What Is Inflation? Definition, Formula & What It Means For You

What Is the Definition of Inflation?

Inflation is a measure of purchasing power. It’s defined as the rate at which the prices of products and services change over a given period (usually a year). Simply put, when inflation rises, consumer spending declines because when prices go up, people can’t afford to buy as much.

For example, when your grandfather tells you that the ice cream cone he is about to buy for $3.89 was just $0.50 when he was your age... that’s inflation. Over time, inflation effectively devalues a currency because the same amount of money buys fewer goods.

Expected vs. Unexpected Inflation

The thing about inflation is that it’s always around—it’s expected. We assume that the cost of everyday goods and services we need will increase gradually over time, and as such, economists factor it into their projections. Unexpected inflation, however, is a different story. This phenomenon occurs when inflation is recorded at higher levels than economists anticipate, and it leads to economic volatility. Governments and policymakers try to stem unexpected inflation and control its negative effects, which we’ll discuss below.

How Is Inflation Measured?

Expressed in percentage terms, inflation takes into consideration many factors, from broad measures like the overall cost of living in a country to more specific needs, like groceries, fuel, and heating costs—even the price of a haircut.

These products and services track specific segments of the economy. Economists categorize these segments into a measurement tool known as a market basket. They then compare the prices of the goods and services over different time periods, and as a result of their efforts, they are able to create an index of prices.

What Are Price Indexes?

There are two major price indexes created by the U.S. Bureau of Labor Statistics, which reflect consumer and wholesale goods.

1. The Consumer Price Index (CPI) measures changes in food prices as well as housing, clothing, automobiles, and other goods and services.

2. The Producer Price Index (PPI) tracks the change in prices of products before they reach consumers. These include raw materials, chemicals, fuel, machinery, fibers, grains, produce, and coffees, to name a few.

Both the CPI and the PPI illustrate similar rates of inflation when measured over long-term periods.

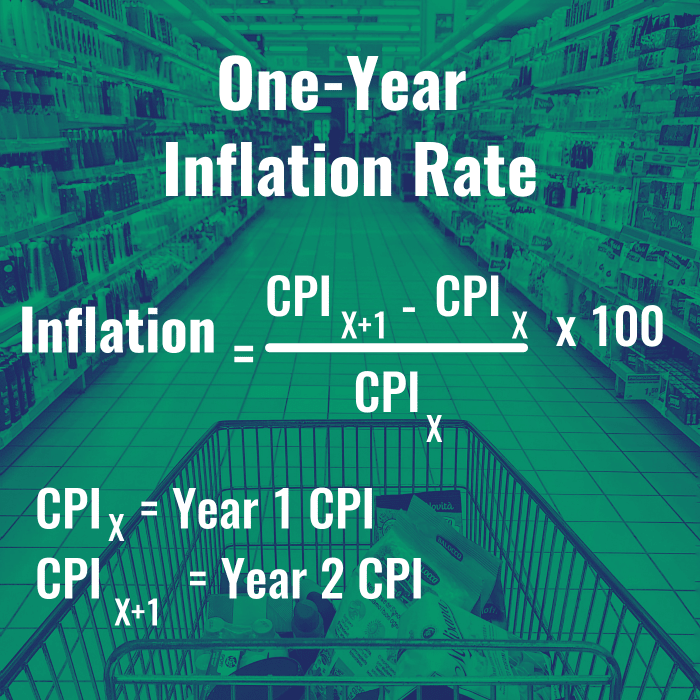

How Is the Inflation Rate Calculated?

The yearly rate of inflation can be calculated by taking the CPI over a two-year period and applying this formula.

To measure the rate of inflation over several years, the Bureau of Labor Statistics has created an Inflation Calculator, which is available at their website.

What Causes Inflation?

