2 Top Dividend Aristocrats That Currently Yield More Than 4%

The bear market of 2022 has undoubtedly caused pain for investors, but it has also yielded some opportunities. Share price declines have pushed dividend yields higher and allowed income seekers the chance to capture a higher rate on new buys than they were able to in the past.

If you're willing to stick with high-performing dividend aristocrats during times like these, you can ride out these times and have confidence that your dividend payments will remain secure.

Here are two dividend aristocrats that now yield more than 4%.

ExxonMobil (XOM)

Overview

ExxonMobil Corporation (XOM) is an American oil and gas corporation based in Irving, Texas. Exxon, the biggest oil refiner in the US, has benefited from the gap between the crude oil price and the petroleum products produced over the years.

Exxon has a 39-year history of increasing annual dividends, making it one of the Corporate American Dividend Aristocrats. It has used its strong cash flows to pay off debt and give money to shareholders in the form of dividends and buybacks of stock.

Dividend Analysis of ExxonMobil (XOM)

The dividend is the driving force behind ExxonMobil's stock price. Many investors have stuck with the oil giant because of its increasing income compared to its rivals, who lowered their dividends as oil prices fell.

ExxonMobil now pays out $3.7 in dividends annually, or a 4.0% trailing yield. Since 1983, the corporation has increased its dividend for 39 straight years.

With an 89% dividend payout ratio and management's dedication to dividends, investors can be assured that Exxon will maintain consistent dividend payouts with an increased yield in the future.

Dividend Yield

Since March 10th, 1973, Exxon Mobil Corporation has paid quarterly dividends to its shareholders.

Exxon Mobil Corp. had a 3.7 dividend yield as of September 15, 2022, with a median of 3.2 for the Oil & Gas - Refining and Distribution sector. Last year, Exxon Mobil Corp's dividend yield was 6.5.

Exxon Mobil Corp. has paid quarterly dividends since March 10, 1973, ranging from 0.95 to 0.88 in 2022. The dividend yield on Exxon Mobil Corp shares has grown by an average of 3.7 per year during the previous five years.

Exxon’s dividend is one pledge that management has always kept. Exxon also thinks that its ability to control and raise dividend payments to its shareholders will be a big part of the future growth of the stock price.

In 2020, when oil prices plummeted due to a pandemic threat, Exxon's dividend yield increased to an all-time high of approximately 9.5%. The company never wavered from paying out a sizeable dividend and, in fact, increased it throughout the last few years. This was true even though the stock price had a lot of negative volatility since 2020.

Exonn now has one of the finest dividends available in the market, given its operating parameters and size. Unless stock prices soar, the management has no plans to further reduce the dividend yield it is currently offering.

Dividend History

As a potential investor, you may want to look into Exxon Mobil Corp's stock dividend history before determining whether or not to buy this stock. Your understanding of the frequency, dependability and long-term growth of this company's dividend payments may all be gained by looking at the dividend history of the XOM stock.

The critical competitive advantage of ExxonMobil is its capacity to provide superior returns through the combination of low-cost assets and a low cost of capital. ExxonMobil raked it in when oil went for over $100 per barrel. Exxon has had to tighten its belt, though, with better capital allocation and operations ever since the price of oil dropped below the $50 per barrel range.

Now that oil has steadied, Exxon's management expects the price of oil will remain stable in the long run. Even if oil prices fall to a low of $40 per barrel, the corporation can still cover its current dividend.

