3 High Yield Dividend Stocks To Buy This Fall That Pay More Than 4%

With interest rates going up to stop inflation, what do you think will happen this fall to the stock markets? We could see stock prices decline, offering investors the opportunity to add some high-yielding stocks to their portfolios.

It's one thing to focus on high yield. It's another to make sure the dividend is safe. There is nothing safer than a dividend that has just been increased. I've selected three companies offering a yield above 4% that will also come with a dividend increase in the next twelve months. The following companies offer both high yield and dividend growth to their shareholders.

AbbVie (ABBV) 4.10%

AbbVie is a research-based biopharmaceutical company. The Company is engaged in research and development, manufacturing, commercialization and sale of medicines and therapies. AbbVie offers its products in various therapeutic categories including Immunology, Oncology, Aesthetics, Neuroscience products, Eye care and Women's health.

Investment Thesis

ABBV’s dependence on Humira, a tumor necrosis factor blocker that reduces the effects of inflammation, has been reduced over the past few years. Humira represented about 58% of profits in 2019, down to 36% in 2021. ABBV will lose Humira’s exclusivity in 2023. New drugs in the company’s immunology portfolio such as Skyrizi and Rinvoq are accelerating more aggressive growth. ABBV expects Rinvoq and Skyrizi to contribute over $15B in sales by 2025. ABBV’s growth is also fueled by its hematologic oncology portfolio, with growth of 8%. In addition, we see promising growth from its psoriasis and rheumatoid arthritis drugs. The company’s primary reason for acquiring Allergan was to diversify its revenue sources and find more diverse ways of extending its patents. The big pharma shows a great balance between growth and income and is part of our Dividend Rock Stars list.

Potential Risks

As Humira’s patent expiration (2023 for the U.S.) is on the horizon, we are reminded of the pivotal role of patents and competition in the industry. Patents allows players to reap the benefits of billions invested in R&D, and while ABBV may be one discovery away from making billions, the same goes for many of their competitors. For instance, competitor Pfizer could impact ABBV’s sales expectations. Now, ABBV must convince the market that its pipeline is worthy of their investment despite Humira’s patent expiration, and a few more quarters may be necessary for this. ABBV also increased its leverage through the acquisition of Allergan. Failures in the pipeline, litigation, or even integration complications with Allergan, are risks that ABBV could face in the future.

Dividend Growth Perspective

ABBV has been generous with its shareholders as of late. The company has successfully increased its dividend since 1973 (including Abbott’s history). Management has more than doubled its payout in the past 5 years, in addition to buying back shares. With a yield of 4.5%, it is a great candidate for any retirement portfolio. The most recent dividend increase announcement in Q4 2021 (+8.5%) demonstrates high confidence from management.

VF Corporation (VFC) 4.90%

V.F. Corporation is an apparel, footwear and accessories company. It owns a range of brands in the outerwear, footwear, apparel, backpacks, luggage, and accessories categories. Its brands include Vans, The North Face, Timberland, and Dickies. VFC has more than 45 consecutive years of dividend increases under its belt and it’s on its way to become a Dividend King.

Investment Thesis

Active brand portfolio management is key in a world where fashion evolves at a rapid pace and brand power means pricing power; VF Corporation got this right. In May 2019, VFC spun off its jean brands into Kontoor (KTB). VFC is now looking to sell its workwear brands to generate cash flow for new acquisitions. VFC has built a successful brand with incredible growth potential with Vans. We like their focus on e-commerce and branded stores to avoid dependence on third-party retailers. This enables VF to control its brands and its message. The company may face a difficult period, but we expect them to pursue further acquisitions at bargain prices. VFC is well positioned to take advantage of consumers’ shift to a healthier lifestyle through its Active and Outdoor segment. Similarly, with labor constraints and rotation, the Work segment might be key. Finally, the stock price has been in a downtrend since mid-2021, and we could be at a good entry point.

Potential Risks

Even though the company demonstrated its ability to manage its brand portfolio, the fashion industry evolves quickly. Thus far, management has successfully maintained its brand power and expanded margins, but this could turn quickly. While the company is reducing its dependence on third-party retailers, many large stores are selling VF products. The brick-and-mortar retail industry is currently not performing well, and this could affect VF sales down the road. VFC has seen sales reduced by double-digits across all their brands. This will be a difficult period, but VF manages strong brands that will survive as shareholders must remain patient.

Dividend Growth Perspective

We believe that the company is in a good position to keep its dividend streak alive. VF still has plenty of room for future dividend growth with a conservative payout ratio, and an investor can expect high single digit increases for the next 10 years. As the company navigates stormy seas, we welcomed VFC’s recent dividend increase from $0.48/share to $0.49/share, and more recently to $0.50. Although both are small increases, it is proof of management’s confidence and commitment in getting through the pandemic and becoming a stronger company. We expect another dividend increase towards the end of 2022.

