With uncertainty in financial markets, it’s time to turn back to insurance and estate planning, focused strategy, and fundamental financial planning.

With the recent volatility in financial markets, there is a sudden rush to return to traditional, perhaps “safe” investments. And it’s a good time to revisit your estate planning.

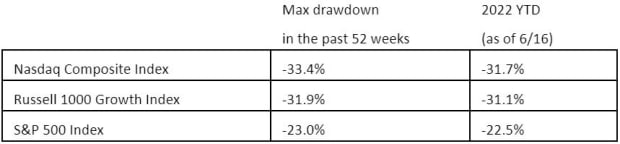

Our investment portfolios have dropped significantly in 2022 and, for many of us, our confidence in the financial markets remains uncertain. We know historically that “markets” have performed and provided us a stable way to systematically invest, with assurance that over time our assets will grow.

Hopefully, we are also reallocating our investments to reflect our risk tolerance as well as our need for liquidity as we age and consider retirement

There seems to be a renewed interest in certainty, in products like annuities and insurance, things that provide guarantees to families and to our retirement incomes, especially should the markets not return to some level of stability. Investors have returned to annuities and T-bills for certain investment returns—trading volatility for certainty—strategies not seen since the 2008 financial crisis. In short, people want to sleep at night!

Interest in life insurance has also suddenly skyrocketed, with people understanding that a reduction in their assets means fewer assets for heirs should they die prematurely.

Makes sense—with news reporting war, global and weather-related disasters, shootings and random killings, escalating crime (and even with the era of COVID potentially in our rearview mirror), we have all suddenly come face to face with events that bring us in direct view of our mortality. As Jim Morrison said, “No one here gets out alive.”

When was the last time you actually reviewed and contemplated the economic needs of your family or business, if you died tomorrow? What plans would you want to have in place if your ability to buy life insurance changed tomorrow?

Most people buy a term life policy, “set and forget it.” Maybe a million dollars isn’t what it was years ago. Surely it doesn’t last as long as it did. In fact, I’ll argue that most of us are under insured. By a LOT.

There are assets, and then there is liquidity. Life insurance brings liquidity to situations at the exact right time.

Life insurance brings money to families who many times have lots of assets, but don’t have liquidity. Most people but term insurance; they set it and forget it.

The problem with these TERM insurance policies is that they are most likely to expire way before you do. Policies don’t get updated or refinanced. Then WHAM, you’re too old to requalify. Or its too costly.

If you’re someone who hasn’t revisited your life insurance policies in the last several years. this is the right time. Term life insurance rates are at an all time low—and there are NEW types of term policies, policies that “spring to life” and can pay for things like long-term care if you need money while you’re alive. (Your current policy likely doesn’t do this.)

Life insurance can be a tool to transfer wealth, preserve assets, and make sure that all those special events (like weddings, home purchases, retirements, and grandchildren) get something special and create legacies.

With the cost of life insurance being at an all-time low and underwriters seeking year-end revenue this is an extremely good time for you to be revisiting your life insurance portfolios.

People who plan are always more successful than those who fail to plan, or those whose plan is simply “whatever.” What’s your plan?

Martin Levy, CLU/RHU is founder of Corporate Strategies Inc./CorpStrat, located in Woodland Hills, Calif. A 30-year insurance industry veteran and Lifetime Member of the Million Dollar Round Table, Levy is an expert in long-term care planning strategies. (818) 468-0862, [email protected]

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>The Chinese Communist Party has planted over 100 million recording devices under our noses. This new technology is recording your face, your voice, and your daily routine. It can hack computers or iPads located in a 5-foot radius and send valuable data back to Beijing.

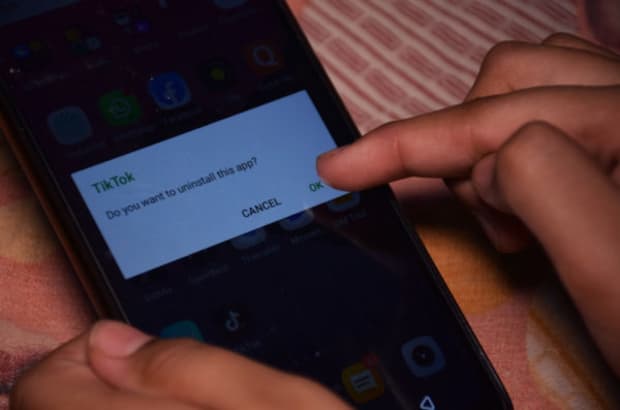

If you spent any time today in a train, grocery store, or crowded café, you passed by somebody carrying this device.You won’t have noticed them. They might even have been a child. If you are the parent of a teenager, chances are this device has already made its way into your home. Its name is TikTok.

These staggering revelations entered the public record earlier this month, when a court settlement in Illinois awarded nearly $100 million to victims of flagrant data theft and privacy violation. In addition to exposing repeated lies by TikTok about the extent of its overreach, the court documents revealed in no uncertain terms the recipient of this enormous quantity of stolen information: the Chinese Communist Party (CCP).

Americans recognize China as our greatest enemy, yet TikTok usage among children continues to grow. While questions have been raised previously about this app’s affect on teenagers’ study habits, body image, and mental health, new revelations paint a sinister picture: TikTok is a weapon of war, insidious and dangerous like no weapon our country has ever faced. Problem is, nobody wants to do anything about it.

Last week, Federal Communications Commissioner Brendan Carr recommended that President Biden and the Council on Foreign Investment in the U.S. (CFIUS) ban TikTok once and for all. The commissioner, who previously urged Apple and Google to remove the app from their stores, spoke out following this new round of revelations concerning data access by parent company ByteDance, a Beijing tech corporation with a close relationship to the CCP.

Currently, the Biden administration is moving forward with a deal they believe can protect the data of TikTok users, but repeated privacy violations by ByteDance prove that these measures are not sufficient. In addition to Carr, officials within the Departments of Justice and Treasury have expressed concern that this deal could allow China to continue to use TikTok for surveillance.

While attempts to prohibit the app fizzled in 2020, the need for a TikTok ban has never been so clear. China is using this app as a backdoor to surveil, infiltrate, and manipulate the lives of more than 100 million Americans. Its capacity for surveillance is so far-reaching that TikTok can even access classified materials from devices that have never installed the app. The new evidence out of Illinois, along with even more proof of espionage discovered by Apple, means that a ban is no longer a discussion but an inevitability.

We can no longer doubt that a child’s favorite video platform is responsible for the greatest intelligence leak to a hostile foreign power seen in our lifetimes. Rather than attempt to bail us out with diplomatic half-measures, President Biden should use CFIUS to eliminate this weapon and plug the leak at its source.

Such a ban may require bipartisan cooperation, and threatens Democrats’ popularity among teens. Yet the only alternative is ceding the most important cybersecurity decision of our lifetimes to Republicans.

THE PEOPLE BEHIND THE APP

It’s like something out of a science fiction movie. Tens of millions of Americans have been seduced by viral pet videos and seven-second dance tutorials to download a free new software, unaware of its dark secret: The app is free because its users are the product, and the buyer is the CCP.

Ideally, a video platform such as TikTok would allow creators from across the world to express themselves without fear of government censorship or surveillance. As co-founder of Triller, I have seen the ways that short-form video content can promote understand and bring people together. Instead, the video landscape is dominated by a dishonest and dangerous software that seeks to exploit its users, who are often the youngest and most vulnerable members of our society.

Today’s teenagers watch more TikTok than YouTube. Yet the newer app is particularly aggressive in its collection of user data, and owned by a shadowy corporation that answers to the Chinese government and the CCP. All TikTok users are introducing into their homes a Trojan horse that can access any device in its range. Our politicians are fully aware of this fact, and President Biden has recently increased efforts to limit Chinese influence in the microchip market. This week, the German government followed suit. Ending TikTok should be next.

