What Does Fungible Mean? Definition, Explanation & Examples

Bitcoin is fungible because any one Bitcoin is worth the same as any other at any given point in time.

What Is Fungibility? What Makes an Asset Fungible?

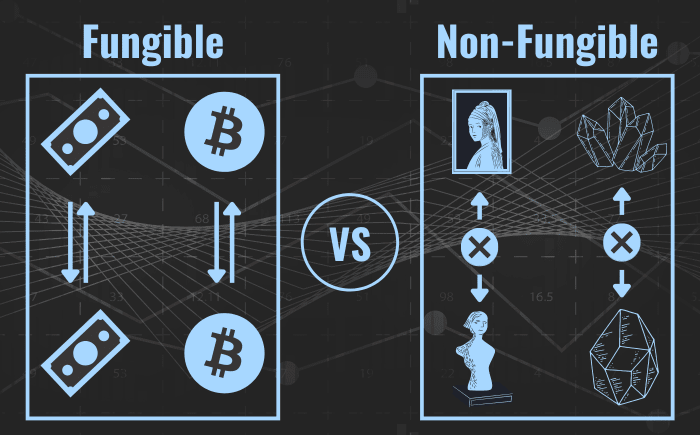

Fungibility is the property of being exchangeable for other assets of the same kind without any change in value or usability. For instance, a U.S. dollar is fungible, because, at a given point in time, you could exchange any one dollar for any other, and your new dollar would have the same value and usability as the one you traded.

Of course, the U.S. dollar does change in value over time relative to other currencies, but it is still fungible because—at any one point in time—all U.S. dollars are worth the same amount. That is to say that all U.S. dollars change in value in ensemble as a currency—not individually as single dollars.

What Sorts of Assets Are Fungible? 5 Examples

- Fiat currencies like the U.S. dollar and Mexican peso

- Cryptocurrencies like Bitcoin and Litecoin

- Shares of a company’s common stock

- Bonds of the same type (i.e., 5-year corporate bonds from the same company with the same yield and maturity).

- Regulated commodities like barrels of class A crude oil or gold bullions

What Sorts of Assets Aren’t Fungible? 5 Examples

- Collectibles like old coins, trading cards, and art

- Precious gems

- Properties like land, homes, and buildings

- Vehicles and equipment

- NFTs (non-fungible tokens)

What Makes an Asset Non-Fungible?

When an asset isn’t fungible, it usually has to do with condition or unique characteristics. Unlike a dollar, which is worth the same amount whether it’s crispy and new or old and wrinkled, two Toyota 4Runners of the same color and year could be with wildly different amounts based on their wear and condition.

Similarly, two gem-cut sapphires—even if they’re the same color and size and come from the same mine—may be worth different amounts based on minute differences in quality, clarity, and inclusions. The same goes for most collectibles—two first-edition copies of The Amazing Spider-Man #1 may appraise at different values due to their condition and the degree to which color has faded from the covers.

Put simply, when something is non-fungible, it is unique or one of a kind. There may be other similar products or assets, but each one has its own particular features and quirks, especially in terms of quality.

What Are Non-Fungible Tokens (NFTs)?

NFTs, or non-fungible tokens, are—at their core—strings of data stored on a blockchain that signify ownership of some sort of digital asset. In this way, they function sort of like certificates of authenticity for digital collectibles.

Note: A blockchain is an unalterable, publicly visible ledger that stores information about digital transactions.

Any digital file can be “minted” as an NFT and then sold and traded. For instance, an artist could create an NFT signifying ownership of an original piece of digital art, then sell it to a fan or collector. While anyone with a computer could download the digital art piece to enjoy, only the collector who purchased it could resell it, as their proof of ownership is embedded in the blockchain.

Visual art is the most common type of asset traded as NFTs, but music, videos, and other assets can be minted into NFTs as well. A collection of digital art by well-known animator and graphic designer Beeple sold for $69 million in March of 2021.