Binance Begins Process of Revealing Proof of Reserves, but Liabilities Remain Undisclosed

In the aftermath of the FTX collapse, Binance, Crypto.com and other major crypto firms pledged to “publicly share proof of reserves,” indicating that they wanted to grow consumer trust in their platform by revealing a full audit of coins.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter - Crypto Investor.

Binance unveiled proof of reserves of the world's largest crypto exchange on November 25 for Bitcoin, and said an audit of other coins would be impending in the next few weeks.

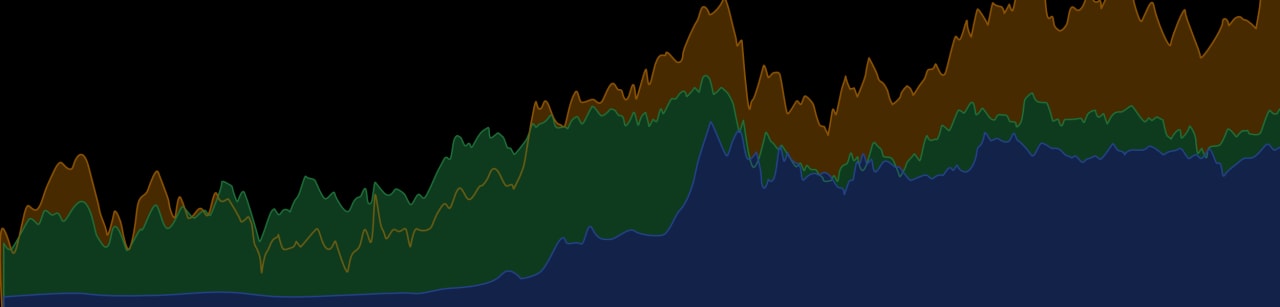

The company provided a breakdown of Bitcoin assets held in reserve for their customers, showing a reserve ratio of 101% (the company says it is holding 582,485 Bitcoin in reserves and users' net balance is 575,742 Bitcoin). "We are showing evidence and proof that Binance has funds that cover all of our users assets 1:1, as well as some reserves,” Binance said.

The company says it is also planning to bring aboard third-party auditors to review their proof-of-reserves, who will provide details on the net balance, equity and debt of each crypto user.

Binance says it will also eventually implement "ZK-SNARKs," or zero-knowledge succinct non-interactive argument of knowledge proofs to demonstrate that customers have enough additional assets to provide collateral for funds, indicating that the total net balance of each user was not negative.

For now, Binance said users could check the accuracy of the figures through an independent method: “For those who want to go a step further and independently verify their funds, they can copy the source code into a Python application and cross reference it themselves.”

However, despite the disclosures, Kraken CEO Jesse Powell said that Binance has not yet offered a comprehensive proof-of-reserve audit, which ideally would map out total client liabilities, offer customers a way to check that each account was part of that total, and provide signatures showing that Binance maintains control over the specific crypto wallets cited in the total. Without disclosure of liabilities, Powell said a "statement of assets is pointless."

The FTX imbroglio has led many crypto firms to champion proof of reserves as a marketing ploy. Speaking at a conference in Indonesia earlier this month, Binance's CEO Changpeng "CZ" Zhao said the crypto industry needed to safeguard investor funds and buoy investor confidence by disclosing proof of reserves: “That is absolutely going to be where the focus is for the next little while, which is right,” he said. “We have learned from our mistakes.”

“This is a critical moment for the entire industry,” echoed Kris Marszalek, CEO of Crypto.com, who said that "there are [still] trustworthy crypto platforms" in the aftermath of the FTX debacle.“Transparency is more important than ever, and safety and security of users and funds remains the priority. It requires full and collective commitment."

After FTX's dramatic fall from grace, CEOs like Marszalek hope to signal that some crypto firms are still worth believing in: “It’s incumbent on us to send a strong message to the world that there are trustworthy crypto platforms," he said.

"Investors will be asking crypto companies more questions about their debt, their internal risk management controls, and their use of collateral pledged against loans,” William Quigley, co-founder of Tether, one of the world’s largest stablecoins, told TheStreet Crypto about the ramifications of FTX's collapse.

Earlier this month, Tether also released its quarterly attestations. The company said it was unrelated to the FTX collapse.