Demand for Crop Data Grows in Brazil

Brazil is now the world’s top soybean supplier as farmers boost crop yields and expand the land dedicated to soybean sowing.

Like any sector that’s seen rapid growth, Brazil’s agriculture has seen challenges. One of the biggest obstacles for farmers has been obtaining access to accurate and timely price data. Traditionally, farmers call grain buyers for price information and to make critical business decisions.

Technology startup firms are starting to change this process, and now farmers in Brazil can use their smartphones to connect them to global markets and receive real-time price information and customized data. That has improved efficiency for both farmers and grain buyers as they aim to meet rising global soybean demand.

Technology Fuels Growth

One such firm is Grao Direto, based in Uberaba, Minas Gerais, which helps to digitally connect farmers and grain buyers to trade grains in the physical market with real-time price information and enables digital contracts between farmers and buyers. The firm started in 2017 and now has more than 70,000 registered users, as it’s been able to ride the growth in Brazilian crop production and improvements in technology.

Alexandre Borges Silva, CEO of Grao Direto, says grain buyers on the platform get a complete breakdown of their deals, including the real-time Chicago Board of Trade (CBOT) price quote, exchange rate, storage fees, costs, premiums, or discounts for customer relationships, export fees, and other information.

Farmers preparing to sell their soybeans can see all available offers customized for them in the physical grain market, plus check prices in both Brazilian reais or U.S. dollars and view logistical modalities. Sellers can also see the forward price deals if they want to lock in future prices.

World’s Top Exporter

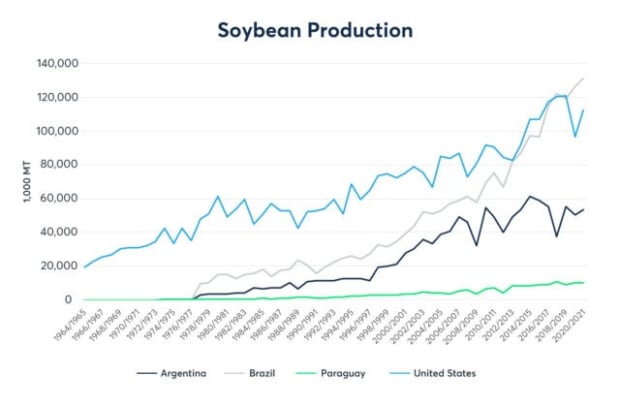

Soybean growth in Brazil has been accelerating for several years. In the 2019/20 crop year, Brazil accounted for 37% of global soybean exports, outpacing the United States, which once accounted for around 80% of global exports.

Fueling the increase has been growth in the amount of land used for growing crops, along with improving yields. Since the 1980s, soybean production in Brazil has multiplied its production by a factor of eight. According to the United States Department of Agriculture, Brazil is expected to produce a record 134 million metric tons of soybeans in 2021.

For farmers, this has meant massive increases in production. That requires more investment in land, equipment, seed, and other inputs. It also brings on more risk – something ag technology is seeking to help solve.

'Not Afraid of Doing Business by Phone'

It’s taken a little while for technology to reach rural areas in Brazil, but Borges says Brazilian farmers are keen adopters and innovators, noting how they have embraced not just smartphone apps, but improved seeds, modern harvesters, drones, and other technology to improve harvests.

“Because of that, they were able to double the productivity ratio that we have here in Brazil,” he says.

He pointed to a recent survey of Brazilian farmers by McKinsey showing 85% of respondents used WhatsApp daily for farm-related purposes and 70% used digital channels daily for farming matters beyond information searching.

“They’re not afraid of doing business by the phone,” he says.

Sebastiao Barroso, a farmer in Indianopolis, Minas Gerais, is one of those farmers. He’s seen big changes in Brazil’s agriculture in the 21 years he’s farmed, and especially in the past five years. Technology has helped him boost crop yields and he’s much more efficient with his time marketing crops using apps like the Grao Direto tool versus calling for price quotes.

“I can close a deal quickly and at any time. I don’t have to wait or miss opportunities that I might not have known about before,” Barroso says.

Jean Becklin, a grain seller at agricultural distributor Futura Agronegocio in Araguari, Minas Gerais, says he used to spend a lot of time on the phone calling for quotes, but now he has real-time access to both historical and daily price data and can negotiate deals digitally.

Becklin says having fresh data available constantly has helped him become much more analytical about strategy. “I can decide better and faster, either in a more aggressive or more cautious scenario. I use a lot of information from the platform to make a more complete, accurate, and quick analysis, and thus be able to execute my strategy and do better deals,” Becklin says.

Data-Powered Innovation

Access to fresh data is critical to farmers’ – and Grao Direto’s – success. As the leading and most diverse derivatives marketplace, CME Group offers real-time market data for benchmark global commodities like corn, wheat and soybeans.

In the past, getting access to that up-to-the-minute data meant provisioning a server and investing in dedicated infrastructure and connectivity. Today, more and more firms like Grao Direto are choosing to access data through the cloud.

By connecting to CME Smart Stream on Google Cloud Platform, Grão Direto was able to use CME Group commodity market data to develop a new tool called “One Click Deal” that provides real-time spot and forward grain prices for thousands of grain buyers, farmers, and producers. The tool takes into account factors including futures and options market prices, distances, taxes, and buying strategies in order to achieve fully personalized, precise total prices for physical grain.

Challenges Ahead

As farmers in Brazil become more connected to the global market and continue to scale up production, their next challenge is learning how to price their soybeans properly. The tactics they may have used to negotiate in the past might not apply to a global market. Both sellers and buyers will need to learn how to scale their businesses efficiently and profitably.

“Farmers will need to negotiate more and learn different ways to negotiate. They're not going to negotiate mostly in the spot market as they did in the past, but also sell a relevant part of their production in the forward market and increase the use of new risk management approaches,” Borges says. He adds that grain buyers should expect farmers to demand more solutions and opportunities that weren’t possible in the days when trade was done over the phone.

Grain buyers will also need to explore how to deal with many more farmers. In the past, they may have prioritized relationships with a handful of farmers because of capacity restraints. Now with the benefit of technology, they can send information immediately to thousands of farmers. They will also need to make the most out of their firm’s infrastructure, especially as they reach out for new suppliers in regions where they don’t have physical branches.

Borges says a key challenge to grain buyers starting to scale up is keeping pristine records regarding product traceability, particularly when it comes to sustainability and social compliance.

“Once you can digitize all the information that you are negotiating, you can have a clear path to a really traceable supply chain. This is more and more important to importers all over the world,” he says.

The same goes for sustainability. “By digitizing traceability, it helps with sustainability and social compliance efforts. This helps them emphasize the good actions that they have already taken.”