Though a ban may provoke some outcry from its users, taking such a dangerous weapon out of the hands of the CCP must take precedence over the risk of seeming “uncool.” For any who doubt the true purpose of this app, look no further than the history of parent company ByteDance.

Created in 2012, ByteDance has rapidly risen to the forefront of the Chinese tech world, with an annual revenue of $34.3 billion and close to 2 billion active users. The rise of ByteDance has been nothing short of meteoric, and can largely be attributed to two entrepreneurs with close ties to the CCP: tech mogul Zhang Yiming and financier Neil Shen.

An engineer who cut his teeth at Microsoft, Zhang created his company with the intent of serving as a preeminent aggregator of user data. That’s right: The users were always the product. After launching a news service and a meme-sharing app (an early probe into teen audiences), ByteDance ventured into the world of video content with the launch of Douyin, a popular Chinese-language service very similar to TikTok.

Since the start, Zhang set his sights on the global market. The success of Douyin allowed ByteDance to purchase lip-sync app Musical.ly, a rival Chinese product with a young and international userbase. Rather than merge the two Chinese apps together, ByteDance kept Douyin exclusive to the Chinese market and rebranded Musical.ly as TikTok, gaining access to a massive new market for overseas user data.

At first glance, the two apps appear identical. However, the Chinese version is stored on separate servers and has far stricter rules of content moderation. Most importantly, only TikTok uses state-of-the-art technologies to track its users and keep them addicted to short-form content. As noted in a 60 Minutes segment earlier this week, it is revealing that China prohibits TikTok in their own country while pushing it to the children of their international rivals.

Zhang claims to not be a card-carrying member of the CCP. However, he was recognized as a de facto Beijing spokesman in a 2020 filing by the Department of Justice (DOJ). DOJ lawyers demonstrated the ways Zhang has repeatedly promoted the CCP agenda: In 2018, before the rise of TikTok, he even made a public show of submission after one of his other apps was accused of violating “socialist core values.”

Despite its creation by this identified CCP ally, TikTok is based here in Los Angeles and presents itself as partially American-owned. This is a charade. The truth can be exposed with a quick look at the man behind the financial curtain: Neil Shen.

Founder and manager of Sequoia China, the primary shareholder in ByteDance, Shen uses this venture capital firm’s affiliation with its San Francisco parent company to conceal his ties to the CCP. Sequoia China has received direct funding from party entities such as the Chinese Academy of Sciences. Any claims of American ownership are farcical.

Much like his partner, Zhang, Shen is an essential part of the CCP strategy to influence the tech sector both in China and abroad. Best known as the largest single investor in the Chinese tech sphere, he has close ties with party leadership and even employed the daughter of a top Politburo official. In March, was appointed as the sole delegate of the venture capital industry at the Chinese Peoples’ Political Consultative Conference, an arm of the Chinese government that advises the party on economic matters.

LAYERS OF CONCEALMENT EXPOSED

In addition to being financed by a close CCP ally, American TikTok employees have revealed that corporate decision-making involves direct input by Beijing. Despite official statements to the contrary, ByteDance executives exert significant control over the company’s activities in the U.S. and retain the ability to access all user data collected by TikTok.

It must be stated that CCP control over ByteDance is crystal clear. Unlike here in the U.S., Chinese corporations like ByteDance are required to give one of three seats on their board to the government. This gives the CCP de facto control of all decision-making, and ensures that the company’s corporate goals match the goals of the state. Additionally, at least 300 current employees of TikTok and ByteDance have worked or still work at CCP media outlets. American companies that do business with Chinese tech may not realize that they are inevitably working with the CCP.

TikTok has attempted to distance itself from ByteDance despite sharing employees and even a Palo Alto workspace. Yet their own privacy policy admits that the app may “share your information with a parent, subsidiary, or other affiliate of our corporate group.” In other words, if you download TikTok, your name, your location, and even your face are being sent to ByteDance executives in China, who then offer full access to CCPleaders.

These concerns were first raised in 2020, during the Trump administration’s abortive attempt to ban TikTok. When questioned about user data being sent to China, TikTok and ByteDance denied everything. They claimed that all user data is held in the U.S. and Singapore, and is not accessed by the CCP. Thanks to the recently settled class action complaint, we know this was a lie. These new documents reveal exactly what TikTok is stealing from us, and how they do it.

The lawsuit contained damning evidence about the app’s use in Chinese government surveillance and exposed repeated attempts to conceal this fact. Take the previous claim that no data is sent to servers in China:

Defendants used the TikTok app to transfer private and personally identifiable user data and content to the following two servers in China as recently as April 2019: (i) bugly.qq.com and (ii) umeng.com. 221. Private and personally identifiable TikTok user data and content transferred to bugly.qq.com as recently as April 2019 includes at least the following items: (i) the OS version; (ii) the mobile device model; (iii) the WiFi MAC address; (iv) the hardware serial number; (v) the device ID and (vi) the IP address. Private and personally identifiable TikTok user data and content transferred to umeng.com as recently as April 2019 includes these same six items, plus at least the following item: (vii) the number of bytes users’ mobile devices have uploaded and downloaded.

This is unambiguous. An independent analysis has revealed that if you use TikTok, your data is being sent to China. And once your data arrives in China, it is the property of the CCP.

CCP domination of the Beijing tech sector is widely understood. According to risk analyst Gabriel Wildau, companies such as ByteDance have no insulation from party pressure, as “the party-state wants the business community to serve its development objectives and is willing to sacrifice corporate profits to make that happen.”

Chinese tech companies are routinely pressed into performing surveillance or harassment duties on behalf of the CCP, including persecution of the Uyghur minority. One of these companies, the tech giant Baidu, patented a biometric technology that tracks users’ faces to determine ethnicity—a useful tool in the CCP campaign to identify and detain mass numbers of Uyghurs. And as this Illinois lawsuit reveals, Baidu is using these tactics not only to track dissidents in China, but everyday TikTok users right here in the United States:

Baidu, Alibaba, and Tencent—popularly known by the acronym BAT – are China’s original tech titans and dominate the fields of artificial intelligence, social media, and the internet in China. The private and personally identifiable TikTok user data and content they possess may well be used by the Chinese government in the future, if it has not already. BAT routinely assist the Chinese government in the surveillance and control of its people through biometrics.

Biometric surveillance involves the use of new technology to track specific details of users’ faces and voices—anything that makes us unique as individuals. This kind of data is especially valuable because, unlike a password, this biometric information can never be changed or recovered.

China now leads the world in facial recognition software, and Chinese startups have been sanctioned by Washington for allowing the Chinese government to use their technology to track, harass, and imprison dissidents. TikTok needs to be understood in this context: It is another tool in the CCP arsenal of mass international surveillance.

As the court documents reveal, BAT tech companies operate the Chinese servers that we now know are used to store TikTok data:

The bugly.qq.com server is owned and operated by China-based tech giant Tencent Holdings Limited (Tencent), and the umeng.com server is owned and operated by another China-based tech giant Alibaba Holding Group Limited (Alibaba). Tencent and Alibaba thus possess TikTok users’ private and personally identifiable data and content. Such data transfers to Tencent and Alibaba servers were accomplished through Tencent and Alibaba source code that Defendants embedded within the TikTok app.

This link between BAT firms and TikTok goes deeper still. Source code created by Baidu is embedded within the app, and TikTok relies on similar biometric techniques to track and capture the faces and voices of users. In 2020, ByteDance VP Ma Wei-Ying gave a speech in English in which he bragged about the company’s use of new techniques to track users and store biometric data in a massive database that can be accessed by the Chinese government. U.S. National Security Adviser Rob O’Brien has warned that all biometric data accessed by ByteDance is inevitably accessed by the CCP.

