, but this could turn quickly. While the company is reducing its dependence on third-party retailers, many large stores are selling V.F. products. The brick-and-mortar retail industry is currently not performing well, and this could affect V.F. sales down the road. VFC has seen sales reduced by double-digits across all their brands. This will be a difficult period, but V.F. manages strong brands that will survive as shareholders must remain patient.

Dividend Growth Perspective

We believe that the company is in an excellent position to keep its dividend streak alive. V.F. still has plenty of room for future dividend growth with a conservative payout ratio, and an investor can expect high single-digit increases for the next ten years. As the company navigates stormy seas, we welcomed VFC's recent dividend increase from $0.48/share to $0.49/share and, more recently, to $0.50. Although both are small increases, it is proof of management's confidence and commitment in getting through the pandemic and becoming a stronger company. We expect another dividend increase towards the end of 2022.

Are you looking for more ideas?

Would you like to get some good deals? Would you like to find exciting companies with a long dividend growth history and not trading at crazy P.E. ratios? This video covers the 3 stocks from this article + two others!

Watch 5 U.S. Undervalued Stocks to Buy Now