T. Rowe Price (TROW) 4.05%

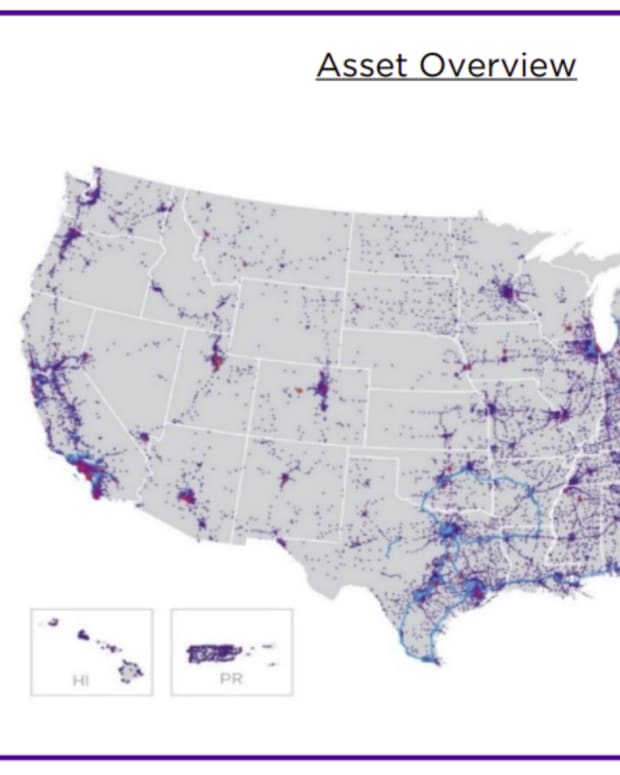

T. Rowe Price Group, Inc. is a financial service holding company, which provides global investment management services through its subsidiaries to investors worldwide. Retirement accounts and variable annuity investments represent 2/3 of TROW’s assets under management (AUM). TROW has over 1.5 trillion dollars in assets under management.

Investment Thesis

TROW has been a model of performance since its IPO in 1986. T. Rowe Price has built its reputation over the past 3 decades and enjoys strong brand recognition. As one of the world’s largest asset managers, TROW also enjoys economies of scale and offers a wide variety of investment products. As 2/3 of its assets are housed in retirement accounts, TROW has one of the stickiest asset bases among its peers. In other words, investors don’t tend to move their retirement accounts (especially institutional) from place to place as they prefer long-term strategies. It’s ability to grow its AUM is impressive, performing even better than we expected.

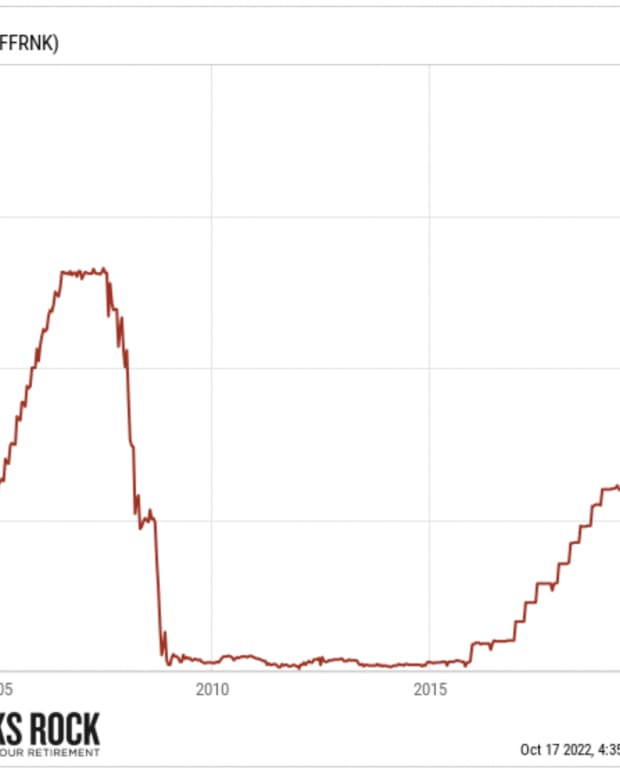

Potential Risks

TROW has seen market crashes in the past, but bear markets always hurt. About 80% of TROW’s revenue comes from management fees based on a percentage of AUM, so the effect of market movements will be immediate on the stock price. The company has reduced its fees on some mutual funds. While this investment is still popular, the major trend is toward ETF’s. TROW will continue to change its fee structure to remain competitive, which could eventually hurt profitability. With the imminent threat of a recession, TROW has been on a downtrend for most of 2022. Tread carefully if you intend to enter a position as the economy’s outlook is gloomy.

Dividend Growth Perspective

Over the past 5 years, TROW has increased its dividend at a double-digit growth rate. Despite the special dividends paid, TROW has maintained its low payout ratio. There is no doubt the company will push its dividend increase streak to 36 next year. Shareholders can expect several more years of solid dividend growth. TROW shows a robust dividend triangle (EPS, revenues, and dividend growth). This is all very positive for TROW’s future through the upcoming difficult quarters for the financial services industry.

The pandemic accelerated the inevitable: global shortage and high inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

On Thursday, September 22nd, I’ll host a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Save your spot now (limited to 500 live attendees)

See you there!

Mike