Additionally, TikTok includes software known as Igexin SDK, notorious for its function as a “back door” to install Chinese spyware on users’ devices. In 2017, Google and Apple removed 500 apps made with Igexin SDK from their store after it was determined that these apps could secretly track users’ phone calls.

Before TikTok, Chinese law enforcement relied more heavily on the products of American tech companies to track users in China and abroad: In the first half of 2017 alone, the CCP requested information from Apple on 35,000 of its users. The rise of TikTok allows the party to cut out the middleman. If the world is hooked on an app developed by a party-controlled company like ByteDance, and financed with party money, then the CCP can track users around the world using homegrown surveillance technology.

The CCP’s control over ByteDance is not a secret. Beijing has an ownership stake in the company and exerts significant control over corporate decision-making. Like the nesting dolls sold in another communist country, the CCP controls ByteDance and ByteDance controls TikTok. These layers of concealment give TikTok users and investors the false sense of a public-private distinction that does not reflect the reality of business in China. When presented with the facts, there can no longer be any doubt that your children’s favorite app is a weapon of the Chinese state.

The CCP is clear in its goals: a global takeover of the artificial intelligence sector, and use of these technologies to track individuals anywhere on earth. Techniques of surveillance, blackmail, and harassment deployed against dissidents in China can and are being used against American citizens.

Just weeks ago, we found the smoking gun: A team of ByteDance officials in Beijing had used TikTok to track the behavior and whereabouts of a U.S. citizen. According to a Forbes exposé, at least one user with no professional relationship with ByteDance was being tracked for unknown purposes on behalf of the government. Once this information is sent to China, there is no way for American users to prevent their data from falling into the hands of the CCP.

FAR-REACHING, AND DANGEROUS, IMPLICATIONS

We know the Chinese government uses TikTok’s data-collection abilities to surveil its users, who number in the hundreds of millions worldwide. But what kinds of user data are they accessing? As the Illinois court documents reveal, everything from the sound of your voice to the drafts in your inbox will be recorded and collected for future use.

TikTok has a simple, friendly interface that encourages users to join through their Facebook or Google account. It’s unlikely that fans of the app realize that this single sign-on feature gives TikTok complete access to the contents of any of those social media accounts. Once TikTok has been downloaded, any kind of sensitive material held in a Gmail account is put at risk.

Even users who do not upload videos are at risk of data collection. When you install TikTok, this app immediately begins searching your device for valuable information. You do not need to create an account or ever open the app:

From each mobile device on which the TikTok app is installed, Defendants take a combination of, among other items, the following user identifiers and mobile device identifiers:

- username, password, age/birthday, email address, and profile image

- user-generated content, including messages sent through the apps

- phone and social network contacts

- the mobile device’s WiFi MAC address, which is the unique hardware number on the WiFi adapter that tells the internet who is connected to it

- the mobile device’s International Mobile Equipment Identity number, which is a unique number given to every mobile device that is used to route calls to one’s phone

- the user’s International Mobile Subscriber Identity number, which is a unique number given to every subscriber to a mobile network

- the IP address which is a numerical label assigned to each user mobile device connected to a computer network that uses the Internet Protocol for communication.

- the device ID, which is a unique, identifying number or group of numbers assigned to the user’s individual mobile device that is separate from the hardware serial number

- the OS version

- the mobile device brand and model

- the hardware serial number, which is the unique, identifying number or group of numbers assigned to the user’s individual mobile device

- the Advertising ID, which is a unique ID for advertising that provides developers with a simple, standard system to monetize their apps

- mobile carrier information

- network information, including the technology that the carrier uses

- browsing history

- cookies

- metadata

- precise physical location, including based on SIM card, cell towers and/or GPS.

Together, all this information allows TikTok and ByteDance, and by extension the government of China, an exceptional ability to track any given individual in the United States. And “track” doesn’t just refer to web-viewing habits—China can pinpoint the physical location of every single person who has TikTok on their device, down to the very floor of a building where a user is standing.

TikTok facial recognition software is another area of great concern. The app’s source code contains lines to detect facial features and face motion, which it uses to predict age, gender, and ethnicity when recommending videos:

When artificial intelligence researcher Marc Faddoul joined TikTok a few days ago, he saw something concerning: When he followed a new account, the profiles recommended by TikTok seemed eerily, physically similar to the profile picture of the first account. Following a young-looking blond woman, for instance, yielded recommendations to follow more young-looking blond women. … Following black men led to recommendations to follow more black men. Following white men with beards produced recommendations for more white men with beards. Following elderly people spawned recommendations for other elderly people. And on and on. … Faddoul also told Recode that he believes it’s more likely that TikTok is using something he calls automatic featurization. This type of recommendation algorithm could take signals from profile images to find profile pictures with similar attributes. These kinds of signals would be correlations between the pictures, which could correspond to anything from skin color to having a beard. The algorithm is simply looking for similarities in the photos or profiles. … What I suspect is happening is that TikTok is featurizing the profile picture, he says, and using these features in the recommendation engine.

This data collection, which happens completely without the consent of the users, is especially concerning in light of China’s push to create an international biometric database.

Any users who have ever activated the in-app camera may find themselves included in Chinese government databases, and can be tracked by Chinese spyware for the rest of their lives. This kind of a database represents an unprecedented privacy threat. With the rise of “deep fake” manipulated videos, access to our faces and voices can be used to blackmail everyday citizens or sow distrust in our leaders and institutions.

Another important feature is the app’s ability to access the user’s clipboard, a feature not disclosed in its terms of service, which means any text, image, or web link that is ever copied may be held forever on ByteDance servers. Not even unsent messages are safe. TikTok records keystrokes, which means that any words or letters ever typed on a device will potentially be recorded, regardless of whether these words are ever uploaded to the internet.

Perhaps the most threatening security implication involves Apple’s Handoff function—a usually innocuous feature that allows TikTok to access information stored on other devices with a shared Apple account. This is how Apple users can access their SMS inbox from their laptops. But when given to the wrong hands, Handoff allows a hacker who has gained access to a cell phone to break into connected devices, such as a government-issued laptop with the same Apple login. This feature also allows communication between different Apple accounts, and the Illinois court docs allege that TikTok has used this feature to access data stored on entirely unconnected devices located nearby.

These revelations paint a clear picture: TikTok operates like a highly effective piece of malware that spreads, like a virus, to effectively any electronic device in its proximity. People who have installed the app lose control of their data even if they never use TikTok, and simple physical contact with another online device can expose others’ data and documents.

Former congressional national security advisor Klon Kitchen, now a senior fellow at the American Enterprise Institute, summarized the threat on 60 Minutes:

Imagine you woke up tomorrow morning and you saw a news report that China had distributed 100 million sensors around the United States, and that any time an American walked past one of these sensors, this sensor automatically collected off of your phone your name, your home address, your personal network, who you’re friends with, your online viewing habits and a whole host of other pieces of information. Well, that’s precisely what TikTok is. It has 100 million U.S. users; it collects all of that information.

If the cause for alarm is still not clear, let me illustrate how easily this app can threaten our national security. A congressional staffer with top secret security clearance is handling documents concerning electric-grid vulnerabilities in their congressperson’s district. These documents are stored on a laptop computer that is only accessed for work purposes. Even if this laptop is kept in a tote bag or in the trunk of a car, a five-second encounter with a nearby TikTok user allows the app access to the mailbox or documents stored on the staffer’s laptop. The electric grid documents are collected by ByteDance employees, who send them to the ever-growing Chinese database of stolen American intelligence. Now consider that 1.2 million people have top secret security clearance, and a full 2.8 million have some access to classified government materials. Most likely, this situation has already happened.

