3 Cheap Stocks to Buy in October

As the S&P 500 kept sliding in September due to higher interest rates and a persistent inflation, more dividend stocks became too cheap to ignore. We have seen the stock market trading at crazy valuations for many years. This year's correction brings some great opportunities for investors looking for good deals. I've identified three undervalued stocks that could be great addition to your portfolio this October.

Innovative Industrial Properties (IIPR)

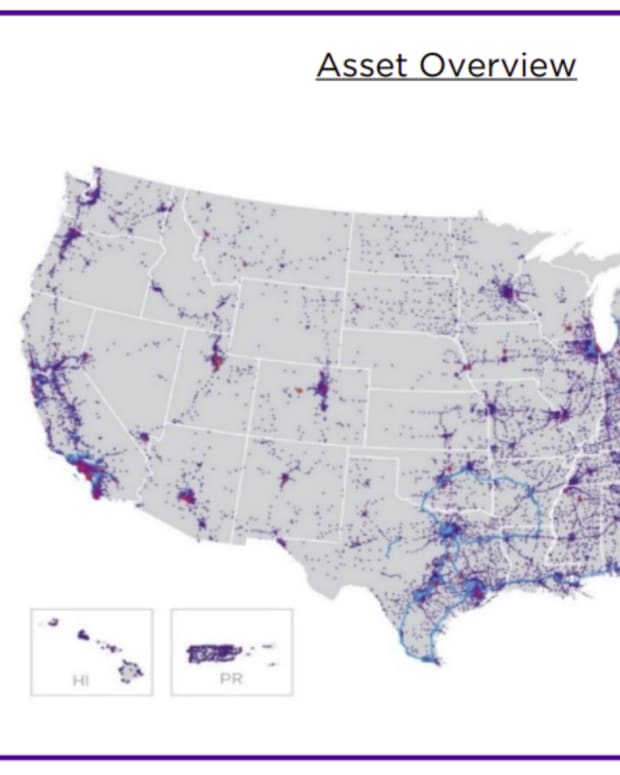

Innovative Industrial Properties, Inc. is an internally-managed real estate investment trust (REIT). The Company is focused on the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated state-licensed cannabis facilities.

Innovative Industrial Properties took at deep nosedive on April 14th after Blue Orca’s short report was released. Blue Orca claims that IIPR is a...

You can find the report here.

IIPR took another hit this summer when it reported that one of its tenants, Kings Garden, forgot to send a $2M+ cheque for its monthly rent. We are talking about 8% of IIPR’s yearly rental income. It’s not good news, but it’s not a catastrophe either (considering the REIT keeps the facility and will likely rent it to another player in this growing industry).

