By Mary Helen Gillespie

“Sabrina,” 53, recommends women on the cusp of divorce assemble a team of advisers including financial experts, a divorce coach, and a mental health professional to guide them through the long, often painful, process.

How has your divorce financially impacted your retirement plans?

It has had a devastating impact. I probably will never recover from the inequity.

Did you hire a financial adviser, a CPA, or other finance professional to help you plan your retirement needs during the divorce proceedings? Would you today?

No, but I was aware of basic information and did research. I am also personal friends with one of the top certified financial divorce advisors in the United States. I would hire one today, before ever hiring an attorney again on retainer with unlimited billable hours.

From my experience with the attorneys, and I had several, they would just drive their agenda anyway and minimize the necessity or the validation of the data and not do what is required.

Also, this would keep people in conflict and returning to the courts and their attorneys even after the final decree. And that’s what they can bill for: conflict.

Was your divorce attorney concerned about your retirement finances? Was the divorce judge?

No, I believe the attorneys were not at all concerned, and I had a few. They told me to get a job (which I did) and refused to address what the actual amounts of all the retirement assets were or any marital asset for that matter. I especially feel the judge was at fault and had a fiduciary responsibility in a court of equity to stop the attorney games and get to the facts. The language used in my court documents is very vague and/or ambiguous or just silent. It doesn’t even have any basic Internal Revenue Service language to divide the assets so to this day I still can’t get these marital assets after 12 years.

It is my belief that dividing marital assets, aside from custody/support, is paramount to getting a divorce and the powers that be behave negligently and sloppily. They don't do the proper due diligence or intentionally commit outright malpractice -- all under their legal immunity. And then they keep people going back into court and drag it out even more and erode most people’s life savings and their quality of life.

How would you describe the quality of your financial life post-divorce?

It’s been a struggle. I was nearly bankrupt and had to pull myself out of what I felt like was financial quicksand. Was a stay-at-home mom for most of the 20+ year marriage with three young children. I disrupted my career to raise the children and then, upon returning to the workforce, faced the disparity of an income gap and earning potential due to the break in my career. A formula for child support and a minimum wage job is barely surviving.

Plus, many women are made dependent on an ex-spouse to pay child support and/or maintenance; and this is a person whom they can’t trust to begin with or doesn’t pay what’s ordered. There is no consequence nor accountability, and it takes months to years to settle while back in the court system.

I was also saddled with marital debt and there was pressure for me to file for bankruptcy.

What other information would you like to share with women in similar situations?

In hindsight, I believe the lawyer is the last person to the table. What you need is a team approach of a financial neutral, a divorce coach to help with the emotions of divorce and all the nonlegal areas, and a counselor/ therapy support for the kids or if there is any domestic violence. Then when you have this team in place and create a foundational starting point of family dynamics, a lawyer can apply the law and protect the parties especially in equitable distribution states like New York and also in the community property states. We blindly put our 100+ percent trust in one person, this lawyer, to get divorced and it just doesn’t work and becomes an adversarial, litigious, costly, and lengthy process.

I haven’t received any marital portion of the marital retirement assets in my late 40s and now 50s due to a defective settlement/transcript that has had a devastating financial impact on my life. This is the result of the judge who signed it, and a qualified domestic relations order (QDRO) that cannot be executed as well as being unfairly assigned all the marital debt. I also have not received back child support payments. Consequently, I have no savings or assets to buy out my ex from the family home. I am making under $50k a year, and now find myself in a devastating housing situation due to rising prices for rentals. I may well find myself working well into what would have been my “retirement years.”

Follow us on Instagram and Twitter!

*************************************

We asked Lili A. Vasileff, president of Wealth Protection Management in Greenwich, CT, a fee-only CFP®, mediator, Certified Divorce Financial Analyst®, and litigation divorce financial expert for her thoughts on Sabrina’s situation. Vasileff agrees with building a team of support and outlines additional steps to take.

Often in hindsight, it comes as no surprise that we wish we did things differently. In divorce, there is the added regret that some decisions cannot be done over and have a long-lasting impact on the rest of one’s life. In Sabrina’s case, she expresses many regrets and describes her current state of financial hardship. What we do not know is the total context for how her divorce unfolded and what her actual outcome was.

In my experience, the number one regret of many home makers in long-term marriages is that they felt rushed or coerced into making financial decisions they did not fully understand.

Here are some pointers for what to do BEFORE you divorce:

- Prepare, prepare, prepare. Gather your financial information: know what it costs to live; know where your assets are and what debts you have. Know your state’s divorce laws and what are typical outcomes for a person in your situation. Find experienced attorneys and interview them well.

- Know what you don’t know. If you are weak on understanding financials, hire a divorce financial planner. If you need emotional support, hire a divorce coach. Build your team.

- Understand that the divorce process (mediation, collaborative or litigation) is a marathon and not a sprint. Pace yourself. Budget for the cost of divorce.

- Hold yourself accountable and responsible for advocating for your own needs and interests. No one knows what you need or want, but you. You must not blindly abdicate this role to anyone, including your attorney.

What can Sabrina do post-divorce now 12 years later?

- She mentioned that she has not received child support. States legislate the enforcement of child support and can garnish wages for this purpose after just missing a few child support payments. It costs nothing for the payee.

- As soon as something goes wrong, act! Sabrina mentions that her QDRO was not executed. One should require that a QDRO specialist be addressed in the divorce agreement. Be specific about who will prepare the QDRO, how much it will cost, when it will be started, and how decision/cost will be shared between ex-spouses. It is not too late to reopen a QDRO that was improperly executed to protect your rights, and the sooner you do, the better. However, if the assets are gone, then you must sue to enforce your divorce judgment.

- Sabrina says that all marital debt was assigned to her. Without any context or facts, it is tough to know what this means relative to the total marital estate and her final outcome. Did she agree to it? Did the judge order it? What kind of debt – the mortgage with the house? One negotiates debts as they do for assets. Often, it is best to pay off debts from the marital assets before dividing the balance between spouses. I recommend having a backup plan if the debt is in your name and your ex-spouse is supposed to pay it off. Creditors will always go after the borrower and Sabrina’s recourse to protect her credit rating is to sue under her divorce decree.

- Sabrina said she was pressured to file for bankruptcy, but we assume she did not. Before bankruptcy, which should be your last resort, try to negotiate with debt holders, try to consolidate, and work with a Credit Counselor or Qualified Agency, etc. Always check your credit rating regularly and make corrections to any misinformation.

- Sabrina has no savings or assets to buy out her ex from the home. We do not know how much equity Sabrina has in the house. There are many options open to her: sell the house, leverage the house, work out with her ex-spouse installment payments of equity over time, ask her ex to refinance the house in his name/take title to the house and have her live in it as his tenant. Her ex has waited 12 years to get his equity out. We do not know what arrangements he may agree to at this point.

- Renegotiate post-divorce: If her ex has failed to make back payments in child support, maybe Sabrina can negotiate for more time to stay in home, or, for greater equity in her home, or, not have to move out at all.

- Sabrina may have to work into her retirement years. Courts cannot force a person to work past full retirement age. They can compel support payments, but not actually make a person work. If her support ends and she has a $50,000/year job, realistically she may have to work longer to have some savings and meet living expenses.

- She can also apply for Social Security on her ex-spouse’s record when he turns 62 if she meets all criteria. This additional income will help her cash flow. Social Security benefits are government entitlements and not rights that can be assigned in a divorce judgment.

Best advice is for Sabrina to work with a financial planner to plan ahead and have a roadmap for her retirement. She has options to consider for improving her financial situation and hopefully, she looks forward to her future and not backwards to her past.

