3 Debt-Free Dividend Stocks

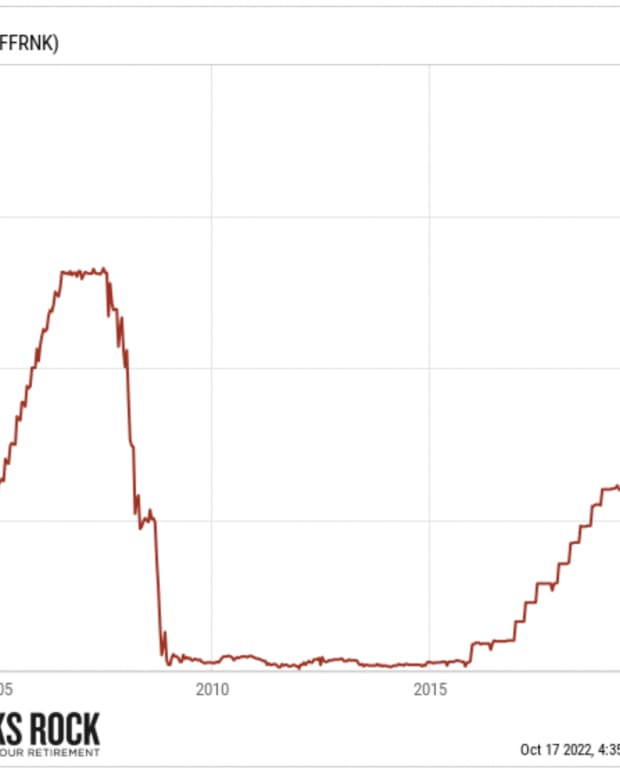

The FED made it clear that inflation is the number one enemy. To kill it, it will keep increasing interest rates until it achieves its goal. With the highest interest rate levels since early 2000, many companies are in trouble.

However, there are a few companies with no long-term debt on their balance sheet. Those companies are currently in a very comfortable position to survive and thrive. Here are my favorite three “debt free dividend stocks”.

Gentex (GNTX)

Gentex Corporation is a designer, developer, manufacturer, marketer, and supplier of digital vision, connected car, dimmable glass, and fire protection products. The Company provides automatic-dimming and non-automatic-dimming rearview mirrors and electronics for the automotive industry; dimmable aircraft windows for the aviation industry; and commercial smoke alarms and signaling devices for the fire protection industry.

Investment Thesis

Gentex is the industry leader and its products are on their way to becoming industry standards. GNTX also possesses a stellar balance sheet with virtually no debt and many of patents. It can weather any economic storm and could be an interesting candidate for a merger. GNTX also benefits from being the first to offer its top-of-the-line products, leading to higher margins for early adoption. We appreciate the company’s effort to diversify its business model and not remain a one-hit-wonder. The company is expanding its product offering to include toll modules, airplane windows, and, in the long-term, healthcare applications such as lighting for operating rooms and iris identification & smoking detection for the interior of autonomous vehicle fleets. GNTX is likely to outperform auto supplier peers due to its industry-leading margins, share repurchases, and strong balance sheet ($280M of net cash at the end of Q2). GNTX is a lower beta stock within its industry.

Potential Risks

Magna Mirrors is GNTX’s largest competitor and has more resources than GNTX. If Magna decides to compete with a similar technology, it could outperform GNTX. In addition, GNTX doesn’t operate in a vast economic moat and has limited pricing negotiation power with automakers. The automotive parts industry is very cyclical and new technology (for example, if cameras were to replace mirrors) could impact demand. Production should remain depressed due to semiconductor shortages, and although there may be other upcoming headwinds, we expect the semiconductor shortage to improve in late 2022. GNTX’s hefty R&D budget enables it to develop new technologies, allowing it to remain competitive.