Investment Thesis

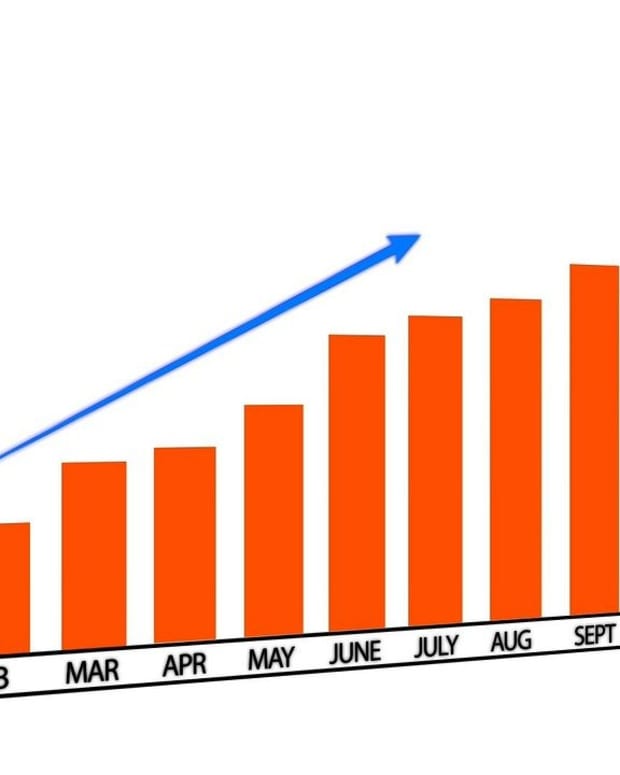

The cannabis industry is growing quickly, but it isn’t doing so without the occasional hiccup. A proven way to enjoy part of this growth is by investing in a REIT that specializes in medically licensed marijuana growers. An investor won’t get the same hype as with a grower, but IIPR is looking to expand. U.S regulated cannabis sales are expected to go from $12.4B in 2019 to $34B in 2025. Both the company’s funds from operations (FFO) and dividends are growing to follow suit. In 2021, the company reported a 75% increase in AFFO while making strategic acquisitions. IIPR also reported 3 dividend increases in 2021, maintaining its strong growth. The stock has experienced a big pullback in 2022 and seems to be attractive. Check out their strong dividend triangle!

Potential Risks

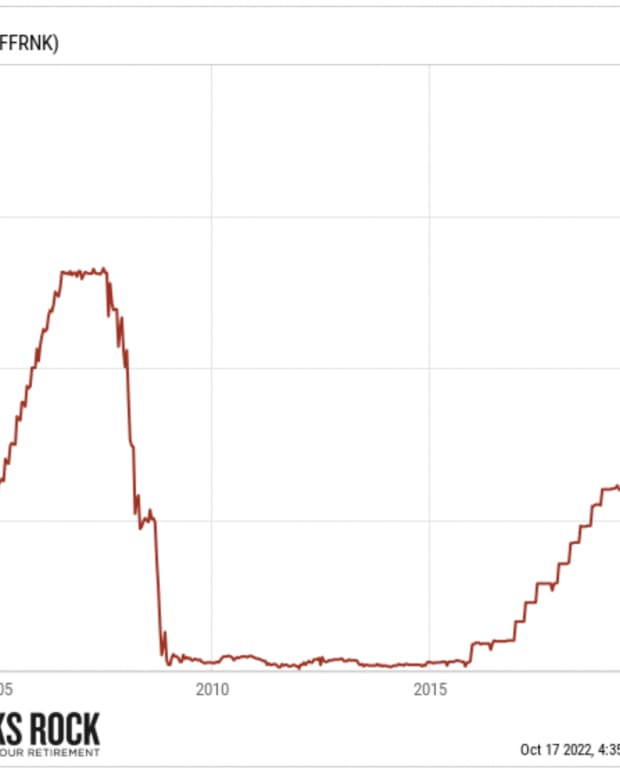

IIPR is not involved in producing any cannabis related products. However, this doesn’t mean that its stock won’t be affected by the hype or fear surrounding marijuana. As we can see on the price graph, if one invests in IIPR, they will experience volatility in the stock price. It’s reassuring to see a company growing quickly, but if management pays too much for their next acquisition or fails to integrate it properly, the result could be negative. While management seeks new acquisition targets, the cannabis bubble also pushes their property prices higher. The cannabis sector is highly sensitive to regulations; what if regulations change? There is news that Kings Garden, one of IIPR’s tenants, is defaulting in July, and we’ll keep an eye on this for developments.

Dividend Growth Perspective

The REIT paid its first dividend in 2017. Although we appreciate IIPR’s growth potential, we have used more conservative numbers for our DDM calculations. At the current price, an investor will enjoy an impressive ~8% yield. Management seems confident in the company’s future as it grows both its business and its dividend at a similar pace. The REIT targets a 75-85% AFFO payout ratio. So far IIPR exhibits an impressive dividend triangle! While 2022 is a tougher year, management showed confidence and increased its distribution by 3% last month. This will be a wild ride and should be considered a speculative play, but we doubt that there will be a more attractive entry point in the near future.

3m Co (MMM)

3M Company is a diversified global manufacturer, technology innovator and marketer of a variety of products and services. The Company operates through four segments: Safety and Industrial, Transportation and Electronics, Health Care and Consumer. 3M recently announced its intent to spin off its Health Care business and intends to complete the pending Food Safety transaction with Neogen by Sep'22.