******************************

Learn more by watching our webinar, Retirement Daily Roundtable - Women, Divorce & Retirement: Creating Your New Personal Finance Plan, with Robert Powell and panelists Amy Shepard, Rick Fingerman, and Katie Marsden.

To find a financial professional with experience in divorce, visit the Institute for Divorce Financial Analysts website.

You May Also Like...

Other relevant articles from Retirement Daily

Common Retirement Questions: What Are My Sources of Income and Financial Assets?

Don’t Outlive Your Retirement Savings

It's All About the Income, Chapter 9: The System is the Solution

December is finally here and Jae Oh, author of Maximize Your Medicare has some year-end planning opportunities with respect to your investment strategy and health insurance premiums.

One thing that people should be aware of is their year-end distributions because the degree that they might exist this year can affect your taxable income according to Oh. “[It’s a] ripple effect that can reach both your individual health insurance or your Medicare premium,” he says. “You do need to incorporate [your distributions] into your taxable income to try to take advantage of lower health insurance premiums or to avoid Medicare's IRMAA, for example.”

Another thing that readers should be aware of is the idea of tax loss harvesting. According to Investopedia.com, tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax due on the sale of other securities at a profit. Oh says that it's been a difficult year for financial markets, making tax-loss harvesting possible, so people should have the help of an accountant who knows the capital gains/losses rules. Tax-loss harvesting can help people buying individual health insurance have a lower tax bill.

Follow us on Instagram and Twitter!

Oh also mentions the idea of an IRA contribution. Making a contribution after getting your distribution and before filing for taxes can further lower your taxable income. “If you had to get an estimate for every thousand dollars, for example, that you lowered your income, you get about 10% lower in health insurance premium. So a hundred dollars a year for a health insurance premium,” Oh says. “So this is not small in terms of what you can actually benefit from if you're paying attention and know how to take advantage of the rules as written.”

For those who have a 401(k) at work, they might be able to increase the amount of their contribution, but it may be tricky according to Oh. The Roth conversion needs to be handled differently because they’re a taxable event for that calendar year. It’s important to plan for how it will affect things like your taxable income, which then impact IRMAA under Medicare and health insurance premiums under the Affordable Care Act.

You May Also Like...

Other relevant articles from Retirement Daily

Year-End Tax and Retirement Planning Strategies

Four Year-End Tax Planning Strategies

End of Year Tax Planning Strategies

By Don Robertson

Experienced investors have a wide range of indicators that help them predict if a company is well-positioned to grow in the future. Savvy traders listen for clues in quarterly calls and scan corporate reports detailing organizations’ earnings per share, operating margins, debt-to-equity ratios, cash flows, and more.

Alongside these data points, I’d argue for one more important cue for careful consideration. Be sure to research a company’s sustainable investments in its human capital. Are they investing in their talent?

The simple truth is that the organizations with the best talent have won the day. And in 2022 and beyond, the organizations with the best talent are going to win again. That’s why there is fierce competition for talent taking place in America and globally.

Human capital can be a business driver. In fact, in 2012, London Business School’s Alex Edmons found that the companies on Fortune’s “100 Best Companies to Work For in America” list generated higher stock returns per year than their peers. Given that, it only makes sense that shareholders should ask tough questions about a company’s culture, talent development strategy, employee engagement scores, and diversity and inclusion initiatives.

An organization’s commitments to its talent are especially important in a recessionary economic environment, which many experts say is a possibility in our not-too-distant future. Whispers about layoffs at several big-name Silicon Valley companies are surfacing in mainstream media like Business Insider, while other organizations have already moved to cut staff.

And in C-suite conversations across the country, some leaders are considering changes to their benefits, compensation structures, and incentives. Many companies – especially those that are publicly traded – get caught up in economic cycles, feeling a need to demonstrate financial results to shareholders each quarter, no matter what. And when business gets a little tough, leaders often start looking for ways to demonstrate strength.

Buy-and-hold investors should consider if companies are thinking longer-term and prioritizing their talent. Organizations that stay committed to their employee value proposition can build higher employee morale, higher productivity, higher employee engagement, and lower vacancy and turnover – all drivers for bottom-line results. Promises kept in the face of adversity can tell investors much more than a number in a spreadsheet within a quarterly report ever could.

More organizations are seeing evidence of a correlation between attrition and revenue. In fact, some large U.S. banks are now tracking employees’ opinions of management and their emotional connections to the company – because organizations with engaged employees may deliver greater returns to investors than others.

Follow us on Instagram and Twitter!

In addition to driving growth, sustained investment in talent is also the right thing to do.

Human capital is increasingly significant in conversations about ESG investing – using Environmental, Social, and Governance data to evaluate an organization’s sustainability. Recent studies by McKinsey and by MarshMcClennan found strong parallels between companies with a strong ESG proposition and increased employee engagement as well as greater talent acquisition and retention.

Of course, if someone feels like they don’t have to cut corners or take excessive risks in pursuit of short-term gains, they can make more responsible and sustainable decisions on behalf of customers and society overall. Moreover, according to the studies, energized and engaged employees who believe in an organization’s mission are more productive and less likely to be lost to attrition.

Since late 2020, the SEC has required publicly traded businesses to disclose more specifics about their talent acquisition and retention strategies. The new guidelines prompt companies to share facts about the makeup of their workforce, initiatives relating to diversity and inclusion, recruiting and retention strategies, employee engagement survey results, pay equity data, and talent development efforts. Done well, these reports can give investors a sense of companies’ talent strategies. And if that strategy is left unsaid in the reporting, sophisticated investors should follow up.

What should investors watch for?

Now is the time to ask leaders about their talent strategy. During quarterly shareholder calls, company leaders typically talk about their annual or multi-year strategies to create growth, ensure competitiveness and build relevance. These conversations are an ideal time to ask if each organization has a firm plan to attract, retain and develop the talent they need to deliver on those business-critical initiatives. Press to understand their employee engagement rates, attrition rates, advancement rates, and DEI scores. Taken together, these data points may indicate where value will be found in the months and years ahead.

This is also an ideal time to review studies that seek to quantify which companies are the best places to work. Organizations like Fortune, Forbes, Glassdoor, and Inc. track data from employees and the entities they serve to create indexes and annual rankings. Businesses that consistently rank highly – in good times and challenging times – may be more committed to their talent strategies than others that rise and fall.

Lastly, keep a close eye on digital conversations. Social media chatter and websites can offer us all an unvarnished inside look at organizations across the globe. If sentiment is positive, greater prosperity may be on the horizon.

About the author: Don Robertson

Don Robertson is executive vice president and chief human resources officer, and a member of the senior leadership team of Northwestern Mutual – a $34+ billion, Fortune 100 financial services company, the largest U.S. provider of individual life insurance, and manager of more than $540 billion in combined company and client assets.

Don launched his career in accounting, finance, and sales, as well as the support of IPO efforts, before moving into HR. He currently serves as a member of the CNBC Workforce Executive Council, on the board of directors for the Wisconsin Humane Society and the Zoological Society of Milwaukee, and on the board of advisors for Catalyst.

You May Also Like...

Other relevant articles from Retirement Daily

Should Rising Rates Lead to Declining Expectations?

New World Order or Continued Global Economy?

Ask the Hammer: Understanding the Exceptions to the Exceptions for IRAs

Jeffrey Levine explains the exceptions to the exceptions to inheriting IRAs.

By Mary Helen Gillespie

“Shannon,” 61, of New Hampshire, outlines the financial lessons learned after her 33-year marriage ended.

How has your divorce financially impacted your retirement plans?

Drastically. I have no real plans to retire.

Did you hire a financial adviser, a CPA, or other finance professional to help you plan your retirement needs during the divorce proceedings? Would you today?

No, but I would if I were getting divorced today.

