Global Crypto Markets Lose Over $100 Billion After FTX Debacle

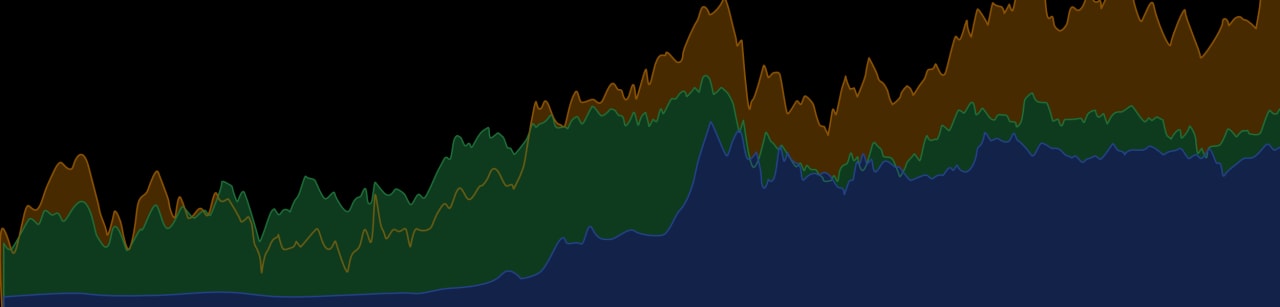

This week, the global market for cryptocurrencies slid precipitously, losing more than $100 billion in a 24-hour period, after Binance announced it would not acquire FTX and the fate of the beleaguered crypto exchange hung in peril.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter - Crypto Investor.

Binance, the world's largest crypto exchange, announced that FTX had myriad problems ranging from "mishandled customer funds and alleged US agency investigations." The news plunged the total market cap for crypto below the $1 trillion mark, and also saw Bitcoin sliding under $16,000 on Wednesday — hitting a two-year low.

Ether, Dogecoin and XRP also faced a 14% price crash.

"The extreme volatility and vulnerability of the cryptocurrency market was illustrated this week by a sharp drop in Bitcoin price caused by the run on just one entity: FTX. These problems stem from the lack of assets backing Bitcoin and most other cryptocurrencies," said Alex Konanykhin, CEO of Unicoin.

"Bitcoin prices are currently reacting to multiple market factors, including the fallout of FTX’s collapse and the positive, risk-on sentiment from the CPI report," Jason Lau, COO at Okcoin, told TheStreet Crypto. "Going forward, I expect continued Bitcoin price volatility until the FTX incident is resolved, and I am seeing increased recognition of the value of Bitcoin as an uncorrelated asset that can be self-custodied, which will likely provide price support."

FTX’s liquidity crisis and insolvency also severely impacted non-crypto sectors and organizations as well. The Ontario Teachers Pension Plan in Canada had been part of FTX's $400 million Series C funding rounds in 2021, and was seen as a group negatively impacted by the fallout.

However, others in the crypto industry are buoyant there will be a recovery.

“In the near-term, crypto prices will fall, but the crypto markets are resilient,” William Quigley, co-founder of Tether, one of the world’s largest stablecoins, told me. “Within six months, most of the negative impact from the FTX collapse will dissipate.”

“Looking at the bigger picture, this mess may end up being a positive experience for the crypto industry," adds Ben Goertzel, CEO of SingularityNET, a blockchain and artificial intelligence project. "It’s not so terrible if crypto players with unsound business models get shaken out of the market, and regulators are nudged to put into place thoughtful rules enforcing greater transparency among large actors in the space."