Dividend Growth Perspective

GNTX has increased its payouts each year since 2011 but did not make an increase in 2021. We were also disappointed by the 2019 (+5%) and 2020 (+4.5%) increases, but we should expect steady growth in the next few years. Current payout and cash payout ratios allow room for future increases. Gentex has ample amounts of cash ($280M as Q2 2022) and virtually no debt. We would definitely like to see a return to the dividend growth policy in 2022, but this isn’t likely to happen until 2023. Management will also continue its share buyback program. Don’t mind the company’s DDM valuation; low yielding stocks must exhibit double-digit growth to generate any value using this model.

LeMaitre Vascular (LMAT)

LeMaitre Vascular, Inc. is a provider of medical devices and human tissue cryopreservation services, which are used in the treatment of peripheral vascular disease, end-stage renal disease and to a lesser extent cardiovascular disease. The Company develops, manufactures and markets vascular devices to address the needs of vascular surgeons, and to a lesser degree, other specialties, such as cardiac surgeons, general surgeons and neurosurgeons.

Investment Thesis

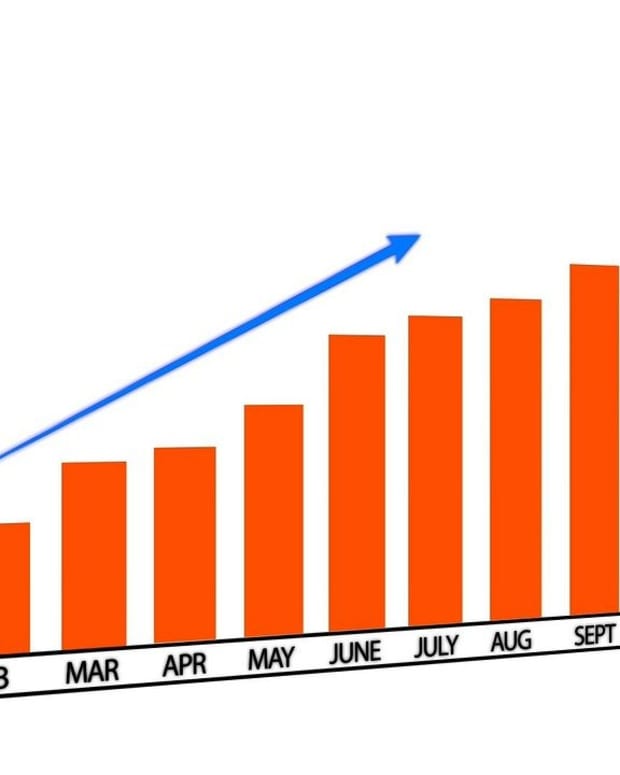

In looking more closely at LeMaitre Vascular, the first thing that comes to mind is growth; The company exhibits strong revenue growth as it acquired 24 businesses over the past 23 years. LMAT also counts on a solid salesforce and engineering department to sell and develop new products. The company currently offers over a dozen products being used in surgeries on veins and arteries outside of the heart. The pandemic caused the slowing of this growth vector, but surgeries and other procedures are picking back up with some signs of improvement in 2022, and a solid outlook for 2023.

Potential Risks

In dealing with small cap companies, one can expect to see shares surge or plummet on any given day. While LMAT has had a successful track record, keep in mind that the stock dropped by more than 40% in the 2018 market correction. We have begun to see a small margin reduction trend over the past couple of years (from their peak in 2017). Since margins may soon become a concern, we look forward to seeing how new acquisitions play out and affect LMAT’s business model going forward. It is also possible that the company may end up paying too much for a new business in a future acquisition.

Dividend Growth Perspective

This stock is another case of a strong double-digit dividend grower with a very low yield. While LMAT has aggressively increased its dividend payment over the last few years, the stock price has grown at an even faster pace. The company has consistently increased its dividend yearly since 2012. Considering both payout and cash payout ratios, shareholders can expect many more years of double-digit increases. Most importantly, the company has almost no debt. This gives management plenty of room to grow by acquisition and to reward shareholders at the same time.