Was your divorce attorney concerned about your retirement finances? Was the divorce judge?

My divorce attorney was supportive of my retirement status. The judge was not.

How would you describe the quality of your financial life post-divorce?

I worked part-time during my entire 33-year marriage. Today, my financial status is much lower than when I was married.

What other information would you like to share with women in similar situations?

Make sure to look into his pension (if he has one).

*****************************

Follow us on Instagram and Twitter!

Retirement Daily shared Shannon’s story with Deanne Phillips, CFP®, CDFA®, ABFP℠, director of Client Learning & Development at Annex Wealth Management. Here are her thoughts for Shannon and other women facing similar issues.

First, the good news: the overall U.S. divorce rate is dropping. Now the sad news: The rate of “grey divorce” is surging – double the rate of 1990. Today, older couples over the age of fifty represent 25% of all divorce cases.

“Older” can mean “less simple.” Since many older couples have accumulated a more complex estate, the separation of assets could be trickier – even more so for someone on the cusp of retiring.

Divorce is often accompanied with plenty of emotional trauma. And when divorce happens to older women, their standard of living plunges as much as 45%. Few people want to feel they have to go back to work at age 65.

Add to those concerns the common feeling women experience of being undereducated when it comes to their finances, the gender wage gap, and women outliving their physical partner, and you’ve discovered a formula for potential personal budgetary crisis.

Let’s face it -- when going through emotional distress in a transition, focusing on what your future will look like and the many financial decisions that need to be made in the present can be tough. Most people just want to “get it over with,” leading to concessions that are later regretted.

Here are tips to help sidestep some common divorce issues:

- Copy all financial records and keep them in a safe place. This includes bank accounts, three years of tax returns, pension and investment statements, pay stubs, employment agreements or contracts, and any financial awards like options for you and your spouse. Also have a copy of debts, loans, mortgages, and bills. This can help save the time and money of going through a recovery process later when it comes to reconciling income, assets and debts.

- Give good consideration around the family home, and whether to keep it. Whatever the motivator – whether it’s keeping continuity with family, sentimentality (after all it’s where the memories were generated), or maybe the idea of moving while transitioning through the divorce is simply overwhelming – remember that houses cost money to maintain, so cash flow becomes even more important. If financing is needed, speak with a lending professional first. Don’t assume you can take out a mortgage.

- Understand tax implications of all the financial assets because they are not all the same. Equalizing the assets from a taxation viewpoint and knowing how the assets will be split and paid out– including any pensions that either of you have – is important. This is where a financial planner or CDFA can aid by laying out the financials and showing how income and assets work for you after the financial separation.

- Ensure the continuation of income. If receiving spousal support, secure a disability policy on the payor if they are still working, and a life insurance policy on them to ensure that you continue to get paid for the duration the decree states, no matter what happens to your ex-spouse. Be sure and include language in the marital settlement agreement around accountability of the payments of those premiums, especially if your ex is paying them, so they do not lapse.

- Understand your Social Security benefits. If you were married over ten years (and not remarried) you are entitled to half of your spouse’s benefit or 100% of yours, whichever is higher. It does not matter if they remarry and it doesn’t impact their benefit at all, so this is not a negotiable asset in a divorce negotiation.

- Tax returns in the year of divorce can be complex. Remember a divorce is a change of circumstances that is effective on the date the decree is stamped. You are then considered divorced for the entire year – even if it is on December 31st. You may be filing your taxes as single or head of household, but you still might have marital income for that year. Since the divorce year income might be complex, consider using a tax professional to help you.

And finally, even if people are doing the divorce themselves (pro se) and feel they have an amicable enough relationship to do so with a mediator, we always recommend having an attorney or someone advocating for you. There are so many considerations and having the right team at the time to ensure that you not only financially and emotionally survive the process, but helping to understand that one can thrive after, is important. It helps you see if you will be ok. And ultimately, that’s what women want to know while they are going through this process: Will I be ok?

**********************

Learn more by watching our webinar, Retirement Daily Roundtable - Women, Divorce & Retirement: Creating Your New Personal Finance Plan, with Robert Powell and panelists Amy Shepard, Rick Fingerman, and Katie Marsden.

To find a financial professional with experience in divorce, visit the Institute for Divorce Financial Analysts website.

You May Also Like...

Other relevant articles from Retirement Daily

How Your Adult Children Can Stop Relying on You Financially

Read below to discover the balance of supporting your children and your bank account.

Retirees Going Back to Work: Starting a Business

Are you retired? Do you want to start a business? Here are some things to consider!

Saver's Credit: How a SECURE Act 1.0 Provision & 2.0 Proposal Impacts Retirement Benefits

Learn from our expert how Americans’ saving power will expand with the SECURE Act’s Saver’s Credit.

Istock

By Allison L. Lee

You and your spouse may visit the same primary doctor, financial advisor, and tax preparer. But what about preparing your wills? The short answer is: it depends!

Working with the same attorney as your spouse can offer several benefits, but there are also dividends to going your own way. Consider the following common situations when deciding whether or not you and your spouse should hire the same estate lawyer:

Your estates are relatively simple and interests aligned.

Trusts and estates experts agree that an attorney can be effectively engaged to represent a couple in planning their estates — especially when the estates are relatively simple (think: no sophisticated tax planning, a first marriage with or without children, and property located in one area). This joint representation can be a time and money saver since there’s no need to retain two separate lawyers and trek to two separate law offices.

Of course, it’s important to understand the considerations of a joint representation, including that there are no secrets. This means that you, your spouse, and the lawyer are able to agree that the lawyer will share any information learned from one spouse with the other spouse. These terms should be clearly outlined in the engagement letter that you and your spouse sign when you retain the lawyer.

One spouse has property in another state

Let’s say you own property in another state that is not co-owned with your spouse. This commonly happens when there’s an out-of-state property that’s part of one spouse’s immediate family, like business property or real estate that they co-own with a parent or sibling. This can also include property that one spouse is likely to inherit with the intention and expectation that it stays in the ancestral line.

You’ll also likely want to engage an attorney in the other state to make sure that any important local law considerations are addressed — even if you and your spouse decide to engage the same primary attorney for the joint estate planning representation. An out-of-state attorney can help advise if there are any special planning considerations that you might want to make, such as placing property into a family-controlled entity like a limited liability company.

Coordinating a call between your out-of-state attorney and your primary in-state attorney could be in the cards since there can be interrelated planning considerations that will need to be addressed in your will or trust.

Follow us on Instagram and Twitter!

You and your spouse have different communication styles.

Let’s say you prefer to work with a professional who is more talkative and wants to really get at the heart of your planning goals. Your ideal advisor is always challenging you to better describe the lasting legacy you want to leave. Your spouse, on the other hand, wants to keep the talking short and sweet. In such a case, you might each find it helpful to seek independent counsel to make the estate planning process most productive and comfortable for you.

Depending on the size and capacity of the law firm, it may also be possible for you and your spouse to work with different attorneys at the same firm. This allows you each to work with an attorney that matches your communication style when handling your planning matters. Because at the end of the day, seeing a professional whose style doesn’t align with your preferences will make it less likely to come out of the process feeling satisfied and willing to re-engage when your planning needs require an update.

One or both of you want to use a “floating spouse” provision.

In certain circumstances, trusts and estates attorneys generally agree that you and your spouse will want independent counsel. One such case is when a spouse wants to incorporate a “floating spouse” provision into their documents. Generally speaking, a floating spouse provision defines a “spouse” as the person you’re married to from time to time. This becomes relevant if there’s a divorce and the former spouse would have otherwise had a vested beneficial interest in a trust.

