3 Cheap Dividend Stocks to Buy in November

As the S&P 500 kept sliding in November due to higher interest rates and a persistent inflation, more dividend stocks became too cheap to ignore. We have seen the stock market trading at crazy valuations for many years. This year's correction brings some great opportunities for investors looking for good deals. I've identified three undervalued stocks that could be great addition to your portfolio this November.

Air Products & Chemicals (APD)

Air Products and Chemicals, Inc. is an industrial gases company. The Company provides essential industrial gases, related equipment and applications to customers in various industries, including refining, chemical, metals, electronics, manufacturing, and food and beverage. APD is the largest supplier of hydrogen and helium in the world, with several facilities on customer sites. It serves multiple customers and various industries. Switching costs are high for its customers. However, its high CAPEX (over $14B) combine with higher interest rates give investors headaches. The market also fears that APD won’t be able to pass the increase of commodity prices (notably higher natural gas prices) to its customers.

Investment Thesis

APD has a diverse way of positioning its business in a sector where most are stuck with commodity price fluctuations. As a provider of industrial gases, APD signs long-term contracts with its customers. Industrial customers are more concerned with stability and reliability than costs, since gases make up a small part of their expenses but are vital to their business. APD strategically acquired Shell’s and GE’s gasification businesses in 2018. The company became a leader in its industry and has opened doors to expand its business in China and India. APD has an impressive backlog of projects that we think will continue to improve its top tier return on invested capital. APD’s ambitious growth plan, including $14.1B to be spent on its project backlog, has potential to continue improving return on invested capital. Demand for hydrogen should continue to increase in 2022 and 2023 as demand for jet fuel recovers.

Potential Risks

While the company’s core business is protected with long-term contracts, growth is still linked to the economic cycle. As an industrial gas supplier, APD’s sales are contingent on the demand for gases. It seems that the company recovered from the last economic downturn, however demand remains cyclical. Industry competitors also made valuable acquisitions recently: Air Liquide bought Airgas in 2016 (market cap of over $80B) and the Praxair-Linde merger in 2018 (market cap of over $170B) resulted in a second giant with whom APD must compete. The resulting competition for market share is fierce, with price wars leading to lower margins. Higher raw material input costs could also put pressure on ADP’s bottom line. While APD has great prospects for expanding its business in emerging markets, other players also have available the same opportunity.

Dividend Growth Perspective

Air Products & Chemicals has a stellar dividend streak that began in 1982. While the stock price more than doubled between 2016 and 2020, its dividend increased from $0.81/share to $1.50/share (+88%). In 2022, the company rewarded shareholders with a very strong 8% increase (to $1.62/share). That made the yield a little more attractive at 2.5%. We think APD should generate enough free cash to fund dividends, and with both payout and cash payout ratios under control, shareholders can expect more dividend growth in the coming years. There is no doubt that APD is a candidate for Dividend King status in the future.

STAG Industrial (STAG)