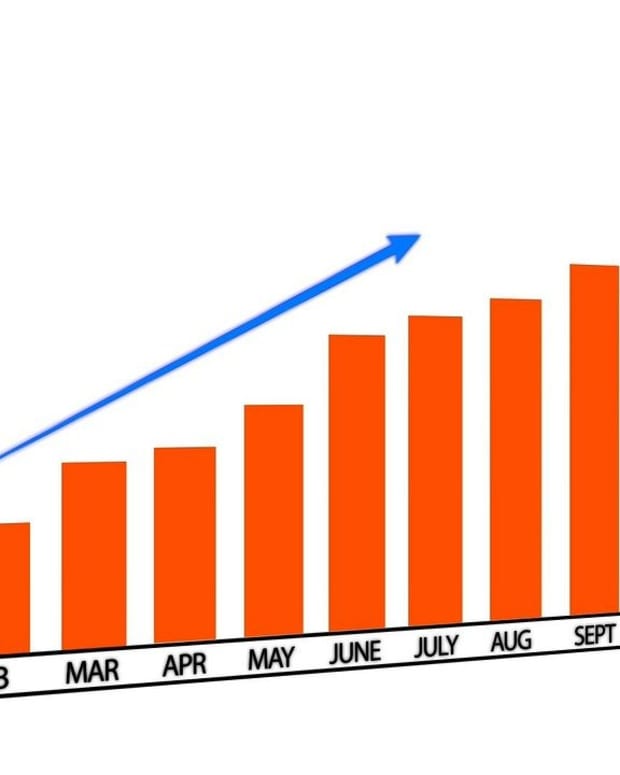

This is a safe bet for many investors as even though there are fluctuations and turbulences in the oil barrel price and Exxon’s stock price, the dividends they will earn will be the same and will only increase if not for being constant. As mentioned earlier, Exxon’s dividend has only increased in the past 39 years, with the latest increase being in 2021, as shown in the graph below.

Dividend Sustainability

XOM has long been a favorite among dividend investors due to its 6% yield last year and nearly 4% yield this year. However, there are significant concerns about the sustainability of that dividend.

ExxonMobil distributes a $0.88 quarterly dividend or $3.52 per share yearly. The firm expects its diluted earnings per share for 2022 to be $9.14, which is significantly more than its yearly dividend. The payout ratio would, at worst, be around 38.4%. This payout ratio is very sustainable considering the low payout ratio of 38.4%.

Although not raising the dividend is preferable to the dividend cut that so many analysts had pegged as a likely conclusion, even though the company's financial stability was under severe strain due to heavy debt burdens, thin profit margins, and low oil prices in 2020, Exxon still managed to give promised dividends to its investors.

The situation seems more promising now that the COVID pandemic has been fully contained. ExxonMobil will function in a more profitable environment and make large expenditures on high-potential projects. Management reaffirmed its commitment to continuing to pay and raise the dividend recently. Analysts believe the next dividend raise will be significant, unlike the one-cent raise in 2021.

Cash Flow Analysis of ExxonMobil (XOM)

Exxon Mobil has been able to increase its cash flows over time significantly, and with further cost cuts, the corporation anticipates that trend to continue. Exxon, which suffered its first-ever financial loss during the pandemic as oil prices plummeted, is now the S&P 500 Index's third-largest free cash flow producer, trailing only Apple Inc. and Microsoft Corp.

After cutting costs and locking investment spending at historic lows, ExxonMobil is now well-positioned to gain from rising commodity prices. Exxon Mobil initially projected to have about $30 billion in extra cash after dividend expenditures, despite significant capital spending and growth in the past.

To make the most of new market opportunities, ExxonMobil is constantly boosting capital expenditures. Exxon Mobil is also planning to make significant investments in low-carbon technologies, creating a new industry that will bring in money in the future.

Debts Analysis for ExxonMobil

Exxon Mobil's use of debt is relatively sensible. That indicates that they are increasing their level of risk to increase shareholder returns. Debt often becomes a significant issue when a firm finds it difficult to pay it off through capital raising or cash flow. The most typical scenario, however, is one in which a business manages its debt well and to its benefit.

According to Exxon's Annual Long Term Debt History, Exxon Mobil had US$42.5 billion in debt at the end of March 2022, a significant decrease from greater highs over the previous year. However, it does have US$11.1 billion in cash to counter this, resulting in net debt of around US$36.5 billion.

The net debt of Exxon Mobil is only 0.68 times its EBITDA. Moreover, despite being 38.3 times larger, its EBIT helps offset its interest expense. As a result, we don't want to be concerned about its extremely prudent use of debt.