Here’s a practical example: Let’s say you create and fund an irrevocable trust and intend to name your spouse as a beneficiary. Because the trust is irrevocable, your ability to make any future changes is greatly limited. You may ask yourself, “but what happens if we get a divorce?”

By incorporating a floating spouse provision, you could protect your interests by having your current spouse removed as a beneficiary and substituting in their place a new spouse. Not all individuals prefer this, but if you and your spouse express an interest in this type of arrangement, you should consult independent counsel since your interests are considered legally adverse.

There’s no one-size-fits-all solution when it comes to planning the estates of a married couple. In certain cases, including if any part of the plan creates adverse interests, a joint representation may be difficult or even impossible. However, if you and your spouse have relatively simple estates, aligned interests, and similar communication styles, signing on to a joint representation with one estate attorney may be a great choice for planning your estate — and having your spouse by your side could give each of you that extra push to take care of this essential life task.

About the author: Allison L. Lee

Allison L. Lee is the attorney-at-law and director of trusts & estate content for FreeWill, a mission-based public benefit corporation that partners with nonprofits to provide a simple, intuitive and efficient platform to create wills and other estate planning documents free of cost. Through its work democratizing access to these tools, FreeWill has helped raise more than $4 billion for charity.

You May Also Like...

Other relevant articles from Retirement Daily

Saver's Credit: How a SECURE Act 1.0 Provision & 2.0 Proposal Impacts Retirement Benefits

Learn from our expert how Americans’ saving power will expand with the SECURE Act’s Saver’s Credit.

Istock

Inflation Got You Down? Consider these Benefits

Can I Switch from Medicare Advantage to a Medigap Plan?

Yes, you can make the switch, but there are some things to consider before you do.

Now that Thanksgiving, Black Friday, and Cyber Monday are over, there’s another more recently adopted holiday to look forward to: Giving Tuesday.

Giving Tuesday is a day for people to give back to those in need, whether through donating, volunteering, raising money, etc. If you choose to give back during this season of gratitude, it’s important to reevaluate your financial plan to include your preferred organizations, decide on a system that works for you and choose the best method for giving, while helping your bank account in the process.

Julie Virta, CFP®, senior financial advisor with Vanguard Personal Advisor Services, shares four approaches to building or revamping donations into your financial plan.

Qualified Charitable Distributions from an IRA

The first way to go about donating within your financial plan is through qualified charitable distributions (QDCs) from an IRA. Although you can only utilize this process after full retirement age of 70.5, with this method, you have the opportunity to give directly, up to $100,000 out of that traditional IRA.

“It can be a really good starting point for those retirees that do have larger traditional IRAs,” said Virta. “Especially if you’re already taking required distributions, it can offset [them and] you don’t necessarily need that cash.”

Securities vs. Cash

When giving a donation, there’s more ways to do so besides cash or check – securities. If you’ve saved throughout retirement into an appreciated fund, you’re able to give that security to most organizations instead of cash.

“For example, if you wanted to give a large cash donation to any organization, instead of just writing a check for that, you could give securities in that same amount,” said Virta. “It would be a way for you not to have to sell the security, take a capital gain, and then give the cash from those proceeds.”

Follow us on Instagram and Twitter!

Bunching Donations

Oftentimes people choose multiple charities to donate to throughout the holiday season versus one. This method of bunching donations, or donating to various entities at once, can actually maximize your tax dollars and be more financially beneficial.

“If there’s a commitment you’ve made to a charity or a couple of charities you want to give to, maybe over the course of a 12-month period, sometimes you might want to bunch those together to take advantage of the tax deduction – if you wanted all that tax deduction in one year,” said Virta.

For example, “rather than give to one organization in December and another in January, do them both in this year and then you get a greater amount of tax deduction in the one year versus spreading it out in the two years, [when] you might not have as much opportunity on that tax deduction,” said Virta.

Donor-Advised Fund

If you’re someone who wants to get the immediate tax deduction, yet you don’t know which charities you want to give to, you could use a donor-advised fund.

What is a donor-advised fund? – “a vehicle that you can give to and then essentially, you can let the dollars stay in that vehicle and they can grow with the market. And then you can give it to the various charities you want to give to at a future point, but it gives you the immediate tax deduction upfront,” said Virta.

In other words, moving money into a donor-advised fund gives you the immediate tax deduction with the time to determine later on which organizations you want to benefit from those dollars.

There’s also a way to combine this strategy with the securities method for those who want to give securities and not cash.

“If you were giving to a donor-advised fund and didn’t necessarily know your charities yet, you could give securities into the donor-advised fund as a way to take advantage of giving securities versus cash,” said Virta.

Course (and recourse) of Action

While it’s important to consider charitable giving when developing your first financial plan, it’s equally important to revisit those plans for giving on an annual basis. Factors like the state of the market, your retirement status, organizations of choice, and more can differ, and those should be reevaluated and reflected in your overall financial plan.

“You don’t necessarily need to do the same thing every year. Maybe one year, it’s more advantageous to you to give securities. Whereas this year, maybe you turned 70.5 and want to take some dollars out of your IRA,” said Virta. “It’s really something that should be reevaluated annually as you’re giving and thinking about what’s the best approach for this year in terms of how I’m giving?”

Keep these tips in mind for your charitable giving and consult a CFP® for help with incorporating any strategies into your personal financial plan. Happy giving!

You May Also Like...

Other relevant articles from Retirement Daily

TRICARE for the Military and Their Families

Retirement Daily Roundtable - Women, Divorce & Retirement: Creating Your New Personal Finance Plan

Reimagining Retirement - An Interview with the Author

Eric Weigel of Reimagining Retirement reflects on the nine factors to acquire and maintain wealth.

In this Retirement Daily Learning Center webinar, John Nersesian, the head of adviser education at PIMCO, details everything you need to know about charitable giving: what to give; who to give to; when to give; and how to give.

]]>By Philip Herzberg, CFP

If you are feeling deflated by several months of soaring inflation, investment market losses, and interest rate hikes, there is still time to save money on taxes with year-end planning strategies.

Here are four proactive planning moves that may help you lower your 2022 tax bill.

Consider a Roth IRA Conversion

The recent stock and bond market decline has made the Roth IRA conversion more attractive for those who are well-positioned to leverage this strategy in a historically low tax rate environment. A market downturn permits investors to convert a larger portion of an IRA and enjoy tax-free growth, as well as possible tax-free distributions in the future, inside the Roth IRA with the eventual stock market recovery. Another Roth conversion incentive is a lower tax bill, as the liability for a conversion will be cheaper now than it had been when the markets were elevated.

If you are considering converting some or all of your traditional IRA into a Roth IRA, conversion funds must be out of the pre-tax IRA by December 31st, 2022. Since there are many potential unintended consequences, such as Medicare premium and capital gains tax rate increases that may come with the extra income from Roth IRA conversions, experts advise against this strategy in the absence of a complete set of facts. Seek the guidance of qualified tax and CERTIFIED FINANCIAL PLANNERTM professionals to evaluate whether a Roth conversion is beneficial for your situation.

Bunch Charitable Gifts with a Donor Advised Fund (DAF)

Investors still desire to make charitable gifts despite economic concerns. With the $12,950 standard deduction for single filers and $25,900 standard deduction for married couples filing together for 2022, many taxpayers will not itemize write-offs, making it more challenging to claim a deduction for charitable donations. If you give yearly, you may think about “bunching” these donations with a DAF, which is a beneficial way for donors to minimize their taxes and maximize their philanthropic impact.

Consider establishing a donor-advised fund (DAF), which enables you to make gifts, immediately qualify for a charitable tax deduction, and then give grants to IRS-qualified 501(c)(3) public charities over time. The most tax-effective manner to fund a DAF is by contributing highly appreciated publicly traded stocks. There is a greater benefit to charitably donating profitable securities than cash, as you would avoid paying capital gains taxes you would otherwise owe when selling assets to fund the donation. Donating appreciated securities to DAFs has become a beneficial way for donors to minimize their taxes and maximize their philanthropic impact.