Garmin (GRMN)

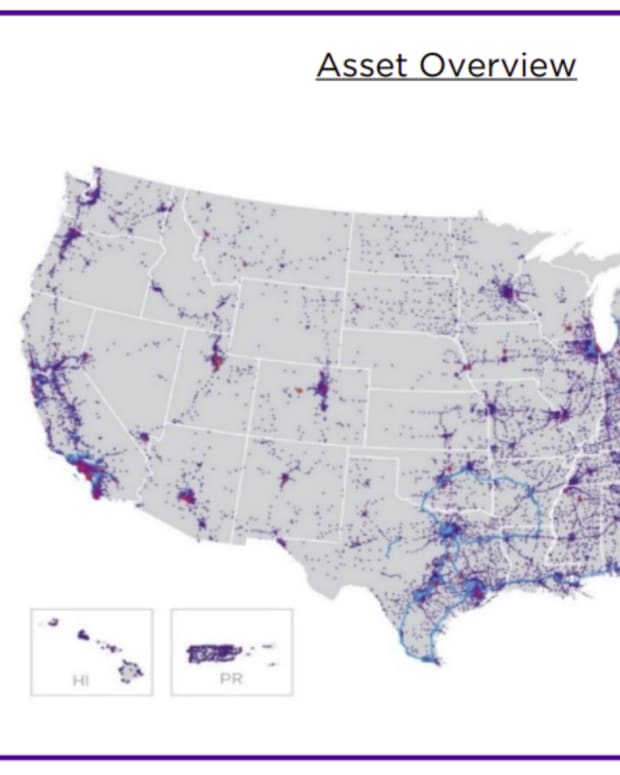

The Company and its subsidiaries offer global positioning system (GPS) navigation and wireless devices and applications. The Company operates through five segments: fitness, outdoor, aviation, marine and auto. It offers a range of auto navigation products, as well as a range of products and applications designed for the mobile GPS market.

Investment Thesis

After navigating an industry crisis, GRMN has proven its ability to shift its business model away from the automotive industry. Although the traditional use of auto GPS is declining thanks to smartphones, GRMN has developed new applications for its technology in the fitness, outdoor, marine, and aviation industries. GRMN is gaining traction particularly in the aviation market. With the exception of the Fitness segment, underlying demand for its products appears to be healthy, and only constrained by supply chain issues. Garmin’s order backlog has increased in Aviation and Marine, while Auto has been affected by reduced OEM orders. However, we fear that technology may evolve again and that most of GRMN’s devices could become obsolete.

Potential Risks

In the late 2000’s, GPS technology was revolutionary, and Garmin surfed on its first-mover advantage and built a strong business. Today, GPS applications are common, and most smartphones and smartwatches can easily compete with what Garmin offers. GRMN is now facing fierce competition from other tech giants with larger budgets. We are concerned with how GRMN will be able to survive competition from Apple, Google, and the like and it seems that the company could face the same fate that it did with its automotive GPS products. Finally, currency exchange rates could be less favorable than we expect. We are curious to see how the company can reinvent itself for a third time.

Dividend Growth Perspective

After a short break between 2015 and 2017, GRMN rewarded its shareholders with dividend increases in 2018, 2019, 2020, and 2021. The 2021 increase was a strong 9%. Recently, GRMN also declared a 2022 dividend increase from $0.67 to $0.73, representing another 9%. Considering the company has a strong balance sheet and is currently exhibiting strong revenue growth coming from its Fitness and Outdoor segments, we believe shareholders can expect mid- to single-digit dividend growth going forward. In this economic environment, Garmin’s diversified portfolio could bring less volatility.

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? There are too many investing articles contradicting one another. This creates confusion and leaves you with the impression you will not reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook which will give you the actionable tools you need to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build and manage your portfolio through difficult times.

- Enjoy your retirement.