There are many factors that can cause inflation. Natural or man-made disasters, like wars or oil spills, can cause prices for raw materials to skyrocket. Increased consumer demand for products or services can also drive-up prices, causing inflation. Federal policies, such as raising or lowering interest rates, have an effect on inflation, as do monetary policies, which can enhance or devalue currencies.

What Are the 3 Types of Inflation?

Economists have defined three main types of inflation by their root cause:

1. Demand-pull inflation happens when there is an imbalance between supply and demand. When demand for a product outpaces production capacity, it causes a strain on resources, and this results in an increase in prices.

2. Cost-push inflation occurs when production costs increase prices. An example of this can be found in the energy sector. When the supply of crude oil is disrupted, demand may be unchanged, but gasoline prices will rise because supplies have lessened.

3. Built-in inflation happens when consumers expect inflationary pressures to persist through the future. In order to maintain their standard of living, they also expect their wages will rise in tandem. These increased wages, in turn, spur higher prices for products and services. This phenomenon is also known as a “wage-price spiral.”

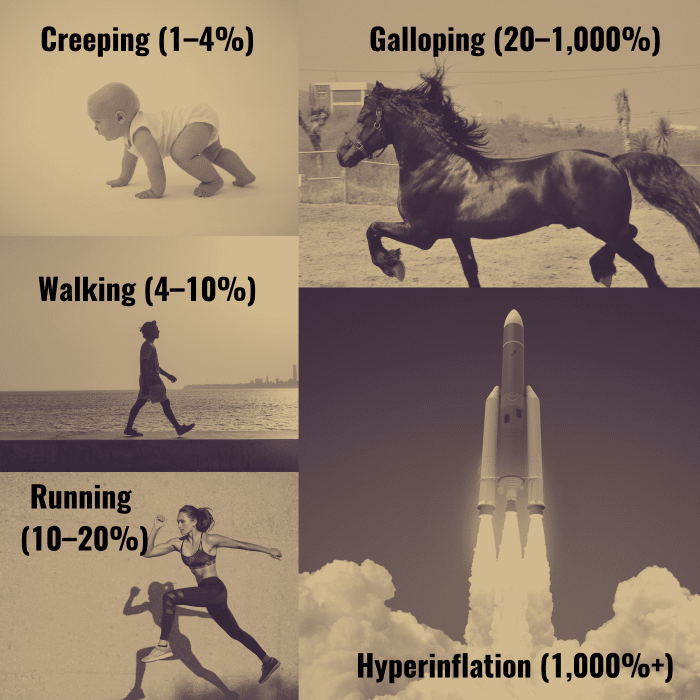

The 5 Speeds of Inflation

Economists have even developed a scale to define the speed at which inflation is increasing. The scale consists of five inflation speeds: creeping, walking, running, galloping, and hyperinflation. Creeping inflation can barely be felt in the economy, whereas galloping inflation illustrates a rapid increase in prices—one that can be challenging to control.

Inflation falls into one of five general categories depending on its rate.

Clockwise from top: Pixland via Photo Images; CanvaRosyMexico via Getty Images; CanvaCosmin4000 via Getty Images; Jacob Lund via Canva; Yogendra Singh via Pexels; Canva

How Is Inflation Related to Interest Rates?

The country’s central bank, the Federal Reserve, helps to regulate inflation by raising, maintaining, or lowering interest rates, which has a powerful effect on the overall economy. Their actions impact everything from borrowing costs in the real estate market to bond yields to the prices of raw material goods, like commodities.

Why Does Raising Interest Rates Curb Inflation?

It is widely accepted that lower interest rates spur economic growth. By their very definition, lower interest rates mean that the costs associated with borrowing money, i.e., the “interest” or premium an investor must pay to receive those funds immediately, is lower. When consumers pay less interest, they also have more money to spend and feel compelled to buy more—and more expensive items, like homes and cars—because it will cost less in the long run to pay for them.

In a similar way, corporations, factories, and even farms benefit from lower interest rates, as they, too, can afford to make larger purchases, like machinery or land, which could also spur productivity.