Follow us on Instagram and Twitter!

Save Tax Money with Charitable Donations from IRAs

Those who are philanthropically inclined and are not able to annually itemize deductions can utilize qualified charitable distributions (QCDs), a direct transfer to qualified charities from their IRAs, as an impactful strategy to save money on taxes. If you are age 70½ or older, you may utilize QCDs to donate up to $100,000 every year. For individuals age 72 or older, a significant positive of using this QCD strategy is that you can satisfy your IRA required minimum distribution (RMD) by directly donating up to $100,000 of the RMD to charity from an IRA, paying no tax on what would have been a distribution taxed as ordinary income. Be mindful that you cannot obtain a double tax break by taking a QCD and receiving an itemized deduction for a charitable gift. Rather than counting as an itemized deduction, QCDs for those taking RMDs may lower your adjusted gross income, which can possibly help you avoid Medicare premium increases.

Withhold Taxes from Year-End IRA RMDs

There is still time to avoid later penalties for some retirees who have not made quarterly estimated tax payments for 2022. Retirees generally need to send tax payments four times per year if they are not withholding enough from self-employment income, investments, Social Security, pensions, or other guaranteed income sources. There’s an opportunity for retirees to avoid penalties for missed payments by withholding taxes from year-end RMDs.

For instance, if you need to withdraw $50,000 from an IRA by year-end to fulfill your RMD for 2022, you can estimate the year’s total federal and state tax liability and withhold the funds from your RMD. If you gauged you still owed $4,000 in taxes to meet quarterly estimated tax obligations, you could choose to withhold that amount, send it to the IRS, and receive the remaining $46,000 withdrawal. Notably, if you complete this withholding by December 31st, it is considered “pro-rata” for each quarter, meaning it counts as on-time payments made by each deadline. Consult your qualified tax professional, in tandem with your CERTIFIED FINANCIAL PLANNERTM professional, to figure out how much you would need to withhold from your IRA RMD to avoid late penalties.

About the author: Philip Herzberg

Philip Herzberg, CFP®, CDFA®, CTFA, AEP® is a lead financial advisor at Team Hewins, a wealth management firm with offices in South Florida and the San Francisco Bay Area.

You May Also Like...

Other relevant articles from Retirement Daily

A Next-Gen Investor’s Journey to Opening a Roth IRA

How Your Adult Children Can Stop Relying on You Financially

Read below to discover the balance of supporting your children and your bank account.

Retirees Going Back to Work: Starting a Business

Are you retired? Do you want to start a business? Here are some things to consider!

In this video, Eric Weigel, author of Reimagining Retirement, discusses the nine keys to true wealth encapsulated in the NET WEALTH system. The NET WEALTH system covers all major areas of your life and starts with the traditional drivers of retirement planning:

- Where you live (your NEST)

- Your money situation (EARNINGS), and

- How you spend your TIME.

It then focuses on the other areas of your life that can truly turbo-charge your happiness and fulfillment:

- Sharing your knowledge and experience (WORK)

- Regulating your emotions (EMOTIONAL ENERGY)

- Pursuing meaningful goals (ACHIEVEMENTS)

- Growing spiritually, emotionally, and intellectually (LEARNING)

- Remaining engaged deeply in the lives of family and friends (TRIBE), and

- Staying physically and mentally fit (HEALTH).

By designing your own version of your future self and adopting the NET WEALTH system, Weigel says you will make more informed and intentional decisions. "You’ll turn lack of clarity, indecision, and uncertainty into a vision for your life and give you actionable steps for finding happiness and fulfillment," he says.

You May Also Like...

Other relevant articles from Retirement Daily

Women, Divorce and Retirement: Be Bold to Secure Your Future

“Joyce,” 61, of Virginia offers up a supportive message to fellow divorcees.

Homeownership is Still a Key Part of the American Dream

Bloomberg News

Medicare's Annual Election Period Ends on December 7th

Meet the Experts

Bob Powell (00:03): All right. Welcome everyone to our Women, Divorce and Retirement webinar. I'd like to remind everyone that all attendees are muted and off video, but the event is being recorded. And if you have a question, please type it into the chat box at the bottom right of your screen. Panelists will, we’ll have panelists speak to their top items and cover questions as we go through the webinar today. And as a reminder, everyone will receive a link to the recording when it's posted on retirement daily.

I'd like to take a moment to introduce our subject matter experts for today's webinar. We have Rick Fingerman, who is the co-founder and managing partner of Financial Planning Solutions. We have Katie Marsden, who is a wealth advisor for Buckingham Strategic Wealth. And Amy Shepard who is a financial planner at Sensible Money. Welcome.

So, the order of business today is in essence to look at what happens now that your divorce is final. Where do you begin as you contemplate your new life as a divorced woman? And Katie, we're going to start with you. You've developed a checklist that outlines the topics that divorcees need to address, including how assets in a house get divided. Where do you suggest that they begin?

Understand Your Goals

Katie Marsden (01:25): So, one of the best places to start is to really take a step back and what I like to call it is redesigning your future. What I mean by that is starting from scratch with really all of your financial plans to reassess what's important with you and how maybe your goals have changed for the future. There's likely been changes in your life, some big, some small changes around income sources, cash expenses, maybe where you live, how much assets you have towards retirement. There's been quite a bit of changes. I recommend people really just take a step back and start with the basics of putting together a new plan and focusing on what their goals are.

So, kind of thinking through what do you want your financial future to look like? Have your goals changed; your aspirations changed? Has your timeline, maybe, for retirement or other things changed? And then taking a look and figuring out, okay, what do we need to change as far as your finances go to support those goals? And not everybody's ready to do this on day one, but the idea is to get you start starting to think about how some of these changes in your life should change your overall plans.

Bob: You mentioned goals-based planning. Why is that important?

Katie: It's important because it is really focused on you as an individual and what you're trying to accomplish, rather than just focusing on a return figure. Other things, it's to make sure that your needs are met as an individual and that you get where you're trying to go at the end of the day.

Bob: In terms of cash flow, two things that probably might be different than they were before you were divorced is the notion of having child support and alimony. Is that something that people need to weigh into their plans as they think about their basics?

Katie: And it varies so widely from every individual. So, cash flow in general has likely changed a lot going from possibly one income to two or two incomes to one or one to having just support payments. So, starting a really close look at your cash flow, where is the money going, what expenses do you have? That is a great place to start just to reassess everything and see how it fits in with your plans.

Bob: Amy, Rick, anything to add to that?

Amy Shepard: I would just always echo what Katie says. I think just having your goals figured out, knowing what's important to you, if you know that it makes it a lot easier to start tackling all the financial pieces and working through a checklist that probably does seem overwhelming.

So, I think it does help give some clarity when you can take a step back and just think about what's really important and what do you want to accomplish with your own life.

Rick Fingerman: Yes, exactly. I think those points are right on, because when you're in a relationship, your goals might be very different than your partner's goals.

So now it's your opportunity to really put a plan in place that gets you where you want to be. Having that checklist and having someone to work with, especially to work you through the process is really key.

Manage Your Risk - Insurance

Bob (04:47): So, one of my favorite topics is risk management. And Amy, obviously when someone is newly divorced, they have to revisit all the possible insurance needs that they might have, whether it's health insurance, property and casualty, disability insurance, life insurance, et cetera. Walk us through what folks need to know.

Amy: There's a lot here, so there's a lot to look through, but some of the big ones that I've seen frequently, health insurance could be a big factor for a lot of people. If you are on a spouse's group plan and maybe now, you're not able to be.