Should You Invest in ExxonMobil Considering Its Outstanding Dividend Payouts?

Exxon Mobil is a wise long-term investment owing to its willingness to fund energy initiatives and its comparatively longer reserve life. Exxon Mobil has kept investing in energy projects because it thinks that oil and gas demand will be higher than the market and industry anticipate. This belief has turned out to be correct, and the firm continues to do so.

The fact that XOM had sustained yearly dividend growth for 39 years running is something everyone should take note of. There is very little chance that XOM will ever have to reduce its existing dividend payout. Another important investing benefit for XOM is its dividend yield is higher than that of its main rivals and peers, especially the other US oil majors.

AbbVie (ABBV)

Overview

AbbVie is a multinational pharmaceutical conglomerate based in the United States. It began business as an independent firm from its parent company Abbott in 2013.

Most of the 16 drugs that make up AbbVie's total pharmaceutical portfolio include Lupron, Androgel, and Creon (pancreas therapy). But Humira, an anti-inflammatory drug that is also one of the world's most popular medicines, is undoubtedly the company's best product.

AbbVie is also a dividend-growth firm. Since its early years as a division of Abbott, AbbVie has raised its dividend for more than 40 years straight. As a result, it belongs to the Dividend Aristocrats index like ExxonMobil.

Dividend Analysis of AbbVie (ABBV)

AbbVie pays a comparatively high dividend yield of 3.9%. That delivers far more dividend income than the typical S&P500 investment average, which offers just 1.3%. With a $10,000 investment, you could receive $390 more in dividend income each year from AbbVie. The difference becomes much more significant when you multiply it by the years you have owned the shares and add the consistent dividend increases the company produces. Here are some important dividend aspects you should consider, which can help you understand Abbvie better.

Dividend Yield

Since February 15, 2013, AbbVie Inc. has distributed quarterly dividends to its stockholders. AbbVie Inc. has a dividend yield of 3.9 as of September 16, 2022, versus the pharmaceutical median of 0.

Last year, AbbVie Inc's dividend yield was 4.4. AbbVie Inc. distributed quarterly dividends starting on February 15, 2013, that ranged from 0.4 to 1.41 in 2022. The dividend yield on AbbVie Inc. shares has risen by an average of 3.2 per year during the previous five years.

Dividend History

Before choosing to buy this investment, as a prospective investor, you might be interested in researching the dividend history of AbbVie Inc shares. On September 9, 2022, AbbVie (ABBV) confirmed that stockholders of record, as of October 13, 2022, will receive a $1.41 dividend per share on November 15, 2022. ABBV now offers shareholders an annual dividend of $5.64 per share or 3.92%.

The company has raised its dividend 6 times in the last five years, and during that time, its payout has increased by 15.91%. The payout ratio for ABBV is now 42% of earnings.

Without a doubt, there is no reason to worry right now regarding the dividend history and what AbbVie has to offer in the future in terms of dividends. In nearly the previous 12 months, AbbVie recorded a free cash flow of over $22 billion, compared to dividend payments of $9.5 billion. The company appears to be doing well, which is unlikely to change soon.

Dividend Sustainability

AbbVie distributes a $1.41 quarterly dividend or $5.64 per share yearly. The firm expects its diluted earnings per share for 2022 to be between $13.78 and $13.98, which is significantly more than its yearly dividend.

The payout ratio would, at worst, be around 40.14%. This has been an outstanding improvement since last year's 86%. Also included in income under generally accepted accounting standards (GAAP) are non-cash expenses like amortization and depreciation.

AbbVie has a sizable cushion between its annual distribution and adjusted earnings, which should alleviate investors' concerns regarding its current payout, even with a potential loss in revenue from Humira(its best-selling drug) and weaker-than-expected results from Rinvoq in the future.

Cash Flow Analysis of AbbVie (ABBV)

In nearly the previous 12 months, AbbVie recorded a free cash flow of over $22 billion, compared to dividend payouts of $9.5 billion. The company seems to be in good form, which will not change very soon.

