How Warren Buffett Got Apple Stock Wrong

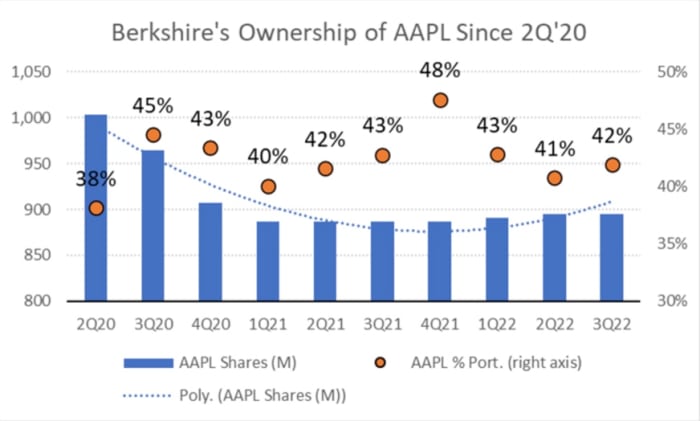

Apple stock (AAPL) - Get Free Report is Berkshire Hathaway’s largest holding. Warren Buffett’s conglomerate reported last week that the firm had allocated a sizable 42% of its portfolio to shares of the Cupertino company as of the end of Q3.

Considering that AAPL has easily outperformed the S&P 500 over virtually any time frame, Buffett and crew have clearly been proven right on their highly concentrated bet. But in one sense, Berkshire got Apple stock wrong: by leaving some money on the table.

Read more: How Apple Stock Continues To Impressively Outperform

Buffett: not enough of an AAPL fanboy?

If an investor had put a whopping 40% of the portfolio in Apple stock in early 2020 and made a killing, it would be unreasonable to look at the glass half empty and say that he or she missed out by not investing even more in this outperforming name.

In other words: Warren Buffett and his portfolio managers have done great by being long AAPL since early 2016 (modestly at first, then much more aggressively in the past few years). Kudos to them.

But Buffett is best known for being a value investor. Maybe this is why, in the last several quarters, Berkshire Hathaway has divested some of its Apple shares just as the stock recovered strongly from the bottom of the COVID-19 bear, reached in Q1 of 2020. See chart below, particularly the blue bars.

“Buying low, selling high” seems like a reasonable approach to investing – that is, if one can figure out what “high” and “low” mean exactly. But in the case of AAPL, the strategy has fared worse than the simple “buy and hold, don’t trade” idea that I have defended on this channel.

Case in point, Warren Buffett and his company would have done better over the past 10 quarters if they had left their Apple position alone, instead of selling the 2020 rally into the first half of 2021.

AAPL: how Buffett left money on the table

Berkshire Hathaway owned 1 billion shares of Apple in Q2 of 2020, worth at the time $91.5 billion. Had the firm held on to the same shares through today, the position would have been worth nearly $152 billion now, for about 66% appreciation.

Instead, Berkshire Hathaway progressively shed its Apple position, from 1 billion to a low of 887 million shares in Q4 2021. Assuming, for simplicity, that the sales proceeds were parked in the S&P 500, Berkshire’s Q2 2020 investment in Apple would have been worth about $150 billion today.

Sure, the difference of nearly $2 billion in gains may not represent much to a conglomerate the size of Berkshire Hathaway – although it certainly looks like an endless pile of money to most of us, mere mortals.

But what strikes me as curious is that even the almighty Warren Buffet has not been able to time Apple stock all that well, at least in the past 10 quarters.

Dare I say, humbly, that the Oracle of Omaha should have been more open to the idea of “buying and holding, not trading” AAPL, as I believe to be the best strategy for this particular stock?

Ask Twitter

In the past 10 quarters, WarrenBuffett and his $BRKA $BRKB left about $2 billion on the table by selling some of the firm’s AAPL position after the 2020 rally, rather than just buying and holding. What do you think they should do with their Apple shares now?

Land a Top Equity Research Job with Peak Frameworks

Equity research is a great career path that combines deep industry analysis and financial modeling, while exposing you to the strategic frameworks of many different types of investors in the stock market.

Many students have used the Peak Frameworks Equity Research course to break into the industry out of school, or to transition into the field from a non-finance career path. The lead instructor has experience working at Goldman Sachs and J.P. Morgan and was involved in the recruiting process at both banks, so you’ll get a comprehensive view of the skills you need to get and prepare for an interview.

To learn more, click on this link and use the code APPLEMAVEN10 for 10% off the course.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting the Apple Maven)