Or I have seen instances where folks are already retired and there's some setup where even though now, you're divorced, you can stay on an ex-spouse's insurance for a period of time if it's to get you to Medicare age or something like that. So, health insurance is important whether or not you figured it out before the divorce was final or after the fact.

There’re so many options out there and we all know health insurance does not get cheaper, it's only more expensive as time goes on. And so just taking the time to figure out what's the best coverage, whether it is an option that somebody might have to go through their own employer, or if you're not working, what are your options? That can be overwhelming. So just taking the time to figure out and making sure that basic need is covered, that you have health insurance in place. That's a really big one.

Another one is life insurance. And so going back to what Katie said about the goals, depending on what your goals are, your insurance needs may have changed if your goals have changed. A lot of times we get life insurance to help cover our financial contribution to our marriage, but if we're no longer married, we may not have the same need for life insurance. Or maybe the numbers still support needing the life insurance, but we have to make sure we go through the steps of updating beneficiaries. Maybe we don't want an ex-spouse listed as the beneficiary anymore. So that's an important thing to go through.

And I think it's a two-part consideration: One, do you still need life insurance and two, if you do, how do you structure it so it matches your goals? Make sure that any proceeds go where you want them to.

I think for a lot of people, especially with children, maybe they change it from an ex-spouse to their kids or if they have a trust set up or something like that, you just, again, want to tie it back to what your goals are.

Another really important thing, I think, that divorced or otherwise, [another] insurance consideration is long-term disability. It's something that doesn't get enough attention, but it is important at any stage in your life. But it's another really important thing to look at when your whole financial and emotional life changes after a divorce.

So, long-term disability insurance is really important if you are still working and maybe your timeline has changed for when you expected to retire. If there's still a lot of working years ahead of you that are needed to make your goals a reality, having long-term disability insurance is really important because it essentially protects your income. And so, if you have an unfortunate event, like something as, I'm going to say minor, as maybe a car accident that you can recover from, but it takes you out of work for a period of time, to something more serious like cancer or some other illness, that it does affect people well before we want to think that it does.

We tend to think that all that stuff really happens when we're really old, but that's not the case. And I think just again, having the risk management in place to make sure that whatever the goals are that you first identified, that you are supporting them even as life continues to throw curve balls, because I'm sure divorce is one big one, but they're, they're always around every corner. I think those are some of the really important insurance considerations to look at.

Bob (08:44): Insurance is never quite frankly, the most exciting of topics to talk about, but it's certainly one of the most elemental blocking and tackling aspects of a financial plan. Katie, Rick, any additional thoughts?

Katie: Two things that came to mind for me. One was just know when your COBRA, if you have COBRA insurance, know when it expires so you could start planning for it well before the coverage ends.

And just one other thing that came to mind was for some of the clients that I work with who have been out of the workforce, [they] have found since their health insurance is such a large expense that if they are able to find work that they enjoy doing and can have that cover for a period of time, if they're below Medicare age, that it can be a big sigh of relief from an expense perspective. So that's just something to think about how it can help the bottom line by getting that coverage through an employer.

Bob: And in cases where someone may have to use ACA, there's also the possibility depending on their income of receiving advanced premium credits as well.

Katie: Correct. Correct.

Bob: Right. Rick, at any additional thoughts?

Rick: Yes, I mean, just a few things I've seen in the years I've been doing this, sometimes on homeowner policies, you might have a rider for boats or other types of things that might not be in your picture anymore. Maybe the ex-spouse has that, or maybe that car is still on your auto policy, things like that. But it's a good chance to sit down with your agent and really look at things like deductibles, see if there's any gaps in coverage, make sure you have an umbrella policy, which is just a liability policy over and above any kind of liability that you have on your car, because we live in a litigious society and if you happen to hit someone with your car or they fall down your stairs, you want to be protected that way.

And then lastly, one thing I've seen is where the divorce decree might have said that life insurance was supposed to be kept for a spouse for a number of years. So, you want to be careful of changing beneficiaries, which I totally agree with because I've seen more mess up with people that just never change a beneficiary, whether it's life insurance, whether it's a 401(k) plan, and that exposure is still on there and it can cause real problems later on. So just want to be mindful of all those things. As you pointed out, insurance isn't always the most riveting topic, but it is a really important one to look at.

Saving & Investing Now That Your Single

Bob (11:07): So, Rick, divorced women still need to save and invest for many goals, retirement included. What do divorced women need to know about this topic?

Rick: Well, when you are a married couple, generally speaking, one person hopefully at least is saving towards retirement. If they're both in the workforce, hopefully you're both saving. And then when you split up, in theory, some expenses go away, but two people can live cheaper than one usually. And so, it's important to have, again, that comprehensive financial plan to figure out what your expenses are going to look like in retirement and then back into how much money do I need to fund my life once those paychecks stop, whether it's support of some kind or money from a job. Once those paycheck stops, you have to rely on other forms like Social Security or maybe a pension or investments and earnings and things like that.

I think it's really important to get a handle on that first, and then you can back in and say, I need to save X for a number of years, and then just stick to that plan and adjust as time goes on. And if you're working with a financial, certified financial planner, for an example, hopefully they will keep you on track and make any adjustments that are needed over the years.

Bob (12:22): There's also, I think, Rick, this notion of one's risk tolerance may be different going forward as a divorced spouse versus when they were a couple.

Rick: Absolutely. I don't like to stereotype or generalize, but I will. Because in my experience, women tend to be more logical thinking when it comes to risk tolerance and investing where some spouses might be much more aggressive and that might not be a good feeling for that, that divorce spouse. So, you really want to look at your risk tolerance, see what you're comfortable with, and it might be a good opportunity to look at certain value-type investing, too. We have clients that want to invest in a certain way, whether that's excluding certain things like tobacco and alcohol or fossil fuels and things like that. Or also be inclusive to try to invest in companies that might have more equal pay for everyone, those types of things. So, it's a good time to really look at it as a new journey going forward for yourself versus how it might not have really fit you well as a couple.

Bob (13:30): You mentioned timelines and the need to reevaluate them. One thing that comes to mind is oftentimes women may leave the workforce during their childbearing years or may leave the workforce for one reason or another, and that impacts both their ability to save for retirement and impacts their Social Security benefits, et cetera. Amy or Katie, any thoughts about how timelines need to be adjusted given the possibility that women enter and exit and reenter the workforce?

Katie: In general, women tend to have less saved than men. They do studies showing the amount that women have saved and invested versus men. And in general, women have less saved, but for some of the reasons that you mentioned of not necessarily being in the workforce as long, but then on the flip side, women also are more likely to live longer than men. So, we have a little bit of a financial planning conundrum there, we have a little bit less to work with and a longer time horizon, in some cases. Of course, there's always exceptions to every situation, but it's something that is important to be mindful of and making sure that we're including that as part of our plan and that we're making the dollar stretch as long as they'll, they'll likely need to go,

Bob: Amy?

Amy: Yes, I always share when it comes to longevity, I have a great aunt who just recently passed away at 107 years old. And so yes, she is definitely one of the exceptions, but women do tend to live longer than men. And so yeah, Katie, you hit that the nail on the head there. It is really important. I think the only thing I would add is just that you don't need to have a lot to make a solid financial plan. I think it can be really overwhelming when you go through a major life change like a divorce, and then you start thinking about your future and people naturally think about the dollars in the sense. But I have seen plenty of situations where I work with folks that never made a substantial amount of money, but they've been able to do just fine in retirement.