Investment Thesis

3M has been on a downward spiral over the last few months as its COVID fame fades. We still believe that 3M’s competitive advantages are well-renowned and industrial clients are reluctant to abandon such a world-class company for competitors as they know MMM will deliver quality products. 3M possesses one of the strongest business models among the dividend kings and its dividend growth potential will continue to be one of its most valuable characteristics to investors. By becoming a leader in R&D in many sectors, 3M has created a truly unique economic moat. This will not be a high-growth investment, but at current levels, an investment in MMM is safe as steady cash flows are virtually guaranteed.

Potential Risks

MMM has been penalized by the stock market since the beginning of the year. This was because the company faced many short-term headwinds such as a slowing in both the automotive and semiconductor sectors and faced legal issues including their liability in products containing PFAS (per and polyfluoroalkyl substances). In 2019, several lawsuits arose in the U.S., bringing dark clouds. Some of MMM’s products are becoming commodities, where competitors could undercut each other with more aggressive pricing. After the price has dropped to 52-week lows, the stock now offers an attractive 5% yield.

Dividend Growth Perspective

3M has been paying dividends to its shareholders for over a century and has had more than 50 consecutive years of increases and is considered as a Dividend King (click here to see the full list). Over the past few years, MMM has been even more generous with its dividend increases and the payout ratio has jumped to over 50%. Still, there is plenty of room for management to increase the dividend in the future. We have, however, reduced our dividend growth expectations down to mid-single digits. Nonetheless, MMM is a very interesting pick for retirees looking for a strong and consistent dividend payer.

Lam Research (LRCX)

Lam Research Corporation is a supplier of wafer fabrication equipment and services to the semiconductor industry. The Company designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Investment Thesis

Lam succeeds in the market with solid results and surfs on many tailwinds. It is gaining market share in wafer fabrication equipment (WFE) used for radio frequency amplifiers, LEDs, optical computer components, and CPUs for computers. Lam Research’s strength lies in its high margins. The company counts many strong chipmakers (Samsung, Electronic Arts, Taiwan Semiconductor Manufacturing) as customers and offers a strategic service to them. These large chipmakers need Lam’s high-tech products to remain successful and LRCX is therefore expected to grow faster than other players in its industry. We expect LRCX to benefit from elevated investments by memory chip customers in the coming quarters, led by NAND investments. The demand from the need to increase capacity and productivity by chipmakers will be key for growth. LRCX currently exhibits a very strong dividend triangle.

Potential Risks

Lam Research faces strong competition from Applied Material (AMAT) and Tokyo Electron. If LRCX invests well in R&D to develop cutting edge technologies, it will be a dominant player. However, new players keep innovating with the right technologies. While facing strong competition, LRCX must deal with the cyclical demand of semiconductors. We expect the company to see some growth in the coming years after most of its customers have reduced their inventory over the past 2 years. As we saw in 2018, LRCX’s stock price can be quite volatile as the demand for semiconductors fluctuates. We are bullish in the long-term demand for semiconductors, but in the short-term, demand is highly cyclical and in line with companies’ investment cycles.

Dividend Growth Perspective

With such a strong dividend triangle, you can guess that LRCX is part of our Dividend Rockstar List. Lam paid its first dividend in 2014. Its quarterly payment began at $0.18/share and has risen to $1.725 since then. After its bullish stock price appreciation in 2019, LRCX now only offers a 1.9% yield. LRCX exhibits a strong dividend triangle where both revenues and earnings are on an uptrend. The company currently has payout ratios of about 18%, leaving plenty of room for future double-digit dividend growth. Considering the yield, an investment in LRCX is more for the future of its high-tech products than for its current dividend income.

The Pandemic Accelerated The Inevitable: Global Shortage & High Inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

I recently hosted a webinar on how to invest in a time of crisis. I’ll address the delicate situation of being a retiree (or soon to retire) in this crazy market.

Watch the replay now (it’s free, no strings attached!)

See you there!

Mike