In an environment of rising interest rates, consumers typically cut back on spending and those big-ticket purchases, and as a result, the economy slows.

Ever mindful of inflationary pressures, the Federal Reserve will raise the Fed Funds rate when the CPI and WPI rise more than 2% or 3% a year.

How Is Inflation Controlled?

Consumers aren’t the only ones who borrow money, by the way. Banks lend money to each other, and the rate by which they do this is known as the Fed Funds Rate. Ever mindful of inflationary pressures, the Federal Reserve will raise the Fed Funds rate when the CPI and WPI rise more than 2% or 3% a year. This helps to keep inflation in check because when prices rise, demand falls, and so too does inflation. It’s a fine line the Fed must walk in order to achieve low inflation and price stability, and thus contribute to a healthy economy.

Is Inflation Good or Bad?

People generally think of inflation in negative terms—that’s because when prices rise and things become expensive, people can’t afford them.

However, inflation can be viewed positively by certain individuals:

- Borrowers can benefit from inflation, especially if it’s reflected as increased income. If the borrower took out a loan prior to inflation, and wages have increased, the borrower benefits because they have more money in their paychecks to pay off their debts.

- Individuals receiving Social Security enjoy an increase in their monthly benefits paychecks, which automatically increase when the CPI rises.

- Companies, too, can benefit from inflation—if they raise prices to meet surging consumer demand.

- Owners of tangible assets, like property or commodities, may enjoy the benefits of inflation, since it increases their value.

- Lenders may enjoy inflationary environments because they know when the Federal Reserve raises interest rates to curb inflation, they will receive a premium on the loans they have made.

It all depends on your point of view.

How Does Inflation Affect the Stock Market?

The stock market is often driven by emotion, and so even modest changes in the level of inflation can be viewed by investors as a signal to sell. Perhaps the greatest correlation between inflation and the stock market can be seen in earnings growth—or more specifically, investor expectations of said growth. For example, if inflation rises at a higher than anticipated rate, investors will expect to receive a premium on their investments to compensate for the increased risk they are taking. As a result, stock prices will likely fall.

How Does Inflation Affect the Housing Market?

The housing market is also affected by inflationary pressures. Lending becomes tighter and money more difficult to borrow when inflation is on the rise because mortgage rates are higher. Housing prices also tend to rise with inflation, along with the prices of other goods and services. This combination of factors effectively discourages people from taking out mortgages, which negatively impacts housing inventories and the economy in general.

Can Inflation Cause Unemployment?

Inflation does not affect the employment rate per se, but certain types of inflation, specifically wage inflation, are thought to have an inverse relationship with employment. An economist by the name of A.W. Phillips theorized that when unemployment is low and labor demand is high, employers will increase wages to secure the workers they need. He also found that in the opposite scenario, when unemployment is high and demand is low, wages will decrease, albeit slowly. His theory has come to be known as “The Phillips Curve.”

Glossary of Inflation-Related Terms

- Deflation, the opposite of inflation, happens when the prices of goods and services decline, usually due to changes in monetary supply. On the upside, consumer purchasing power increases, i.e., they “get more for their dollar,” although it must also be noted that deflation usually signals a slowdown in the economy.

- Disinflation, not to be confused with deflation, simply means that inflation is increasing at a slower rate than previously expected. For example, if the monthly CPI was measured at a 4.2% annual rate in June and 3% in July, prices disinflated by 1.2%—yet are still increasing at a 3% annual rate.

- Hyperinflation is inflation that is off the charts high and still accelerating. We are talking rates of 1,000%+. Hyperinflation has crippling effects on an economy and can crash a currency. In Hungary after World War II, the rate of hyperinflation was so bad the government needed to print a 100 quintillion dollar bill, making it the highest denomination ever issued.

- Stagflation is a toxic combination of high inflation, high unemployment, and little to no economic growth.