Cyberspace is the front line of the escalating United States conflict with China. Hackers employed by the Chinese government have gained access to at least six state governments and multiple federal agencies. Teams of Chinese hackers have stolen technology from research universities and corporate secrets from many prominent businesses. In 2018, CCP hackers seized data from half-a-billion customers of Marriott hotels.These underhanded tactics are an assault on both national security and free trade. As per the FBI:

The Chinese government is fighting a generational fight to surpass our country in economic and technological leadership. But not through legitimate innovation, not through fair and lawful competition, and not by giving their citizens the freedom of thought and speech and creativity we treasure here in the United States. Instead, they’ve shown that they’re willing to steal their way up the economic ladder at our expense.

The FBI has teams working around the clock to counter the efforts of Beijing cybercriminals. But as the Chinese and American economies become increasingly interconnected, particularly in the world of tech, more avenues open for unscrupulous actors to gain access to sensitive information pertaining to business or the military. If TikTok usage continues to spread, Chinese hackers may be able to access this kind of material without needing to crack a single encryption.

In an attempt to staunch the bleeding, the Department of Defense has blocked its members from accessing TikTok. Thanks to the Handover feature and other methods of inter-device communication, this is not sufficient. Servicemembers’ devices constantly communicate with the devices of a child, friend, or spouse who has ByteDance software installed. Much like the current ongoing security negotiations with TikTok, this kind of quick fix cannot be effective at stopping China from accessing Americans’ information. If the White House is serious about protecting our data and keeping us safe, then they will recognize that there is no way to outsmart such an effective weapon. The only recourse is to ban it.

Because if they don’t do it, somebody else will.

A TIKTOK BAN IS INEVITABLE—AND OVERDUE

Inaction on this front leaves the Biden Administration and the entire Democratic party wide open to criticism by Republican opponents. Figures such as Mike Pompeo have criticized Barack Obama and other Democrats for normalizing TikTok usage by using the platform for voter outreach.

While many criticized Trump administration efforts to ban the app or divest it from Chinese ownership, Democratic leaders such as Senator Mark Warner have acknowledged that “Donald Trump was right on TikTok,” stating: “If your kids are on TikTok … the ability for China to have undue influence is, I think, a much greater challenge and a much more immediate threat than any kind of actual, armed conflict.”

A bipartisan letter penned by Senators Chuck Schumer and Tom Cotton to the National Security Council in 2020 underscored these concerns, emphasizing that “TikTok is a potential counterintelligence threat we cannot ignore.” Over the summer, Senator Cotton urged Treasury Secretary and CFIUS chair Janet Yellen to discuss with President Biden the possibility of resuming the discussed ban on TikTok.

Revelations from the recent $100 million settlement in Illinois vindicate attempts to ban TikTok by the previous administration. This new proof of TikTok’s use as a weapon by the CCP should compel the White House to finish the job. There is an international precedent for such action: Other governments, such as India, Pakistan, and Indonesia, have already enacted bans on TikTok.

Such a ban is also well within the authority of the federal government. Statements by U.S. lawmakers suggest bipartisan interest in potential legislation to prohibit the app. Alternatively, CFIUS can shape our regulatory landscape in ways that make it impossible for malicious apps such as TikTok to operate legally.

So far, the Biden administration has still been unwilling to criticize TikTok directly. In addition to the ongoing negotiations that may do more to protect ByteDance and our security, a recent press conference highlighting intelligence threats from China neglected to mention which app or tech company is at the center of Chinese espionage operations.

This hesitation is understandable. TikTok is particularly popular among young people—Pew Research Center reports that nearly half of those under 30 use the app. However, recent polling data indicates that a majority of Americans ages 18–24 and a plurality of those ages 25–34 support a ban. Any potential Gen-Z ire will evaporate once TikTok is supplanted by a new short-form video platform, just like Vine or Periscope before it. Its replacement will not be a weapon of war created by a hostile foreign power.

Commissioner Carr believes that a ban on TikTok is inevitable. This was followed by IAC Chairman Barry Diller’s prediction that the app will be banned.

The writing is on the wall. I urge the Biden Administration to use CFIUS to ban the app as soon as possible and not leave this to a future administration.

As I noted in my previous op-ed, President Biden has already shown the good sense to ban TikTok usage by campaign staffers, close associates, and even members of his family. The next step is extending this protection to the rest of the country.

Whichever party bans this rapidly growing software will prove they have the courage to defend our country from foreign threats and the foresight to identify dangers that were unimaginable before our social media age. If President Biden banishes TikTok from our shores, he will dismantle the greatest weapon China has in its assault on our safety and our liberty, and demonstrate that Americans’ lives are not for sale.

Ryan Kavanaugh is the 26th highest grossing movie producer of all time and the co-founder of Triller, one of three fastest growing social media apps.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>At the helm of PacSun, Brieane Olson has focused on the intersection of the virtual and physical spaces, along with community impact, which is at the core of the brand. Over the past two years, PacSun has announced partnerships with ASAP Rocky, Jerry Lorenzo, the Los Angeles Rams, and, most recently, New York’s Metropolitan Museum of Art and ComplexCon. Here, she shares the brand’s evolution from retail into virtual gaming spaces and beyond.

TELL ME ABOUT THE CULTURE OF PACSUN AND THE IMPRINT ACROSS CULTURE FROM MUSIC, SPORT, DIGITAL, AND INNOVATION.

I’ve been at PacSun for 16 years so it’s been a unique journey of reinvention and a fluid evolution of our customer. I would be remiss to talk about our brand without first talking about our consumer as we consider our consumer to be at the forefront, as the cultural pioneers of the future. Our brand is right at the intersection of culture from sport to fashion, so anything relevant to that Gen Z consumer is our mission to cultivate and create these really powerful moments for our brand. Not only is the PacSun brand representative of that, but you can see that across our brand partners and the collaborations that we bring to life. The consumer is at the heart of what our PacSun purpose is and what propels our values and decision-making. Creativity and innovation are key, along with a keen focus on the sweet spot of our consumer demo being 16 to 24.

CAN YOU SHARE HOW THE BUSINESS CHANGED AND YOUR PLANS COMING OUT OF COVID?

We all had to pivot and adjust plans, but there were some real growth opportunities. From a leadership standpoint, COVID was trying for a lot of organizations because you had your teams fully remote. For PacSun’s leadership team, we had a core advantage of having our team working together for over a decade. These close relationships that were already in place both professionally and personally helped us improve our performance and created a closeness despite being fully remote. Having a close-knit and tenured team that had worked together for years made it more manageable to motivate, inspire, and lead a team through what was a very challenging chapter of the pandemic. Our results in 2020 and 2021 were quite humbling because, despite what was happening globally, we had some of the best revenue performance in years. I think a large part of it was that there was a large macro push towards athleisure and casual clothing with everyone at home. Also, there was a real focus on culture and being able to connect from a digital standpoint, which we had a head start on.

WHAT IS YOUR APPROACH ACROSS DIGITAL AND EXPERIENTIAL LANDSCAPES?

We are ensuring that we create experiential moments with the customer, whether we are building on Roblox or at retail in our stores. We realize how important identity is in the virtual space. Social interaction and academic engagement all became digital during the pandemic. I’m fascinated with the evolving relationship between identities in the virtual and physical spaces as a brand and the corporate and social responsibility and role brands play in helping to navigate the space.

HOW DOES PACSUN UTILIZE SOCIAL PLATFORMS AND HOW DOES THIS ENHANCE THE PACSUN BRAND’S STORYTELLING?

Our PacSun team flourishes in moments where there’s reinvention or a real need for creativity and innovation. We did a lot of experimentation and exploration into new spaces. We grew our TikTok platform in 2021 to a million followers. After 18 months we had 1.6 million followers, and recently in 2022 eclipsed the 2 million mark. We think about it as a way to engage, whether it’s from an entertainment standpoint, product focus, or community engagement where we can amplify the voices in our community. For the majority of the pandemic, we focused on evolving and extending our brand voice—whether on Pactalks, TikTok, Snapchat, or gaming—allowing the amplification of our brand voice through brand ambassadors and going well beyond the traditional approach with influencers.