Even though cash is the heart of any organization, growth-oriented businesses are more vital and benefit from greater-than-average cash flow growth than established businesses. This is because increased cash flow helps these enterprises grow without requiring costly outside funding.

AbbVie currently has year-over-year cash flow growth of 58.7%, which is greater than several of its competitors. In actuality, the rate is comparable to the 8.8% industry average.

Investors should concentrate on the current cash flow increase, but evaluating the historical rate is essential to put the present reading into context. Compared to the industry average of 6.5% over the last three to five years, the firm's annual cash flow growth rate was 25.2%.

Debts Analysis for AbbVie (ABBV)

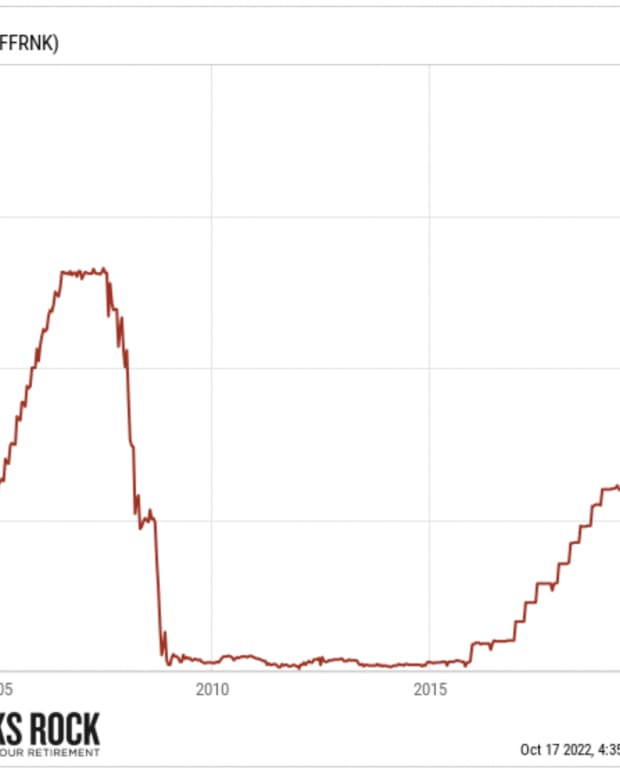

According to the above chart, AbbVie's debt was US$73.2 billion at the end of June 2022, down from US$82.2 billion the previous year. It also had $9.96 billion in cash, so its net debt is approximately $63.2 billion.

According to AbbVie's most recent balance sheet, it had US$34.5 billion in liabilities within a year and US$94.0 billion in liabilities due after that. Even if this may seem like a lot, AbbVie has a sizable market cap of US$239.7 billion, so if necessary, it could potentially improve its balance sheet by raising capital.

AbbVie employs debt in a creative yet responsible way, with a debt to EBITDA ratio of 2.3. In keeping with that tendency, its trailing twelve-month EBIT was 8.5 times the interest expenses. Over the past three years, AbbVie has generated more free cash flows than EBIT. The most notable benefit for AbbVie on the balance sheet was that it appeared capable of securely converting EBIT to free cash flow. As we can see, even though AbbVie has a high level of debt and liabilities, AbbVie is doing a good job at debt management.

Should You Invest in AbbVie Considering Its Outstanding Dividend Payouts?

You might earn $1,000 per year in dividend income from AbbVie with an investment of about $26,500 in the current market conditions. There are no certainties regarding dividend payouts, but AbbVie is a Dividend King with a good track record, and rate increases are likely to continue as long as the business generates strong earnings.

There is undoubtedly a route for investment in AbbVie to experience a considerable increase in value over time, given the firm's growth potential and high-yielding dividends. AbbVie's total returns over the previous ten years have been 538%, which is far more than the S&P 500's gains of just 227%. AbbVie has a bright future and makes a lot of money, which means that this pattern is unlikely to change. This is because AbbVie has a lot of cash flow and could use it to pursue more development opportunities to grow its pipeline.