White House After FTX Collapse: Crypto 'Risks Harming Everyday Americans'

On Thursday, the White House waded into the FTX collapse controversy, with White House press secretary Karine Jean-Pierre saying, “Without proper oversight of cryptocurrencies, they risk harming everyday Americans.”

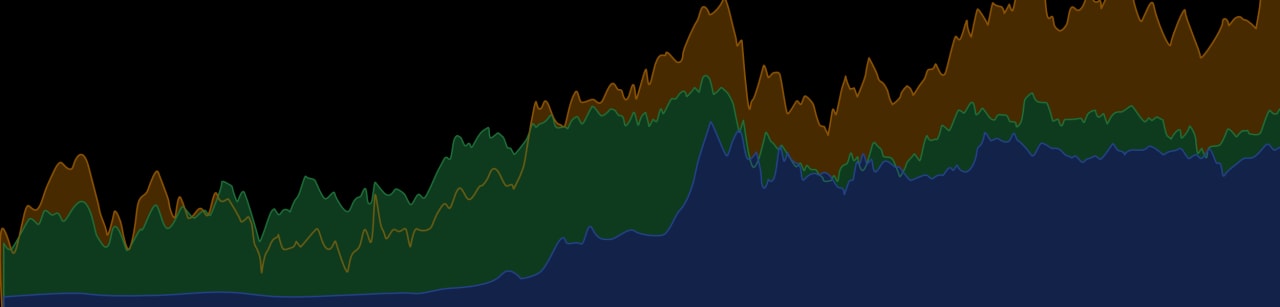

In the last 48 hours, one of the world's most prominent crypto exchanges, FTX, became mired in controversy after Binance dropped out of an acquisition bid of the company, declaring that FTX had "mishandled customer funds and alleged US agency investigations." The total market cap for crypto fell below the $1 trillion mark, and also saw Bitcoin sliding under $16,000 on Wednesday — hitting a new two-year low.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter - Crypto Investor.

"The most recent news further underscores these concerns and highlights why prudent regulation of cryptocurrencies is indeed needed," Jean-Pierre said about FTX. She added that the government and regulatory agencies were continuing to monitor the situation.

This immediately ignited fury from crypto enthusiast and U.S. government whistleblower Edward Snowden, who testily called the White House “opportunistic serpents" who were capitalizing on the moment to push for greater government regulation.

In the aftermath, some regulators have sounded the alarm about crypto and indicated that they were looking to leverage the moment to implement sweeping reforms and gain control in reining in the industry.

"Never let a good crisis go to waste," U.S. Commodity Futures Trading Commission commisioner Kristin N. Johnson said on TV, commenting that "global markets are fragile" and clear regulation and legislation were needed to prevent greater financial losses.

In the crypto industry, many CEOs are echoing a sentiment of wanting to clean up their house, metaphorically speaking. “We need to raise our standards,” Kraken CEO Jesse Powell said on Twitter. “The damage here is huge. An exchange implosion of this magnitude is a gift to Bitcoin haters all over the world.”