On the other hand, I've seen situations where people make more money than you could ever imagine, and they're struggling to plan for their retirement. And I think the piece of advice I would give is just try not to worry too much. If you feel like you don't have enough and sit down with somebody and really look over the numbers, go back to your goals and figure out if what you have is sufficient for you. If sometimes people are surprised to find out that by doing things like delaying Social Security can give them enough monthly income to cover the vast majority of their expenses. And that can be a relief even if there isn't a ton of investment that have been accumulated. I think the takeaway is just there's always options and it's really important to explore them all.

Tax Planning

Bob (16:31): So, let's turn our attention to income taxes. Divorced women are sometimes in for a surprise when they file as a single taxpayer when it comes to RMDs or collecting Social Security. Amy, what do our divorced audience need to know about income taxes?

Amy: Bob, the big thing like you mentioned, is not only has your life changed in so many ways, but your tax situation has also changed quite a bit because now you file taxes most likely as a single taxpayer instead of a married taxpayer, which has its own set of considerations. And so, when you add a lot of the things we've talked about, one being women live longer than men, statistically; women don't have much saved, all of that. For a lot of divorced folks, there's a kind of this surprise tax bomb waiting later in life. So, as you progress through your life, as you progress through retirement, if you do have pre-tax retirement accounts, at age 72, you have to start withdrawing from them. Well by 70, you've also started Social Security. And what I often see is that later in life, especially single taxpayers, they start to creep up into higher tax brackets later on where in the early years, whether it was when they were still working or after they've retired but before gotten into their seventies, sometimes there's what we call the opportunity zone, where they have some lower tax years, they can do some long term tax planning to help reduce those future required distributions and reduce the amount of taxes they spend over their lifetime.

And so, it all comes back to the importance of having a financial plan. Looking long term and not getting so caught up in just the short term. There's of course going to be really important short-term things that you have to tackle, but it's really important to look at the big picture, look at what your goals are, and then map out what you expect your tax situation to look like over the next several decades. And then see what decisions you can make early on to help limit the amount that goes to taxes. And for a lot of people, not only do they like the idea of saving money on taxes, but it's also really comforting to know that if you have a strong tax plan in place, it has the potential to give you more money to enjoy doing the things you want to do. And I think it's just the long-term view is really important to just spend the time and look at it and make decisions based on the numbers, based on the numbers and your goals instead of just guessing on what might be the right choice.

Employer Benefits

Bob (19:07): So far, all that we've talked about does seem like quite a bit of work. Katie, any thoughts about income taxes and maybe making that topic less painful?

Katie: Two things that came to mind with that topic. One, Amy mentioned that most people have to, after a divorce is finalized, file as a single taxpayer. And just taking a look at if it was included in your documents, if you have children, if you can file as head of household, every little bit helps. And then the other piece of just who can use the children on their tax return for the child tax credits.

Another important thing, which I think we all kind of forget because you set it and forget it, but if you are working to take a look at your withholding and see how taxes have been withheld from your employer. And if going forward there is changes that you can make, so to touch base with the HR department of your company or your CPA to make sure that you're not doing too much or too little because that can make a difference in our cash.

Bob: Rick, any additional thoughts?

Rick: Katie just brought up a good point about benefits at work made me think about could be opportunities there. Again, looking at that overall comprehensive financial plan, seeing if you're on track for retirement, it might be a good opportunity to max out your 401(k) plan if that's available at work. Maybe incorporate a flexible spending account that uses pre-tax dollars to pay for medical stuff like your kids might need braces or things like that. Or even a health savings account, an HSA, which is really a great vehicle, if you have a high deductible health plan, it might be a good fit for you.

I think, again, it sounds like this whole thing comes down to having a really good financial plan and someone to help you with all that. But yeah, the tax component can be huge. You know, filing single, Katie pointed out head of household would be a great thing to do if you're eligible. And some people just don't do that if they're doing their taxes on their own especially. So yeah, I think again, look at everything that's available.

Retirement and Social Security Planning

Bob (21:23): I'd like to remind everyone who's attending the webinar that you can ask a question using the Q and A button at the bottom of your screen. We will be leaving more than sufficient amount of time to take questions from everyone here with our esteemed panelists.

So, I want to turn my attention to one of my favorite topics, retirement planning. Rick, from your perspective, what do folks need to know about Social Security, RMDs, QDROs divorce, spousal benefits, et cetera, joint and survivor pensions, et cetera?

Rick: Yes, all that good stuff. Well, we'll start with Social Security. If you're married for at least 10 years and you're divorced, you're entitled to a divorced benefit on your spouse. And generally, 50% of their full retirement-age benefit. There are some caveats of when you actually start collecting. If you collect at 62 versus your full retirement age, your benefit is reduced. If you're married, your spouse that you're collecting on doesn't, if you're married, can be married. But if you are married, remarried, you can't do that. But if they pass away and you remarried after age 60, there's an opportunity to collect a hundred percent of what they were getting. So Social Security plan can be a big piece of that to see where it makes sense to collect, whether it's your own work record or an ex-spouse’s record. When it comes to RMDs, I think Katie mentioned at 72, maybe it was Amy, I'm sorry, at 72 you have to start taking these required distributions and it's a good opportunity.

Someone pointed out that there might be a window where your income is lower and maybe there's some opportunity to during those low tax bracket years to do things like Roth conversions where you could limit the amount of those required distributions that you might need later on if it seems like you're going to be in a higher tax bracket later. So, looking at all that I think really makes sense, too.

As far as QDROs, I’ve seen situations that QDROs, basically a qualified domestic relations order, and it's generally around someone's 401(k) or workplace plan to split that up between spouses, so it's not a taxable event. So, you want to make sure that once the divorce is settled that the QDRO has not been, those assets haven't been transferred, you want to make sure that that gets done properly. Because that I've seen cases where that sits around for five, six years and just never gets done and that's not ideal.

The Value of the Checklist

Bob (23:51): What advice do you have around making sure that it does get done? Working with a planner, having a checklist in place?

Rick: Yes, absolutely. Working with a planner, having that post-divorce checklist to some, make sure nothing's forgotten. The checklist I think is a great idea because it could be as simple as saying check beneficiaries, is the QDRO completed? There was one, was the house retitled, if you're keeping the house, all those things are really important because it's easy to forget this stuff even for us that do it every day. So, we really want to have some kind of checklist, check it off. I always feel good checking things off personally, I've even written things down just so I can check them off. But it's a good feeling and I think the client feels good too, knowing that they're making some progress.

Bob: Katie, I know you're fond of checklists. Any additional thoughts on QDROs and Social Security and RMDs and retirement planning in general?