CAN YOU TALK MORE ABOUT THE IMPORTANCE OF THE PHYSICAL VERSUS VIRTUAL SPACES AND HOW YOU ARE STAYING AT THE FOREFRONT OF THESE TRENDS?

The metaverse can feel overwhelming for a brand trying to navigate their voice in the space, but how and why you determine how to make moves, with which partners and being true to what your resources are, are all key questions as you begin. For Pacsun, we looked to our consumers, as young as Gen Alpha, as we made some progressive moves in this space. I think a really important point of delineation is that PacSun is not trying to chase the metaverse because it is a trendy thing to do. Our desire to enter the metaverse actually came from our in-depth consumer research over the past few years, and a recognition that many young consumers are really into gaming. The pandemic accelerated the growth of digital, but PacSun had already strategically invested in our long-range plans towards digital integration and acceleration, so our growth was well prepared. Many luxury brands have done a phenomenal job leading the way. PacSun is in a really exciting stage of exploration, innovation, and experimentation. When things don’t work, we use it as a learning and evolve, because we know growth comes from exploration and that means success and failure. In order to see growth and pioneer the future, you have to push boundaries and get a bit uncomfortable.

TALK TO US ABOUT YOUR ROBLOX INTEGRATION.

We were one of the first brands to have our catalog of PacSun-branded clothing on Roblox. We saw such amazing engagement from the consumers and replication of styles and I see that as a great honor when the consumer is replicating your styles because they want to get that look. We fondly coined that “product emulation,” and it is a true testament to brand affinity for us.

CAN YOU SHARE SOME OF THE UNEXPECTED BRAND EXTENSIONS PACSUN HAS BROKEN INTO, INCLUDING CREATING ITS OWN GAME?

The expansion of the PacSun brand into gaming was more challenging than we had anticipated. We anticipated a shorter timeline, but when we went to build the game, we were working on it for far more months than anticipated. Our brand expanded beyond gaming this year. In our spring 2022 campaign we bridged the concept of the physical and virtual worlds with [social media influencer] Emma Chamberlain, and marked a key milestone for Emma’s first virtual avatar; similar to ASAP Rocky in his first NFT, she chose to keep her identity similar to her true physical self when debuting in the virtual space.

SoundBytes is a marketing collective bringing best-in-class marketers together to propel collaboration, innovation, and deal-making, featuring a diverse range of speakers and addressing key topics across entertainment, music, sports, and media. The mission of Soundbytes is to build community, create authentic connections by sharing insight and intel to help propel collaboration and business objectives forward into the future. Run by Michelle Edgar and Jessica Nuremberg, SoundBytes has curated over 30 sessions featuring Fortune 500 C-suite marketers.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>We live in tumultuous, uncertain times, and the destiny of every organization depends on how well it can leverage its human capital in general, and its top talent, in particular.

As I have mentioned a few times before in CSQ, the importance of talent management in times of crisis and change is difficult to overestimate. Talented employees always remain in demand—in a good economy, they are your most valuable assets that provide extraordinary value, while in difficult economic conditions, they are the ones who can keep your company afloat and competition at bay. In times of change, talent is the only true strength organizations can rely on.

As the “Great Resignation” has shown, people no longer want meaningless and thankless jobs; they would rather stay away from the regular workforce than go back to a “hamster wheel” of nine-to-five office work. However, the peak of mass voluntary turnover seems now to be behind us, and most companies can finally refocus their talent management endeavors from talent acquisition to talent retention.

Organizations should not yet breathe a sigh of relief, though, since instead of the “Great Resignation,” it appears that we are now dealing with the “Great Recalibration,” when people begin rethinking the role of work in their lives. Retention is not only about good compensation, developmental opportunities, and great working atmosphere anymore, but is also about flexibility, trust, purpose, balance, asynchrony, and emotional well-being. Smart organizations are, therefore, already starting to adjust retention strategies around these important factors.

Some experts recommend that organizations work on creating “sticky” workplaces, those that people do not want to leave. It goes without saying that adequate compensation, benefits, and career growth opportunities should just be the first step— necessary but definitely not sufficient. To take the next step and begin creating a sticky workplace, it is necessary for managers to listen to their employees, addressing their concerns, anticipating their needs, promoting health and wellness, supporting open, transparent, and multidirectional communication, and establishing and maintaining trust, among other strategies. To build your own sticky workplace, it is essential to understand the basic assumptions that underpin this model.

Work stickiness is based on the notion of job embeddedness, which is a relatively novel concept in the world of people management, especially when it comes to talent retention. The traditional view on the issue of retention includes the factors from voluntary turnover research (job satisfaction and the absence of job alternatives) and other positive behavioral aspects of an employee’s attitude toward their job (organizational commitment, perceived management support, etc.). The more recent research has shown, however, that there are more factors that make employees stay with a company. The first set of factors includes all sorts of off-the-job aspects of an employee’s life, such as family pressure, community commitment, and hobbies. The second set involves the emotional attachment an employee has to their co-workers, various company activities, perks, and job routines. Scholars used the term “embeddedness” to combine all of these factors that greatly influence retention.

Simply put, people stay not only because they are satisfied with their jobs and have no other job alternatives, but also because they are embedded into their jobs via various links to their families, co-workers, and communities.

Researchers argue that job embeddedness consists of three key factors: links, fit, and sacrifice.

- Links are defined as the connections people have with other people or groups of people. Links could be either on the job, such as professional associations, or off the job, such as a church community.

- Fit is an employee’s perceived match with their job, company, and local community. Just like with links, fit could be either on the job (compatibility with co-workers, corporate culture, etc.) or off the job (compatibility with family schedule, etc.).

- Sacrifice is an opportunity cost of what people have to relinquish if they decide to leave. Most sacrifices involve financial inducements—such as retention bonuses, stock options, and educational funds—that people forgo if they leave. However, the more important sacrifice people can make is to give up an opportunity for long-term professional development with the company, flexible working arrangements, mental health support, pleasant organizational environment, among others.

To sum up, job embeddedness reflects a whole variety of both on- and off-the-job factors that help keep people, and especially, top talent, in their current jobs.

So, how should practicing managers use this concept to revise, systematize, and rebuild their retention strategies? First, think about on-the-job links that you can offer your employees, be it a paid-for memberships in professional associations, clear career paths, or continuous professional development opportunities.

Next, turn your attention to fit and make sure that your valued employees are deployed in job roles that match their knowledge, skills, and abilities, and that they can take advantage of flexibility in where and when they work and enjoy a supportive work environment.

Finally, when considering sacrifices that your most valued employees will make if or when they decide to leave you, besides purely financial stimuli, pay special attention to non-financial ones, such as the sense of purpose and belonging, talent-centered organizational culture, and career growth opportunities.

Once again, (re)developing your retention strategy based on the notion of job embeddedness will assist you in being more systematic in your approach and help you succeed in turning your organization into a sticky workplace.

One word of caution, though: Do not be overzealous with job stickiness. Creating too much embeddedness (i.e., maximizing links, fit, and sacrifice) can make people feel trapped within the company, which will have the opposite effect on your retention efforts. Just like with everything in our lives, use your common sense and keep a meaningful balance between the three main components of job embeddedness.

Vlad Vaiman is Professor and an Associate Dean at the School of Management of California Lutheran University and a visiting professor at several premier universities around the world.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>Matilda Sung has established herself in a male-dominated world in a series of bold yet graceful plays. She’s confidently invested $500,000 to $1 million into companies in the interconnected universes of sports media, sports betting, entertainment, and technology. However, she’s also looking at the long game of these industries, not only ensuring they are on strong financial footing, but that they will also become more diverse with more women and people of color joining their ranks.

