FX Futures: How Currency Trading Revolutionized Finance

Financial futures today represent 90 percent of global futures trade, with currency futures being the first financial futures product to trade 45 years ago

Today's financial world would look vastly different without the creation of currency futures in the early 1970s. Launched in 1972, they ushered in a new era of free-market ideas and activity.

As chairman of the Chicago Mercantile Exchange, Leo Melamed sought to diversify beyond the exchange's meat futures and other agricultural contracts.

In the backdrop were the changes going on in the world economy, which was growing again 20-plus years after World War II. At the time, economists from the major world powers gathered annually to fix their foreign exchange rates against the U.S. dollar, known as the Bretton Woods agreement. But global economic growth, increased competition among countries and faster delivery of news and information started to make these yearly ministerial meetings obsolete. When President Richard Nixon took the U.S. off the gold standard, valuations were changing.

"It was constant change," says Melamed. "Constant change is what we do as an exchange... For me, that juxtaposition of the old Bretton Woods model versus the new world we were living in was answered by an exchange which had the ability to accommodate change as it occurs moment to moment."

"Currencies had latitude to float in wider bands against each other and therefore their value was potentially subject to greater uncertainty," says Paul Houston, CME Group's global head of FX. "What great innovation to design a currency future that could fix the value of the price an investor would pay or receive for a currency."

Alan Bush, senior financial economist at ADM Investor Services, says watching the fluctuations in foreign exchange rates gives clues about a country's economic health.

"Foreign exchange rates are an extremely good gauge of how the political and economic fortunes of the country are faring and are likely to fare ahead. It's a good barometer of future economic prospects of any country," Bush says.

Houston says, the importance of FX markets can be seen in facilitating international trade and investments through enabling currency conversion. FX Futures enable an efficient mechanism for hedging and also for trading currencies for investment purposes in their own right.

A New Kind of Futures Market

In the early 1970s, Melamed was convinced a currency futures contract would be the answer to the changes occurring. He just needed to convince others.

"I realized what I was thinking was almost heretic," he says, noting that until then, all futures contracts were based on agricultural products.

To do so, he met with University of Chicago economist Milton Friedman in late 1971, who, for $7,500, wrote a feasibility study on currency futures. Melamed used that paper to convince a majority of CME board members to approve currency futures. He also met with government officials to explain the plan with Friedman's paper in hand.

Leo Melamed and Milton Friedman on the floor of the Chicago Mercantile Exchange

"I believed the idea was so magnificent, it was so big, it needed the government to understand what I was doing, otherwise I might have enemies out there that I didn't need to have," he says.

On May 16, 1972, the CME listed seven currency futures -- the Canadian dollar, British pound, German deutschemark, Japanese yen, French franc and Mexican peso and Italian lira.

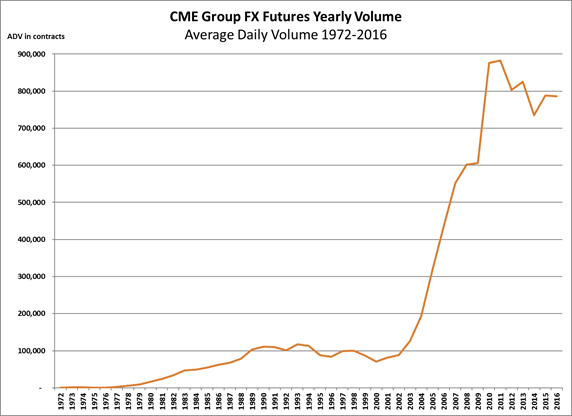

That first trading day 333 contracts changed hands, and that year 144,336 contracts traded. From there, the CME listed Treasury bill futures and was looking for other financial instruments to list.

Having the world's major currencies trade in one location made sense, too.

"The virtues of centralized broadly accessible market places have been recognized since medieval times. That's why 'the market' is still in the center of many cities," says Harold de Boer, managing director at Transtrend B.V.

To make the financial contracts more appealing, the International Monetary Market (IMM) was created. An IMM seat only allowed the holder to trade financial contracts and created an illusion that this was separate from the rest of the exchange. These seats were cheaper, which attracted younger traders to the financial pits. It worked, and after several years the financial contracts became well-established.

First day of trading at the IMM.

So why start with currencies and not interest rates or equities? Currencies were all in the news at the time, so it made sense to go with what was on top of people's minds. They were deliverable, a requirement at the time. Cash-settled contracts weren't approved until the early 1980s and led to the listing of the Standard & Poor's 500 stock index futures.

45 Years and Counting

Today, 59 currency futures and 30 options on currency futures are offered at CME Group. The FX market has thrived over the past 45 years, and recent changes in legislation, such as the Dodd-Frank act, have helped drive more activity in the market. Open interest in currency futures is setting records, as more users are holding positions at the exchange.

More recent trends in currency trade show an increase in interest in trading emerging-market currencies, like the Chinese renminbi, South African rand and Russian ruble. Houston says CME will continue to focus on attracting a broader range of users. Recent initiatives include changing minimum tick increment, reducing block sizes and launching monthly FX Futures and volatility quoted FX options.

"The objective is to offer greater choice to market participants but without disrupting the successful franchise we have today," he says.

New Tech, Same Fundamentals

Users are also finding more ways to access the market. Technological change began accelerating in the 1990s with the introduction of electronic trading and the Globex system.

"The electronic age has made the accessibility to centralized markets even more efficient and more global," de Boer says.

Just as Melamed saw the speed of news and information flow pick up in the 1970s, trading technology has increased how fast news gets delivered now.

"Political and economic news is almost instantaneously reflected in exchange rates and futures prices," Bush says. "The order execution and reported fills, with the advent of electronic trading, you get everything much faster now."

Though the technology keeps changing, the fundamentals of the FX market have not. Bush says the futures markets remain the firm's primary hedging tool to reduce risk of exchange-rate losses.

Written by Debbie Carlson. Read more from the author here.

Read more stories like this on OpenMarkets. And for trader tools and resources visit: https://activetrader.cmegroup.com

(This article is sponsored and produced by CME Group, which is solely responsible for its content.)

Read more stories like this on OpenMarkets. And for trader tools and resources visit: https://activetrader.cmegroup.com