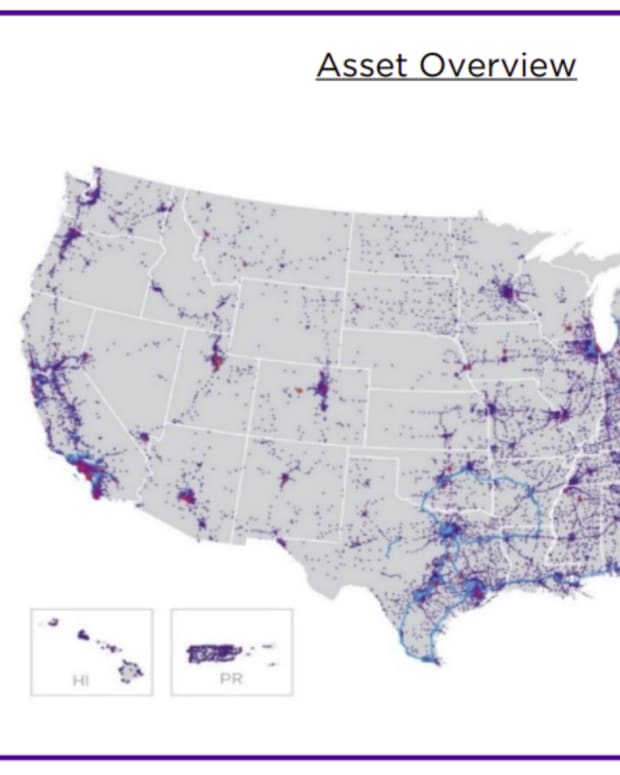

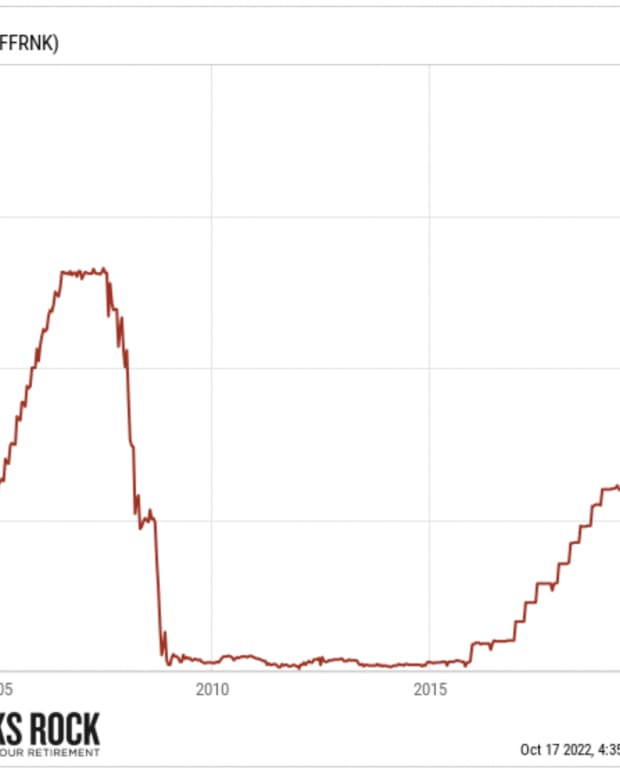

As the name suggests, STAG industrial is an industrial REIT. The Company is focused on the acquisition, ownership and operation of industrial properties throughout the United States. The Company owns approximately 559 buildings in 40 states with approximately 111 million rentable square feet, consisting of approximately warehouse/distribution building and light manufacturing buildings, two flex/office buildings Value Add Portfolio buildings. It owns both single-and multi-tenant properties. As it’s the case for many REITs, STAG is being left for dead by the market as investors fear higher interest rates would struggle FFO (funds from operations) going forward.

Investment Thesis

After years of being the underdogs, Industrials are now seeing major growth thanks to e-commerce and the pandemic. While the growth of e-tenants’ credit profiles is important, the need for warehouse space keeps growing. STAG is one of the largest players in the industry and uses its size and strong balance sheet to acquire more real estate. The REIT has 40% of its customers involved in e-commerce activity. We appreciate STAG’s highly diversified tenant base offering warehouses to multiple industries. Roughly 55% of their tenants’ credit profiles are publicly rated and 30% of all tenants are investment grade companies. STAG focuses on smaller and individual properties. This enables the REIT to face less competition and improve diversification.

Potential Risks

REITs need debt to grow, and STAG’s debt continues to increase quarter over quarter. The company has more than doubled its debt to reach approximately $1.8B over the past 5 years. Still, STAG possesses a credit rating of BAA3 (Moody’s) and BBB (Fitch). The issue with such an aggressive growth plan is not only the debt levels but also the risk of becoming too big. There have been massive investments in the industrial REIT sector, and the participants in that market could reach an oversupply. We like the business and the monthly dividend, but we think there is little upside potential at this point; for the first time in some time, STAG reported a drop in revenue in Q2 2022. We see property prices increasing, and there may be less feasible deals for STAG to pursue; stockholders should keep an eye on the Commercial Real Estate arena if they hold STAG.

Dividend Growth Perspective

STAG offers a good yield of 4.6% with monthly distribution. This is perfect for income-seeking investors. Through the REIT’s diversification and stellar business model, an investor can expect to get paid for several years. Unfortunately, the latest dividend increase was minimal. The paycheck should follow inflation, but don’t expect much more out of it. We can look at STAG as a “deluxe” bond. Its business model has proven to be “Covid-19 proof”, so an investor can rest easy with this investment.

Church & Dwight (CHD)

Church & Dwight Co. develops, manufactures and markets a range of consumer household and personal care products and specialty products focused on animal and food production, chemicals and cleaners. Its consumer products are focused principally on its 14 brands. CHD is known for iconic brands Arm & Hammer, OxiClean, Trojan, and First Response.

Investment Thesis

CHD has a remarkable business model, characterized by strategic acquisitions in markets that it can improve. In 2019, the firm announced the addition of Flawless, which manufactures electric shaving products for women. The firm acquired Zicam, a leading brand in the cough/cold shortening category, in 2020. Following those acquisitions, their marketing department worked at securing additional market share. Since the company sells personal care and household products, which are staples, sales likely won’t plummet during a recession. For the remainder of 2022, the company could face margin pressure due to a concentrated supplier base and co-manufacturers.

Potential Risks

While CHD has built a solid portfolio of well-known brands, it faces fierce competition. The company competes with large conglomerates, which put additional pressure on prices. Also, major retailers, such as Walmart, enjoy strong negotiating power. Add to this rising transportation costs and raw material inflation and you have a perfect storm working to decrease margins. Management’s decision to invest heavily in R&D and marketing to keep their edge seems to be the proven path to success. Earnings beating expectations over the last several quarters has been driven by either a favorable tax rate, lower-than-expected marketing spend, and/or incentive compensation, which makes one wonder about the quality of these earnings.

Dividend Growth Perspective

CHD has successfully increased its dividend annually since 2000. While the company isn’t attractive to income seeking investors, we can expect CHD to reward with a higher paycheck each year. Management tends to use the bulk of its cash to fund acquisitions, R&D, and marketing. Payout ratios should remain low, leaving additional room for future dividend growth. Over the past 5 years, CHD has had a high mid-single digit increase rate of 7.3% CAGR. While the dividend has surged from 10 years ago, we find a 6% growth rate more sustainable over the long term. The latest dividend increase was a disappointing 4% in 2022. If you would like to add CHD to your portfolio, we advise waiting for a more reasonable stock price.

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? There are too many investing articles contradicting one another. This creates confusion and leaves you with the impression you will not reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook which will give you the actionable tools you need to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build and manage your portfolio through difficult times.

- Enjoy your retirement.