Sung may be under 40, but she brings over 15 years of management experience to her day-to-day mission helping companies strategize, conceptualize, develop, and deliver on digital products, services, and experiences. The Ludis Capital co-founder and general partner describes herself as a “hands-on/early-stage investor” focusing on companies demonstrating superior growth and potential for impact to business, economy, and society. During her rookie years after graduation, Sung joined the investment banking track of an international bank as the only woman in her cohort of new hires. After earning her MBA, she did stints with an all-star lineup of financial and tech companies like PayPal and HSBC Investment Banking.

Today, Sung is an active mentor and advisor to numerous entrepreneurs and budding MBA graduates. She also sits on a number of startup advisory boards and is a stalwart investor with various private HNW investor groups, including the Tech Coast Angels Group in Los Angeles. She’s a regular presence as a judge and speaker at various industry events, sharing her expertise on topics like startup development and fundraising, strategy planning, web3 and crypto, and numerous sports tech specific subjects, including over-the-top (OTT) platforms, gaming and betting, and connected health and fitness.

Simply put, calling her an MVP in this burgeoning space barely scratches the surface. In this conversation, we’re starting with her accomplishments in her work with the NFL’s social media efforts and the changing landscape of sports betting. From there, the field is wide open. Christopher Yang, who serves with Sung on the executive board of Tech Coast Angels–Los Angeles (one of the largest, most active angel investment networks in the U.S.), sat down with her to discuss her career, play by play.

ALTHOUGH HOLDING POSTS AT HSBC, MCKINSEY, AND PAYPAL BEFORE AGE 40

IS A GREAT ACCOMPLISHMENT ON ITS OWN, YOU MADE YOUR NAME AS THE

PERSON RESPONSIBLE FOR THE NFL’S ENTIRE DIRECT-TO-CONSUMER EXPERIENCE.

WERE YOU ALWAYS DRAWN TO THE SPORTS WORLD?

I didn’t think I was going to end up working in sports, or end up back in finance and venture after years of focusing on investment banking. I was a typical consultant, on the road four days a week, sometimes five, maybe home for the weekends, or leave on a Sunday. I loved it. I had such a wonderful time working with companies in different sectors, including manufacturing, financial services, pharma, and you name it. My purpose was helping them think through their strategic objectives in the context of technology and digital.

After I had my first child, however, it was a challenge to transition to being a new mom while maintaining that management-consultant lifestyle. One of my clients actually said, “Hey, why don’t you talk to the NFL in L.A.? They’re actually looking to build out their digital strategy group.” I thought, “I’m a fan, but I’ve never worked for a sporting organization before.” As you can imagine, my friends and my husband insisted I go talk to them. I went in and had a conversation with David Jurenka, who was brought in to basically run their owned and operated entity, and from there, I went to work for the NFL.

WHAT WAS THE PROCESS OF PLANNING FOR THE IMPLEMENTATION OF THESE

DIRECT-TO-CONSUMER GOALS AND OBJECTIVES?

As all of the NFL is direct-to-consumer channels, I needed to really think through how we could position them in the beginning. But in my initial conversation with David and the slate of folks I met, I just really hit it off with everybody. I was thoroughly impressed with how they were thinking about the world, the sport, and the opportunities and threats that they were facing. I wasn’t expecting that in full honesty. They have been tracking and monitoring a number of trends that needed to be addressed. For example, people weren’t necessarily going to in person games as often as they used to. People weren’t re-upping their season tickets, the new generation of fans just weren’t consuming the same way. A good number of them didn’t have TVs, and if they did, they didn’t have cable. We had to consider repositioning the NFL in such a way that we can cater to this next generation of fans.

WHAT IS IT ABOUT IN THE INTERSECTION OF SPORTS, TECHNOLOGY,

AND ENTERTAINMENT THAT YOU FOUND MOST INTRIGUING?

In this role, I was in the sweet spot of being able to sit at the cross-section of some of the world’s most valuable content as well as a host of really fun, interesting technologies that allow consumers and fans to watch more easily and engage with what’s going on. During this time, the impact of this intersection came to me like an “aha!” moment. It is technology that is not just disrupting football or the NFL, but also the possibility to disrupt sports in a big, meaningful way. When I was at McKinsey, I had a front-row seat to seeing different industries, manufacturing, financial services, and pharma get disrupted. I learned that sports is no different. It became apparent to me that there are all these different parts of the sports fan journey that could be disrupted by technology and that can be improved with additional technology investments.

WHAT ARE SOME EXAMPLES OF OTHER SPORTS THAT HAVE CHANGED

THEIR APPROACH TO REACHING FANS IN THE WAKE OF NEW INNOVATIONS

LIKE STREAMING TECHNOLOGY?

One of the examples we talk often about is Major League Baseball (MLB) and BAM streaming technology. I don’t know if readers remember when MLB stripped out Bamtech, its tech arm, about 20 years ago, and each of the MLB teams committed a million dollars to this. They built the streaming technologies really just to power baseball on OTT devices for fans. This, in turn, started an entertainment startup parent powering some of the shows for Hulu and Disney. You may recall that a year or two ago, it was all over the news that Disney ended up buying out the remaining portion of their ownership of BAM tickets.

CAN YOU EXPLAIN YOUR APPROACH TO SPORTS TECH, AND WHAT SETS YOUR COMPANY APART FROM OTHER VENTURE CAPITAL FIRMS IN THE SAME VERTICAL?

Here is the broad way I would explain our approach to somebody who isn’t necessarily involved with sports tech. We typically look at things at a very high level, at the intersection of sports technology and media and human. At the macro level, we believe in investing in technologies, mostly software, some hardware, that serve to drive growth, expand the consumption and delight around sports and entertainment. People think sports tech is small, but actually it covers a wide area. It could be at the professional level or the amateur level, junior level and the youth sports or teams as well. We look at everything from broadcast technologies to data analytics for our sporting leagues, and athletes to health and fitness applications, to sports betting to fantasy and gaming.

WHAT SIZE COMPANY DO YOU USUALLY INVEST IN?

As far as sort of the criteria and what we look for, there’s sort of a few principles that our team goes by that have guided us over the last several years and going forward as well. These principles are made up of observations that we have had in our respective careers, either as sports execs, former or current athletes, founders of gyms, and financiers. Everybody in our network has come together to sort of pull these ideas into one place. And one thing we observed was the fact that the sports industry is actually grossly under monetized.

THERE’S TALK OF A RECESSION LOOMING AHEAD. HOW HAS THAT IMPACTED

YOUR INVESTMENT APPROACH, PARTICULARLY IN THE SHORT TERM?

We’re actually in the middle of a market correction. When we cranked up our numbers again recently, we noticed the gap had closed. When you’ve got Netflix, for example, losing a good chunk of its market cap, the numbers have closed. With our business on the other side, what’s much more telling is the fact that the sporting leagues, the NFL, for example, renegotiated a number of their contracts in 2020. They’re looking at a valuation of the league and the clubs at north of $100 billion.

When you do the math, it works out to about $250 per fan, which is five times what it was before they had those renegotiations and revaluation of the teams. What has driven up that revaluation is the ability to prove that the more they can connect to more fans, they can drive more engagement, which is driven by that technology. Our second principle is around this idea that sports is really a place where you can test some of the latest and greatest technologies.

WHERE DO YOU SEE ALTERNATIVE INVESTMENT IN SPORTS AND GAMING GOING?

I think on the entrepreneurial side, we’re going to see healthy growth and new entrants coming in. They come from a wide range of backgrounds, and not just folks who were former athletes or those who earned their sports business degree. There are folks who are data scientists, PhDs, and other fields. This is what’s most exciting—attracting people, entrepreneurship, ideas, and innovation from people who aren’t necessarily from the sport space.