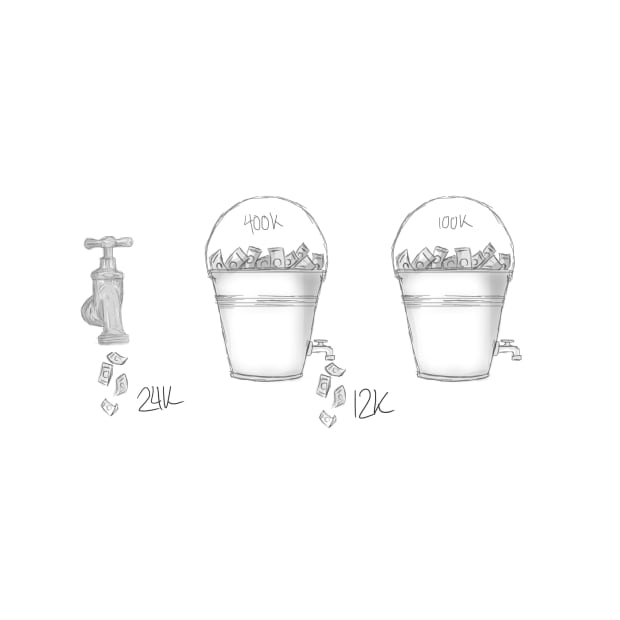

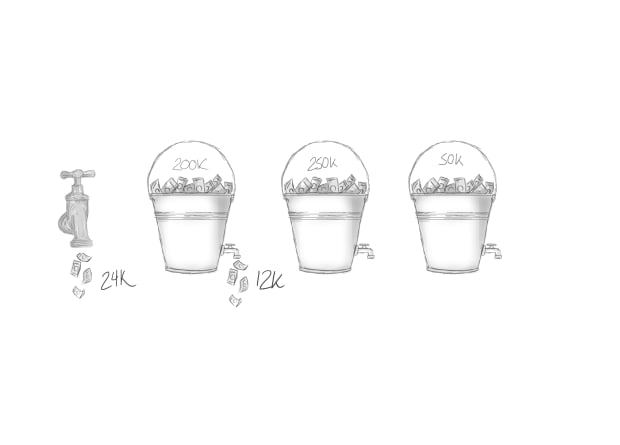

Katie: Yes, I make a checklist for everything. I would just echo a basic, what Amy was saying earlier, about not getting overwhelmed or feeling that you, maybe, aren't exactly where you want to be at a certain point. Because the reality of a lot of divorces is that you had a pot of money that's now split in two. And that regardless of how big or small that amount is, it can make people feel uneasy because you're planning with a different amount than what you had been previously.

So, what I like to remind people is that in any retirement planning there's always levers to pull. You can save more, spend less, work longer, it just depends on your priorities. So, before you get overwhelmed by looking at how the dollars have changed, also taking a look at how maybe some of your habits could be adjusted to where you can still end up in the same place. But just what levers can you pull? And for different people that's a different answer. So just exploring those options and seeing how to get to a comfortable place with getting to retirement.

Bob: Amy?

More on Social Security

Amy: I think I just will emphasize the importance of the Social Security planning. Social Security is, like many of the topics we're discussing a lot, a lot of rules, there's a lot of nuances but there's also a lot of benefit. And I think some people are often surprised when we put the numbers on paper to show how much value Social Security could provide over a lifetime. And then how that value can change, depending on if you start benefits earlier or later.

And, I think, just emphasize the importance again of just taking the time to work through these things carefully. A lot of the decisions that you make when it comes to retirement planning are one and done. You make the choice and you want to make the right one. And so, to make the right one and not regret a decision or make it hastily, I think it's just really important to spend the time working through all the details.

Bob (26:52): I know when I talk to readers, they're often surprised that they're entitled to divorced spousal benefits or even a deceased beneficiary’s benefits. Do you find that to be the case in your practice that divorce women are sort taken aback that they can receive those benefits?

Amy: Sometimes people are, they just didn't know what the rules were or there's just such so much conflicting information out there they didn't understand them the right way. There's also a lot of confusion about the amount that you can receive. I've had a lot of people come to me and say, oh well I thought I could just get 50% of my ex-spouse's benefit because we were married for 10 years. And that is partially true, but sometimes you know, 50% of their benefit may not be as much as if you took your own benefit.

And so Social Security, the way that it has tended to work is when you do file for benefits, they look at an ex-spouse's record and they give you the biggest benefit you're entitled to. But sometimes Social Security doesn't always know all the rules depending on who you talk to when you call. And so, I think it's just important again, to just not only spend the time to do your own homework, and some people don't love doing their own homework and that's okay, that's why it just makes it even more valuable to work with a planner that can help you go through all of those pieces and make sure that what you heard or what you think you're entitled to is the right thing for you.

Defined Benefit Plans

Bob (28:19): So, they don't as prevalent as they once were, but some folks still have defined benefit plans and typically the beneficiary can choose a single life or maybe a joint and survivor option as well. Katie, any thoughts about what folks, divorced women need to know about defined benefit plans

Katie: As far as receiving them?

Bob: After the, post-divorce?

Katie: That can be a little complex. Most of the time it's determined, kind of what's going to happen, with those plans during the divorce. So oftentimes I'll see that a client will, or maybe you didn't necessarily work at an employer, but you're entitled to a portion of your ex-spouse's pension and some places it's easier and harder to get information. Some of them you have an option to get a lump sum. Others you can take it at your retirement age.

There's a lot of different rules so it can get a little complex. But what I would say is to make sure you call, get all of the information that you can from the plan administrator, and understand timing, what those payout amounts might be, what happens to your benefits if something were to happen to you, if you could name a beneficiary, there’s just a lot to make sure that you get the information and then when you can start taking those benefits and how best to receive them. So that's where just getting the information is the first step because every plan is different

Estate Planning

Bob (30:01): So, we've covered a lot of ground. The last big topic is estate planning and divorce. Women, obviously they need to update their wills. Durable powers of attorney, we mentioned beneficiary designations, and the like. Katie, talk more about estate planning for divorced women.

Katie: Estate planning tends to fall, I think, at the bottom of everybody's list. It's thinking about our own death, is not really something most of us want to do, but it's really important and particularly after a divorce.

I use this example because I think it really hits the point that I'm trying to make. Assume that you were to go out tomorrow and were hit by a bus and you haven't updated any of your documents. Do you really want your ex-spouse to be the one making decisions about your healthcare if you haven't updated it? And if it were me, I would say absolutely not. That's not really who I'd want in charge. Not necessarily a bad thing. Sometimes that might be still the person you want, but having the option to take a look at your entire estate plan and decide who are the people that you trust, and that you want in those roles, that may different.

I mean oftentimes when you're married it's by default you pick your spouse to make those decisions, both from a financial perspective and health perspective, and named in your will. That likely has changed for most people. You might want to name if you have adult children, to name them or maybe a sibling or somebody else that you will carry out your wishes. And I'd say a lot of our planning from an estate planning perspective changes after a divorce of what we want to happen with the dollars that we have, where we want them to go, are they different people? Do you have charities in mind?

We always recommend to meet with an estate planning attorney. Most of the time you're going to want to start from scratch because if you did have documents in place previously, they might not be as relevant anymore. But you just want to make sure that you have the right people in place to ensure that your wishes are carried out if something were to happen to you. Also, important if you have children and there's decisions that you want to make sure are known and in writing. And if there's funds being left to them who you want to be the guardian of that. There's quite a bit from a planning perspective of just making sure your wishes are known and updated and you continue to keep them relevant.

Bob: Rick, Amy thoughts on that?

Amy: A couple thoughts came up for me. One of the big ones is yes, super important to update all your estate planning documents, but also really important to know that just because you update say your last will, if you don't also update all of the beneficiaries on your other accounts to match, the will to a certain extent can be irrelevant.

What I mean by that is if your will says one thing, but the beneficiary on, say your retirement account, says something else, the beneficiary listed on the actual account is what is going to hold true. And so, I think it's just important to know it's not as simple like most things, it's not as simple as just update your estate plan. You still have to go through each account to make sure all the beneficiaries match. So, everything says the same thing. The other thing is that if you are working and you work for a large enough company, a lot of big companies offer the option to enroll in a legal plan benefit during open enrollment.

I know when people hear the term estate planning or an estate planning attorney, they see dollar signs and they say, oh that sounds really expensive. And it can be. I mean basic estate plans usually run a couple thousand dollars.

One way to still tackle it but more maybe cost effectively is, if you have a legal plan benefit through work. It's something that you don't want to postpone, you know, ought to tackle it. And with legal benefits through work, usually you can only enroll in them during open enrollment or if there's a qualifying event. You may have the option to sign up for one even if it's not open enrollment. But I think the short version of the story is make sure your new estate plan matches all the account beneficiaries and also just look at options on how you can try to get your estate planning done for as an affordable cost as possible.

Q&A