India to Launch Central Bank Digital Currency Trial

Starting November 1, South Asia's largest economy is planning to begin its pilot program for a central bank digital currency. The Reserve Bank of India has shortlisted nine banks to participate in the pilot project, including the State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC.

The project's initial focus will be on "settling secondary market transactions in government securities."

The government is hopeful the digital rupee program will making inter-bank transfers more efficient, reduce transaction costs and facilitate cross-border payments, particularly for remittances.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter - Crypto Investor.

Earlier this year, the central bank recommend expanding the definition of "bank notes" to include cryptocurrencies under the Reserve Bank of India Act, 1934.

However, this past June, India's central bank published a report declaring that crypto was not currency and lacked any intrinsic value.

“Cryptocurrencies are not currencies, as they do not have an issuer, they are not an instrument of debt or a financial asset and they do not have any intrinsic value. At the same time, cryptocurrencies pose risks,” the Reserve Bank of India said.

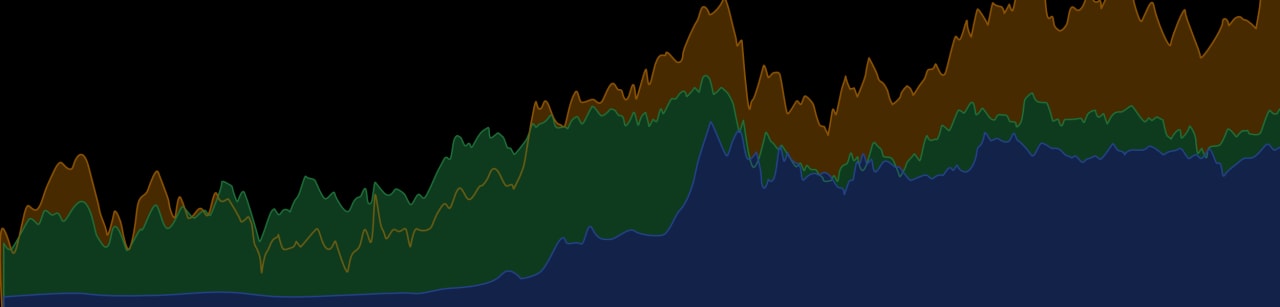

India has the highest crypto adoption rate in in the world after Vietnam, boasting more than over 100 million citizens investing in crypto, according to an estimate from crypto firm TripleA. Chainalysis’ Global Crypto Adoption Index last year placed India first in the world for adoption of virtual currencies.