The other thing that I’m really excited about is sort of this growing level of access for not just sports tech, but for venture-like alternative investments. There’s been a growing awareness and education in the space. For us, there’s a lot of tier-one athletes who are getting into the space. However, what I think we’re excited about is some of the tier-two or tier-three college or high school getting more financially literate and getting excited about alternative investments at large.

WHAT ABOUT WHAT’S HAPPENING ON THE INVESTOR SIDE?

I see a parallel, similar type of growth. In terms of diversifying the investor base, I think we’ve seen a lot of that for sports tech, as it’s a lot of high-net-worth, small, medium, large family office-type setups. But we’re increasingly seeing more interest from institutional side investors. In the last couple years, when it got time to look more carefully at a company that we might invest in, we’d ask the owner who else is being considered or who else is on the capital table. We were surprised to see some of those other names.

WHERE DO NEWER TRENDS SUCH AS BLOCK CHAINS AND NFTS COME INTO THIS?

There’s so many exciting things you can do when it comes to fan engagement with blockchain, above and beyond NFTs or tokens, and we’re pretty excited about that. When we talk to our athletes as well as our fans, there’s this idea that data is something that one can own. There’s a startup we’re talking to right now that’s looking to basically mobilize data for the athletes and have them have ownership over it. Consider this: You’re a tier-one athlete, you perform on a certain level, and you have a history of how you got to where you are. That data can be used for so many things, above and beyond field performance, and into the mass market. We’re looking to build up their athleticism on many fronts.

HOW DO WE PACKAGE DEALS IN A WAY THAT ALLOWS ATHLETES TO MONETIZE?

There are a host of issues we need to figure out, like ethics, data breaches, all that kind of stuff. But once you figure that out, you need to be sure every athlete owns our data. But the fans’ data is also important. For example, the data tracked shows I go to this many Rams games, and that I’m the biggest consumer in my household. They know I buy milk and yogurt every month. There are many interesting things in the data space that can benefit the athletes and their fans, but we’re probably not there yet. However, we’re starting to scratch the surface.

Matilda Sung is a General Partner at Ludis Capital, an investment management firm that invests in early stage companies operating at the intersection of sports, technology and media & entertainment.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>TELL US ABOUT YOUR CAREER JOURNEY.

I started my career as an engineer, working on 3D sound technologies at Dolby. I liked making products that empowered others to create, so that’s been kind of the threads through my career. Prior to joining Logitech, I founded a company in the creator space in the early days of user generated content enabling brands to connect with their fans beyond just likes and comments. We enabled brands to create interactive, user generated viral campaigns. After doing that for three years, I wanted to get back into the mix of hardware and software. Hardware was reaching a pivotal point where it was no longer a disconnected device. Logitech was a well-known company in the consumer PC consumer electronics space, and they were reinventing themselves.

WHAT OPPORTUNITIES DID THE PANDEMIC PRESENT IN THE MARKETPLACE FOR YOUR BUSINESS?

Eighteen months prior to the pandemic, we acquired Streamlabs, a live streaming software allowing users to easily stream themselves and their game play. It essentially allows anyone to create TV quality broadcasts from their bedroom. We saw the market moving in this direction, but the pandemic propelled everything a few years forward.

At the start of the pandemic, we saw many people turning to live streaming to overcome isolation and help raise awareness and funds for those most impacted by the pandemic. As the pandemic endured, many decided to become creators, sharing their passion, building communities and finding ways to monetize. Quite a few found success and some became internet superstars. Take Khaby Lame, an ex-factory worker in northern Italy – he blew up on TikTok after he got laid off due to covid. He’s now a Millionaire!

Creators really are the most influential people of the next decade. We’re moving from Media Corporations producing hundreds of TV shows consumed by billions. To millions of independent creators creating millions of shows daily catering to billions of people.

Over the last decade – creators have been making money almost exclusively via ad rev share and brand sponsorships. In fact, Influencer Marketing revenue grew more than 8x in the last 5 years to reach nearly $14B in 2021. The reduced effectiveness of traditional ads and the stricter privacy laws – will further drive the growth of influencer marketing. It is estimated to quadruple over the next 5 years.

TELL US ABOUT THE SHIFT YOU’VE SEEN WITH MARKETING AND INFLUENCERS.

There’s a shift in how brands need to think about reaching their audience. It’s becoming increasingly more expensive to buy access to audiences. Creators are building direct authentic connections with consumers – and building loyal fanbases. Over the past few years they have diversified their income and no longer want to promote any product/service to their audience. A recent survey by UTA – revealed that 40% of consumers in the US have already paid creators directly. They are paying them to support them – to get access to exclusive content and shout-outs, for virtual meet-and-greets, merch and more. Creators are now referred to as solopreneur: creating a business as an enterprise of one – the ultimate decentralized model where anyone can create a scalable business as a single individual. In this context, it’s critical that companies think of creators like sports brands think of athletes. You don’t just sponsor an athlete or team for 1 game. It’s a long-term relationship based on common values and trust!

AT LOGITECH, HOW DO YOU WORK WITH CREATORS?

We don’t utilize creators, we serve creators and partner with them. We look to first align our values. With creators, you decide to work with their audiences and it’s built on trust and having an authentic voice in a relationship.

HOW ARE YOU GOING TO CONTINUE AND EVOLVE AND GROW YOUR COMMUNITY?

The world is more dynamic than it’s ever been and things are evolving faster than they ever did. You need to know where you’re going, but at the same time, be ready to adapt to the environment we live in.

We did the first TikTok live show two years ago, before people were thinking about live streaming. This year, we did the first award show within a Metaverse together with Roblox. We’re going to continue to evolve in the way that we engage the community.

TALK TO ME ABOUT THE CONVERGENCE BETWEEN THE PHYSICAL AND DIGITAL?

I’m very bullish and passionate about how this is all going to shake out. For the next 10 years, we’re going to continue to see this evolve. I look at my kids and realize their relationship to digital and physical is different than mine as they blend the two in a much more seamless way. Although both digital and physical are still fairly disconnected at the moment, there are different ways to interact and engage with virtual environments that feel more natural.

Another model is more hybrid – we’re already used to having a phone in our hands, allowing us to talk and connect and listen to the news in real time no matter where we are. The next step is to overlay relevant contextual information in real-time. It’s like having a sixth sense.

TELL US ABOUT THE CLOUD GAMING PLATFORM YOU LAUNCHED LAST WEEK.

Cloud gaming is a super-exciting new way to play games. I love that you can access game libraries from anywhere. What we wanted to do was challenge ourselves to build a device that was perfectly optimized for cloud gaming. This meant precision controls similar to a high-end Xbox controller—a large HD screen, amazing battery life and lightweight design so players can enjoy long gaming sessions, without any compromises.

LOOKING AHEAD, WHAT IS THE FUTURE FORWARD?

The world is expecting a certain level of authenticity. Creators know this better than anyone because they’re engaging one-on-one with their community every day. Partnering with creators brings back a high touch that you have a tendency of losing as you get bigger. This whole creator economy is opening up a world of services that is actually enabling everyone to participate in the ecosystem.

We’re going to see people engage more and more in both the physical and digital spaces. We’ve seen people go purely digital during the pandemic, but as the world has reopened, the lines between digital and physical are increasingly being blurred. Virtual reality and augmented reality are transforming how we interact with others, the experiences we’re having from home, as well as, how we experience the physical world around us.

THE PAST TWO YEARS HAVE BROUGHT A LOT OF CHANGE. TELL US ABOUT THE PIVOTS YOU’VE HAD TO MAKE.

It’s funny because it came out of the startup ecosystem and pivot became a big thing in Silicon Valley 10 years ago. People were talking about pivots every time they were changing their strategy or the way they were thinking about their business. Life is a journey. Pivots, in that context, could refer to anytime you make a significant change in your life.

