Bahamas: Stop Saying We Lack Crypto Regulations After FTX

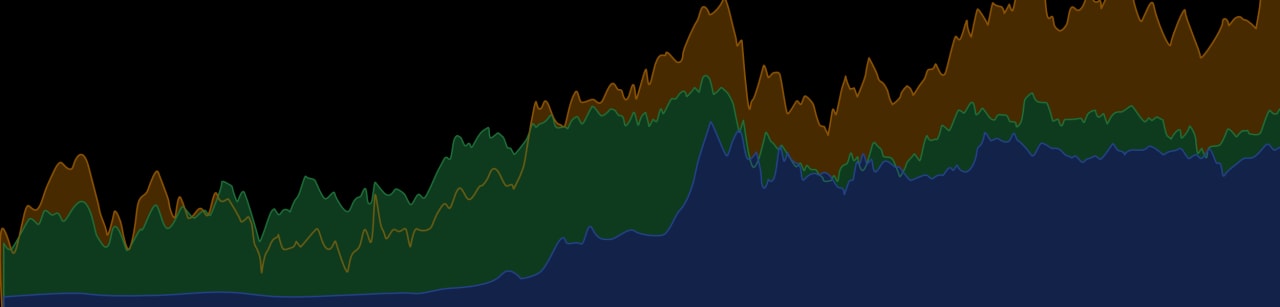

After the FTX debacle, the island nation of the Bahamas has come under scrutiny for hosting now bankrupt and insolvent crypto exchange FTX, which is under investigation by U.S. regulators. Bahamian government officials are on the offensive, defending the country's commitment to legislation and rule of law around digital assets.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter - Crypto Investor.

"We have been shocked at the ignorance of those who assert that FTX came to the Bahamas because they did not want to submit to regulatory scrutiny," said Ryan Pinder, the country's attorney general and Minister of Legal Affairs on Sunday. "In fact, the world is full of countries in which there is no legislative or regulatory authority over the crypto and digital asset business, but the Bahamas is not one of these countries."

Cryptocurrency in the Bahamas is governed by 2020's Digital Assets and Registered Exchanges (DARE) Act, and the Financial and Corporate Service Providers Act, which compelled crypto entrepreneurs like Sam Bankman-Fried to leave Hong Kong for the Caribbean nation after China tightened restrictions on cryptocurrency.

FTX is also not the sole crypto exchange located on the island – crypto exchange OKX maintains an office in the Bahamas and touts legislative clarity as a chief reason for its presence there.

On Sunday, Pinder highlighted the fact that FTX's sister entity Alameda Research – which was largely owned by Sam Bankman-Fried before it filed for bankruptcy – does not maintain a legal presence in the Bahamas. This makes it difficult for government officials to go after the company.

Pinder added that FTX's collapse owed as much to poor management by FTX founder Sam Bankman-Fried as to FTX's role as a crypto firm: "What happened can more readily be understood as a case of a very large business failure as a result of questionable internal management practices and corporate governance."

He also said that the Bahamas was "the first regulator in the world" to pursue action against FTX in the wake of revelations that the company had allegedly siphoned off billions of dollars of customer funds to shore up sister company Alameda Research. "The Securities Commission [in the Bahamas] was able to move so quickly because of the strength of the legislative framework, which was already in place in the Bahamas," Pinder said. "For safekeeping," the government froze FTX assets and transferred them to a crypto wallet.