I am a very intuitive person. Important decisions in my life have been driven by two things: Pursuing my passions and driving positive impact. As you go through your life and your career, your ability to have impact naturally grows but the greatest impact comes from empowering others.

SoundBytes is a marketing collective bringing best-in-class marketers together to propel collaboration, innovation and deal-making featuring a diverse range of speakers and addressing key topics across entertainment, music, sports and media. The mission of Soundbytes is to build community, create authentic connections by sharing insight and intel to help propel collaboration and business objectives forward into the future. Run by Michelle Edgar and Jessica Nuremberg, SoundBytes has curated over 30 sessions featuring Fortune 500 C-suite marketers.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>If you’re like most people, you’ve probably never heard of generative AI. And that’s understandable—it’s a fairly new concept in the world of artificial intelligence (AI). But even though it’s still in its infancy, generative AI is starting to make waves in a variety of industries. Here’s a closer look at what this promising technology is all about and why you should care.

WHAT IS GENERATIVE AI?

In a nutshell, generative AI refers to AI systems that are capable of creating new data based on what they have learned. That might sound confusing, so let’s break it down with an example. Say you’re training a generative AI system to identify different types of animals. Once the system has learned what specific features distinguish, say, a cat from a dog, it can then generate new data that includes animals it has never seen before, like tigers or bears. This ability to create new data makes generative AI immensely powerful and opens up a world of possibilities.

WHY SHOULD YOU CARE?

Generative AI systems are already being used in a number of ways. For instance, they can be used to generate realistic 3D images or videos (a process known as “rendering”). They can also be used to create new products or altogether new designs for existing products. Some companies are even using them to generate realistic fake news stories in order to test the susceptibility of their employees to fake news sources. These are just a few examples of how generative AI is being used today—and as the technology continues to develop, there will likely be many more applications for it in the future.

WHY NOW

AI is rapidly evolving and changing the way we interact with technology. Generative AI in particular has seen a great deal of progress in recent years, fueled by better models, more data, and greater computational power. These advances have allowed systems to not only learn from existing examples, but also to create new examples from scratch. This has given rise to new applications for generative AI, including improved recommendation engines, novel photo- and video-editing tools, and intelligent assistants that can generate personalized responses on demand.

One key advantage of generative AI is its ability to uncover insights that may not be immediately apparent when working with existing datasets. For example, by generating thousands of new samples from an existing dataset, it becomes possible to train new models on these results to extract even more information from the data. And as this technology continues to advance at such a rapid pace, it seems clear that generative AI will play a major role in shaping the future of AI and beyond.

Suman Talukdar is a Founding Partner at AiSprouts.vc, helping entrepreneurs build category-leading ventures.

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>Our investment portfolios have dropped significantly in 2022, and for many of us, our confidence in the financial markets remains uncertain. We know historically that “markets” have performed and provided us with a stable way to systematically invest, with assurance that over time that our assets will grow.

Hopefully, we are also reallocating our investments to reflect our risk tolerance as well as our need for liquidity as we age and consider retirement.

There seems to be a renewed interest in certainty, in products like annuities and insurance, things that provide guarantees to families and retirement incomes, especially should the markets not return to some level of stability. Investors have returned to annuities and T-bills for certain investment returns, trading volatility for certainty—strategies not seen since the 2008 financial crisis. In short, people want to sleep at night!

Interest in life insurance has also suddenly skyrocketed, with people understanding that a reduction in their assets means fewer assets for heirs should they die prematurely.

Makes sense … with all of the news reporting war, global and weather-related disasters, shootings and random killings, escalating crime, and even with the era of COVID potentially in our rearview mirror, we have all suddenly come face to face with events that make us face our mortality. As Jim Morrison said, “No one here gets out alive.”

When was the last time you actually reviewed and contemplated the economic needs of your family or business, if you died tomorrow? What plans would you want to have in place if your ability to buy life insurance changed tomorrow?

Most people buy a term policy, “set and forget it.” Maybe a million dollars isn’t what it was years ago. Surely it doesn’t last as long as it once did. In fact, I’ll argue that most of us are under insured. By a LOT.

There are assets, and then there is liquidity. Life insurance brings liquidity to situations at exactly the right time. It brings money to families who may have lots of assets, but don’t have liquidity. Most people buy term insurance, but the problem with term insurance policies is that they are most likely to expire way before you do. Policies don’t get updated or refinanced. Then WHAM, you’re too old to requalify. Or it’s too costly.

If you haven’t revisited your life insurance policies in the last several years, this is the right time. Term life insurance rates are at an all time low. Then there are the new types of term policies that spring to life and can pay for things like long-term care if you need money while you’re alive. Your current policy likely doesn’t do that.

Life insurance can be a tool to transfer wealth, preserve assets, and make sure that special events—like weddings, home purchases, retirements, and grandchildren—get something special and create legacies. With the current low cost of life insurance and underwriters seeking year-end revenue, this is an extremely good time to revisit your life insurance portfolio.

People who plan are always more successful than those who fail to plan. What’s your plan?

Martin Levy, CLU/RHU is founder of Corporate Strategies Inc. (CorpStrat), located in Woodland Hills, Calif. A 30-year insurance industry veteran and lifetime member of the Million Dollar Round Table, Levy is an expert in long-term care planning strategies. You can reach him at (818) 468-0862 or [email protected].

Syndicated and originally found on CSQ.com. The article, for reference, is here.

]]>Work Autonomy

- Build autonomy into the job. Some successful organizations I am familiar with build autonomy into the job. They delegate responsibilities to their teams as much as possible by staffing them according to professionals’ competencies and seniority. These firms are trying to put their professionals on projects that require a high level of autonomy, so staffing is extremely important here.

Read more of Vlad Vaiman’s thought leadership.

- Think about eliminating middle management. In an interesting twist, some companies I follow have almost no middle management. Teams themselves take full charge of a project, and nobody is looking over their shoulders. The only measure here is customer satisfaction.

- Build on professional pride. Most organizations realize that professionals come to work with a certain level of professional pride. Therefore, they are given a large degree of professional autonomy or elbow room to complete their task, and no solutions are dictated from above. The expectations of good performance, however, are quite high.

- Promote thought leadership. Some companies give great autonomy to professionals by making thought leadership the norm. They are encouraged, and sometimes pushed, to think outside the box. These behaviors are supported for as long as the employee remains productive.

Fair Pay and Benefits

- Keep current with market realities. Most successful strategies involve having a special in-house compensation person or group who follows market trends. These firms tend to have state-of-the-art compensation systems that keep up with current market realities. The same could be applied to the benefit system, with thriving organizations usually having good profit-sharing systems and generous bonuses. Generally, in most companies, the compensation system is considered successful in terms of retaining employees if it is at market level or better. On the intrafirm level, most firms tie compensation to performance. In other words, there is a salary range for every position, with the actual numbers depending on an individual’s performance and contribution to the common goal.

While professionals are on their way up the organizational ranks, monetary rewards should be at the center of any compensation system. As talented employees ascend the organizational ladder, it becomes relatively less challenging to satisfy their economic needs. Therefore, the focus for retaining these employees should switch to more non-monetary rewards and incentives.

Rewarding poor performance is one of the major reasons top professionals become dissatisfied.

From the broader viewpoint on compensation, employee stock option plans (ESOPs) remain one of the most popular and most commonly used compensation and retention tools, especially in large, well-established organizations. The main idea behind using ESOPs is the perception that the employees could be motivated to perform more efficiently and productively if they own part of the company. Employees find stock options attractive because they provide them with an opportunity to harvest the benefits of the wealth they help create. Along with these benefits, ESOPs also help the firm in linking the performance to compensation packages and reiterating the importance of team effort among employees.